Today is a lazy day, and there's hardly any water left. Since entering the holiday, the whole world has become quiet; even Trump hasn't caused any trouble, which feels a bit unusual. Recently, the only thing Trump and the White House have revealed that could help the risk market is their communication with China regarding tariffs, and they have already reached some consensus.

However, the impact of tariffs on the current market is minimal. The focus moving forward will be on the economy. There isn't much important data coming out next week; we are just waiting for the GDP data at the end of the month. Although April isn't over yet, the trading difficulty in April has indeed been quite high, mostly driven by events.

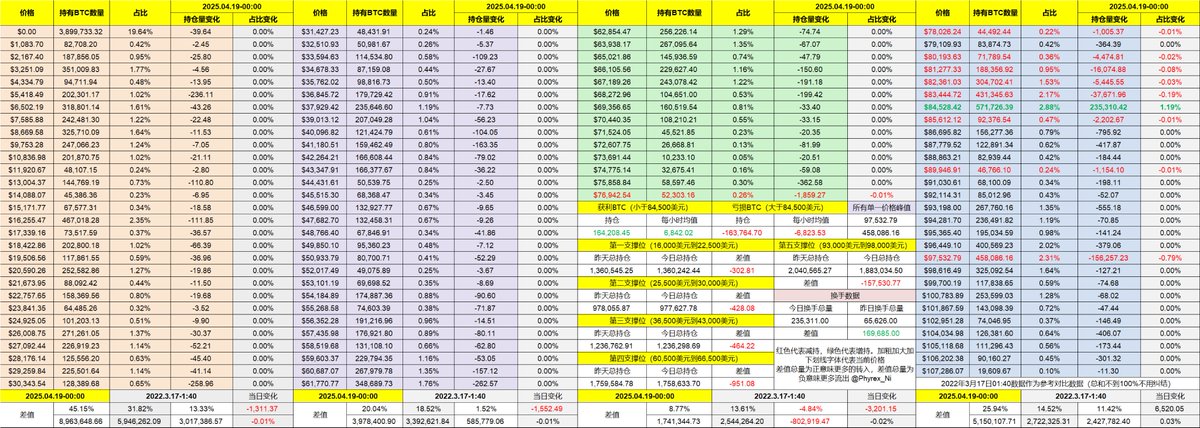

There's not much to say about Bitcoin either; the price is oscillating within a very narrow range, and the trading volume is extremely low. I've already explained this with data in the pinned weekly report, so I won't elaborate further. The only slight movement today is that over 156,000 $BTC have been transferred within the exchange, likely a conversion of the exchange's own wallet, not involving turnover or user behavior; I've checked the data.

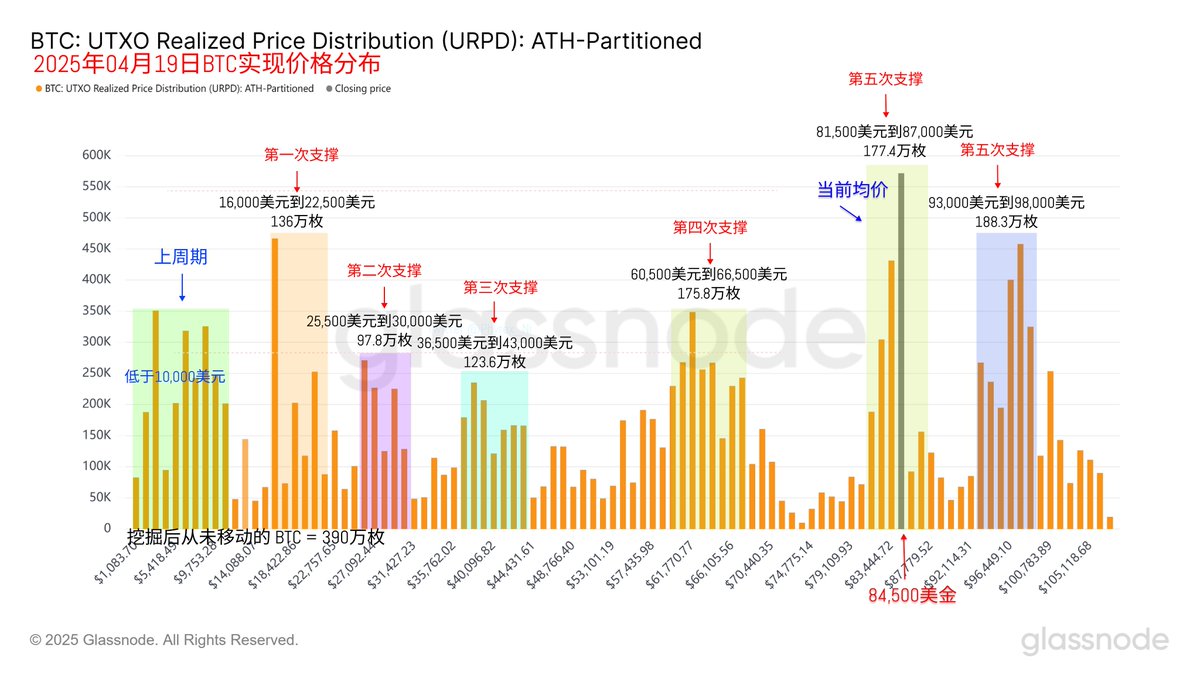

This has led to a bottom formation between $81,500 and $87,000, with over 1.77 million BTC stuck in this range, and the open interest has exceeded that of the previous four bottom formations.

Interestingly, investors between $93,000 and $98,000 remain very calm, and the open interest in this range consistently holds the top position. Investors in this range have mostly been washed out, so it will be interesting to see who attracts whom next.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。