Source: Cointelegraph Original: "{title}"

In the rapidly changing cryptocurrency trading market, not all price fluctuations stem from natural market behavior; some fluctuations are actually carefully orchestrated by speculators seeking short-term profits. One typical tactic is short selling, usually dominated by large market participants known as "whales."

These traders employ strategic short selling, borrowing and selling assets at the current price with the aim of buying them back at a lower price after the price drops.

So, how is this operational strategy specifically implemented?

This article will delve into the essence of short selling and its operational mechanisms. It will also explore its impact on the cryptocurrency market, identifying characteristics, and self-protection measures for retail investors.

What is a bear market attack?

A bear market attack is a deliberate market manipulation strategy that aims to depress asset prices through large-scale sell-offs and the spread of fear, uncertainty, and doubt (FUD). This strategy can be traced back to the early days of traditional stock markets, where influential traders would collude to manipulate prices for profit.

The specific operation involves selling a large amount of the target asset in the market. The surge in supply creates downward pressure on prices. At the same time, manipulators spread negative news or sentiment through the media, amplifying market panic and uncertainty. When panic spreads, small investors and retail traders are often forced to sell their positions, further exacerbating the price decline.

Bear market attacks are fundamentally different from natural market corrections. While both can lead to price declines, bear market attacks are carefully planned and deliberately executed, aiming to profit investors holding short positions. In contrast, natural corrections arise from broader economic trends, market adjustments, or genuine changes in investor sentiment.

Bear market attacks are typically viewed as a form of market manipulation. Regulators closely monitor trading activities, investigate suspicious trading patterns, and penalize fraudulent behaviors such as pump and dump or wash trading. To enhance market transparency, regulators require exchanges to implement compliance measures, including KYC (Know Your Customer) and AML (Anti-Money Laundering). Through penalties, trading bans, or legal actions, regulators strive to maintain market fairness and protect investor rights.

Regulators are curbing manipulation in the cryptocurrency market by implementing strict rules and oversight. In the United States, the Securities and Exchange Commission (SEC) oversees cryptocurrency assets that meet the definition of securities, while the Commodity Futures Trading Commission (CFTC) regulates commodities and their derivatives. In the European Union, enforcement under the Markets in Crypto-Assets (MiCA) framework is handled by the financial regulatory authorities of each member state.

Did you know? In 2022, just 1,000 wallet addresses influenced over 50% of Bitcoin (BTC) daily trading volume, these addresses are commonly referred to as "whales," highlighting their significant impact on the market.

Who executes bear market attacks?

In the cryptocurrency market, "whales," as large investment entities, have the capability to execute bear market attacks. With control over substantial amounts of cryptocurrency, these whales can significantly influence market trends and prices, while small retail investors find it difficult to shake the market.

Compared to ordinary traders, whales leverage their substantial financial resources and advanced trading tools to operate in different dimensions of the market. While ordinary investors focus on short-term profits or follow market trends, whales often make strategic buy and sell decisions aimed at creating price fluctuations favorable to their long-term holdings. These carefully orchestrated market actions often have an impact before ordinary investors even notice.

As an ordinary cryptocurrency investor, you may notice large-scale asset transfers between major wallets. Such significant capital movements often trigger strong reactions within the cryptocurrency community. For example, when a whale transfers a large amount of Bitcoin to an exchange, it may signal impending selling pressure, leading to a price drop. Conversely, transferring digital assets from an exchange to a personal wallet may indicate an intention to hold long-term, potentially driving prices up.

The relatively low liquidity in the cryptocurrency market is a key factor that allows whales to exert significant influence in trading. Compared to traditional financial markets, the cryptocurrency market has fewer trading participants, meaning a single large transaction can trigger significant price fluctuations. This means that whales can intentionally or unintentionally affect the market environment, making it difficult for retail investors to respond.

Did you know? Bear market attacks often trigger forced liquidations of leveraged trading positions, sometimes causing cryptocurrency prices to plummet by over 20% in just a few minutes.

Real cases of whales profiting from price declines

In the cryptocurrency space, due to its anonymous nature, specific cases of bear market attacks are often difficult to verify. However, the following examples of whales profiting from cryptocurrency price crashes will help illustrate the operational mechanisms of this market phenomenon:

Terra Luna Collapse (May 2022)

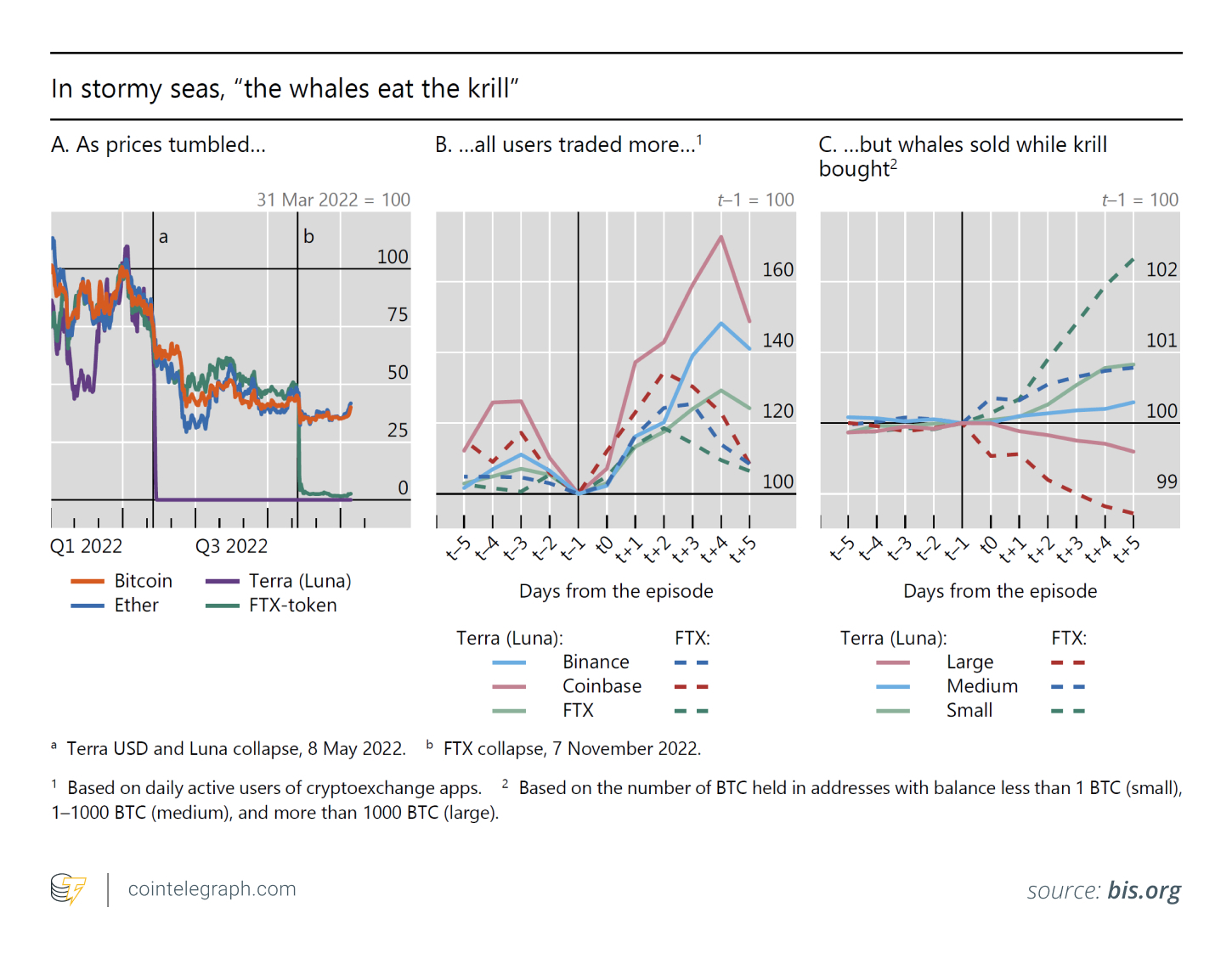

According to a research report published by the Bank for International Settlements (BIS), during the turmoil in the cryptocurrency market in 2022, the collapse of Terra (LUNA) created systemic risks from which whales profited significantly from the losses of retail investors. Retail investors primarily bought cryptocurrencies at low prices, while whales seized the opportunity to sell their holdings and profit from the market decline.

In May 2022, the Terra blockchain was forced to suspend operations due to the failure of its algorithmic stablecoin TerraUSD (UST) and its ecosystem token LUNA, resulting in a market cap evaporation of nearly $45 billion within a week. The operating entity behind Terra filed for bankruptcy protection on January 21, 2024.

FTX Collapse (November 2022)

In November 2022, the close financial ties between FTX and Alameda Research triggered a series of chain reactions: a bank run, failed acquisition plans, FTX filing for bankruptcy, and its founder Sam Bankman-Fried facing criminal charges.

According to the same BIS report analyzing the Terra Luna collapse, during the FTX crisis, when retail investors rushed to buy the declining cryptocurrencies, whales had already completed large-scale sell-offs before the price plummeted.

In the image, item B illustrates a phenomenon of capital flow where large investment institutions negatively impact small investors through asset liquidation. Meanwhile, item C shows that after significant market volatility, large Bitcoin holders (whales) reduced their holdings, while small holders (referred to as "retail" in the report) increased their holdings. The price trend indicates that whales sold Bitcoin to retail investors before the price significantly dropped, thus profiting from the losses of retail investors.

Bitconnect (BCC) Ceases Operations (January 2018)

Bitconnect, a cryptocurrency project that claimed to provide high returns through trading algorithm bots, faced a catastrophic collapse in early 2018. Despite its market cap exceeding $2.6 billion, the platform was widely regarded as a typical Ponzi scheme. The token's value plummeted by over 90% within just a few hours. Although this was not a traditional short attack, the concentrated withdrawal by insiders and large holders, combined with negative public sentiment, triggered a chain reaction that severely impacted retail investors.

Did you know? The trading movements of whale wallets are closely monitored, and some trading platforms even offer real-time alert services to help retail investors anticipate potential shorting risks.

Key steps for whales to implement short selling in the cryptocurrency market

In the cryptocurrency space, whales leverage their substantial financial resources to trigger significant market declines and profit from the ensuing panic. This strategy typically unfolds in the following steps:

Whale Playbook: Unveiling Market Manipulation Tactics

Cryptocurrency whales employ complex strategies to execute short selling and manipulate the market for advantage. These tactics allow whales to far exceed retail investors in price manipulation and profit, who often can only respond passively:

Impact of bear market attacks on the cryptocurrency market

As a market phenomenon, bear market attacks can have severe repercussions on the cryptocurrency market. This article will analyze their impact on different market participants and the overall ecosystem:

Signs of bear market attacks in cryptocurrency

Bear market attacks are essentially a form of market deception, exhibiting characteristics similar to genuine downward trends, often misleading traders to exit prematurely. Rapid price declines may be misinterpreted as the onset of a bear market, leading retail investors to make hasty decisions.

Typically, these declines are temporary, and once large funds realize profits, the market quickly stabilizes and rebounds. Accurately identifying the characteristics of bear market attacks in cryptocurrency is key to avoiding investment losses.

Here are typical characteristics of bear market attacks in cryptocurrency:

How to protect yourself from bear market attacks in cryptocurrency

To effectively guard against the risks of bear market attacks in cryptocurrency, it is advisable to adopt the following protective strategies:

Ethical Debate: Market Manipulation vs. Free Market Dynamics in Cryptocurrency

In the cryptocurrency space, there is a significant contradiction between the mechanisms of free market operation and market manipulation behaviors (such as short attacks). Proponents of free market principles advocate for minimal regulatory intervention, believing it fosters industry innovation and market self-discipline. In a truly free market system, the pricing of goods and services should be entirely determined by market supply and demand. However, due to the decentralized nature of the cryptocurrency market and the lack of regulation, it often becomes a breeding ground for market manipulation.

Short attacks are organized market manipulation behaviors where manipulators collude to depress asset prices, misleading other investors' judgments, thereby undermining market fairness. This malicious behavior not only harms the interests of ordinary investors but also shakes the trust foundation of the entire financial system.

Market regulation advocates point out that without appropriate regulatory mechanisms, these market manipulation behaviors may escalate, leading to unfair competition and severe economic losses. While the free market mechanism has its value in enhancing efficiency and driving innovation, allowing market manipulation behaviors in the cryptocurrency space could lead to catastrophic consequences. Events like short attacks highlight the necessity of establishing a balanced regulatory system to ensure market fairness and protect investor rights.

Global Regulation of Market Manipulation Tactics in Cryptocurrency

Manipulative behaviors in the cryptocurrency market (including short attacks) have drawn significant attention from global regulatory agencies. In the United States, the Commodity Futures Trading Commission (CFTC) has included digital currencies under commodity regulation and actively combats fraudulent activities such as wash trading and spoofing. The U.S. Securities and Exchange Commission (SEC) has also taken stringent measures against entities involved in market manipulation of digital assets.

The European Union has established a comprehensive regulatory framework through the implementation of the Markets in Crypto-Assets (MiCA) legislation, aimed at curbing market manipulation and enhancing consumer protection in the stablecoin sector.

Despite the numerous efforts made by regulatory agencies, the decentralized nature and cross-border attributes of cryptocurrencies still pose significant challenges to regulatory work. To effectively combat market manipulation and protect investor rights in the digital finance space, establishing a global collaborative mechanism and a flexible regulatory framework is crucial.

Related Articles: Coinbase: The Crypto Market is in a Bear Market, Possible Rebound in Q3

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。