Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Ethereum has recently been "not so good."

From the reallocation movements of several established crypto institutions to the long-dormant whales awakening and choosing to reduce their holdings, the ETH market seems to be enveloped in a cold wind.

What is even more concerning is that this phenomenon is not an isolated event: some institutions' on-chain ETH holdings are nearing zero, spot ETF funds are continuously flowing out, and on-chain activity has also seen a dramatic decline… Do these signals mean that the Ethereum ecosystem is undergoing a more profound change?

Liquidation, Reduction, and Loss: Is ETH Facing a "Sell-off Wave"?

Ethereum may quietly be facing a wave of "smart money" reduction. Several established institutions have recently shown unusual reallocation actions. Well-known crypto VCs such as Galaxy Digital, Polychain Capital, B2C2, and Spartan Group have successively deposited thousands to tens of thousands of ETH into exchanges.

Long-dormant Ethereum whales are also gradually "reviving." Some addresses have not moved for 3 years, or even as long as 10 years, but have recently activated and transferred large amounts of ETH to trading platforms. Some whales have chosen to exit at a loss, with some even liquidating their entire holdings without hesitation.

Here is a set of data compiled by ChainCatcher, which statistics the amount of ETH recently deposited into exchanges by some institutions and whales (incomplete statistics):

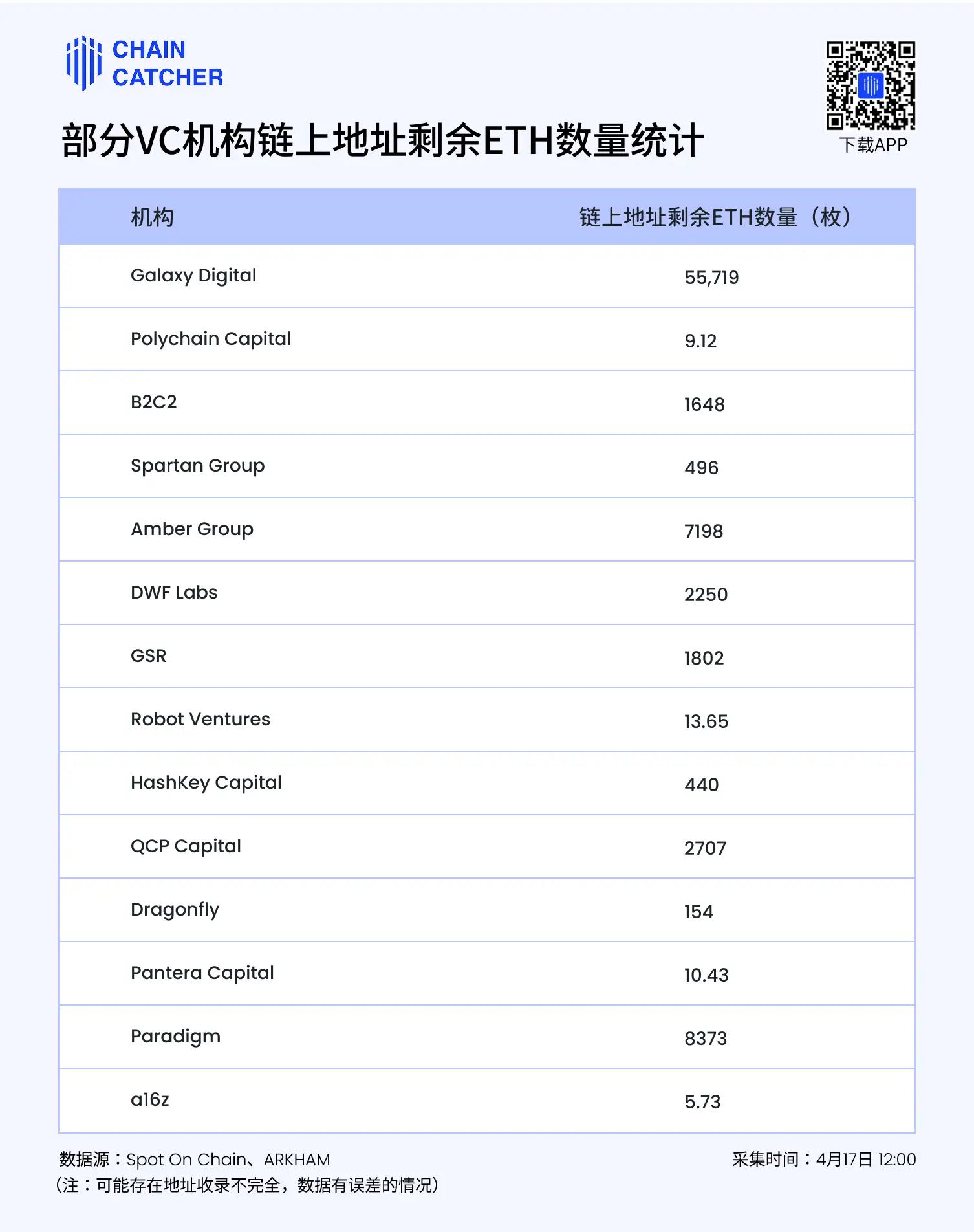

By examining the remaining ETH amounts in institutional on-chain addresses, it is evident that several mainstream VCs have relatively low on-chain ETH holdings, such as Dragonfly, GSR, and Spartan Group, which currently hold only a few hundred ETH. More notably, some institutions' holdings are already close to "empty," with the remaining ETH in their on-chain addresses even dropping to single digits.

Here is a statistical table of the ETH holdings in the on-chain addresses of some institutions compiled by ChainCatcher (Note: Data may have certain inaccuracies due to incomplete address inclusion or attribution determination, for reference only):

Although the on-chain holding data of VCs may have uncertainties, the actual on-chain transfers and sell-offs that have occurred are too clear to ignore. Has ETH truly disappointed them? Is this a strategic reallocation, or a loosening of emotions and faith?

Next, let's look at some reference data.

Network Activity Plummets, Capital Outflow Intensifies

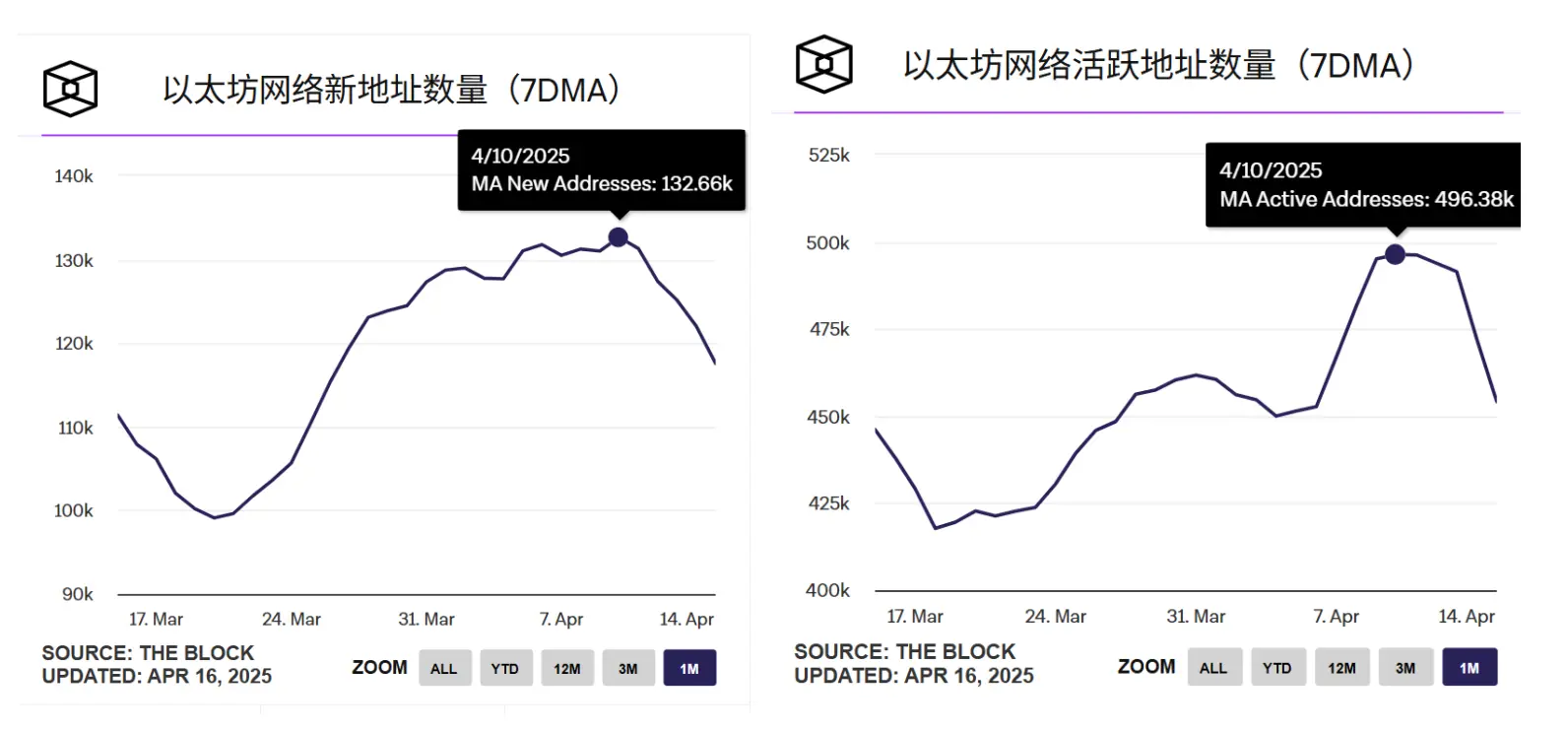

According to data from The Block, since April 10, the number of new addresses and active addresses on the Ethereum network has both sharply declined, while the average transaction fee for Ethereum has dropped from $0.86 to $0.63, indicating a dramatic contraction in network activity.

Data: The Block

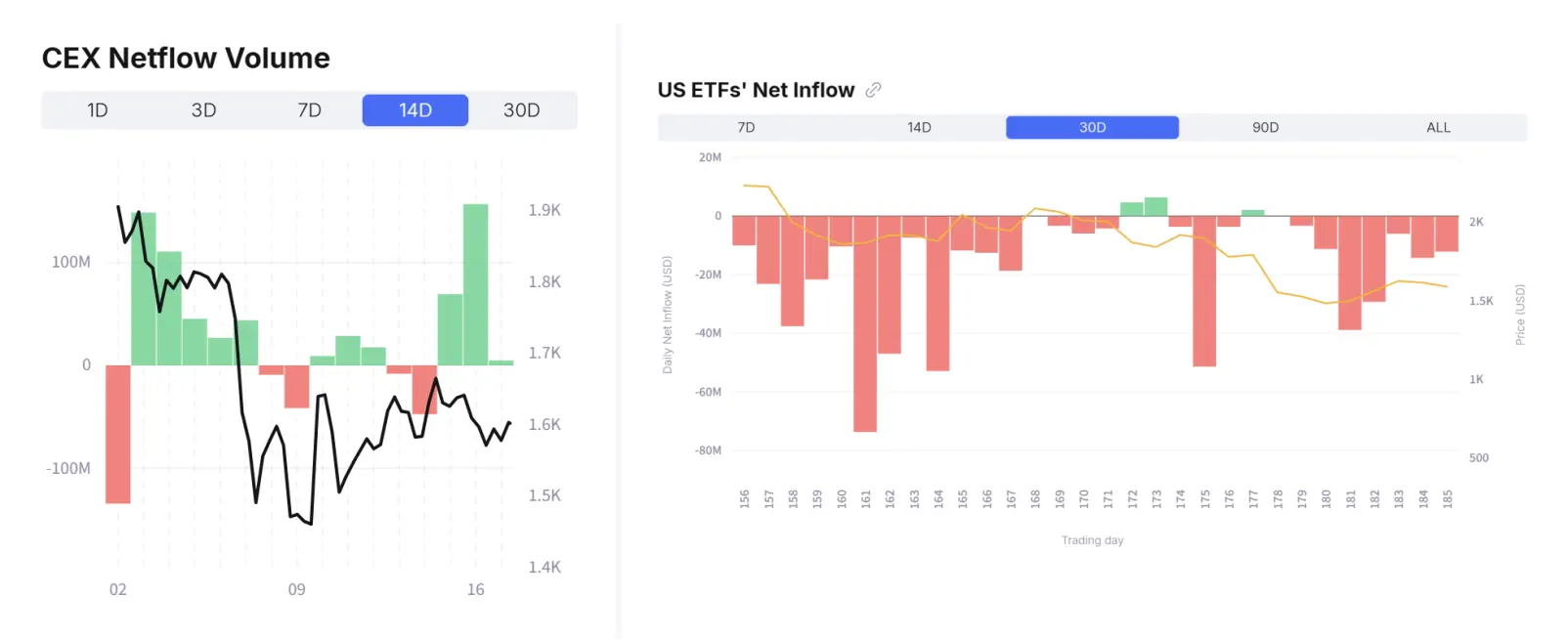

From the capital flow situation of Ethereum on CEX and the performance of spot ETFs, the overall trend is also not optimistic. Ethereum's spot ETF has been in a state of net outflow for nearly 30 consecutive days, with market funds continuously withdrawing. Meanwhile, in the past 14 days, the inflow of Ethereum on CEX has significantly exceeded the outflow, with a large amount of ETH being transferred to exchanges, releasing sell pressure signals.

On-chain analyst @ali_charts has reported that in the past week, Ethereum whales have cumulatively sold as much as 143,000 ETH, further confirming the trend of market reduction.

Data: Spot On Chain

The cold wind of the market is quietly blowing towards the heart of Ethereum. The gloomy sentiment is spreading like a plague, and investors' confidence is beginning to waver, as if a storm is now unavoidable.

In the face of this "bitterly cold" market, is ETH really heading towards decline? Can it turn the tide and reignite hope? In this moment fraught with crisis, what can ETH do to save itself and regain the lost trust?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。