Today's homework is quite challenging. The market originally expected Powell to respond in a dovish manner in the face of tariffs and the potential for economic recession. Even if there was no reaction to interest rate cuts, he should at least have come out to soothe the market. However, Powell maintained a neutral stance (perhaps) while making some hawkish remarks, such as indicating that there is no hope for interest rate cuts and that there are no plans to pause the balance sheet reduction, denying the possibility of an economic recession.

Of course, he only believes that the economy will face a downturn, but this time he did not indicate that there would be intervention if the economy does decline. He also elaborated on the significant impact of tariffs on inflation, which, although one-time, could have a long-lasting effect. This means that the Federal Reserve cannot make decisions prematurely; they must first see the impact of tariffs.

This indicates that, at least for now, Powell and the Federal Reserve believe there is no possibility of interest rate cuts in the first half of the year, nor will there be any additional adjustments to the balance sheet reduction. Powell also mentioned GDP data, so whether there will be adjustments to monetary policy going forward may still depend on GDP results. As of today, the GDPNow forecast is -2.2%, and after excluding gold imports and exports, it is -0.1%. However, GDP data itself includes gold, so it depends on how the Federal Reserve interprets this.

If they believe that gold imports and exports do not truly affect actual GDP, then GDP may not reflect that the U.S. is entering a recession, which is actually a good thing for the economy—after all, who wants a recession? But this also strengthens the Federal Reserve's determination not to cut rates in the short term, leading to a game between inflation and economic recession: whether inflation will decline first or the economy will enter recession first.

This may not be good news for the market. Additionally, Powell stated that the president has no authority to dismiss any Federal Reserve officials, let alone the Federal Reserve Chair. Although outsiders feel that Powell's job is just to flip a coin once a month.

Moreover, Powell expressed the importance of stablecoins, believing that the U.S. needs to establish a legal framework for stablecoins as soon as possible. This is also a form of progress and recognition for the cryptocurrency industry. Although Powell has previously mentioned a relaxed approach for banks entering the cryptocurrency space, this time he emphasized the need for legislation on stablecoins, suggesting that regulation on cryptocurrencies could be relaxed somewhat.

Looking back at Bitcoin's data, the turnover rate began to decline today, which supports yesterday's viewpoint. Such a significant turnover yesterday should have been internal transfers within exchanges; the actual turnover rate among users may not be high. Data also shows that the current exits are mainly from short-term investors, especially those who bought the dip in the last two days. Even if they are at a loss, they are exiting, likely worried about the continued decline in the price of $BTC.

However, in reality, there is no more negative information at the moment. The market has already emerged from the significant threat of tariffs, realizing that while tariffs may still have an impact, the scope of that impact is mainly between China and the U.S. Other countries, including Europe, can still coordinate. Moreover, even between China and the U.S., there are now opportunities for mediation, as both sides have expressed a willingness to communicate further today.

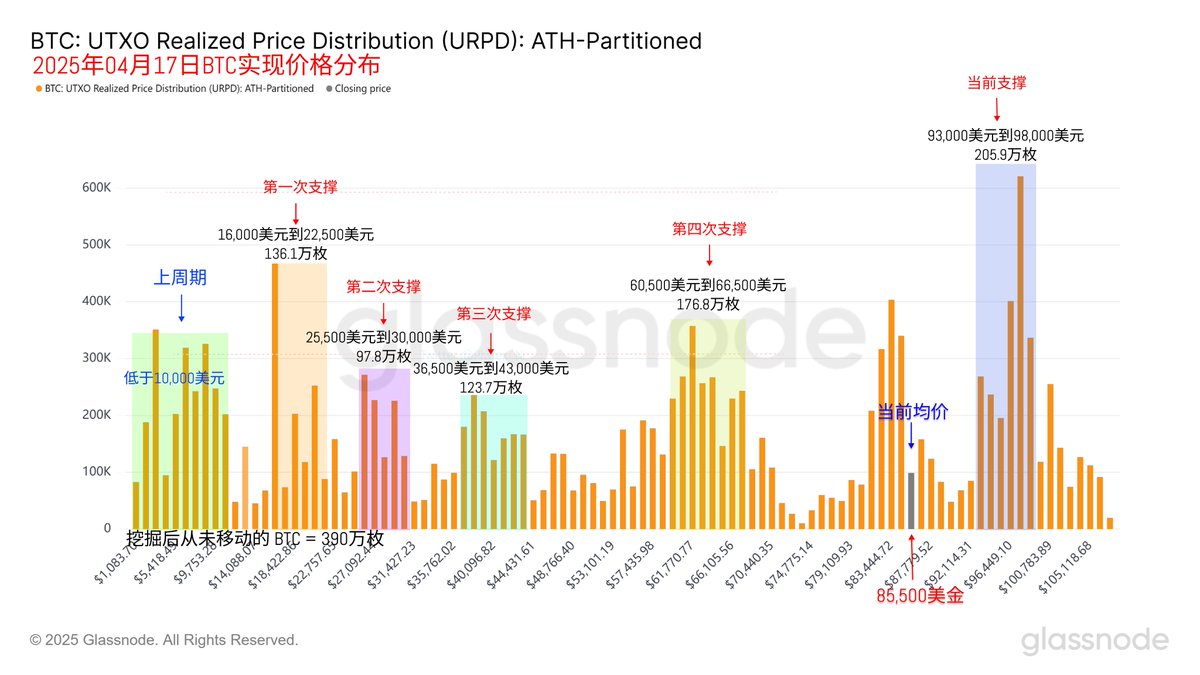

From the perspective of the concentration of chips, the bottom formation around $83,000 is gradually strengthening, with more investors entering this range. However, even now, investors between $93,000 and $98,000, and even those above $100,000, have not shown signs of exiting. This is also the biggest difference in this recent cycle; there is almost no panic among loss-making investors.

This also represents that the majority of investors are optimistic about the long-term trend of Bitcoin.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。