Source: Cointelegraph Original: "{title}"

The monthly market review from the U.S.-listed cryptocurrency exchange Coinbase shows that despite a contraction in the crypto market, it seems to be preparing for a better quarter.

According to Coinbase's institutional investor monthly outlook report released on April 15, the market capitalization of altcoins has dropped 41% from a peak of $1.6 trillion in December 2024 to $950 billion by mid-April. BTC Tools data indicates that this metric hit a low of $906.9 billion on April 9 and was at $976.9 billion at the time of publication.

The report shows that venture capital funding for crypto projects has decreased by 50%-60% compared to 2021-22. In the report, Coinbase's global research director David Duong emphasized that a new round of crypto winter may be approaching.

"Multiple converging signals may be indicating the start of a new 'crypto winter,' with some extreme negative sentiment already forming due to the introduction of global tariffs and potential further escalation," he stated.

The report notes that reduced venture capital interest "significantly limits the injection of new capital into the ecosystem," which is mainly reflected in the altcoin sector. According to Duong, the reason for this is the current macroeconomic environment:

"All these structural pressures stem from the uncertainty of the broader macro environment, where traditional risk assets face ongoing resistance from fiscal tightening and tariff policies, leading to paralysis in investment decision-making."

According to Coinbase researchers, these facts have led to "a difficult cyclical outlook for the digital asset space," and they recommend remaining cautious in the next four to six weeks. However, the report's authors state that the market direction could experience a explosive shift:

"When market sentiment eventually resets, this change could be quite rapid, and we maintain a constructive view for the second half of 2025."

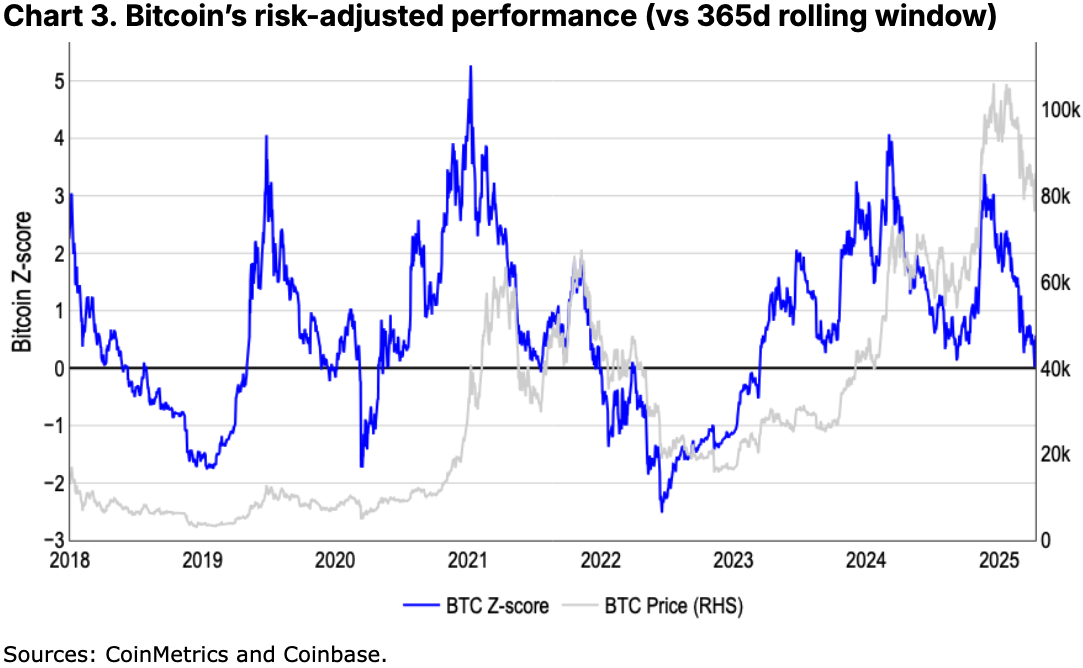

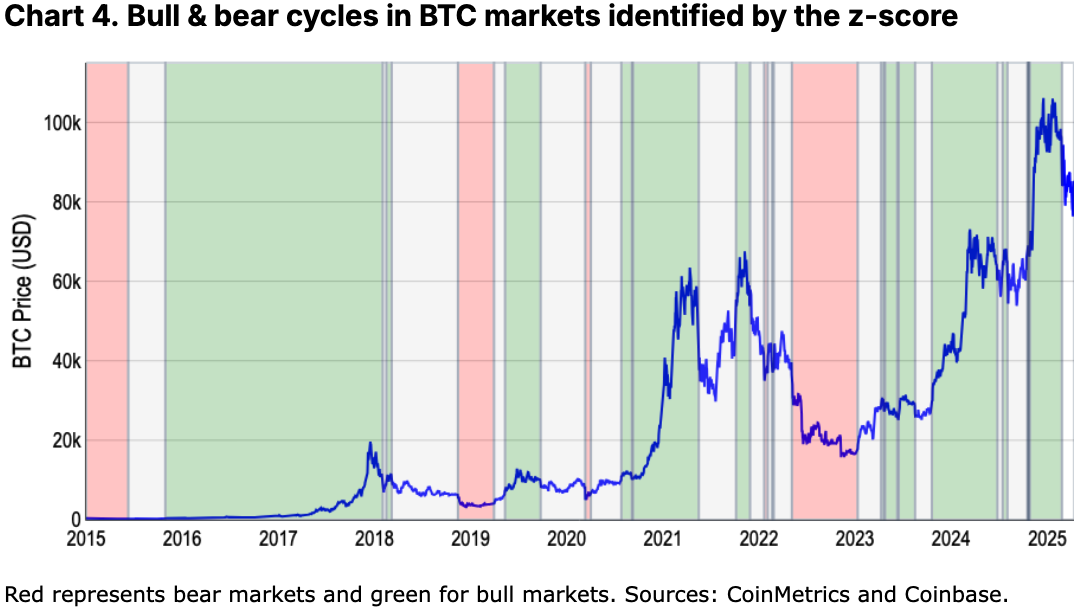

Duong cited several indicators to show the transition of the crypto market between bull and bear phases, including risk-adjusted performance and the 200-day moving average.

Another indicator is the Bitcoin Z-score, which identifies overbought and oversold conditions by comparing market value to realized value. The Z-score shows anomalies in current price performance compared to historical data.

Bitcoin's risk-adjusted performance. Source: Coinbase

This indicator "naturally explains the larger volatility of cryptocurrencies," but reacts slowly. In stable markets, this indicator tends to generate fewer signals. Based on this, Coinbase's model determined that the bull market ended in late February, but has since considered the market to be in a neutral state.

Coinbase's Z-score Bitcoin model. Source: Coinbase

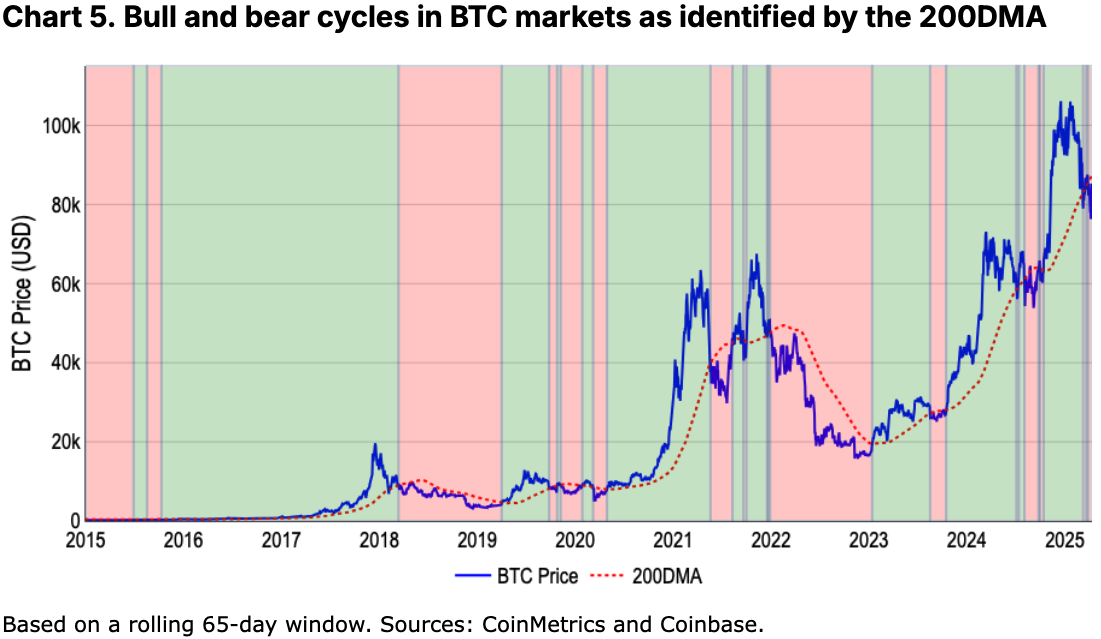

In contrast, Coinbase analysts stated that the 200-day moving average is a better indicator for assessing market trends. By considering the market data from the last 200 days, it can smooth out short-term fluctuations while maintaining relevance.

Coinbase's Bitcoin 200-day moving average model. Source: Coinbase

The report also noted that the reliability of using Bitcoin's performance to gauge broader crypto market trends is diminishing. This is because cryptocurrencies are expanding into new areas, including decentralized finance (DeFi), decentralized physical infrastructure networks (DePIN), and AI agents, all of which have specific market drivers independent of Bitcoin.

Duong pointed out that the 200-day moving average indicates that Bitcoin's recent decline has placed it in bear market territory as of the end of March. Meanwhile, applying the same model to the Coin50 index, based on the top 50 cryptocurrencies, shows that it has been in a bear market since late February.

Coinbase's 200-day moving average model applied to the Coin50 index. Source: Coinbase

Recent reports suggest that Bitcoin's resilience to macroeconomic headwinds is strengthening compared to traditional financial markets. According to Wintermute, "Bitcoin's decline has been relatively mild, returning to price levels seen during the U.S. election period."

Duong believes this trend is diminishing Bitcoin's role as a general cryptocurrency indicator. He wrote:

"As Bitcoin's role as a 'store of value' continues to grow, we believe there is a need for a comprehensive assessment of overall market activity in cryptocurrencies to better define the bull and bear markets of this asset class."

Related: Wintermute: Bitcoin shows increasing resilience during market downturns

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。