Author: Justin Bons, Founder of Cyber Capital

Translator: Luffy, Foresight News

Solana has had one of the most dramatic comebacks in crypto history, facing controversy since its inception. However, it should no longer bear the brunt of criticism. From the infamous FTX collapse to false usage metrics, centralized design, and downtime issues, Solana has endured numerous challenges but has emerged stronger from adversity. It has genuinely changed, forcing us to alter our perceptions of it. Many are eager to sing Solana's demise; however, we really should change our damn biases.

I must admit that I bear some responsibility for this perspective, as I was one of Solana's harshest critics for many years. However, today's Solana is vastly different from its past. For this reason, in 2023, I transitioned from a critic of Solana to a supporter.

In this article, we will thoroughly analyze all my past criticisms and demonstrate how Solana has improved and why it now deserves our support. For the sake of decentralization and our shared crypto-punk values, changing our views is not a weakness but a superpower.

Downtime Issues

Solana has experienced multiple downtimes, which is indeed worthy of serious criticism, as a mature blockchain should theoretically never face such issues.

However, it is undeniable that Solana's stability has been continuously improving. The key here is whether technological changes can give us sufficient reason to be confident in the future stability of its network.

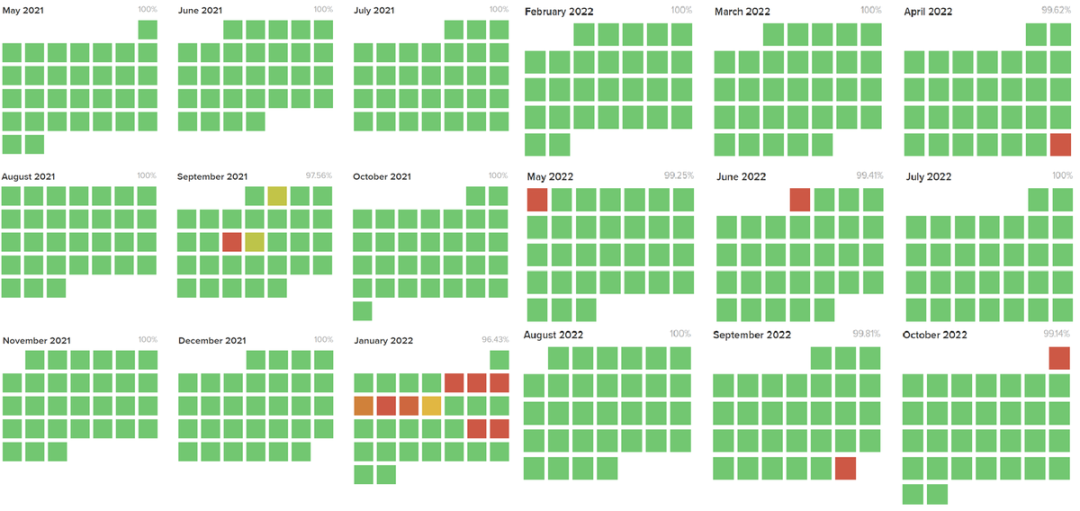

Let’s first take a close look at past failures and their root causes; the uptime charts for 2021 and 2022 were truly abysmal:

Source: Solana Status

On September 14, 2021, the Solana network went down for over 20 hours. Due to excessive memory usage by nodes, restoring network operation was extremely difficult. On June 1, 2022, Solana again went down for more than 4 hours, this time due to a transaction bug that caused the entire network to stall. On October 1, 2022, Solana experienced another downtime of over 3 hours due to invalid blocks causing a chain split.

I won’t elaborate on each downtime incident, as there are detailed records elsewhere. In short, it is clear that this was a severe test for Solana, and its condition was dire, riddled with flaws. If it were still in such a state today, I would certainly maintain a critical stance. But on the contrary, each time a problem was resolved, it became stronger. Now, let’s look at the subsequent situation:

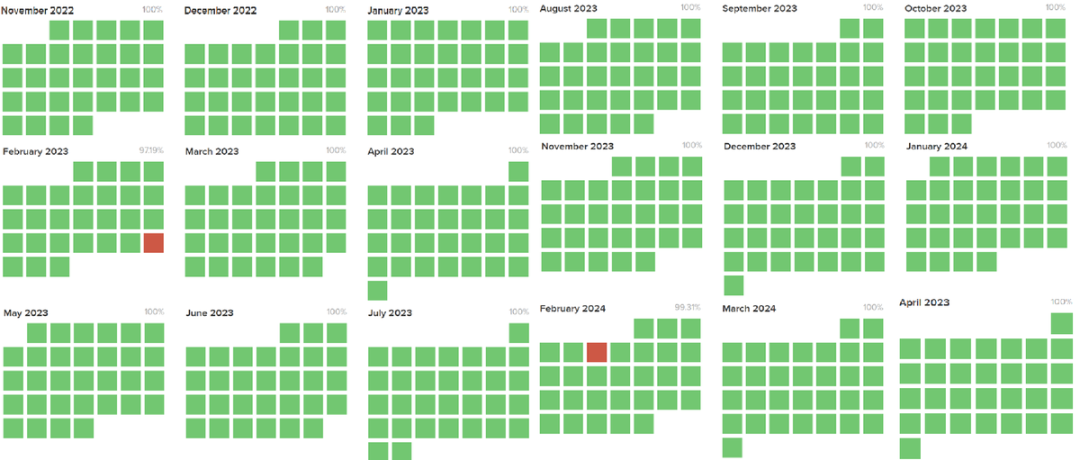

Source: Solana Status

In the following year, there was significant improvement compared to before; although it is still not perfect, the progress is indeed remarkable. Most of these failures were related to Solana's lack of a well-developed fee market. The implementation of the fee market during this period was one of the main reasons I shifted to support Solana, as it paved the way for achieving perfect stability in the following year:

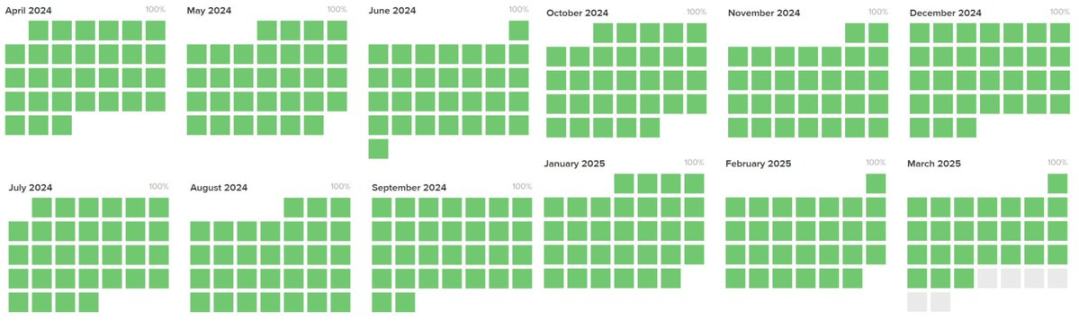

Source: Solana Status

However, Solana still faces other issues: congestion, spam, RPC failures, network bottlenecks, etc. For a blockchain that frequently sets new usage records, these are normal growing pains. Importantly, there have been no downtimes, which is a significant improvement compared to previous years, indicating that Solana is maturing.

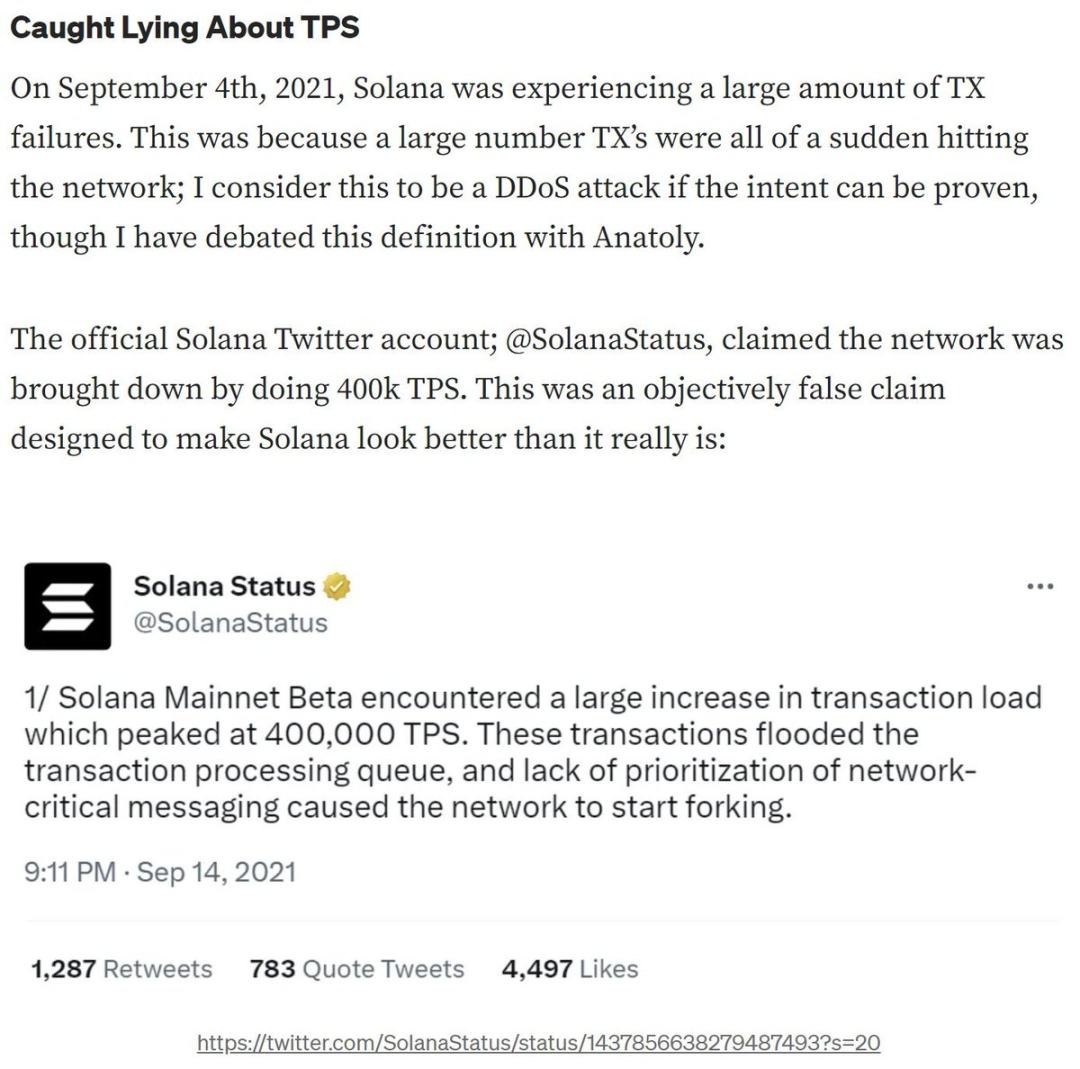

False TPS Metrics

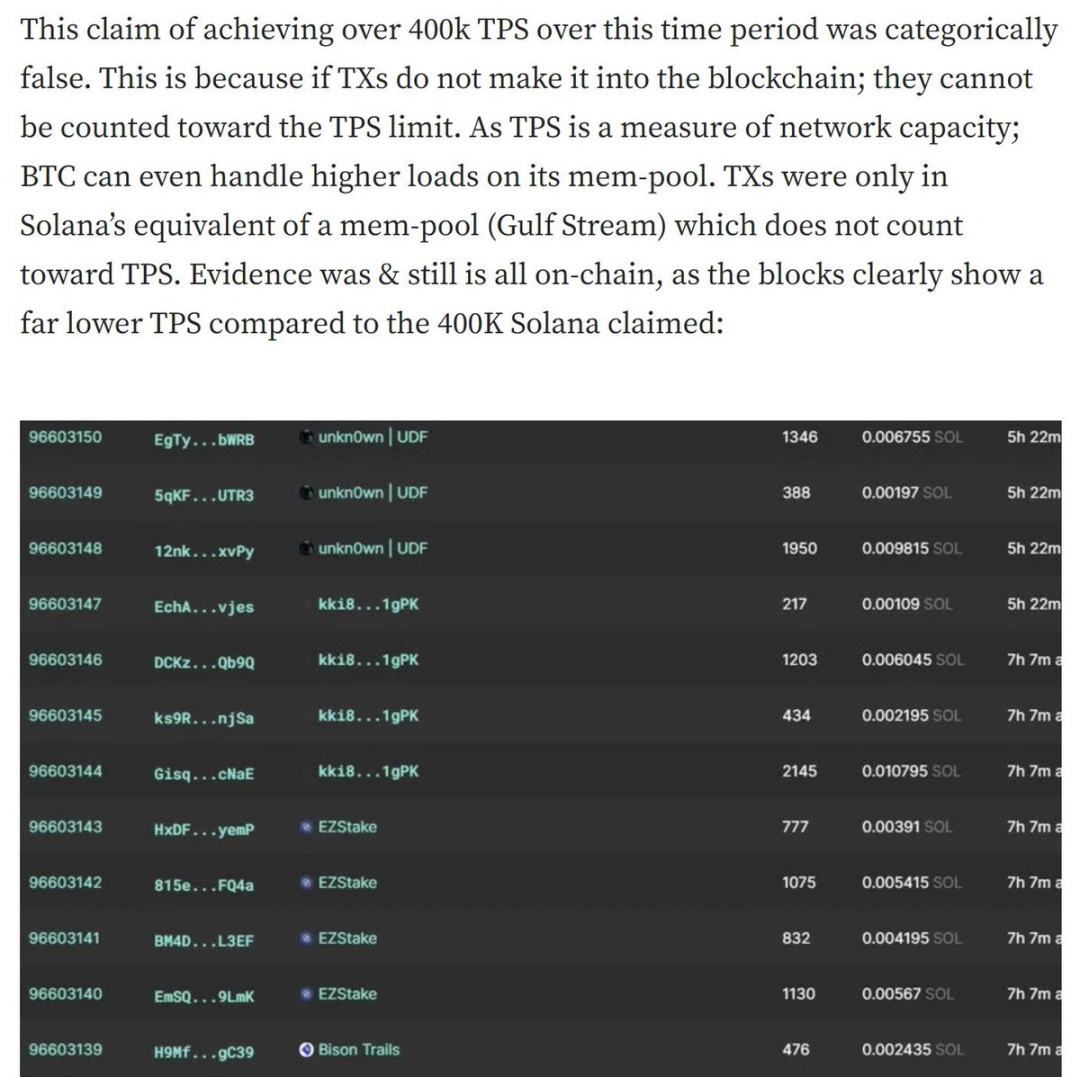

Next, let’s talk about the false usage data: when I first pointed out this issue in 2021, Solana had almost no real usage. So when it claimed to achieve over 40,000 TPS, it was completely lying.

Since then, Solana has cleaned up this misinformation in its external communications and no longer spouts TPS claims; in fact, Solana's leadership is now much more honest in its communications.

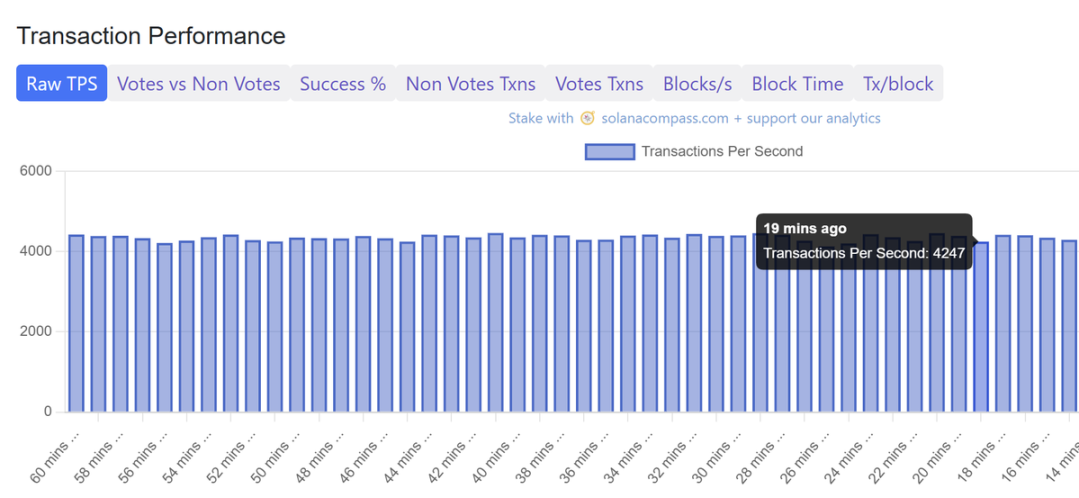

Even today, TPS data can still be misleading. By the most conservative estimates, the adjusted numbers are still extremely impressive. Let me break it down for you: first, the raw TPS is currently 4247:

Source: Solana Compass

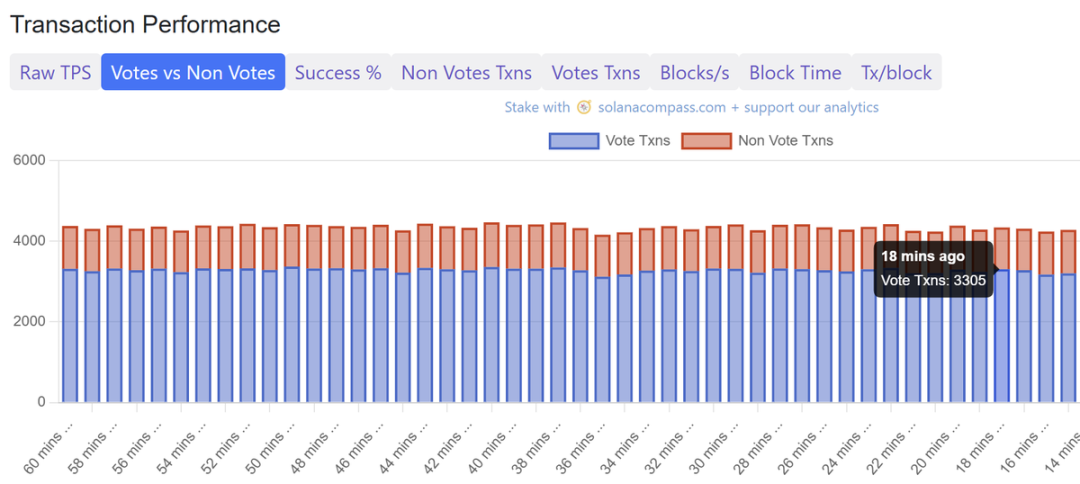

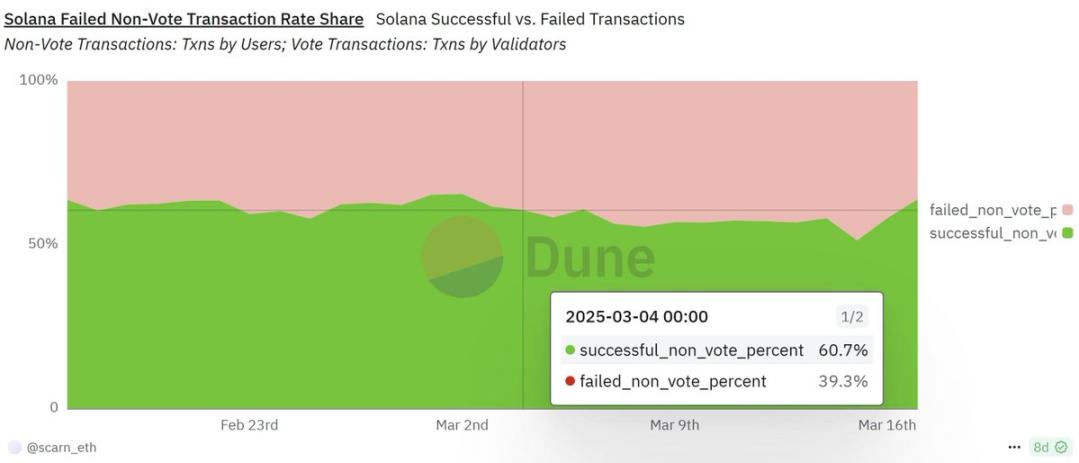

Now, if we exclude voting transactions, we are left with 1109 TPS. For the sake of argument, we can also exclude "failed transactions."

So, 4247 raw TPS - voting transactions = 1109; then excluding "failed transactions" (calculated at -40%) = 665.

Source: Solana Compass

Source: Dune Analytics

This adjusted usage still far exceeds the total of all other blockchains today.

This makes Solana the undisputed leader in the decentralized application space. This is also why some current criticisms seem unfair, as they give the impression that Solana is not leading in usage, but the facts are clear: even by the most conservative estimates, it is leading.

Moreover, excluding "failed transactions" is not entirely reasonable, as these transactions are destined to fail and incur fees. These transactions are primarily driven by seasoned participants who essentially double pay to have their transactions included in blocks faster, expecting that most of them will fail. This does not reflect the failure rate of ordinary users; according to my own tests, the failure rate for ordinary users is below 0.2%, which is entirely reasonable.

But for the sake of argument, even excluding failed transactions, Solana still stands out.

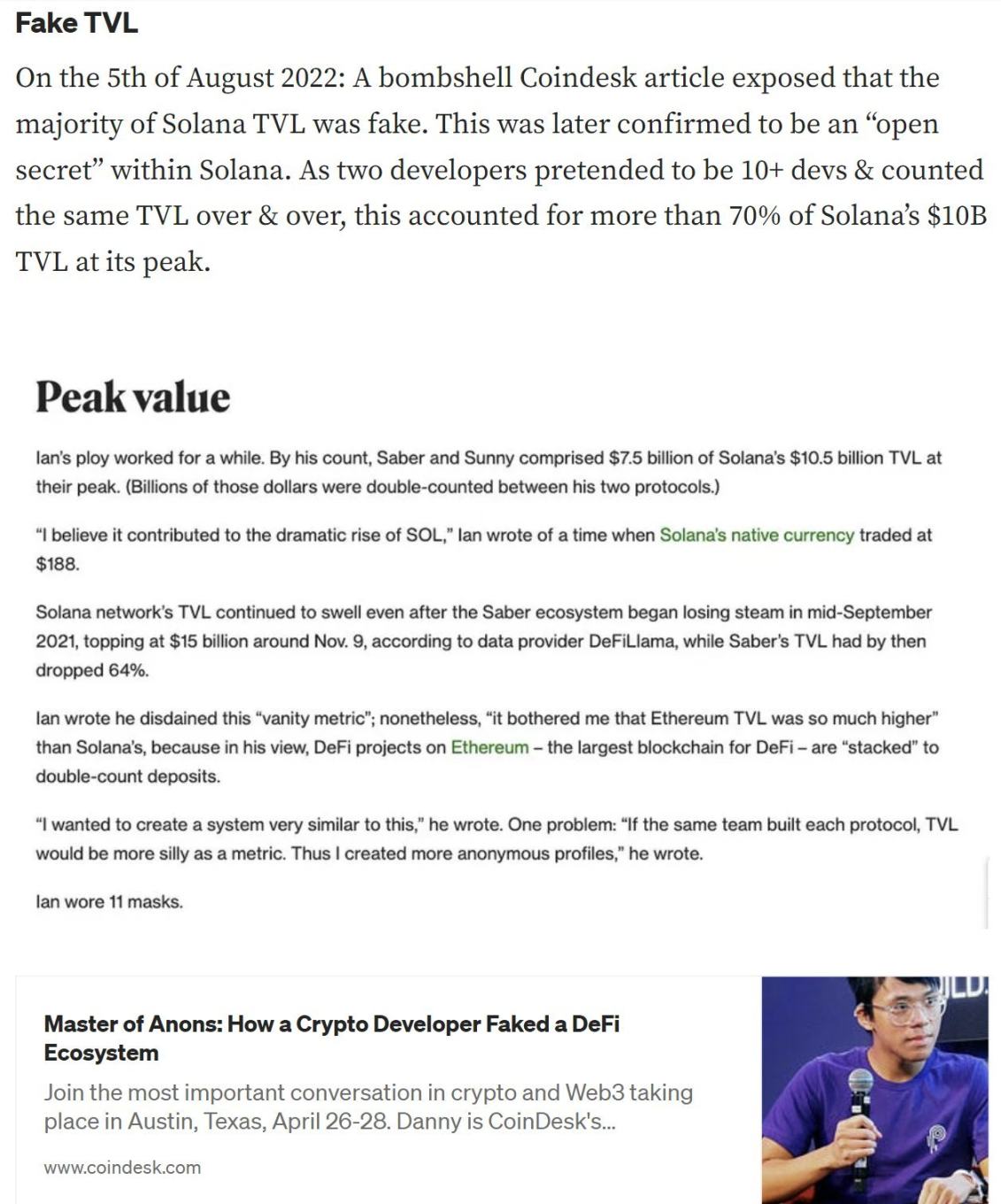

False TVL Metrics

TVL data has also had similar issues, sometimes being greatly exaggerated:

Fortunately, with the adjustment of the ecosystem, these are just growing pains; the comparison of TVL metrics is now fairer, though still not perfect. Under the current statistical methods, no blockchain is perfect. At the very least, it can be said that all blockchain ecosystems are continuously unifying the application of the same standards.

Solana's TVL still reaches a considerable $6 billion and is growing rapidly, with a bright outlook:

Source: DeFiLama

Revenue

Even as L1 and DApp revenues hit new highs, many are still unwilling to face reality.

What many fail to understand is that revenue metrics cannot be faked, as Solana is decentralized enough to ensure this.

The reason is that to "fake" these transaction fees, "wash traders" would have to pay all the costs out of their own pockets. Since they ultimately cannot control which validators receive these fees, "wash traders" are genuinely footing the bill for all the costs, making it impossible to fake fee revenue.

Source: DeFiLama

If someone believes that Solana's founders are spending up to $5 million a day to "fake" fee revenue, I honestly don’t know what to say to such a person; that has descended into a crazy conspiracy theory. Perhaps I should suggest that such individuals examine their investment portfolios to see if bias is at play.

It can be said that revenue is the most important metric because it proves the actual use cases of cryptocurrency while providing a solid and sustainable foundation for future decentralization and security.

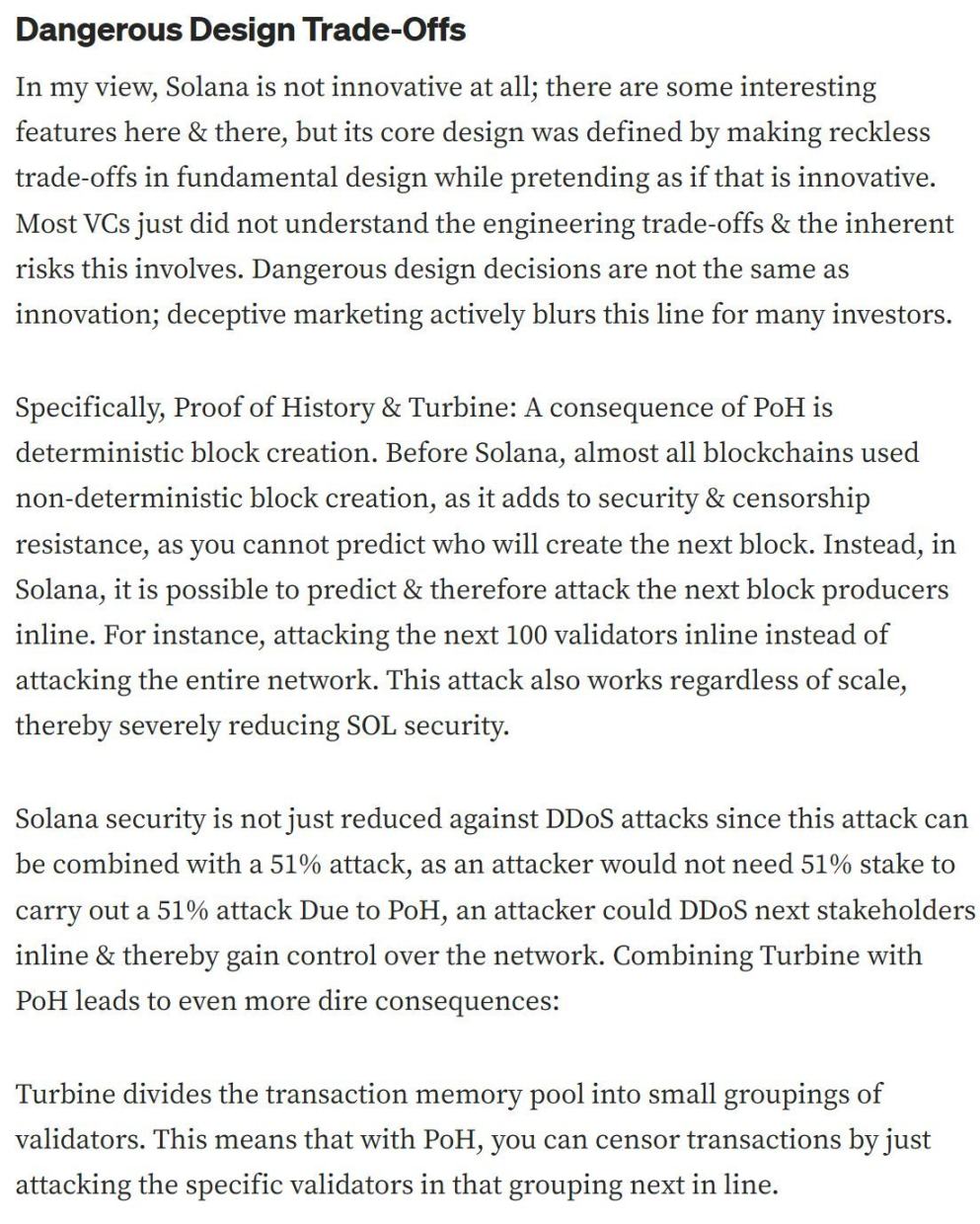

Dangerous Design Trade-offs

Some of Solana's design decisions, such as Proof of History (PoH) and the Turbine mechanism, have indeed sacrificed a degree of decentralization in pursuit of speed. I must confront this issue directly; what does it mean? In reality, it lowers the barrier to attack.

Roughly estimated, this may have reduced security by about 20%. Nevertheless, this is only a slight weakening of economic security. It allows attackers to perform DDoS attacks on the next set of validators, making them leaders, thereby reducing the amount of tokens required to launch a "51% attack." I provided a more detailed explanation of this in my previous criticisms:

Source: Screenshot from "Criticism of Solana: Lies, Fraud, and Dangerous Trade-offs"

Despite this, Solana's market cap is still three times that of the next largest L1 blockchain. Even with this trade-off, Solana still possesses a high level of security. Is this specific trade-off worth it? It's hard to say.

However, what is certain is that today's Solana is not insecure; it has ultimately achieved a balance. In practical terms, Solana is much more secure than its market cap competitors.

Decentralization is a category that involves multiple interacting factors. For example:

A high-capacity blockchain with 10,000 nodes running on supercomputers is more decentralized than a low-capacity blockchain with only 100 nodes running on Raspberry Pis.

This is an extreme example, but it highlights my point. This is why, despite Solana's higher node requirements and centralized design decisions, it is actually very decentralized in terms of its scale. Scale plays a crucial role in the actual decentralization process. Solana achieves this by widely distributing stakes across 1,300 validators:

Source: Solana Beach

This actually confirms the long-standing theories and debates surrounding the maintenance of decentralization, which can be traced back to the Bitcoin block size debate. There has always been a conflict between scalability and decentralization, most typically reflected in the "Blockchain Trilemma." The solution is to find the right balance between the two extremes, as being at either end of the spectrum leads to failure—either being useless or overly centralized.

So, after Bitcoin and Ethereum deviated from this vision, seeing Solana realize it is truly a dream come true. I hope this better explains my shift in position as a 2013-era supporter of large block Bitcoin and why I now support Solana.

Governance and Client Diversity

Solana has multiple competing clients, which is significant for decentralization. Without multi-client support, a blockchain is essentially a single-party governance system. You can vote, but there is only one party to choose from.

Multi-client support also greatly enhances the network's resilience, as it means that a single implementation vulnerability can no longer paralyze the entire network.

There are very few blockchains that can achieve this, and Solana is on that list. Therefore, this achievement should not be underestimated; it demonstrates a strong commitment to decentralization. Maintaining two clients is far more challenging than maintaining just one. This explains why few are willing to take this step; they prefer to cover up obvious centralization issues, while these "shadow rulers" pretend it is a system of "elite management," when in reality, they can control any changes.

Solana also has a basic on-chain governance mechanism, which is still being refined. But just having such a commitment already puts it far ahead of Bitcoin and Ethereum, in my view, as Bitcoin and Ethereum effectively operate under a dictatorship when it comes to decision-making regarding rule changes.

Solana recently failed to pass the SIMD228 proposal, which seems contradictory but is actually a significant milestone. Disagreements and conflicts are true signs of decentralization. Think about it… The proposal had the support of all of Solana's top leadership, yet stakeholders still vetoed it. There is no better evidence of true decentralization than this. Today, in Solana, the checks and balances of good governance are indeed functioning properly.

The Off-Switch

This is an absurd claim that I have never mentioned in my previous criticisms, but it is at least worth a brief response.

Solana does not have an "off-switch." Unlike permissioned chains (like XRP and HBAR) or chains with some permissioned elements (like ALGO and BNB), Solana has no permissioned elements; it is a truly public, trustless, and decentralized blockchain, which is an undeniable fact.

This misunderstanding may stem from a lack of understanding the difference between a blockchain stopping operation and the actual existence of an off-switch. Consensus mechanisms are complex, and there are various ways a blockchain can stop operating, and this is not the result of centralized control. I don't want to waste time on this ignorant criticism, as anyone with a bit of technical knowledge knows the truth.

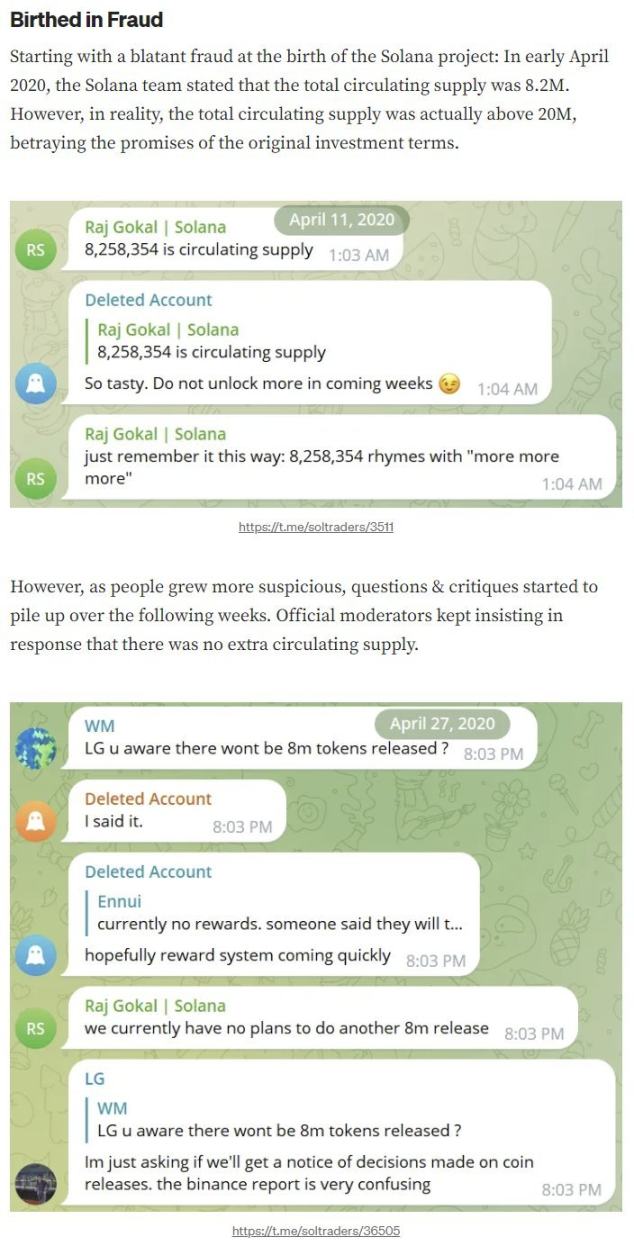

Fraud and Lies

Fraud and lies are harder to tolerate. As I mentioned in my previous criticisms, the Solana team has exhibited a series of misconduct over the years. However, since then, the Solana team has indeed made significant improvements in the honesty and professionalism of their communications.

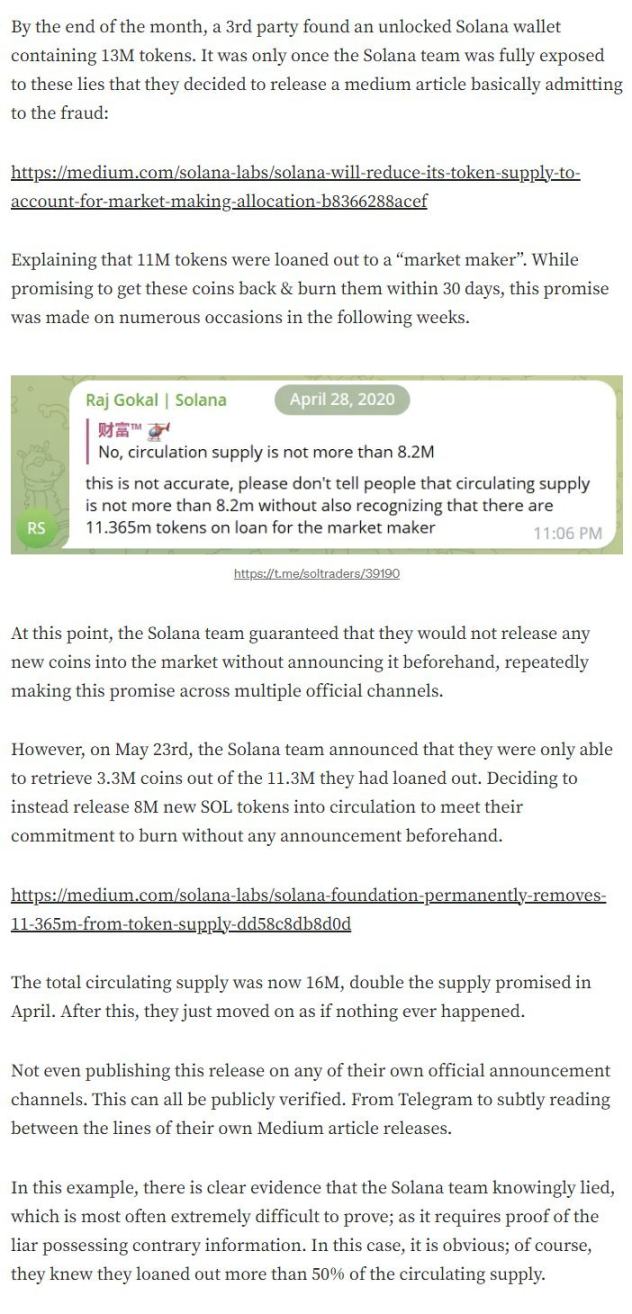

However, the ugly truth is that in 2020, the Solana team did lie about the circulating supply. Even though these numbers are now irrelevant to the market, it is undoubtedly a stain on Solana's history. For complete transparency, I provided a detailed explanation of this in my previous criticisms, and I even included evidence:

Source: Screenshot from "Criticism of Solana: Lies, Fraud, and Dangerous Trade-offs"

My response boils down to the concept of decentralization: a blockchain can transcend its founding state. Decentralization means that Solana is not defined by its past leadership. Especially with the arrival of mass adoption, leadership will dilute power and change. This means that even if you do not trust Solana's current leadership, we can still support it.

Personally, I have rebuilt my confidence in its leadership because the "patterns of misconduct" have ceased. But what I mainly want to say is that you do not actually need to trust the leadership.

That is the meaning of decentralization: you do not need to trust anyone! Past mistakes still exist, but we can look to the future.

Summary of Past Criticisms

To summarize my past criticisms, as I did at the time:

In 2020, Solana's leadership lied about the supply, but this has no substantial impact now.

Solana has improved its external communications, and real TPS is hitting new highs!

Blockchain explorers now show "real TPS."

TVL is no longer "fake."

Most Dangerous Trade-offs Have Been Corrected

I have steadfastly defended crypto principles while continuously adjusting my stance as cryptocurrencies have evolved. Some accuse me of being a shill because my shift in position seems quite sudden.

This accusation is not only a personal attack but also appears absurd on the surface, considering how negative my past attitude towards Solana was. Even if they wanted to buy me off, I would absolutely be the last to be bought.

Perfection is the Enemy of Excellence

If we are too picky, the blockchain space will split into thousands of chains, which is detrimental to the development of cryptocurrencies. Or, at the very least, in achieving the goals of the crypto-punk movement, we should rationally allocate our support.

Remember, this comes from someone who rejects 95% of blockchains. I even loudly criticized the top two market cap blockchains (Bitcoin and Ethereum) in 2016 and 2022, respectively, because they deviated from the on-chain scaling path.

This is why, if we refuse the third-largest blockchain (Solana), we better have a solid reason. My life is already difficult enough, managing the world's oldest liquidity fund while always taking contrarian strategies. This is also why, in good conscience, I can no longer continue to criticize Solana, as they have fixed the flaws I criticized… I have to become an admirer.

Even though the most popular content I have published is criticism of Solana. This has led many in my audience to dislike me for my shift in position, and many in the Solana community are cautious towards me as a former critic. I think sometimes, this is the price of being a free thinker.

Of course, there may technically be better blockchains, but is there a smoother path to mass adoption than supporting Solana? I would rather present clients with real revenue data than theoretical data…

The important thing is that Solana is decentralized enough to achieve censorship resistance, immutability, financial sovereignty, and many other characteristics, all on a blockchain that can now achieve large-scale applications, which is ultimately the key.

Conclusion

As a value investor supporting the overall scaling theory, it is only natural that I shifted to support Solana as it gradually emerged.

Solana is far from perfect; even at the time, it was not my favorite design. However, we must respect its success in usage, as true value lies within.

Decentralized scaling is meaningless; conversely, Solana's opponents claim it ignores this, which is not the case.

In an environment where Ethereum has decided not to scale on L1 at all, Solana has become the new king. Of course, there are still many competitors eyeing the throne, and diversification remains key. However, in the truly important areas: practicality, usage, and revenue, we cannot ignore Solana's clear advantages in the market today.

To overlook this at this stage stems either from a serious misunderstanding of Solana or its competitors or from deep-seated bias. We all need to correct our damn biases! This is why being able to change one's mind in this industry is a superpower.

As an early adopter of Bitcoin and Ethereum, I later became a critic when these blockchains deviated from the on-chain scaling path.

Solana's success deserves our applause as crypto punks. Because only through scalable technology can the masses be liberated, and Solana is currently realizing this beautiful vision.

Perfection is the enemy of excellence, and Solana is already excellent enough. Not free, rather dead; you too will fall in love with Solana just like I did.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。