Written by: Yuliya, PANews

In a recent podcast interview with Wealthion host Anthony Scaramucci, Propy founder and CEO Natalia Karayaneva shared her bold vision for the future of the real estate industry. As a professional with 15 years of experience in real estate development and a software engineer, Natalia has deep insights into the pain points of traditional property transactions. She stated, "In the next decade, you may only need a few clicks to purchase property online from anywhere in the world, with the entire process being quick, low-cost, and free from fraud concerns." While this vision sounds futuristic, Natalia believes that such transformation is already beginning to manifest, driven by technological advancements and market demand.

Cross-Industry Innovation by an Engineer and Real Estate Expert

For a long time, the real estate market has been constrained by high transaction costs, lengthy transfer processes, and a plethora of fraud risks. The traditional home buying process often involves cumbersome contract signing, bank loan approvals, and property registration, with the entire transaction cycle potentially lasting several months. At the same time, issues such as title fraud, identity theft, and fund transfer scams have caused significant losses for buyers, making this market fraught with uncertainty. As cross-border property transactions increase, these risks have also expanded globally. During the digital transformation process, the collision between traditional paper document management and new technologies has exacerbated identity theft and fund transfer risks, further increasing market uncertainty.

Propy was born to address these industry challenges. As a dual-expert with a deep understanding of the real estate development ecosystem and the underlying logic of blockchain, Natalia leads a team of 40 in developing groundbreaking solutions. The Propy team has built a decentralized property management system based on smart contracts, achieving multiple innovations through blockchain technology:

- Automation: The system can automatically execute transaction terms, verify property ownership and fund flows in real-time, significantly shortening transaction cycles.

- Secure and Transparent Mechanism: The distributed ledger technology of blockchain ensures that all transaction stages are open and transparent, preventing information tampering and fraud.

- Real-Time Tracking: Each transaction step is recorded on the blockchain, allowing relevant parties to view transaction progress at any time, effectively reducing the risk of human error.

Currently, the Propy platform has processed over $4 billion in transaction volume. Through its unique property tokenization scheme, the platform has successfully made complex cross-border real estate investments as simple as sending an email. From Bitcoin mortgages to property tokenization, Propy is reshaping the way the real estate market operates, opening a new era for global buyers.

Creating Two Buying Models for Buyers, Combining Blockchain and Traditional Processes

So, how does Propy specifically make buying a home easier? They offer two purchasing methods to cater to different user needs.

The first is for users already familiar with cryptocurrencies. The entire process is very simple. As Natalia said, "For users accustomed to using cryptocurrencies, you just need to connect your digital wallet and with a few clicks, you can buy a house, provided that the property has been converted into a digital asset." This method shortens the home buying process, which would normally take several months, to just a few minutes.

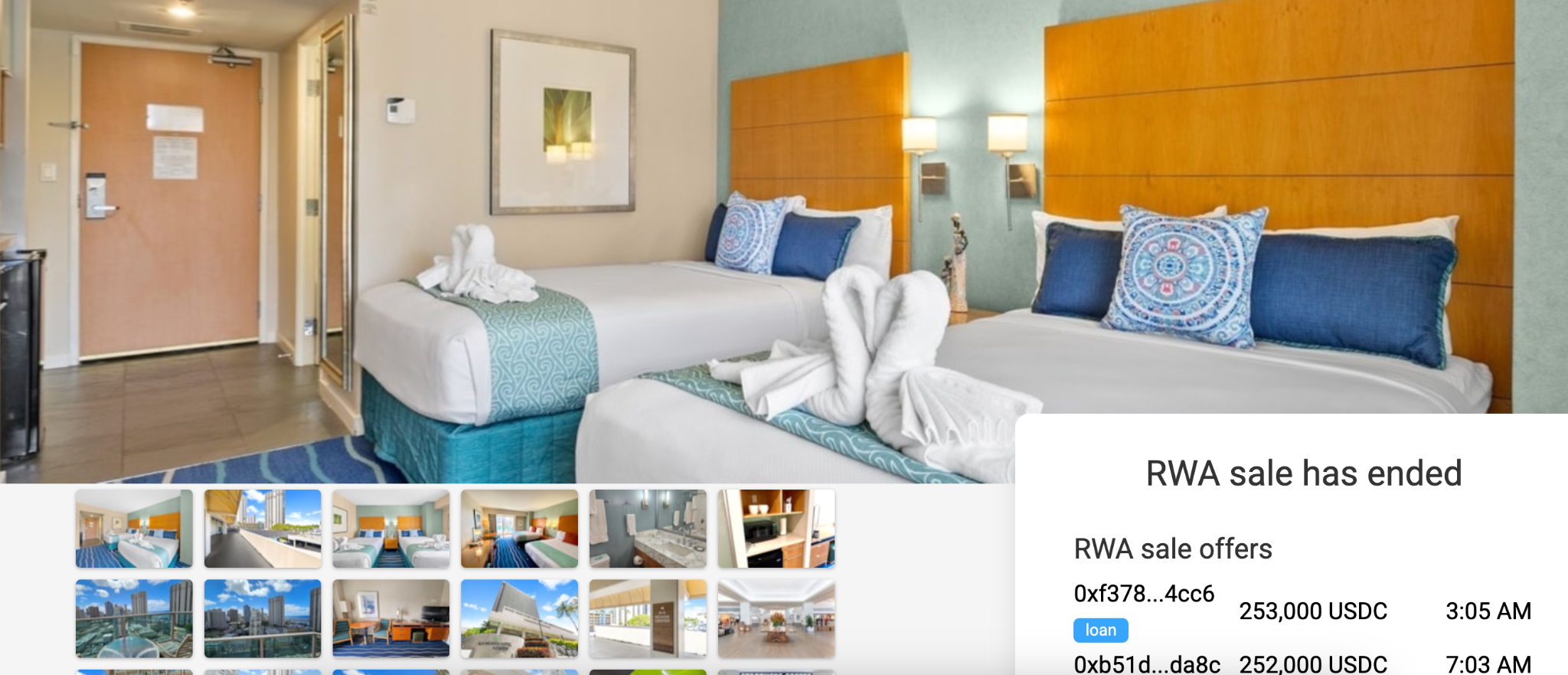

For example, in January of this year, Propy launched a new loan product that supports purchasing Hawaiian condos with collateralized crypto assets, with a starting bid of 250,000 USDC. Since the entire transaction is conducted on the blockchain, buyers no longer have to go through the traditional 30-day transaction process and can almost complete the transaction immediately. The good news is that by February 2, the property was sold— the buyer obtained a loan by collateralizing Bitcoin to complete the purchase. Natalia elaborated on this innovation: "In the transaction we completed last month, a buyer holding Bitcoin was able to bid on the property without needing to sell their Bitcoin. We believe Bitcoin is a great collateral; you can use it to invest in other assets. In this transaction, if you have $250,000 worth of Bitcoin, once you win the bid, you can immediately obtain a Bitcoin-based loan without any review or waiting for the traditional bank's 30-day loan approval, allowing you to become a homeowner right away."

Of course, not everyone is willing to completely abandon traditional home buying methods. The second method combines traditional real estate transaction processes with innovative technology, suitable for users who still prefer traditional buying methods. Natalia explained, "In fact, our most popular method is still the more traditional one. We have dedicated title and escrow companies; you need to sign a purchase agreement, and then our AI system will immediately process this contract and start the transaction process. Even at night or on weekends, the transaction can be initiated immediately." This method retains some key steps of traditional home buying but significantly improves efficiency through technology.

Achieving Property Tokenization and Introducing Crypto Mortgage Mechanisms

There are many benefits to purchasing digitized properties on the Propy platform, the most obvious being the speed of transactions and ease of liquidity.

Natalia emphasized, "The advantage of tokenized assets is that you can purchase them immediately, obtaining property ownership in just a few minutes. They are more liquid, so you can sell them within an hour or a day by initiating an auction on the Propy RWA market." This high liquidity fundamentally changes the characteristics of real estate as an investment category, making it closer to the trading experience of other financial assets. In the future, RWA trading platforms like Coinbase and Opensea may support real estate transactions. Currently, these platforms do not require KYC and AML certification, but with regulatory adjustments, real estate tokenization is expected to become mainstream.

At the same time, Propy is also exploring the possibility of fractional ownership of properties. Natalia explained that by further splitting NFTs, multiple buyers can jointly own a property and divide rights according to their shares. However, since these transactions fall under the category of securities, they must be filed with the SEC in the United States.

Natalia pointed out that this process is relatively complex, taking about four months to complete, and the transparency requirements for SEC filings make it more akin to a small IPO, resulting in higher costs. Therefore, for small properties, the implementation difficulty is significant, but from a technical perspective, it remains feasible. She believes that although the current threshold is high, fractional ownership of properties will be one of the future development directions of real estate tokenization.

Of course, Propy is continuously optimizing platform features to enhance user experience and meet the rapidly changing market demands. In the future, users will be able to manage real estate NFTs independently through the Propy platform or wallet, thereby enhancing their control over assets and further lowering transaction barriers.

In terms of property management, Propy ensures compliance with local laws and regulations and has established a property transfer verification mechanism. Users can choose to sell through traditional methods, maintaining compatibility with the traditional market to meet conservative investors' needs; or they can choose to transfer tokenized ownership on the blockchain, achieving fast, low-cost transactions and gaining global liquidity opportunities.

Additionally, Propy has launched an innovative cryptocurrency mortgage model, providing a new option for investors who do not wish to sell their crypto assets. This loan model accepts Bitcoin, XRP, or Ethereum as collateral. According to Natalia, "Our most recent transaction used Bitcoin as collateral for a two-year loan with a 10% interest rate and monthly repayments. It operates similarly to a mortgage, but the main advantage is that it does not require the lengthy 30-day mortgage approval process, which is particularly suitable for investors primarily holding crypto assets, as traditional financial institutions often do not recognize the collateral value of crypto assets.

In terms of repayments, the platform supports repayments in multiple cryptocurrencies, offering flexible repayment terms. Users can choose to repay early without penalties, while interest rates can be dynamically adjusted based on market conditions. To control risks, the platform has implemented comprehensive risk management measures, including real-time monitoring of Bitcoin price fluctuations, establishing a margin call mechanism, providing smart contract automatic liquidation protection, and setting up a professional risk assessment team.

It is worth mentioning that Natalia also proposed a future vision of Bitcoin as collateral for real estate investments. She stated, "I believe that in the future, Bitcoin will become a high-quality collateral, allowing users to access other asset classes. Imagine being able to automatically obtain on-chain loans based on your Bitcoin holdings, without credit checks and without going through the lengthy 30-day traditional mortgage approval process."

This decentralized finance (DeFi) + real estate model will make real estate transactions more efficient, increase liquidity, and provide investors with unprecedented freedom. With Propy's continuous innovation, the real estate market is moving towards a more intelligent and decentralized new era.

Furthermore, Propy has deployed multi-layered security mechanisms to prevent fraud. Natalia pointed out, "If fraud occurs, our AI or other means may detect it, and we will report these fraudsters to the FBI and all relevant service agencies according to the current rules of the property industry and re-record the contracts." This multi-layered security mechanism significantly reduces the risk of fraud in property transactions, providing users with a more secure trading environment.

Accelerating Transformation through Regulation and Institutionalization

Looking ahead, Propy is confident in the digital transformation of the real estate industry and maintains active cooperation with regulatory and financial institutions to ensure the compliance and scalability of its solutions.

On the regulatory front, Propy actively cooperates with government agencies' policy adjustments to promote the legalization process of real estate tokenization. Natalia mentioned, "Now the SEC and other agencies are studying fractional ownership of real estate on the blockchain and how to allow more citizens to invest, as this is clearly a security. I always advise all real estate operators and owners entering the tokenization field to follow SEC rules and register under Reg D, Reg A, etc."

At the same time, the regulatory environment is evolving in a more positive direction. Natalia noted, "After multiple dialogues with legislators, I also see their willingness to actually relax certain securities laws for some assets, especially those backed by assets like real estate." This shift in regulatory attitude will pave the way for further development of blockchain real estate, enabling more people to enjoy the conveniences brought by this innovative technology.

As blockchain real estate gradually enters the mainstream, institutional adoption is also showing positive signals. Natalia pointed out, "About a week ago, Robinhood's Vlad tweeted about Robinhood becoming a platform for purchasing real estate. I think they are referring to securities, specifically fractional ownership of real estate." This indicates that mainstream financial institutions are recognizing the potential of blockchain real estate and beginning to make moves, which is a strong impetus for the development of the entire industry.

Conclusion

While homebuyers still need to go through the traditional process of selecting properties, such as examining communities, touring homes, and assessing investment returns, Propy's innovation significantly simplifies the transaction process after the purchase decision is made. Once a buying decision is made, the property transfer will become simple and transparent, allowing buyers to instantly understand the property's ownership status and potential risks. More importantly, the entire transaction process can be completed in just a few minutes. If a change of residence is needed in the future, the property can also be quickly liquidated, truly achieving high liquidity of real estate assets.

Looking ahead, Natalia holds an optimistic view of the cryptocurrency market and the realm of real-world assets (RWA). She anticipates that annual U.S. home sales could grow from the current 5 million units to 20 million units. This growth is attributed to the innovation in transaction methods—future home buying will be as convenient as using ride-hailing or short-term rental platforms today. The impact of this innovative model extends far beyond developed countries. For many developing countries that struggle to attract investment due to a lack of a robust property rights system, this will be a life-changing opportunity. The digital transformation of U.S. real estate transactions is expected to become an important cornerstone for driving reforms in global capital markets, opening doors for investment and financing in more countries.

Propy is leading a real estate revolution through blockchain technology and cryptocurrency, committed to creating a more efficient, transparent, and inclusive global real estate market. As technology continues to evolve and adoption rates rise, the future of buying homes with Bitcoin has quietly arrived. This transformation not only addresses many pain points in the current real estate market but also holds the promise of returning home buying to its essence of meeting housing needs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。