Original Title: The State of Crypto Lending

Original Author: Zack Pokorny, Galaxy Digital Researcher

Original Translation: Aiying compliance

GalaxyResearch released the full report titled "The State of Crypto Lending" on April 14, 2025, summarizing data for the entire year of 2024: Lending is an application scenario for cryptocurrencies that has found strong market fit both on-chain and off-chain. At the peak of the market, the lending market size once exceeded $64 billion. The lending market plays an important role in building a financial ecosystem based on digital assets, allowing users to obtain liquidity from their held assets through lending, thereby deploying in decentralized finance (DeFi) or trading on on-chain and off-chain platforms.

This report explores the on-chain and off-chain cryptocurrency lending markets, divided into two parts: the first part reviews the history of the crypto lending market, market participants, historical scale (including on-chain and off-chain), and some key moments in the field. The second part delves into the operational mechanisms of some lending products and other sources of leverage in both on-chain and off-chain environments, who is using these products, and the risks associated with each product. This report comprehensively presents the landscape of the crypto lending market, revealing one of the most widely used yet opaque areas in this crypto economy. Most importantly, the report provides a rare perspective on the scale of the off-chain lending market, a historically relatively opaque part of the crypto industry.

I. Key Conclusions

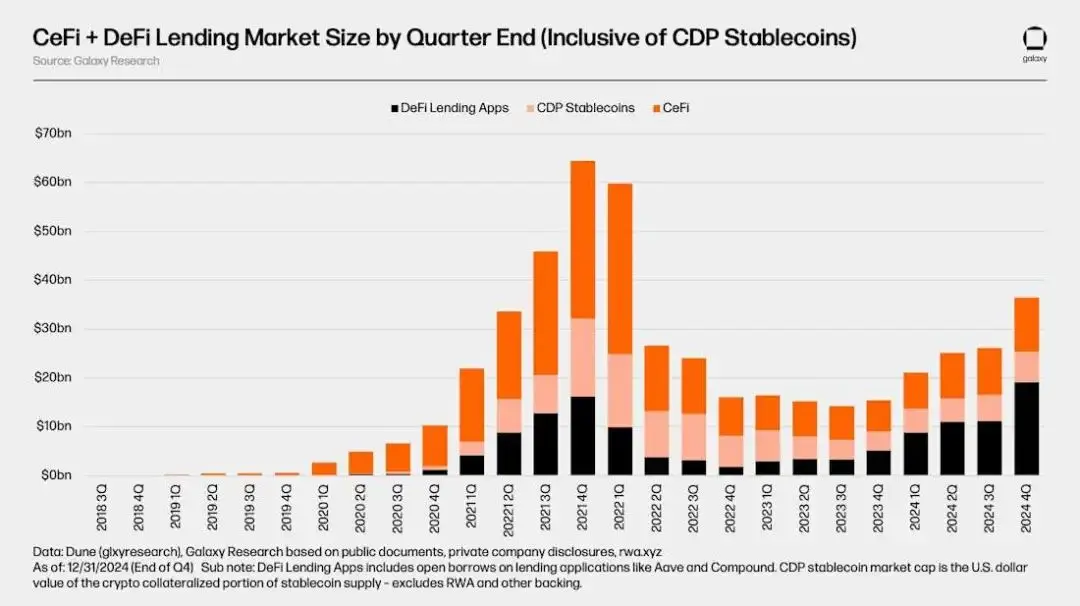

The overall scale of the crypto lending market remains significantly below the peak levels seen at the end of the 2020-2021 crypto bull market. As of the fourth quarter of 2024, the scale of the crypto lending market, including collateralized debt positions (CDPs) stablecoins, was $36.5 billion, a 43% decrease from the historical peak of $64.4 billion reached in the fourth quarter of 2021. This decline can be attributed to the collapse of lenders on the supply side, as well as the shrinkage of funds, individuals, and enterprises on the demand side.

As of the fourth quarter of 2024, the total scale of the crypto lending market was $36.5 billion, with the top three centralized finance (CeFi) lending institutions being Tether, Galaxy, and Ledn. These three companies had a total loan book size of $9.9 billion at the end of the fourth quarter of 2024, accounting for 88.6% of the CeFi lending market (with Tether accounting for approximately 73% at $8.2 billion). The market size is primarily composed of:

- Centralized Finance (CeFi) Lending: $11.2 billion

- Decentralized Finance (DeFi) Lending: $19.1 billion

- Crypto Asset-Backed Collateralized Debt Position (CDP) Stablecoins: $6.2 billion

Since the low point of the crypto market bear market in the fourth quarter of 2022 (with an on-chain lending scale of $1.8 billion), on-chain lending applications have experienced strong growth. As of the fourth quarter of 2024, the total open borrowing across 20 lending applications and 12 blockchains was $19.1 billion. This means that DeFi borrowing has grown by 959% over eight quarters.

II. Market Overview

The provision of crypto lending services primarily occurs through two channels: decentralized finance (DeFi) and centralized finance (CeFi). Each has its unique characteristics and products offered. Below is a brief overview of CeFi and DeFi lending services:

1. Centralized Finance (CeFi)

CeFi refers to the lending services for cryptocurrencies and related assets provided by centralized off-chain financial companies. Some CeFi entities utilize on-chain infrastructure, or their entire business is built on-chain. CeFi lending can generally be divided into three categories:

a. Over-the-Counter (OTC)

OTC trading is provided by centralized institutions, offering a range of customized lending solutions and products. OTC trading is bilateral, allowing both parties to reach personalized agreements, with borrowing terms including interest rates, duration, and loan-to-value (LTV) ratios. These products are typically available only to qualified investors and institutions.

b. Prime Brokerage

Prime brokerage platforms provide margin financing, trade execution, and custody services. Users can withdraw margin financing from the prime broker for use elsewhere or for trading activities on the platform. Prime brokers typically offer limited financing for crypto assets and crypto ETFs.

c. On-Chain Private Credit

This allows users to pool funds on-chain and deploy them through off-chain agreements and accounts. In this model, the underlying blockchain effectively becomes a crowdfunding and accounting platform to meet off-chain credit needs. Debt is typically tokenized, either as collateralized debt position (CDP) stablecoins or directly through tokens representing shares of the debt pool. The use of funds is usually quite narrow.

2. Decentralized Finance (DeFi)

DeFi refers to applications driven by smart contracts that run on blockchains, allowing users to borrow against collateral in cryptocurrencies, lend for yield, or use leverage when trading. DeFi lending and borrowing have the following notable characteristics: operating 24/7, offering a wide range of borrowable and collateral assets, and being fully transparent, allowing anyone to audit. Lending applications, collateralized debt position stablecoins, and decentralized trading platforms all allow users to obtain leverage on-chain.

a. Lending Applications

These on-chain applications allow users to deposit collateral assets (such as Bitcoin and Ethereum) to borrow other cryptocurrencies. Loan terms are pre-set by the application through risk assessments and adjusted based on the collateral and borrowing assets provided by the user. On-chain lending and borrowing are similar to traditional over-collateralized lending.

b. Collateralized Debt Position Stablecoins

These stablecoins are over-collateralized with individual cryptocurrencies or a basket of cryptocurrencies. Their principle is similar to over-collateralized lending and borrowing, but the collateral deposited by users issues synthetic assets.

c. Decentralized Trading Platforms

Some decentralized trading platforms allow users to obtain leverage to amplify trading positions. Although the functionalities of decentralized trading platforms vary, the role of providing leverage is similar to that of CeFi prime brokers. Leverage funds typically cannot be transferred from decentralized trading platforms, but they serve a similar purpose to CeFi's financing services.

III. Market Development and History

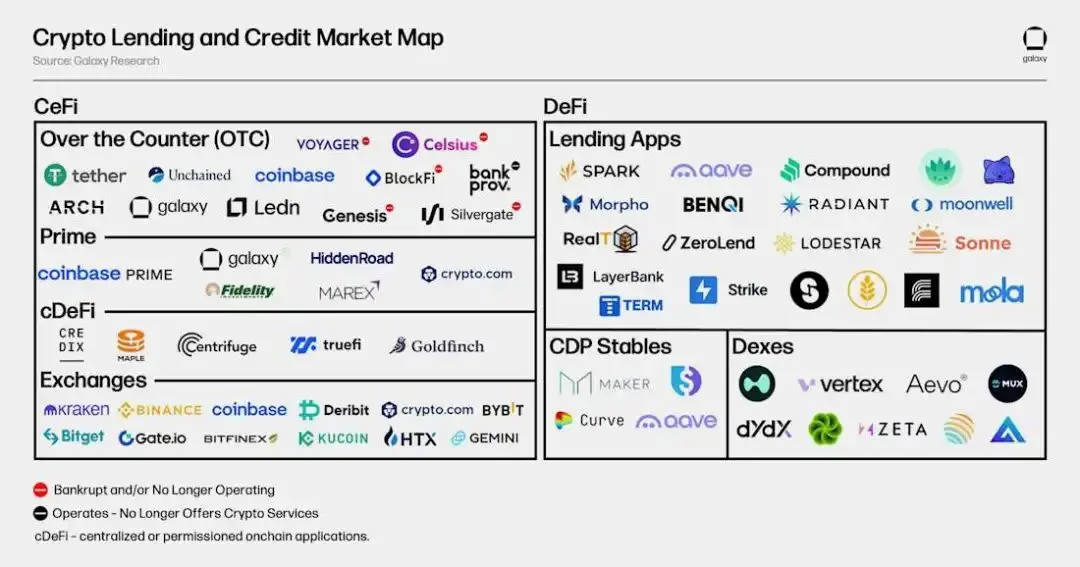

The following chart shows the main historical participants in the CeFi and DeFi crypto lending markets. In 2022 and 2023, as cryptocurrency prices fell and market liquidity dried up, many of the largest CeFi lending platforms collapsed, particularly Genesis, Celsius Network, BlockFi, and Voyager, which all filed for bankruptcy during these two years. This led to an estimated shrinkage of 78% in the CeFi and DeFi lending markets from the peak in 2022 to the low of the bear market, with open borrowing in CeFi lending decreasing by 82%. The following sections will delve into the historical evolution and scale of the crypto lending market.

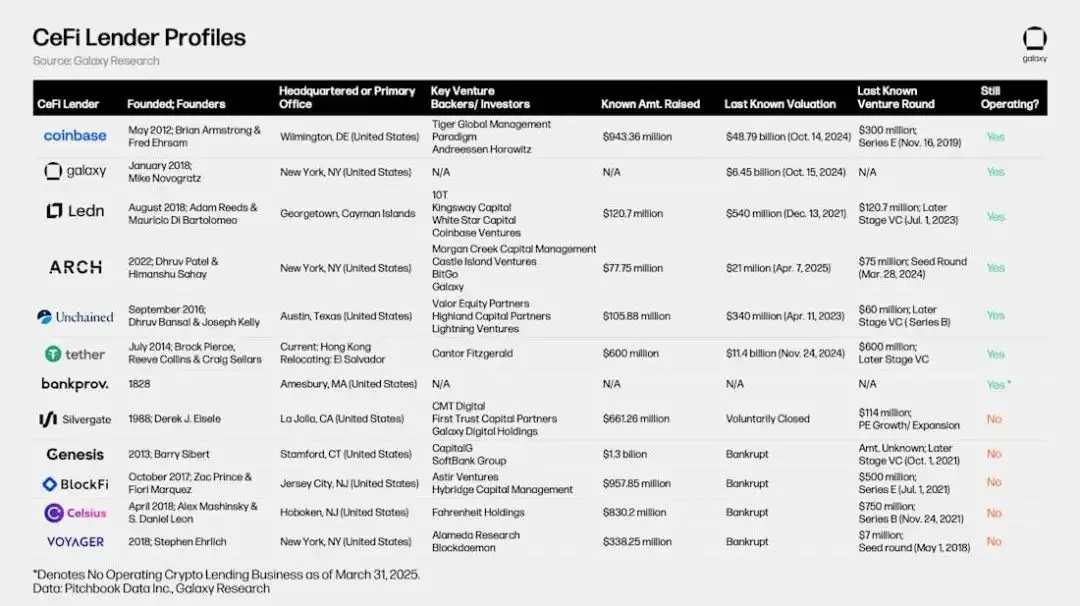

The following table compares some of the largest historical CeFi crypto lending institutions. Some of the listed companies provide multiple services to investors, such as Coinbase, which primarily operates as a cryptocurrency trading platform but offers credit services to investors through OTC cryptocurrency loans and margin financing.

IV. History of Crypto Lending

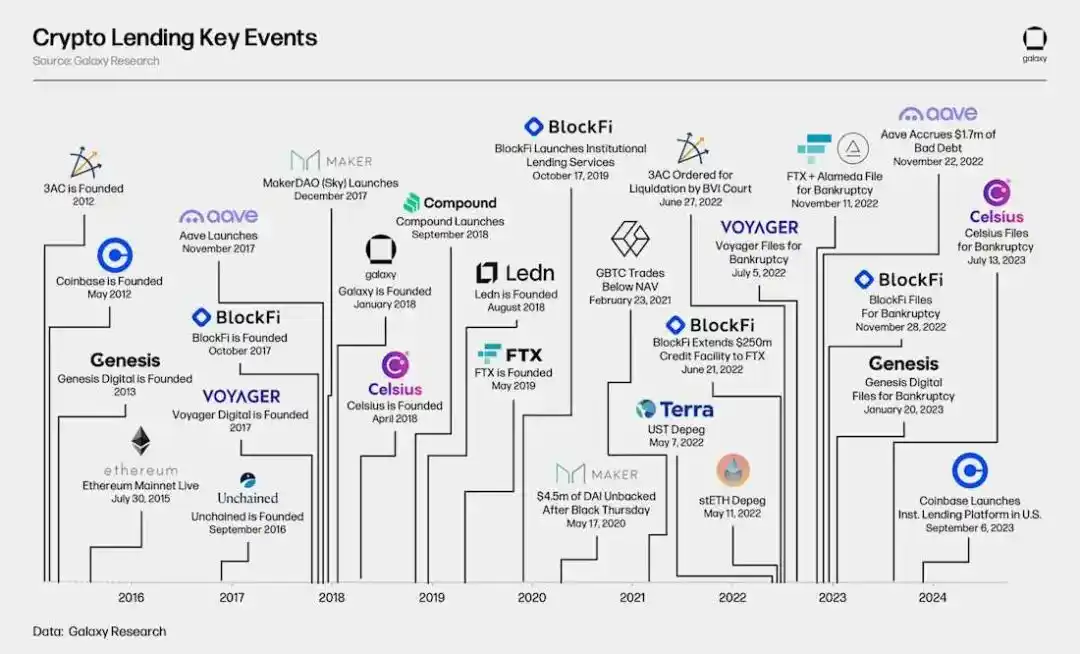

Although on-chain and off-chain crypto lending only began to see widespread application by the end of 2019/early 2020, some current and historically significant participants were established as early as 2012. Notably, Genesis was founded in 2013, with its loan book size once reaching as high as $14.6 billion. On-chain lending and CDP stablecoin giants like Aave, Sky (formerly MakerDAO), and Compound Finance launched on the Ethereum platform between 2017 and 2018. The emergence of these on-chain lending/borrowing solutions was made possible by the advent of Ethereum and its smart contracts, which officially launched in July 2015.

The end of the 2020-2021 crypto bull market marked the beginning of a turbulent 18 months for the crypto lending market, during which the market was plagued by bankruptcy events. Several significant events during this time included: the decoupling of Terra's stablecoin UST, which ultimately became worthless along with LUNA; the decoupling of Ethereum's largest liquid staking token (LST) stETH; and Grayscale's Bitcoin Trust (GBTC) beginning to trade at a discount to net asset value (NAV) after years of trading at a premium.

V. Market Scale

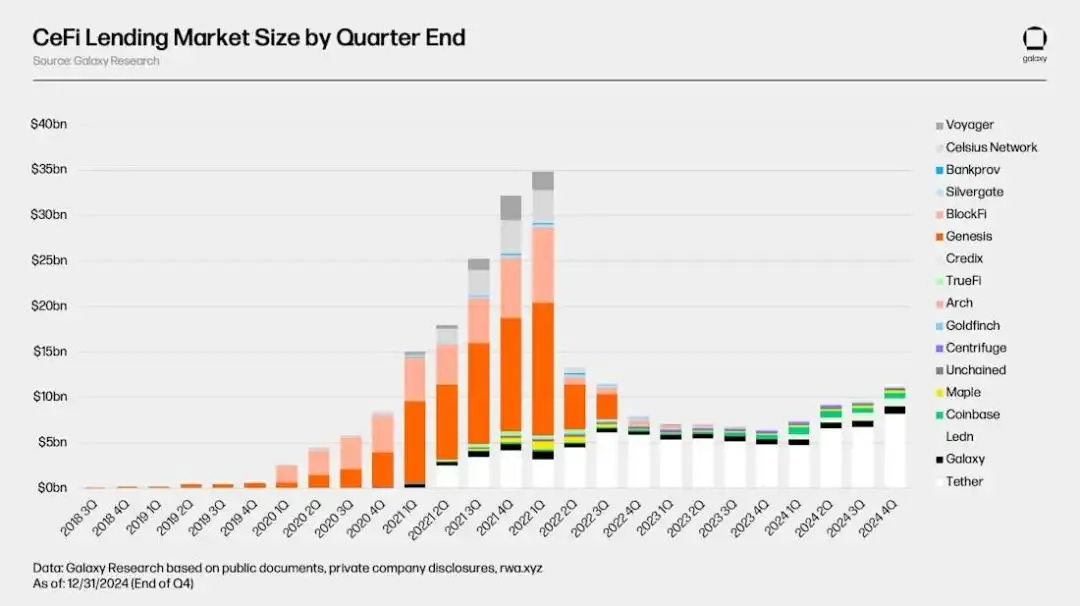

The total scale of the DeFi and CeFi crypto lending markets remains significantly below the peak levels seen in the first quarter of 2022 (based on quarter-end data). This phenomenon is primarily due to the sluggish recovery of the CeFi lending market following the 2022 bear market, as well as the collapse of the largest lenders and borrowers in the market. The following analysis looks at the scale of the crypto lending market from the perspective of CeFi and on-chain platforms.

At the market peak, Galaxy Research estimated that the total loan book size of CeFi lending platforms with accessible data was $34.8 billion; while at the market low, the scale of the CeFi lending market dropped to $6.4 billion (a decrease of 82%). As of the end of the fourth quarter of 2024, the total scale of the CeFi lending market was $11.2 billion, a 68% decrease from the historical peak but a 73% increase from the bear market low.

As the CeFi lending market has shrunk over the past three years, the number of outstanding loans has concentrated on fewer lending platforms. At the peak of the CeFi lending market in the first quarter of 2022, the top three lending platforms (Genesis, BlockFi, and Celsius) accounted for 76% of the market, holding a total of $26.4 billion out of $34.8 billion in loans. Today, the top three lending platforms (Tether, Galaxy, and Ledn) still maintain an 89% market share, with Tether accounting for approximately 73% as shown in the chart above.

When assessing the market dominance of one lending platform compared to another, it is important to note the distinctions between each platform, as not all CeFi lending platforms are the same. Some platforms only offer certain types of loans (e.g., Bitcoin-collateralized loans only, altcoin-collateralized products only, and cash loans excluding stablecoins), serve specific types of clients (e.g., institutional clients versus retail clients), and operate only in certain jurisdictions. It is this combination of factors that allows certain lending platforms to scale more significantly than others.

As shown in the chart below, on-chain applications (such as Aave and Compound) have achieved strong growth through DeFi lending, rebounding from a low of $1.8 billion in outstanding loans during the bear market to a total of $19.1 billion in outstanding loans across 20 lending applications and 12 blockchains by the end of the fourth quarter of 2024. Compared to the bottom, DeFi lending has grown by 959% over the past eight quarters. As of the end of the fourth quarter of 2024, the total outstanding loans of on-chain lending applications increased by 18% compared to the historical peak of $1.62 billion during the 2020-2021 bull market.

The recovery speed of DeFi lending has outpaced that of CeFi lending. This can be attributed to the permissionless nature of blockchain-based applications, as well as the fact that DeFi lending applications survived during the tumult of the bear market, while many large CeFi lending platforms declared bankruptcy and ceased operations. Unlike those CeFi lending platforms that went bankrupt and stopped operating, many DeFi lending applications and markets were not forced to shut down and continued to operate. This fact demonstrates the design and risk management practices of large on-chain lending applications, as well as the advantages of algorithmic, over-collateralized, and supply-demand-based lending models.

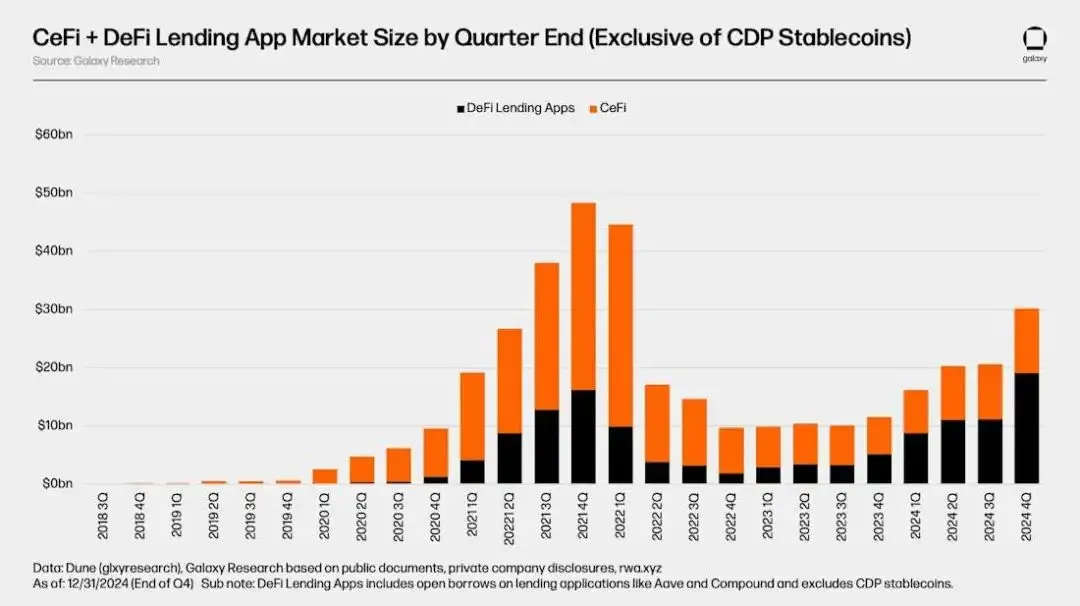

Excluding the market capital of crypto-collateralized CDP stablecoins, the crypto lending market reached a peak of $4.84 billion in outstanding loans in the fourth quarter of 2021. This market hit a low of $960 million four quarters later in the fourth quarter of 2022, a decline of 80% from the peak. Since then, the total market size has expanded to $3.02 billion, primarily driven by the expansion of DeFi lending applications, which represents a 214% increase from the historical low in the fourth quarter of 2024.

It is important to note that there is a potential issue of double counting between the loan book size of CeFi and the borrowing in DeFi. This is because some CeFi platforms rely on DeFi lending applications to provide borrowing services for off-chain clients. For example, suppose a certain CeFi platform borrows USDC on-chain using idle Bitcoin and then lends the same USDC to off-chain clients. In this case, the on-chain borrowing of that CeFi platform would appear in both the outstanding borrowing of DeFi and in the financial statements of that platform as outstanding borrowing from its clients. Filtering out this double counting is very difficult due to the lack of disclosure and clear attribution on-chain.

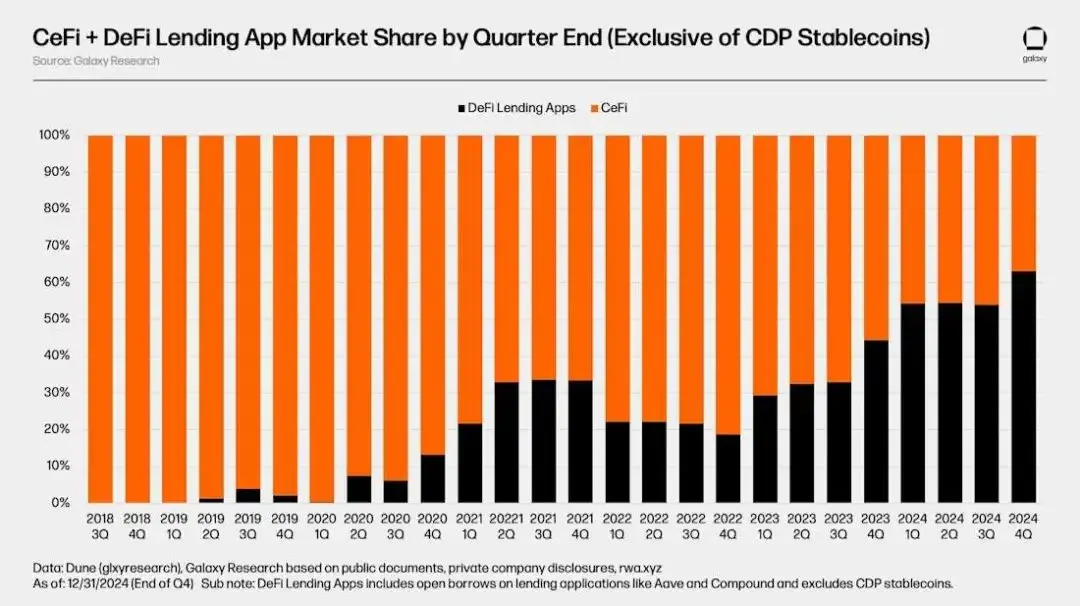

A significant change in the crypto lending market is that DeFi lending applications have shown stronger dominance than CeFi platforms during the bear market and continue to expand during the market recovery. During the 2020-2021 bull market cycle, when excluding the market capital of crypto-collateralized CDP stablecoins, DeFi lending applications accounted for only 34% of total cryptocurrency borrowing; by the end of the fourth quarter of 2024, the market share of DeFi lending applications had risen to 63%, nearly double its original share.

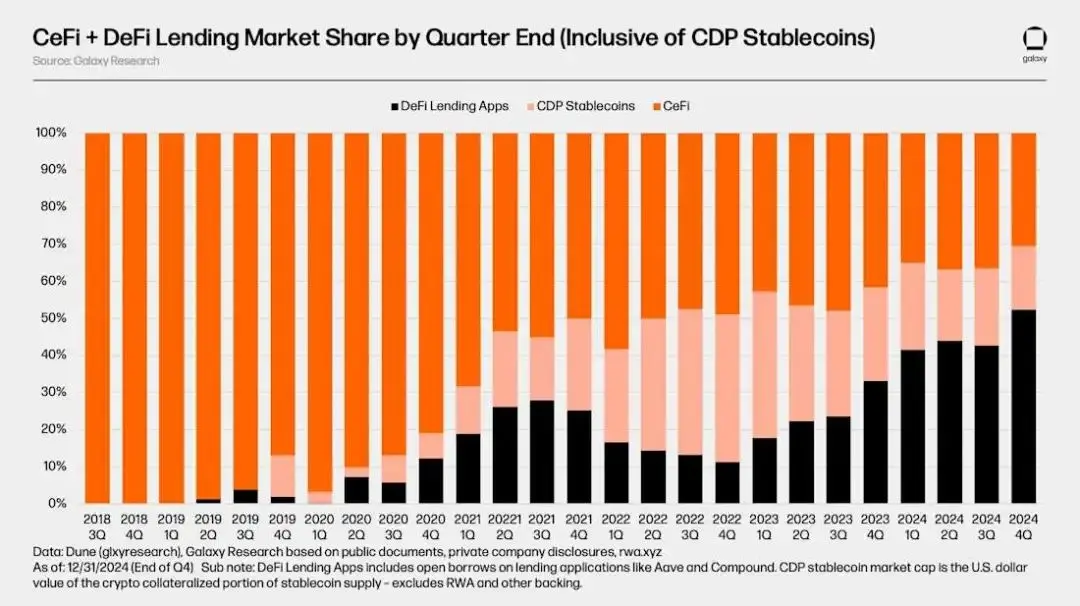

Including the market capital of crypto-collateralized CDP stablecoins, the total size of the entire crypto lending market surpassed $6.44 billion in the fourth quarter of 2021. At the bottom of the bear market in the third quarter of 2023, the market size was only $1.42 billion, a decline of 78% from the bull market peak. As of the fourth quarter of 2024, the market has rebounded by 157% from the low in the third quarter of 2023, reaching a total size of $3.65 billion.

It is important to note that, similar to borrowing through DeFi lending applications, there may also be issues of double counting between the loan book size of CeFi and the supply of CDP stablecoins. This is because some CeFi entities rely on the issuance of CDP stablecoins backed by cryptocurrencies to provide borrowing services for off-chain clients.

When including crypto-collateralized CDP stablecoins, a noticeable increase in the market share of on-chain lending and borrowing can be observed. As of the fourth quarter of 2024, DeFi lending applications and CDP stablecoins accounted for 69% of the entire market. Since the fourth quarter of 2022, their share has shown a steady upward trend. A noteworthy phenomenon is that the dominance of CDP stablecoins as collateralized leverage is gradually declining. This can be partially attributed to the increased liquidity of stablecoins, improvements in lending application parameters, and the introduction of neutral stablecoins like Ethena.

VI. Market Data Logic and Sources

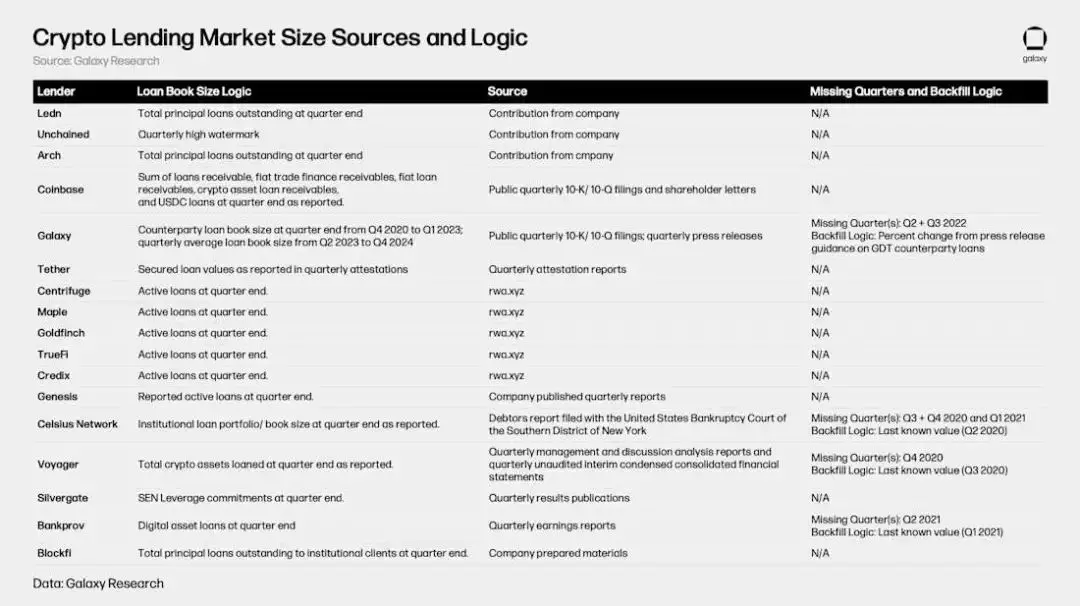

The table below shows the sources and logic used to compile the above DeFi and CeFi lending market data. Although data for DeFi and cDeFi can be retrieved through on-chain data, which is transparent and easily accessible, obtaining CeFi data is more complex and less available. This is due to inconsistencies in how CeFi lending platforms record outstanding loans, differences in the frequency of public information, and the general difficulty in obtaining information.

VII. Venture Capital and Crypto Lending

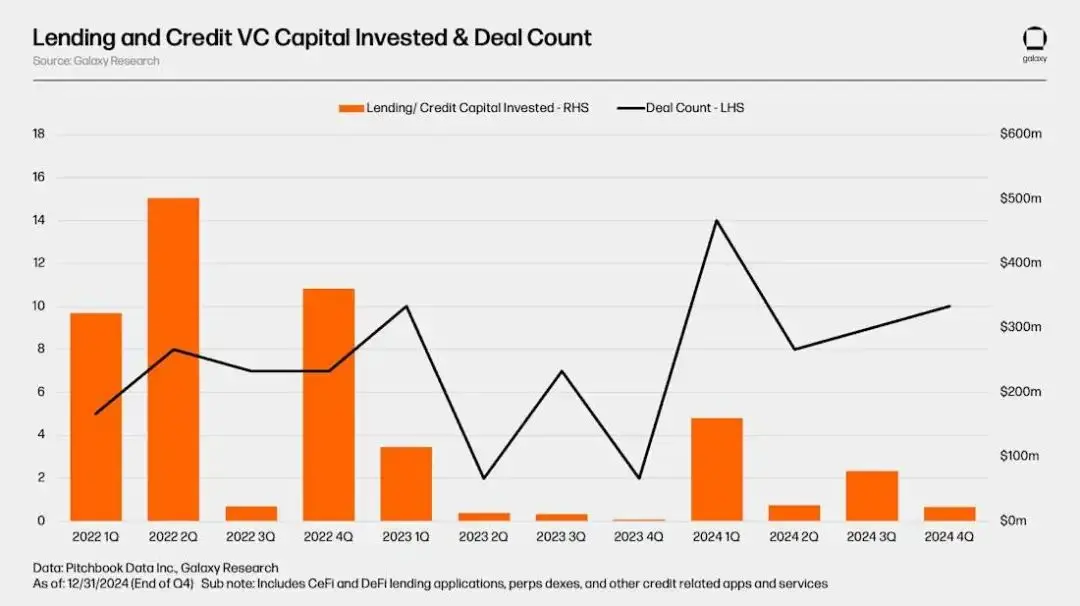

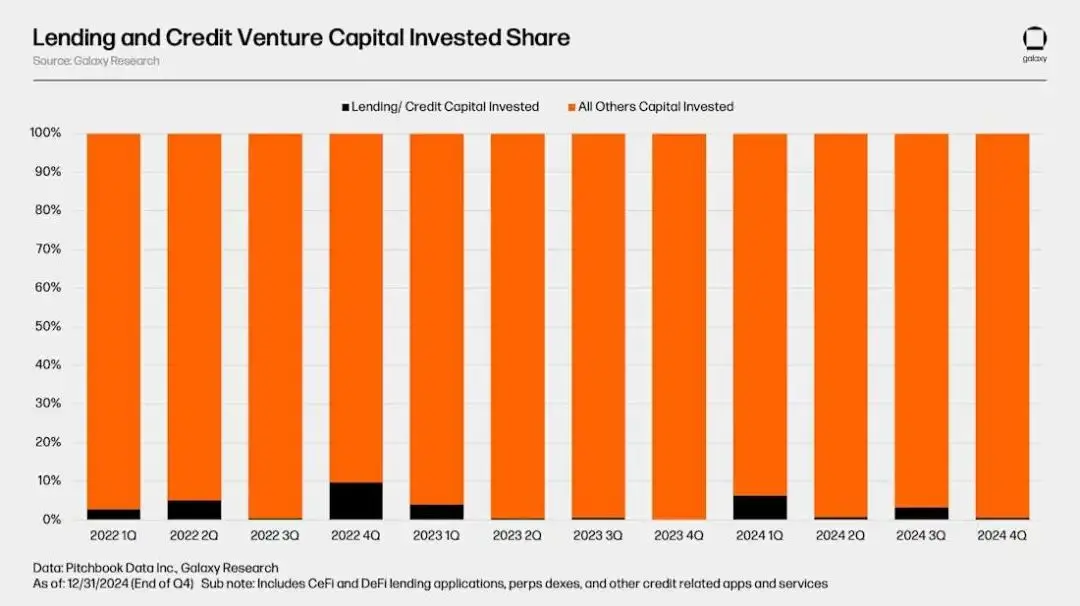

CeFi and DeFi lending/credit application platforms raised a total of $1.63 billion through 89 transactions, occurring between the first quarter of 2022 and the fourth quarter of 2024. Among these transactions, the second quarter of 2022 saw the most capital raised, with eight transactions collectively raising at least $502 million. The fourth quarter of 2023 was the lowest quarter, with total capital raised of only $2.2 million.

For the crypto economy, venture capital investment in lending and credit applications accounts for only a small portion of total investment. From the first quarter of 2022 to the fourth quarter of 2024, lending and credit applications averaged only 2.8% of venture capital each quarter. Lending and credit applications accounted for 9.75% of total quarterly funding in the fourth quarter of 2022, their largest share; while in the most recent fourth quarter of 2024, their share was only 0.62%.

VIII. Historical Review and Future Outlook of the Crypto Lending Market

Root Causes

The core reasons for the collapse of the crypto lending market in 2022-2023 include:

- Asset Price Plummeting:

The total market value of cryptocurrencies shrank by 77% (approximately $1.3 trillion), with the Terra ecosystem (UST and LUNA) evaporating $57.7 billion. The sharp decline in collateral value and liquidity exhaustion led to debt defaults.

- Toxic Collateral:

stETH and GBTC: Due to the underlying assets being non-redeemable, poor liquidity led to significant discount trading (stETH at a 6.25% discount, GBTC at a 48.9% discount). Mining machine collateral: The decline in Bitcoin prices combined with increased mining difficulty resulted in an 86% drop in mining income and an 85-91% decrease in value, with some mining machines becoming unsellable.

- Risk Management Failures:

Liquidity Mismatch: CeFi platforms lent long-term but relied on short-term funding, unable to cope with runs during market crashes. Unsecured Loans Proliferation: For example, 36.6% of Celsius's loans were unsecured, and BlockFi provided unsecured loans to FTX. Lack of Risk Control: There was a lack of standardized risk assessments, lax loan reviews, and some platforms had no risk limits.

IX. Future Trends

- Institutionalization of CeFi Lending:

Traditional financial institutions (such as Cantor Fitzgerald and banks) will enter the market, utilizing low-cost funding and regulatory relaxations (such as the SEC's repeal of SAB-121) to expand services. Bitcoin ETFs as collateral will drive growth in leveraged trading.

- Rise of On-Chain Private Credit:

Tokenized debt instruments enhance transparency, reduce management costs, and attract venture capital. Use cases are expanding: on-chain collateral, CDP stablecoin issuance, etc.

- Institutionalization and Innovation in DeFi:

Institutions are accelerating the adoption of DeFi due to improved regulatory clarity and advantages of on-chain liquidity. Centralized companies are building on DeFi protocols (such as Ondo Finance forking Compound), promoting the integration of on-chain ecosystems.

X. Conclusion

Market Differentiation: DeFi has shown resilience during the bear market, with its share increasing from 34% to 63%, continuously strengthening its dominance; CeFi may see institutional entry or recovery, but concentration remains high (the top three platforms account for 89%).

Risks and Opportunities: The entry of traditional finance brings compliance and liquidity, but caution is needed regarding collateral volatility and regulatory uncertainty.

On-Chain Future: Tokenization, automated risk control, and institutional participation will drive crypto lending towards transparency and scalability, becoming a core component of digital financial infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。