Perpetual options + coin-based, allowing any crypto to participate in the game, or a better overtaking direction for CEX.

Written by: Web3 Farmer Frank

In the past five years, from dYdX to GMX, and now to Hyperliquid, the high-leverage narrative of on-chain derivatives has always revolved around "contracts" as the main line.

Among them, several protocols have attempted to balance higher leverage, greater decentralization, and better trading depth from the perspective of "CEX alternatives," successfully occupying the dominant position in on-chain trading structures. In contrast, the trading volume of options products in the TradFi market has been several times that of futures for years, while on-chain it has fallen into a state of stagnation.

In fact, in the field of on-chain derivatives, the "non-linear returns" characteristic of options (limited losses for buyers, unlimited gains) is an ideal product form that naturally adapts to the high volatility environment of crypto—not only avoiding liquidation risks but also achieving a better risk-reward ratio through "time value leverage" under controllable costs.

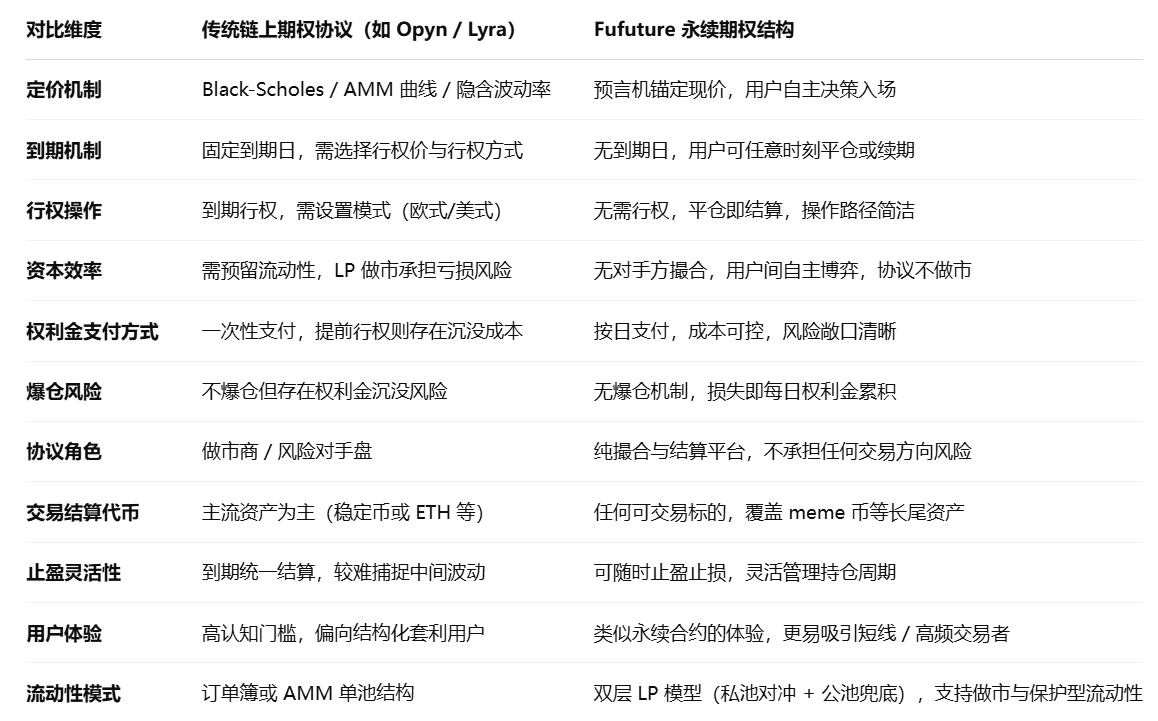

For this reason, options have always been seen as the most promising on-chain path to break the CEX derivatives monopoly. However, while Hegic, Opyn, Lyra, and others have had their highlights and played pioneering roles in the on-chain options narrative over the past few years, they have all been constrained by structural dilemmas and failed to build a scalable user ecosystem:

On one hand, options products themselves have a high level of complexity, from pricing models to strategy construction to exercise rules, resulting in user education costs and trading participation thresholds far exceeding those of contract futures;

On the other hand, on-chain infrastructure still struggles to solve real bottlenecks such as fragmented liquidity, low capital utilization, and high trading costs, leading to poor actual product experiences and severe user attrition;

As a result, on-chain options products generally struggle to form sufficient user retention and market flywheels, almost reaching a dead end. How to use low participation thresholds and flexible trading structures to position options as a better tool for adapting to on-chain derivatives has gradually become a new exploration path.

This is precisely the problem that Fufuture aims to solve. As a decentralized perpetual options protocol, Fufuture does not simply replicate traditional options "on-chain," but rather through a dual structure of "coin-based + perpetual (end-date) options," ensures the non-linear return attributes while discarding complex exercise mechanisms and time limits, thereby constructing a lighter and more sustainable on-chain derivatives interaction paradigm.

In short, in Fufuture's design, the options structure itself is not the goal but a tool to activate a new paradigm of on-chain derivatives. It reconstructs the cost structure and holding logic of traditional options through a "dynamic premium payment + unlimited extension" mechanism, making it no longer limited to "elite strategies" or "mainstream assets," but widely applicable to long-tail assets, high-volatility varieties, and even various non-crypto assets in highly leveraged trading scenarios.

In this context, a more composable, easier to understand, and capable of activating long-tail asset value decentralized options system that can reach global core asset leveraged trading may be quietly taking shape.

The popularity of end-date options and the "impossible triangle" of on-chain derivatives

Have you heard of or traded 0DTE options (end-date options)?

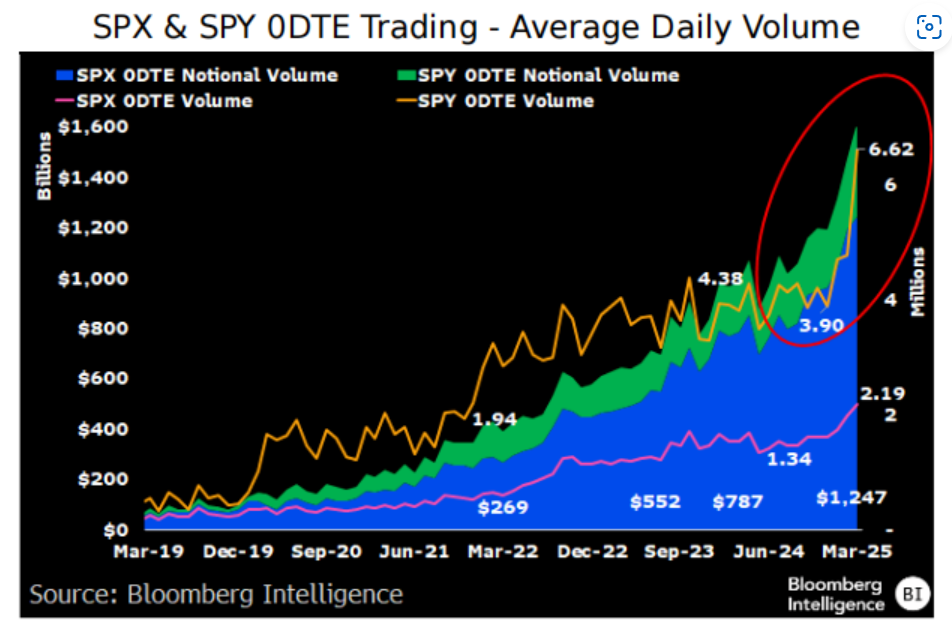

Currently, many crypto players intersect with U.S. stock trading, and you may have noticed an interesting trend: in the U.S. stock market, more and more investors have started to engage in options trading, especially end-date options, over the past two years. Accompanied by the prevalence of "financial nihilism" in the context of massive monetary easing since the COVID-19 pandemic, the trading of 0DTE options in traditional financial markets has almost become a retail frenzy over the past five years:

Since 2016, small trading users have begun to flock to options, with the proportion of 0DTE options trading in total SPX options volume rising from 5% to 43%.

Source: moomoo.com

This also reflects a reality we must face: options are not just elite tools for institutions; they are evolving into an excellent tool for retail investors' high-leverage trading needs.

The question arises: what about on-chain DeFi? Objectively speaking, perpetual contracts still dominate the high-leverage narrative in crypto, as their simple structure, low thresholds, and instant settlement characteristics align perfectly with the preferences of "low attention" users.

However, the complex structure and high thresholds of traditional options products (pricing models, exercise mechanisms, strategy construction, etc.) require a high level of user cognition, while on-chain infrastructure struggles to meet the demands for low costs, high precision, and continuous liquidity, ultimately leading most DeFi options protocols to either remain at niche players or fall into the unsolvable hedge between "product elitism vs. user scalability."

Using a commonly used term, it may be more intuitive for everyone to understand: in the Web3 world, the "impossible triangle" has become a common framework for describing systemic trade-offs (such as the trade-off between scalability, security, and decentralization in L1), and in the field of on-chain derivatives, there is also a structural paradox that is difficult to reconcile—liquidity, capital efficiency, and protocol risk can often only achieve two out of three:

Liquidity: The foundation of all on-chain derivatives trading; a market without liquidity cannot achieve effective pricing;

Capital efficiency: A core indicator of product survival and growth, determining the motivation for users to continue participating;

Protocol risk: Price manipulation, slippage, and liquidity exhaustion can all become systemic flashpoints, as evidenced by Hyperliquid's recent crises;

Thus, options, which in TradFi far exceed futures in scale, have never found a mature landing scenario on-chain. But do "on-chain options" really have no opportunity?

In fact, just as end-date options have become popular in the TradFi market, Fufuture's proposed "coin-based perpetual options" may be a good entry point to avoid a series of classic traps in on-chain options—it takes a different approach by abandoning the complex structure of "exercise date + order book + Black-Scholes pricing" in traditional options, instead building a complete new system around the "unlimited extension + daily premium settlement" mechanism based on crypto infrastructure:

Users do not need to choose an exercise date; they can pay premiums daily to maintain their positions. The maximum loss for buyers remains the premium paid, while the profit potential is unlimited. Prices are anchored by external oracles, and core asset profits and losses are calculated in a coin-based manner (e.g., ETH/USDT settled in USDT, or ETH/SHIB settled in SHIB).

This minimalist design greatly reduces the cognitive threshold for users (no need to consider exercise time and strategy construction), making the options trading experience more aligned with the rhythm and habits of perpetual contracts. For users seeking short-term volatility arbitrage and emotion-driven trading, Fufuture's structured options products resemble a "day contract + time leverage hybrid" with explosive odds.

Therefore, the core design philosophy of Fufuture can be summarized in one sentence: to provide options with a "contract-like smooth trading experience" while retaining the "inherent non-linear return logic of options."

This structure essentially breaks down the "time dimension" of traditional options into "daily dynamic positions," solving the cognitive barrier of complex options exercise paths and users not understanding when to close positions. Additionally, through the daily premium model, it integrates the high-odds structure into the on-chain financial context in a more sustainable way.

Making "end-date options" perpetual is undoubtedly the most attractive choice with "gambling" and high odds for users, especially when they discover that they can even use meme coins sleeping in their wallets to directly participate in high-leverage derivatives trading without worrying about liquidation risks, the balance of the game between on-chain and CEX may truly begin to tilt.

Deconstructing Fufuture: Coin-based, perpetual "end-date options," trading system

To understand the innovation of Fufuture, we must start with three keywords: coin-based, perpetual options, trading system. They do not exist in isolation but together form the core code of Fufuture's innovative architecture.

The design of coin-based + perpetual "end-date options" is to provide users with an options scenario that offers a "contract trading experience," preserving the high-odds characteristics of the non-linear leverage structure while simplifying the complex cognitive threshold of options. The specific mechanisms will be detailed later.

Before that, it is essential to clarify a premise regarding the "trading system": Fufuture is essentially not just a simple on-chain version of an options product, but through a more user-friendly options structure, deeply adapts to on-chain trading needs, creating a new paradigm of on-chain derivatives that allows users to better utilize crypto long-tail assets and engage in low-threshold high-leverage trading of mainstream assets.

In other words, Fufuture's ambition goes far beyond "putting an options product on-chain"; it aims to create a trading paradigm with high adaptability, composability, and extensibility in the on-chain derivatives space. Therefore, it is not a "CEX alternative," but rather captures the trading potential that has not yet been released but truly exists through structural innovation, especially the demand for long-tail assets to participate in derivatives trading and retail investors' low-threshold high-leverage gambling needs.

This is also Fufuture's greatest imaginative space, injecting a new possibility into the on-chain derivatives market—leveraging the innovation of perpetual options, not just to serve existing trading behaviors but to create the ability to serve "unmet trading demands."

1. Coin-based: Unlocking the Derivative Potential of Long-tail Assets

Compared to traditional options that mostly use stablecoins as margin and settlement units, Fufuture's "coin-based" design essentially reconstructs the leverage trading relationship between users and assets from two core dimensions:

Margin Dimension: Fufuture allows users to use any on-chain asset (including meme coins, small-cap governance tokens, and even some tokenized RWAs) as margin for opening positions, opening up derivative participation channels for assets that have long been excluded from mainstream trading systems;

Settlement Dimension: Profits and losses are no longer anchored to USD but are settled directly in the original underlying tokens, making asset trading more aligned with the asset structure and cognitive habits of real holders;

This effectively activates the liquidity of long-tail assets, as many meme tokens and small to medium projects lack futures contract support and cannot place orders for market making on traditional trading platforms, making it difficult for their value to be reasonably discovered and utilized. Coin-based perpetual options can become the most cost-effective derivative path for these long-tail token holders, providing them with more investment choices and risk management tools.

At the same time, for token holders, they often hold a large number of alt tokens. In traditional trading models, they need to convert the underlying tokens into stablecoins for trading, facing not only the risks of conversion costs and exchange rate fluctuations but also needing to convert back to the underlying tokens during settlement, making the entire process cumbersome and increasing uncertainty.

Fufuture's "coin-based" settlement method allows profits and losses to be directly reflected in the underlying tokens, avoiding the conversion losses of intermediate links, and better aligning with users' asset structures and investment habits, enabling them to manage their investment portfolios and risk-reward more clearly and conveniently.

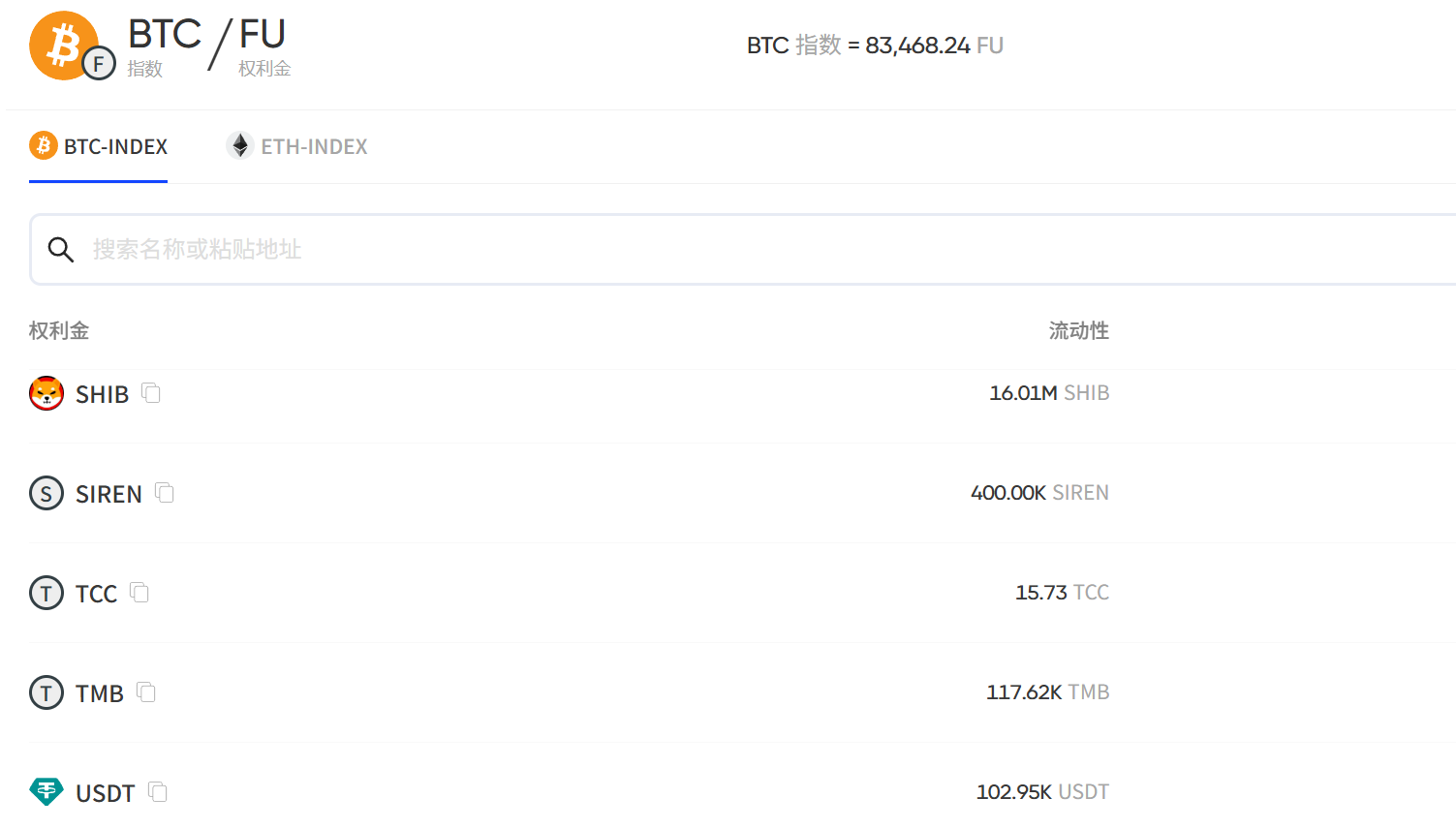

Additionally, the "coin-based" profit and loss settlement method provides an effective market-making means for these assets—first, users can directly use meme tokens like SHIB and SIREN to participate in options trading, alleviating market selling pressure. Furthermore, users and even project parties can act as market makers by participating in the "dual pool" (details below) to provide liquidity and earn profits, thereby stabilizing the supply-demand balance of alt tokens from multiple dimensions.

2. Perpetual Mechanism: Flexible Gaming of Time Dimension

As we all know, the biggest difference between options and contracts is that options do not "liquidate" due to price fluctuations. Fufuture reconstructs this risk-return structure through "perpetualization," allowing users to engage in high-leverage speculation or hedging without the risk of liquidation.

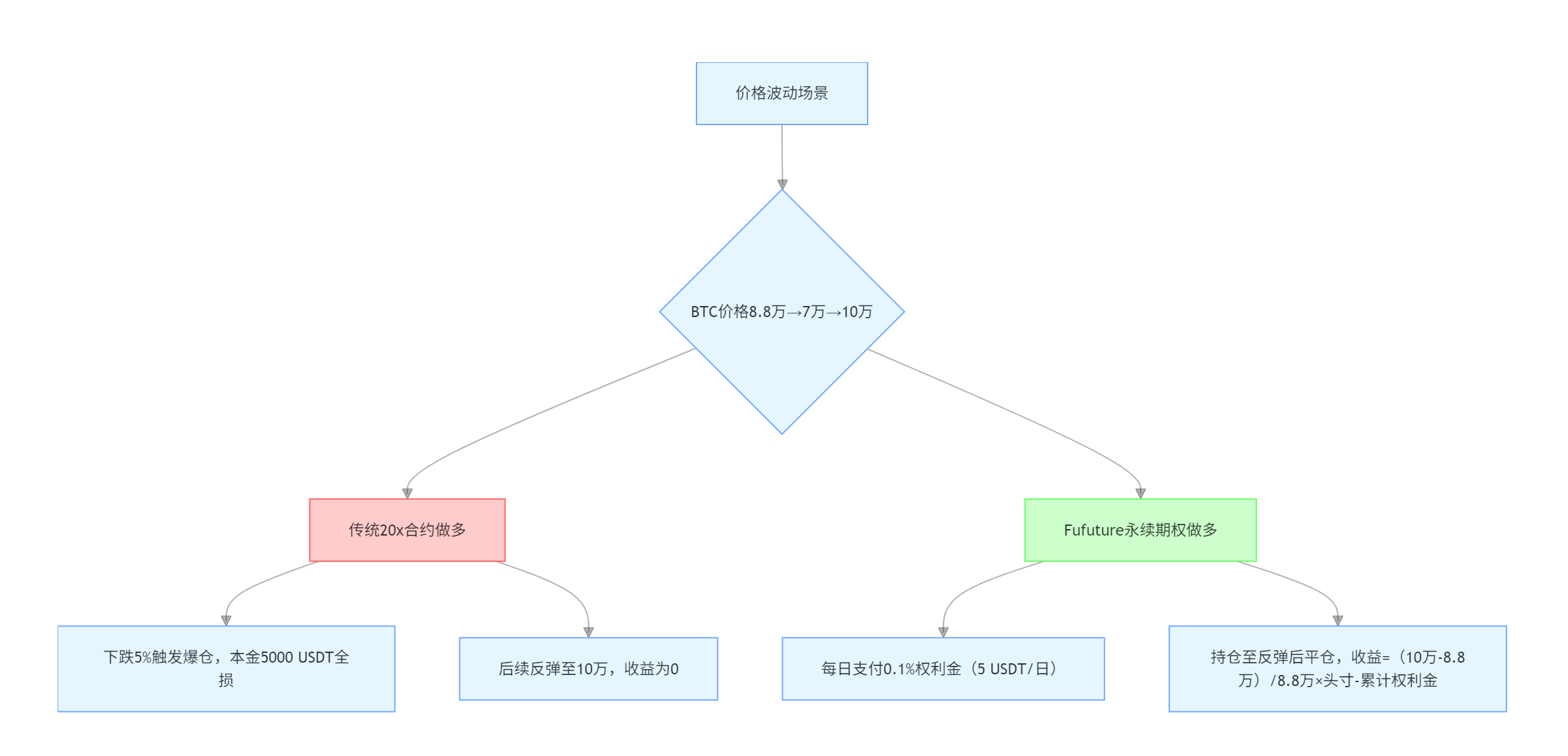

We can understand its "non-linear return" charm through a simple example. Suppose you have 5000 USDT when the price of BTC is 88,000 USD:

If you use a 20x perpetual contract to go long, once BTC drops more than 5%, it will trigger liquidation, losing all principal, even if the price later rises to 100,000 USD, the profit will be 0;

If you use Fufuture perpetual options, you only need to pay a daily premium (e.g., 0.1%) to maintain that position, even if BTC first drops to 70,000 USD and then rises to 100,000 USD, you can still close the position for profit;

Moreover, Fufuture's perpetual options also solve the "time cost mismatch" problem present in traditional options markets: for example, if you purchase a 3-month BTC call option, you need to prepay 20% of the premium (e.g., a 10,000 USDT position corresponds to a 2,000 USDT cost). Even if the market rises significantly in the first week, closing early still incurs the sunk cost of the remaining premium.

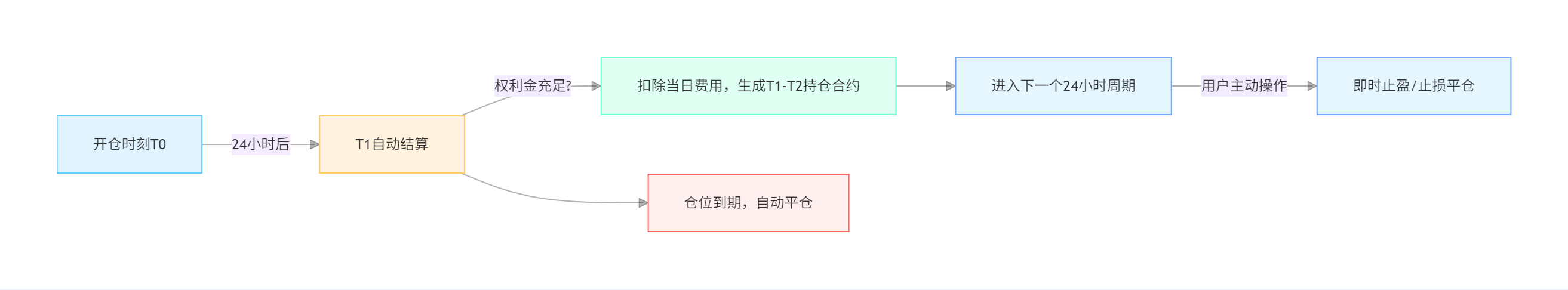

Fufuture, through "dynamic installment payments," allows investors to acquire position holding rights with "rental-like" costs—premiums are paid as used, no longer requiring a high upfront premium for 3 months, but rather a daily dynamic payment, where the system automatically settles and updates positions every 24 hours, requiring no manual operation from users. If the premium balance is sufficient, theoretically, positions can be held indefinitely.

This also indirectly promotes the breakeven point to move forward. Taking the aforementioned 3-month BTC call option as an example, if the premium is 20%, it means the underlying asset must rise at least 20% within 90 days to cover costs. However, Fufuture's perpetual options allow the holding period and corresponding costs to become flexible parameters that can be adjusted at any time:

If the holding period is only 9 days, then only a 2% increase is needed to achieve breakeven; if the holding period is only 18 days, then only a 4% increase is needed to achieve breakeven (a simple estimate, actual results will not strictly follow linear changes).

This optimization of cost structure allows both short-term traders and long-term investors to find suitable strategic spaces—short-term speculators can capture profit opportunities in small fluctuations, while long-term holders can gamble on asset appreciation with extremely low trial-and-error costs.

3. Dual Liquidity Pools: Risk Layering and Depth Protection

In the on-chain derivatives market, "liquidity" is not just a matter of transaction efficiency; it also concerns the stability and risk resistance of the entire trading system. Without a sufficiently robust liquidity protection mechanism, a single extreme market event can trigger the risk of systemic collapse.

Taking Hyperliquid as an example, while it relies on its innovative HLP (Hyperliquid Liquidity Pool) model to provide traders with high liquidity and low slippage market-making support, achieving rapid growth, this model has already faced multiple instances of liquidation due to risks such as manipulation of long-tail assets, exposing its shortcomings.

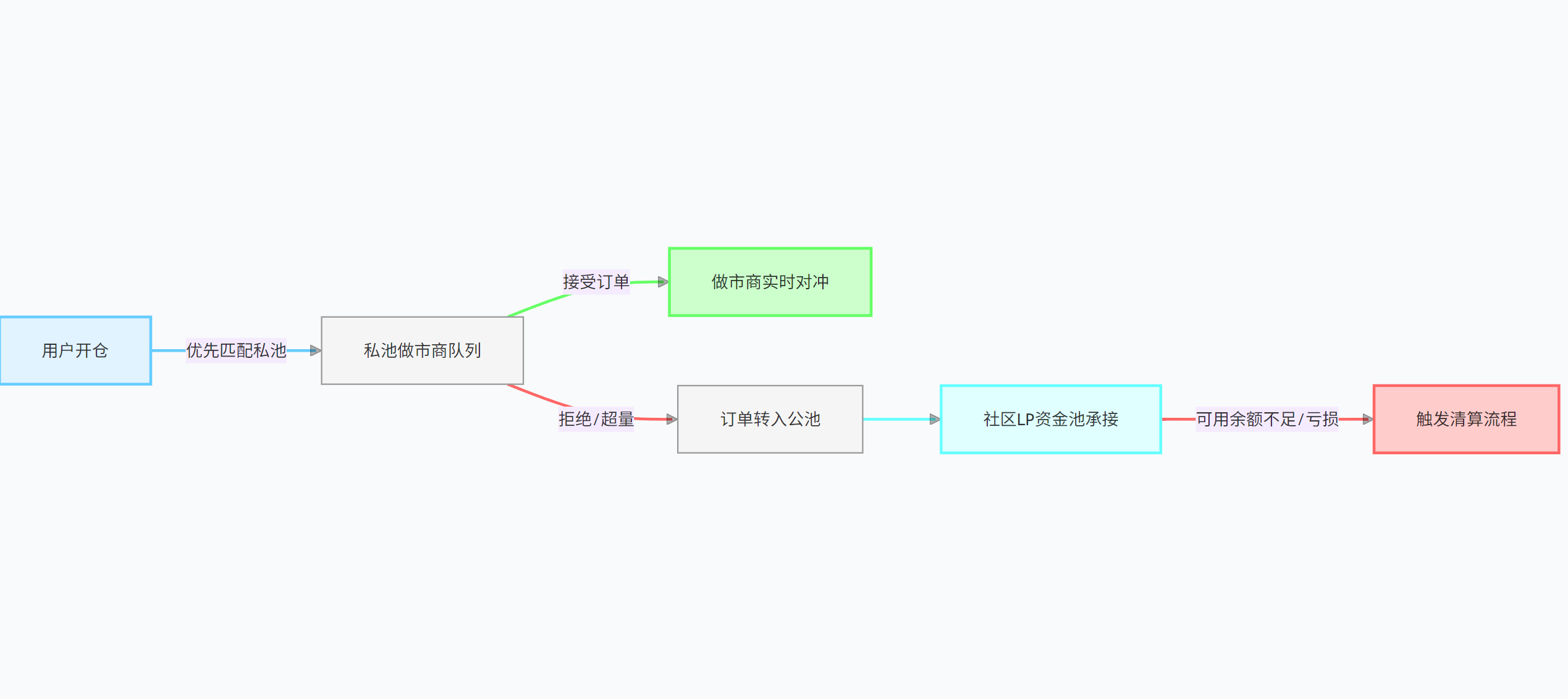

To address this structural risk, Fufuture innovatively introduces a dual liquidity pool mechanism, layering market-making risks and system liquidity:

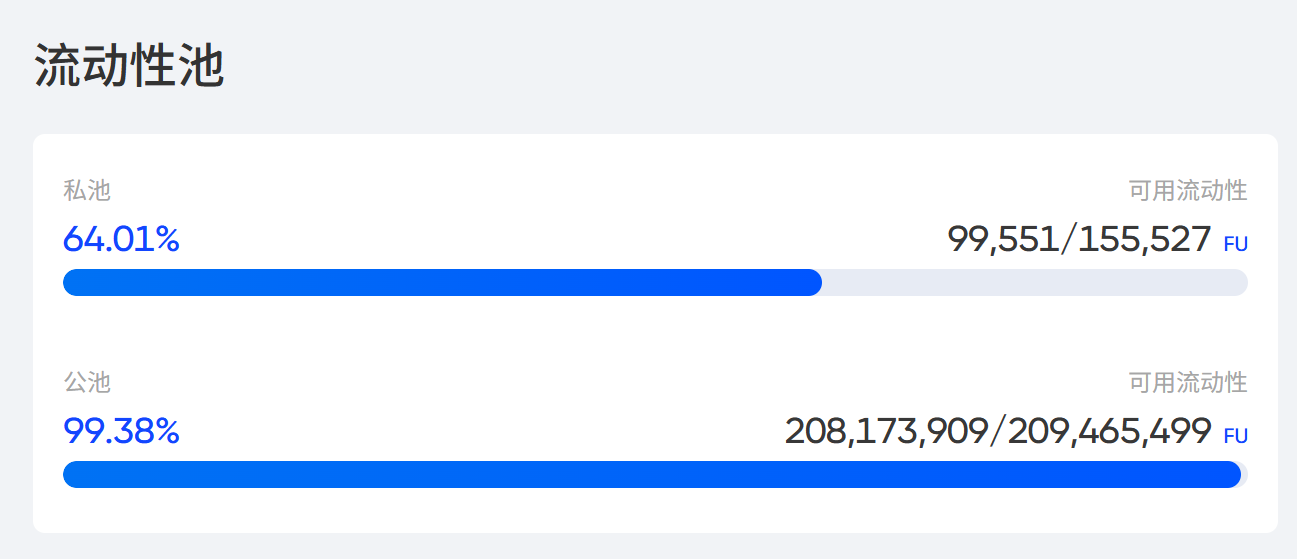

Private Pool: A professional liquidity acceptance layer, which can be seen as a "first-line buffer zone" for user options trading, open only to institutional market makers, actively accepting trading orders and conducting hedging operations, serving as the main counterparty to bear core risks;

Public Pool: A system safety net layer, which can be seen as the "last line of liquidity defense" for user options trading, open to all ordinary users, only providing liquidity as a final buffer when private pool liquidity is exhausted or order liquidation is interrupted;

When users open positions, the system prioritizes routing orders to the private pool and pushes order information to market makers. If the private pool market makers accept the order, they will provide quotes using their own funds or hedging strategies— for example, if a market maker accepts a long position in BTC perpetual options, they can simultaneously buy the underlying asset in the spot market to hedge or lock in risk exposure through cross-platform arbitrage.

If the private pool lacks liquidity or orders are interrupted due to liquidation, the system will then transfer the position request to the public pool, where community LPs provide the final insurance liquidity.

The design of this dual liquidity pool essentially decentralizes the "market maker system" of traditional financial markets and the "liquidity pool" of DeFi, breaking the dilemma of "retail investors bearing systemic risk" through risk layering, allowing professional institutions to become the main bearers of risk.

This also effectively reduces systemic liquidation risks—during high volatility periods, professional LPs control the risk dominance, while ordinary LPs are not passively taking over, ensuring continuous trading depth and avoiding sudden evaporation of market depth due to the exhaustion of a single LP structure. Objectively speaking, this mechanism will undoubtedly promote community LPs' willingness to participate, as public pool LPs do not bear first-line risks, acting more like insurance backing for strategy overflow, returning to the role of "stable earners."

Overall, making "end-date options" perpetual is undoubtedly the most "gambling" and high-odds choice for users. Fufuture achieves an organic integration of the insurance attributes of options and the leverage attributes of contracts through coin-based settlement, perpetual structural design, and layered liquidity mechanisms.

This makes Fufuture not just a "on-chain options platform," but more like an upgrade of the trading paradigm aimed at new crypto users, narrative investment trends, and the liquidity of long-tail assets—reducing the barriers to options trading while reconstructing the time costs and strategic freedom of options, likely paving a new path for future on-chain speculative trading.

From "Options" to On-chain Derivatives Ecosystem: The Decoupling and Reconnection of Crypto and TradFi

If you have truly experienced Fufuture's perpetual options products, you can clearly feel its innovations compared to traditional on-chain options products.

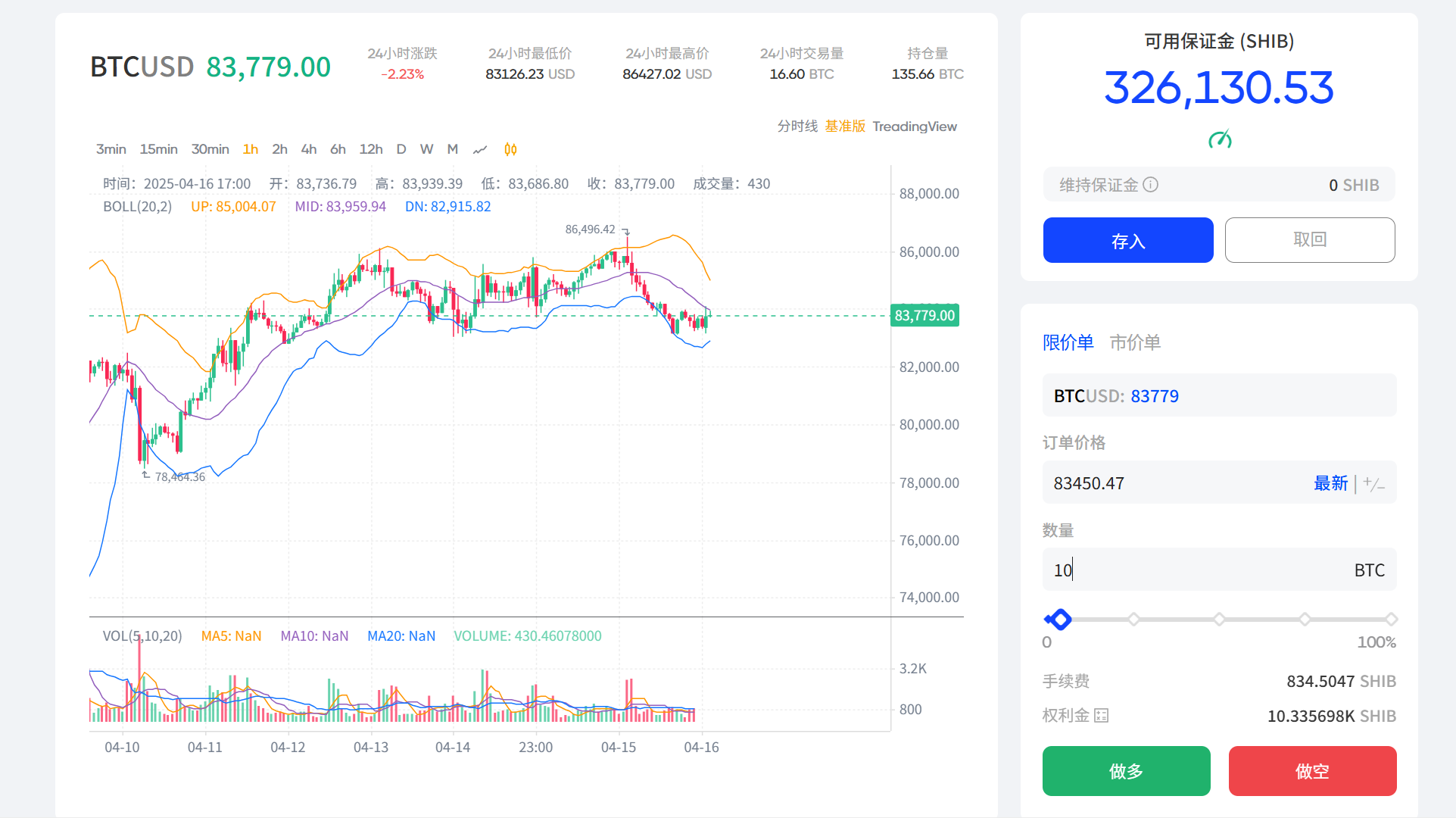

Taking users holding SHIB as an example (this further confirms the advantage of Fufuture's extremely low-cost opening positions to participate in the game), these meme assets can hardly serve as any form of trading collateral in traditional on-chain derivatives protocols. However, on Fufuture, you only need to deposit SHIB into the platform to use it as margin for trading.

In practical operation, as long as you deposit SHIB as "available margin," the entire trading process is almost indistinguishable from contract trading—no need for stablecoins as margin, no need to weigh options for expiration dates, strike prices, or profit-loss curves. Just like daily contract trading, select the underlying asset, direction (long/short), and opening quantity to start trading.

The system will automatically calculate the opening scale based on available margin. For example, if I want to open a long position of 10 BTC, I just need to input the opening quantity and direction, click confirm, and the position will be opened. I only need to pay a small daily premium (automatically deducted from the SHIB margin), and the position can be renewed indefinitely.

Subsequently, users can also flexibly take profits or stop losses based on actual price fluctuations, and the operational experience is almost the same as spot trading, bridging the cognitive gap for users transitioning from spot participation to non-linear derivatives.

It is important to note that the "10 BTC" position here does not mean that you have actually borrowed or owned a corresponding bullish position of 10 BTC, but rather that you have the right to "close this contract and obtain returns linked to the BTC price increase" at any future time.

The key to this structure lies in the "quantity-based" settlement model adopted by Fufuture, where all calculations are based on real-time on-chain oracle data. All user profits and losses are internally settled in terms of the quantity of staked tokens, with gains and losses reflected solely in quantity—when the price rises, profits are reflected as an increase in the number of SHIB, and when it falls, losses are reflected as a decrease in the number of SHIB.

Specifically, the number of tokens required to open a position = position * premium rate * current BTC\ETH index. For example, if the current BTC premium rate is 1.5% and the BTC price is 80,000, the number of tokens required to open a position of 1 BTC = 100,000 * 1.5% * 1 = 1,200. This means that if a user uses USDT as margin to open a position of 1 BTC, they need 1,200 USDT, while using SHIB as margin requires 1,200 SHIB, with no change in the quantity-based aspect.

Now, suppose after opening a position of 10 BTC-SHIB call options, if the BTC price index indeed rises significantly (as quoted by the oracle), from 80,000 to 88,000, then the profit in SHIB quantity = position size × increase ratio = (88,000 - 80,000) × 10% = 80,000 SHIB (not considering premium and transaction fee losses for now).

In simple terms, the Fufuture protocol does not involve any token price conversions; it only records changes in quantity. Therefore, the impact of token prices is only reflected when users withdraw tokens to external markets, greatly simplifying the system's sensitivity to drastic market fluctuations and enhancing users' subjective strategic space.

This also constitutes one of Fufuture's most unique trading layer designs: allowing crypto users to trade the assets they care about using the tokens they own, building native leverage with native tokens, without the cumbersome concepts of "liquidation lines," "expiration dates," or "IV curve matching." Positions can be closed for profit or loss at any time, and only a small daily premium needs to be paid for automatic renewal.

At this point, some readers may also realize that Fufuture's true disruptive nature lies in its technological architecture innovation, which infinitely expands the "supply-side boundaries" of the derivatives market. In simple terms, relying on a multi-oracle aggregation system (currently supporting ChainLink, Pyth, Apro), as long as an asset meets the conditions to be quoted by an oracle, it can form its own options market on Fufuture.

This means that Fufuture is not limited to mainstream assets like ETH and BTC; any mainstream asset that can be digitally quoted (large enough in volume and not easily manipulated in price) can generate an options trading market. For example, by obtaining compliant oracle quotes for US stocks (Tesla, Apple) or commodities (gold, crude oil), users can directly speculate on traditional asset price fluctuations using cryptocurrencies.

We can imagine that when the protocol does not rely on fiat currency price systems, any asset that can be quoted by an oracle can seamlessly connect: SHIB holders can use SHIB as margin to trade the price fluctuations of gold, crude oil, or Tesla stocks, which undoubtedly means a decentralized global asset trading network is taking shape:

Allowing users to directly participate in global mainstream asset speculation using crypto assets, removing intermediaries like banks and brokers, greatly lowering the participation threshold. This is also the charm of perpetual options, because perpetual contracts rely on funding rates to anchor spot prices, which can easily create price differences in low liquidity markets, while options only require paying premiums, completely decoupling from the actual delivery of the underlying asset.

In my view, this is also Fufuture's greatest imaginative space, as it injects a new possibility into the on-chain derivatives market—not to serve existing trading behaviors, but to create a capability that serves "unmet trading demands" through structural design.

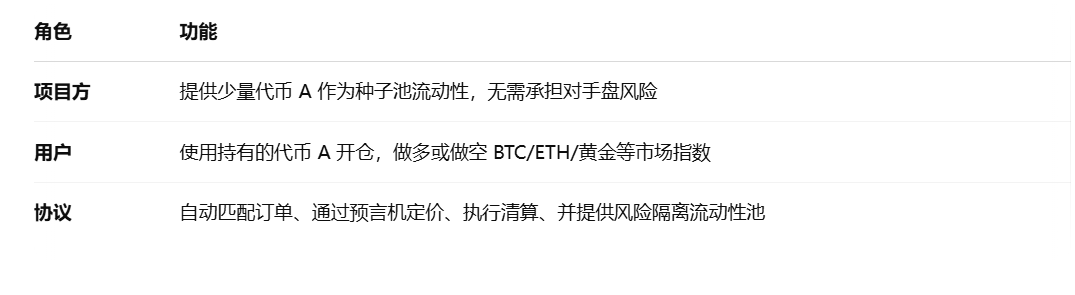

We can even further associate Fufuture's strategic value and optimization path as an "over-the-counter market-making tool":

Project party role: Injecting tokens as seed funds for liquidity pools (e.g., token A), essentially participating in "liquidity as locking up."

User role: Using held token A to trade price indices of BTC/ETH/gold provided by oracles, forming a natural closed loop of "trading as locking up."

In this context, the project party initiates the dual pool by injecting seed funds, attracting users to use their tokens as margin, indirectly achieving a positive cycle of "user positions - trading activity - price stability." Moreover, every transaction by users on Fufuture essentially participates in the ecological construction of "liquidity as locking up," reducing market selling pressure from the source for both parties.

Essentially, this is a win-win opportunity for three parties:

Users do not need to sell tokens for stablecoins, gaining the convenience of trading global mainstream assets using their long-tail asset tokens at a low threshold, and can obtain profits through derivatives speculation instead of passively waiting for token prices to rise, thus reducing market selling pressure.

Project parties only need to participate in the dual pool with ecological funds to encourage holders to complete liquidity locking, with both parties' funds locked in the pool, reducing market selling pressure.

At the same time, connecting crypto with global assets: by introducing stock and commodity prices through oracles, SHIB and other token holders can directly trade the price fluctuations of gold, crude oil, or Tesla stocks without traditional financial intermediaries.

This essentially builds a "modular trading engine for self-deployable options markets," allowing any community to activate new narrative flywheels and on-chain financial vitality for their tokens through Fufuture.

When meme coin holders can easily participate in global asset leveraged trading using SHIB, and when traditional financial price signals can be directly converted into on-chain positions through oracles, a new financial ecosystem without intermediaries, with boundless assets and controllable risks, is quietly taking shape. This may not just be a simple technological breakthrough, but the first true "decentralized leveraged trading revolution" in the history of human finance—it not only redefines the boundaries of on-chain derivatives but also outlines a future scenario of deep integration between crypto and TradFi.

Project Roadmap

In March 2025, Fufuture will officially launch its V2 version, adding limit order functionality, a high-performance volatility modeling engine, and more flexible market-making rules, achieving significant upgrades in performance and user experience.

According to the latest data on the official website, Fufuture V1 + V2 has currently integrated over 20 mainstream public chains, including BNB Chain, HashKey Chain, Manta Network, Mantle, Conflux, and Monad testnet, and supports the construction of over 100 BTC/ETH index-related trading pairs.

According to the official roadmap disclosure, Fufuture aims to expand to over 30 mainstream and emerging public chains by the end of the first quarter of 2025, striving for full industry coverage by the end of 2025.

Final Thoughts

In Web3, many times, "equality" is the ultimate key to liberating product thinking.

Just like the narrative of on-chain options, from Hegic to Opyn to Lyra, it has always been trapped in the narrow alley of "professional strategy tools"—either the complex trading mechanisms deter retail investors, or due to liquidity exhaustion, they become toys for institutional arbitrage, thus falling into the cognitive gap of "complex financial instruments," unable to produce a phenomenon-level player like GMX or Hyperliquid.

Ultimately, on-chain options urgently need a breakthrough that starts from the underlying logic and is more popularized. Only when they are no longer just strategic hedging tools for elite investors, no longer relying on complex strategies and deep knowledge thresholds, but rather become a high-odds trading entry that every on-chain user can understand, use, and speculate on, will the true turning point of the on-chain options narrative arrive.

The significance of Fufuture's "coin-based + perpetual options" lies precisely in starting from this turning point, attempting to push on-chain options trading towards mainstream consensus with a lower threshold.

Objectively speaking, Fufuture is not merely making minor adjustments to the old templates of traditional finance; it is dismantling the complexity, inefficiency, and high thresholds of options product structures one by one—from the coin-based architecture to perpetual design, from dual liquidity pools to decentralized risk isolation mechanisms, Fufuture is eliminating the barriers, constraints, and risks of traditional on-chain options at every step:

Why can't crypto users use the SHIB in their hands to directly bet on the fluctuations of global mainstream quality assets like BTC, ETH, gold, and crude oil?

Why should the dominance of high-leverage trading be monopolized by centralized platforms and institutional market makers?

Why must options be a game only professionals can play, rather than a nonlinear profit opportunity that on-chain retail investors can participate in?

This is a liberation of financial imagination. After all, when meme coins are no longer just used to bet on price increases or decreases but become a trading medium connecting the fluctuations of global mainstream assets, Fufuture constructs a new logical closed loop:

Every crypto token has the opportunity to become a settlement unit for global derivatives trading; every user can gain high-leverage exposure to any mainstream quality asset globally on-chain; every project party/community can deploy their own options market and liquidity management pool at an extremely low threshold.

This is essentially a redefinition of the boundaries of crypto finance—connecting crypto and TradFi in both directions. This also means that Fufuture is no longer a mere alternative to CEX or an elite toolchain of DeFi, but a global decentralized derivatives infrastructure that can actively "create trading demand" and activate asset potential.

Fufuture may become the first singularity in this on-chain financial explosion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。