What are the crypto giants planning?

Written by: Nianqing, ChainCatcher

Recently, the U.S. Securities and Exchange Commission (SEC) has withdrawn a series of lawsuits against crypto companies in a "clean slate" approach, with lawsuits against Kraken, Consensys, Cumberland, Ripple, Robinhood, Nova Labs, and others being dismissed. The new SEC Chairman Paul Atkins has officially taken office and stated that establishing a regulatory framework for digital assets will be a "top priority," aiming to completely change the previous closed and high-pressure regulatory style. Meanwhile, the U.S. Department of Justice has clarified that crypto developers are not responsible for the use of their code by criminals and do not bear liability.

It is clear that the clarity and relaxation of regulations are driving crypto companies into a rapid growth phase.

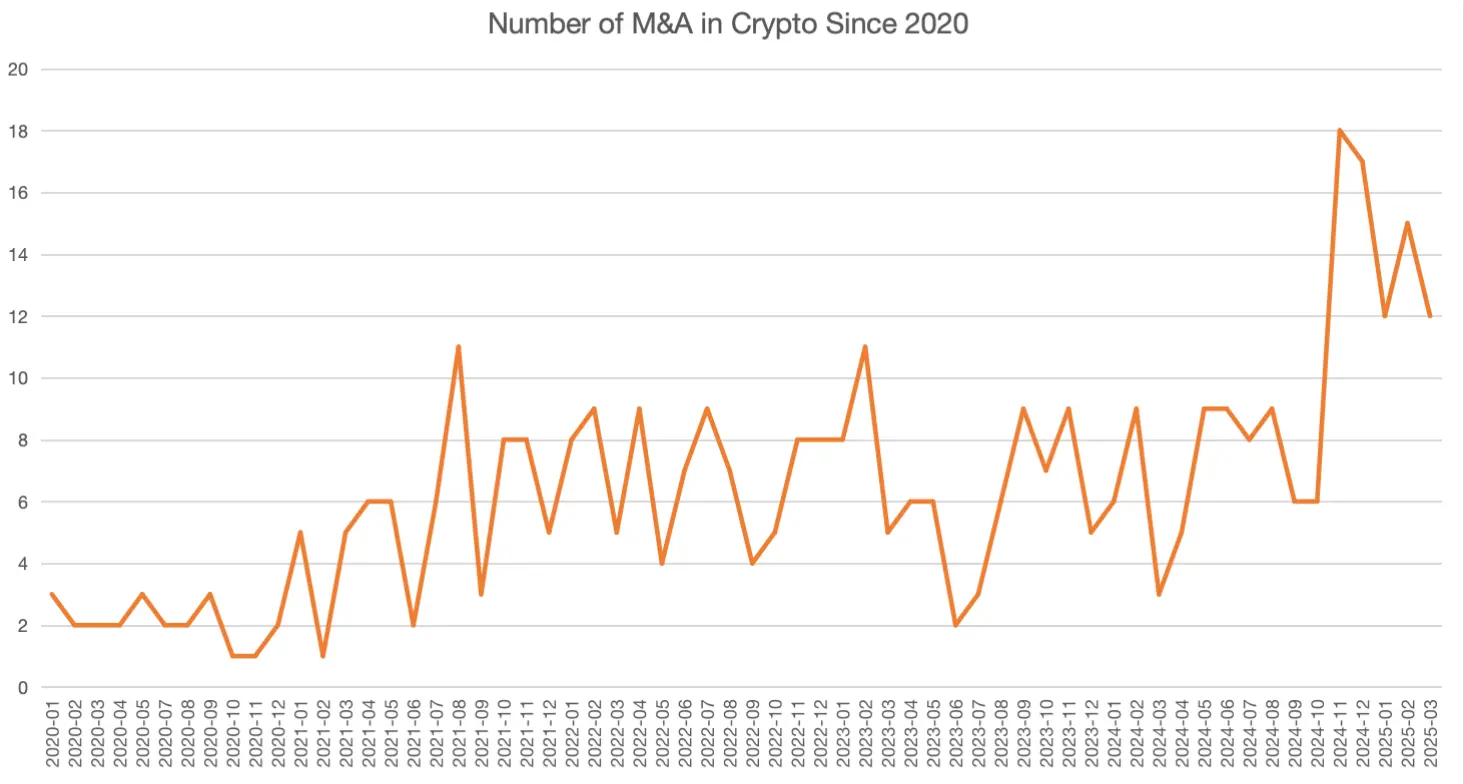

Currently, U.S. crypto firms are experiencing a wave of IPOs and mergers and acquisitions (M&A). More than a dozen U.S. crypto companies are striving to seize the window of opportunity to go public. Additionally, an increasing number of projects are seeking exits through M&A, with the number of acquisitions exceeding 10 for five consecutive months since November 2024. Large-scale mergers are frequent, with acquisition amounts continuously breaking historical highs in the crypto space. The crypto market is entering a phase of consolidation and institutionalization, with one-stop, integrated platform-type crypto giants continuously emerging.

What are the crypto giants planning? What impact will this have on the future crypto market?

IPO Boom: Seizing the Window of Opportunity

2021 was a shining moment for the crypto industry, benefiting from soaring Bitcoin prices, a low-interest-rate environment, and the SPAC boom. Many crypto companies planned to go public through IPOs or SPACs to raise funds and enhance market influence. On April 14, 2021, Coinbase successfully listed on NASDAQ, marking a milestone in the mainstreaming of the crypto industry. However, other crypto companies were not as fortunate as Coinbase; Circle, Kraken, Ripple, BlockFi, and eToro all had IPO or SPAC plans in 2021, but many were shelved due to regulatory uncertainties and market volatility.

In the second half of 2024, with Trump's election, the IPO window for U.S. crypto companies has reopened. Currently, several crypto companies have gone public in the U.S. The Japanese cryptocurrency exchange Coincheck completed its merger listing on December 11, 2024; Fold Holdings successfully listed on NASDAQ through a SPAC merger on February 19; Amber Group's digital wealth management platform Amber PremiumAmber completed its merger listing in March.

Circle, eToro, Kraken, and other crypto companies that previously planned IPOs are also seizing the window of opportunity to advance their IPO plans. Currently, Circle, eToro, Bgin Blockchain, Chia Network, Gemini, and Ionic Digital have submitted S-1/F-1 filings, with a high likelihood of going public in Q2 2025; BitGo, Kraken, Bullish Global, Consensys, Figure, Chainalysis, and Blockchain.com have indicated IPO plans or are in advisory negotiations, with significant potential for listings in 2025-2026.

The specific progress is shown in the image below:

M&A Heat Up, Crypto Market Enters Consolidation and Institutionalization Phase

Recently, there has been a surge in mergers and acquisitions in the crypto market. Amid an overall decline in the primary investment market, more projects are seeking exits through M&A, and leading projects are more willing to optimize their industry layout and expand influence through acquisitions at reasonable valuations.

According to RootData, there have been over 40 M&A events in the past three months, with most acquirers being U.S. crypto companies. Since November 2024, the number of acquisitions has exceeded 10 for five consecutive months, with large-scale mergers frequently occurring and acquisition amounts continuously breaking historical highs in the crypto space.

Trends in crypto M&A since 2020, data source: RootData

Among them, over $1 billion in acquisitions in the past six months have all occurred in the U.S.:

- In December 2024, traditional payment giant Stripe acquired the stablecoin platform Bridge for $1.1 billion.

- In March 2025, Kraken acquired the U.S. futures trading platform NinjaTrader for $1.5 billion.

- In April 2025, Ripple acquired the crypto-friendly brokerage Hidden Road for $1.25 billion.

Additionally, Coinbase is in deep negotiations to acquire Deribit, which is valued at around $4 billion to $5 billion, while BitMEX, a crypto derivatives platform founded by Arthur Hayes, is seeking to sell. If Deribit and BitMEX complete their acquisitions, the acquisition amounts are sure to break new highs.

Bernstein analysts state that as the models of exchanges and brokers/dealers begin to merge, the crypto industry is moving towards a more integrated "one-stop" multi-asset investment platform. For example, Kraken's acquisition of NinjaTrader, Robinhood's integration with Bitstamp, and Coinbase's deep negotiations to acquire Deribit. Deribit's BTC and ETH options market has a monthly trading volume exceeding $100 billion, accounting for about 70% of the market share, while the monthly trading volume of crypto futures is about $45 billion. Coinbase's acquisition of Deribit would allow it to expand into the derivatives space, especially in options, and compete with Binance in the international crypto derivatives market.

In addition to options and derivatives, crypto exchanges' "multi-asset" offerings are even expanding into traditional assets. On April 14, Kraken launched stock and ETF trading in the U.S. market for the first time. On April 12, several SEC commissioners expressed support for establishing a regulatory sandbox for digital assets during the second digital asset roundtable, allowing crypto exchanges like Coinbase to freely experiment in new areas, including offering tokenized securities trading. In the future, crypto exchanges will provide spot cryptocurrencies, crypto derivatives, and tokenized stocks, as well as stocks and stock derivatives. Meanwhile, brokerage platforms like Robinhood will further expand their cryptocurrency and crypto futures businesses.

As traditional assets become tokenized, the boundaries between crypto tokens and stocks are becoming blurred, and the roles of digital asset securities, tokenization, and intermediaries will become clearer. The overlap between crypto exchanges and brokers will continue to increase, and traditional financial firms and crypto companies will further merge. U.S. crypto firms will resemble Fintech (financial technology) more than Crypto.

Crypto Companies Transitioning to Institutional Services

The crypto-friendly policies of the Trump administration have lowered the barriers for institutions to enter the market. The U.S. OCC has approved blockchain-native loan licenses (such as Figure Technologies), encouraging traditional banks to participate. Starting in 2024, institutional services, including digital asset custody, tokenization, payment settlement, derivatives trading, and compliance solutions, have become the main profit growth points in the crypto industry.

At the same time, due to the overall lack of new narratives in the crypto market to attract new users, the customer acquisition costs for crypto institutions, including exchanges, have increased. Compliant crypto companies adhering to U.S. regulations are beginning to focus on institutional business.

Coinbase has made early moves in institutional services to reduce its reliance on retail trading. Its trading revenue share, especially the share of retail trading revenue, is decreasing year by year, with retail trading fee revenue shares of 70%, 65%, and 52.7% from 2022 to 2024. Meanwhile, Coinbase's subscription and services (for institutions) revenue share is increasing year by year, with shares of 17.8%, 22.6%, and 34.8% from 2022 to 2024.

As of 2024, Coinbase's custody assets amount to $220 billion, a year-on-year increase of 100%, primarily serving institutional clients (such as hedge funds and ETF issuers). Over the past year, Coinbase has become a major custodian for Bitcoin spot ETFs.

If Coinbase completes its acquisition of Deribit, it will not only expand its global crypto derivatives market but also enhance its institutional service capabilities. In 2024, Deribit's trading volume nearly doubled, with institutional investors (such as hedge funds and asset management companies) showing a surge in demand for complex financial instruments. Deribit's institutional client base and professional trading tools (such as options and futures) will enhance the appeal of Coinbase Prime. Recently, Coinbase Prime also provided $200 million in credit support to CleanSpark, a Nasdaq-listed mining company, and CleanSpark's digital asset management team has officially launched an institutional-level Bitcoin fund management platform.

Kraken, Gemini, and other crypto exchanges have made similar choices. Kraken heavily acquired the U.S. retail futures trading platform NinjaTrader to enhance its competitiveness in the derivatives market and expand its institutional service capabilities. In April, Kraken also announced a partnership with Beeks Exchange Cloud to launch custody services, planning to go live later this year; meanwhile, Gemini has recently expanded its institutional service business to regions such as Europe and Canada by providing U.S. dollar payment support.

Ripple recently spent $1.25 billion to acquire the crypto-friendly brokerage Hidden Road, with the core purpose of expanding its services for institutional investors. Hidden Road is a one-stop service provider that helps large institutional investors (like Jump Trading, market makers, and hedge funds) connect with exchanges, move money, borrow money, and clear transactions.

Ripple's main business is cross-border payments, but its ecosystem relies entirely on building its own network and forming alliances to sustain itself, making the bottleneck in its payment business evident. Additionally, in June of last year, Ripple acquired the New York-based crypto trust company Standard Custody & Trust Company. This acquisition allows Ripple to engage in cryptocurrency custody and settlement services.

Tokenization Layout

Behind the transition of crypto companies to institutional services is the rapid expansion of the tokenization market.

Recently, Ripple, in collaboration with Boston Consulting Group (BCG), released a report titled "Approaching the Tokenization Tipping Point." This report makes an important prediction—the tokenization asset market is expected to surge from $600 billion in 2025 to $18.9 trillion by 2033, with a compound annual growth rate (CAGR) of up to 53%.

Tokenization refers to the process of using blockchain technology to record ownership and transfer assets (such as securities, commodities, and real estate). The main application scenarios for the tokenization market include trade finance, collateral and liquidity management, investment-grade bonds, private credit, and carbon markets.

It is worth mentioning that, unlike previous distinctions made in the Chinese-speaking world between stablecoins and RWA (Real World Assets), this report includes stablecoins within the category of asset tokenization. This is essentially a battleground for U.S. crypto companies—tokenization. The co-CEO of Kraken recently stated that the scale of tokenized stocks is expected to surpass that of stablecoins.

This year, three crypto companies—Figure, Fireblocks, and Securitize—were selected for Forbes' 2025 Fintech 50 list, all of which are engaged in tokenization businesses, including real estate, bond, and equity tokenization.

Figure Technologies utilizes its self-developed Provenance blockchain to provide home equity loans (HELOC), payment solutions, and asset tokenization services. Additionally, Figure has launched its own tokenized asset. On February 20, the SEC approved Figure Markets (a subsidiary of Figure Technologies) for the development of a "yield-bearing stablecoin" YLDS for the first time. YLDS is pegged 1:1 to the U.S. dollar and is registered with the SEC as a public security, offering yields with a current annual yield of approximately 3.85%. YLDS falls within the same financial category as stocks or bonds.

Fireblocks' core business revolves around the secure storage, transfer, and issuance of digital assets, serving financial institutions, exchanges, payment platforms, and Web3 enterprises. In September last year, Fireblocks acquired the tokenization company BlockFold for $13.6 million to enhance its ability to provide asset on-chain services for large banks and financial institutions. Since 2024, Fireblocks has rapidly expanded its global market presence, already operating in European countries such as Germany and France, as well as in the Asia-Pacific region, including Singapore, Japan, and South Korea.

Securitize gained public attention for its collaboration with BlackRock to launch the tokenized asset BUIDL. Securitize offers integrated services covering fund management, token issuance, brokerage services, transfer agency, and alternative trading systems. On April 15, Securitize announced the acquisition of MG Stover's fund management business, making its subsidiary Securitize Fund Services (SFS) the largest digital asset fund management platform globally. This acquisition "consolidates Securitize's position as a comprehensive platform for institutional-level tokenization and fund management."

In addition to planning an IPO, Circle is also targeting a larger tokenization market.

Circle's IPO S-1 filing shows that 95% of its revenue comes from short-term U.S. Treasury yields, while its own business, such as trading fees, cross-chain bridges, and wallets, generates minimal income. Besides the risks associated with interest rate dependence, high compliance costs and distribution costs consume most of its revenue.

Recently, Circle acquired Hashnote and its USYC tokenized money market fund. Hashnote is a regulated institutional-level investment management platform incubated by Cumberland Labs (the blockchain incubator of DRW), primarily providing institutional investors with tokenized money market funds (USYC), customized investment strategies, on-chain asset management, and custody services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。