Simply sharing my views, which may not necessarily be correct.

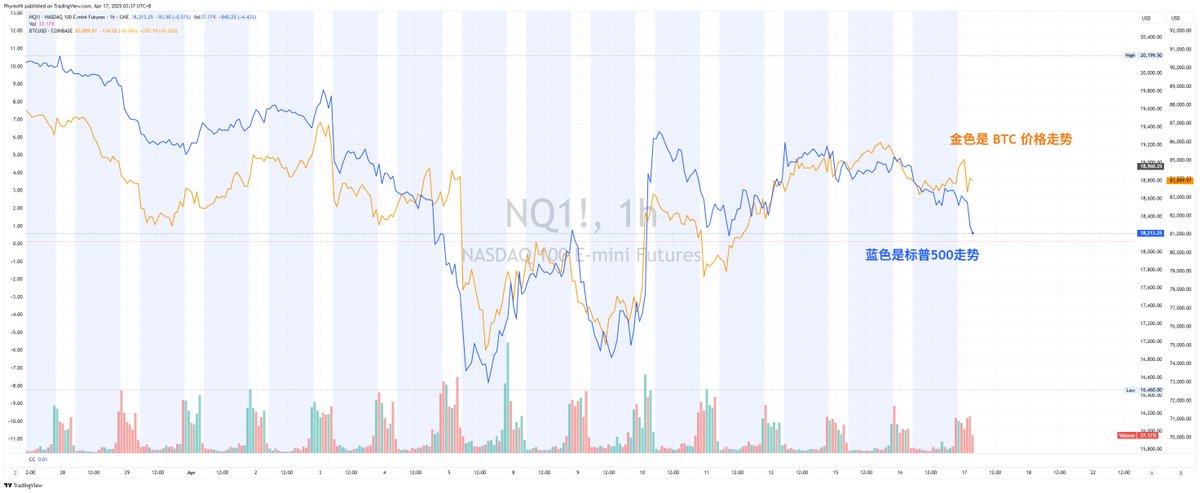

From a broader perspective, the price trends of the S&P 500 and $BTC are quite similar; at times, Bitcoin's decline is slightly less severe, and there are moments when Bitcoin does exhibit independent market behavior. However, overall, BTC has not completely diverged into an independent trend.

From the current BTC chip structure (as mentioned in my work), the current sell-off is primarily driven by short-term investors, while more investors have already established positions around the $83,000 mark, indicating that this level is gradually forming a solid range.

More importantly, even though investor sentiment is not very positive, there are no significant signs of large-scale exits from the loss-making positions above $93,000. In simpler terms, the sell-off of loss-making positions above is not substantial, which suggests that most investors still have confidence in BTC's future and are not in a hurry to sell their holdings.

Thirdly, this situation is not unprecedented; a similar scenario occurred two weeks ago. If I remember correctly, it was on a Friday when Trump announced tariffs, leading to a significant drop in the U.S. stock market, while BTC fluctuated around $82,000. Later, on Monday, due to China's market response and low liquidity, some investors sold off, causing BTC's price to drop to around $75,000. However, at that time, buying interest was quite strong, and investors were very interested in BTC at that price, so it quickly rebounded.

Therefore, my personal views are:

The support around $80,000 for BTC is still quite solid.

The current negative factors do not significantly impact the overall asset allocation for BTC, and liquidation levels are lagging, not prioritized for liquidation.

Powell's mention of cryptocurrencies and stablecoins, indicating openness to bank regulation, is a positive sign that has stimulated investor sentiment.

Thank you.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。