I. Introduction

In April 2025, the Bitcoin market experienced significant volatility. After a high-level correction at the end of the first quarter, influenced by U.S. tariff policies, Bitcoin's price briefly fell below $75,000, triggering market panic. However, it is noteworthy that whales continued to buy large amounts of BTC at lower prices, showing no signs of the large-scale sell-offs typically seen in previous bear markets. Meanwhile, traditional financial institutions are also accelerating their embrace of Bitcoin, with several institutions either increasing their holdings or allocating BTC for the first time.

This article will analyze the situation of on-chain large holders and traditional financial institutions increasing their BTC holdings, combined with the correlation between on-chain capital flows and BTC price trends, to determine whether a bottom has been formed in this round. It will also analyze the impact of the macroeconomic environment and policies on market sentiment and capital flows, providing an in-depth analysis of multiple on-chain indicators to assess market trends.

II. Whale Address Capital Flows

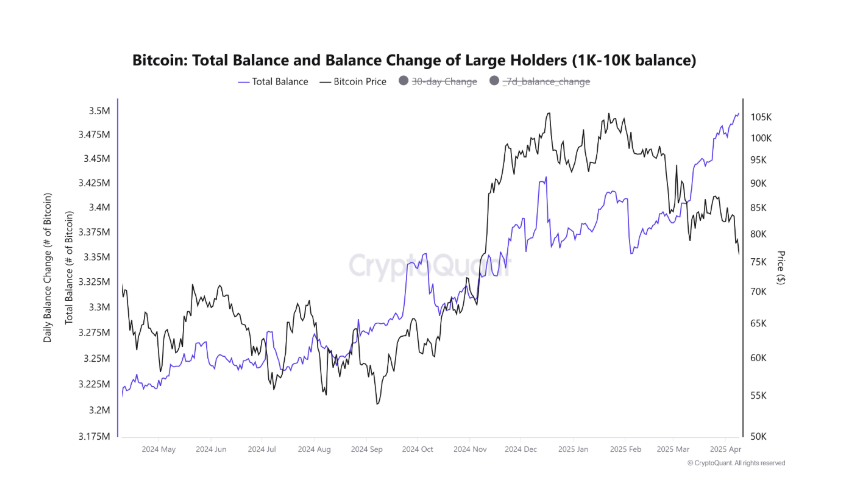

Since March, Bitcoin whale addresses have shown a clear tendency to accumulate at lower prices, with whales seizing the opportunity to significantly increase their holdings, transferring Bitcoin from exchanges and retail investors to whale wallets. The following chart compares the total balance changes of large holders (holding 1,000 to 10,000 BTC, purple line) and Bitcoin prices (black line) from 2024 to 2025. It can be seen that the total balance of whales significantly increased from March to April as prices fell, indicating that whales are accumulating.

Source: https://www.mitrade.com/

Data provided by CryptoQuant analyst caueconomy indicates that the holdings of whale wallets increased by over 100,000 BTC during this period. Even with overall network activity relatively low and retail investors on the sidelines, whales continued to buy in a planned manner. This trend has led to the total amount of BTC held by whales (those holding 1,000 to 10,000 BTC) rising to over 3.35 million BTC, reaching a new peak. The counter-cyclical accumulation behavior of whales is often seen as one of the signals of a potential market bottom.

In terms of specific capital flows, on-chain transaction tracking accounts such as Whale Alert and Lookonchain have repeatedly captured large transfers and balance changes of whales in April. On April 11, over $2.4 billion worth of BTC was withdrawn from the U.S. exchange Kraken, indicating that large investors are concentrating on withdrawing their chips from exchanges, leaning towards self-custody for long-term holding. Another whale behavior is the "large new wallet accumulation." In late March, a billionaire-level Bitcoin whale bought 3,238 BTC in 24 hours, worth about $280 million, at an average purchase price of $86,500. In fact, in the past month, there have been multiple large-scale BTC transfers into cold wallets, totaling over 50,000 BTC withdrawn and stored offline by large investors, indicating that the main players are accumulating at lower prices.

Overall, the capital flow of whale addresses in April exhibited a "net inflow accumulation" pattern: a large amount of BTC flowed out of exchanges and into long-term holding wallets; the overall amount held by whales increased, with almost no signs of panic selling. On the contrary, whales chose to increase their holdings during this round of approximately 30% price correction, which is seen as a reflection of their confidence that the current adjustment is merely a temporary pullback rather than a trend reversal.

III. Institutional Capital Movements

As Bitcoin is increasingly viewed as digital gold and an inflation hedge, more traditional institutions are joining the ranks of Bitcoin holders. According to data from BitcoinTreasuries, there are currently over 80 companies holding Bitcoin.

Source: https://treasuries.bitbo.io/

1. Asset Management Funds

At the beginning of 2025, several Wall Street giants launched Bitcoin-related products. The world's largest asset management company, BlackRock, received a warm market response for its Bitcoin spot ETF launched at the end of 2024, and its fund continued to receive net subscriptions into 2025. Reports indicate that BlackRock is not only investing in Bitcoin but has also recently begun to venture into assets like Ethereum: on April 10, BlackRock purchased 4,126 ETH through its Ethereum spot ETF, worth about $6.4 million. On April 15, BlackRock increased its holdings by 431.823 BTC through its Bitcoin exchange-traded fund IBIT, valued at $37.07 million, bringing its total holdings to 571,869 BTC.

In addition to BlackRock, financial giants such as Fidelity and JPMorgan have also been reported to increase their positions in Bitcoin or related derivatives. Fidelity opened Bitcoin spot trading and custody services as early as 2024, and its client funds showed a trend of newly allocating BTC in Q1 2025. Additionally, institutional investors like Grayscale continue to hold large amounts of Bitcoin through trust products, with the discount rate of its flagship product GBTC significantly narrowing in April, reflecting rising institutional demand.

2. Public Companies and Enterprises

As the public company with the largest Bitcoin holdings globally, Strategy continues to raise funds through stock and bond issuance to purchase Bitcoin. According to the latest disclosed data, Strategy purchased 3,459 BTC between April 7 and April 13, at an average price of $82,618, totaling $285.8 million. As of April 17, Strategy holds a total of 531,644 BTC, with an average holding price of about $67,556.

Moreover, some corporate financial reserves are also increasing their Bitcoin allocations. Consulting reports indicate that more and more companies view Bitcoin as a reserve asset on their balance sheets to combat economic uncertainty. For example, companies like Tesla and Block (formerly Square) have already purchased Bitcoin. To date, although Tesla has not made any further purchases since 2022 and still holds about 10,000 BTC, it has not further reduced its holdings. Traditional industry companies like Norwegian energy company Aker have also long allocated some Bitcoin as a strategic reserve, indicating a more open attitude towards embracing Bitcoin in traditional sectors.

Overall, traditional institutional capital is actively entering the Bitcoin market: from Wall Street asset management giants to public companies and various investment funds, whether for hedging, speculation, or strategic reserve purposes, BTC is being included in the asset portfolios of an increasing number of institutions. This force provides solid buying support for the market and is also an important driving force behind the current wave of whale accumulation.

IV. The Correlation Between BTC Price Trends and On-Chain Capital Flows

In the past few weeks, Bitcoin's price has experienced dramatic fluctuations: after reaching an all-time high of $109,000 in January, it underwent a deep correction of about 30% due to profit-taking and U.S. tariff policies, briefly falling below $75,000. As of April 17, the price has rebounded and stabilized in the $83,000-$85,000 range.

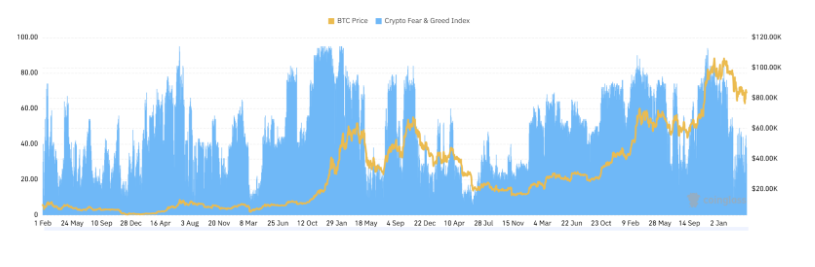

- Correction Phase (from January peak to March low): Bitcoin fell from the $109K high to around $75K at the end of the first quarter, a decline of about 30%. On-chain data shows that during the rapid price drop, there was a net inflow to exchanges (retail investors panic-selling BTC to exchanges for liquidation), while at the same time, whale wallet balances increased (as they bought and withdrew BTC from exchanges). Specifically, from mid-March, the BTC balance on exchanges began to decline, indicating a net outflow; meanwhile, stablecoins saw a net inflow to exchanges, indicating that funds were withdrawing from the falling coin prices and converting into stablecoins for value preservation. Overall, panic sentiment was strong at that time, with the crypto market's greed/fear index dropping to as low as 19 in early April (extreme fear). This extreme fear often signals that selling pressure is nearing its end.

Source: https://www.coinglass.com/pro/i/FearGreedIndex

- Bottoming Rebound Phase (from early April to present): After falling below $75K, Bitcoin quickly rebounded back above $80K and has been consolidating. At this time, the characteristics of on-chain capital flows are: net outflows from exchanges (investors withdrawing coins from exchanges), while a large amount of stablecoins flowed into exchanges (indicating that funds are preparing to enter the market to buy coins). CryptoQuant's monitoring shows that in early April, the net inflow of stablecoins to exchanges reached several billion dollars, hitting a peak not seen since July 2023. This means that at this price level, a large amount of capital is entering, converting into stablecoins like USDT and being deposited into exchanges, waiting to buy Bitcoin and other crypto assets at the bottom. In fact, the total supply of stablecoins grew by about $30 billion in Q1 2025, with the total market cap exceeding $230 billion again. Tether has also issued multiple times in April, providing "ammunition" for the market. With the return of capital, Bitcoin's price has stabilized, repeatedly testing support and resistance areas above $80K.

The interaction between on-chain data and price further confirms the accumulation by large holders at the bottom. Approximately 63% of Bitcoin has not moved on-chain for over a year, reaching one of the highest levels in history, indicating that the vast majority of chips are locked by steadfast holders. The large-scale buying and concentration of holdings by whales, the decrease in supply from exchanges, and the clearing of panic selling all align with the characteristics of past cycle bottoms. As long as the macro environment does not present unexpected negative factors, BTC is expected to regain upward momentum and enter a new upward cycle.

V. The Impact of Macroeconomic Environment and Policies

The linkage between the crypto market and the macroeconomic environment is becoming increasingly evident. The capital flows of whales and institutions in April, in addition to responding to the technical aspects of prices, are also deeply influenced by macro policies and market sentiment.

1. Federal Reserve Interest Rate Policy and Liquidity Expectations

The Federal Reserve's monetary policy directly affects the global liquidity environment, thereby indirectly influencing the capital flows of risk assets such as Bitcoin. The Fed's significant interest rate hikes and balance sheet reductions in 2022-2023 put pressure on the crypto market. However, a shift occurred at the end of 2024: during its last meeting of 2024, the Fed began to lower interest rates, and then in early 2025, it held rates steady twice, maintaining the federal funds rate at 4.25%-4.50%. At the FOMC meeting on March 19, Powell announced that there would be no rate hikes for the time being, while also lowering economic growth expectations and raising inflation forecasts, indicating an increase in uncertainty regarding the economic outlook. The Fed's dot plot suggests two rate cuts are expected in 2025, with rates projected to fall to around 3.9% by the end of 2025. Additionally, the Fed announced a slowdown in the balance sheet reduction process starting in April, effectively sending a signal of easing to the market.

These policy shifts are favorable for the crypto market: a peak and subsequent decline in interest rates imply an improvement in the liquidity environment, enhancing investors' risk appetite for the future. The market is particularly focused on the Fed's potential rate-cutting cycle: many institutions (such as JPMorgan) predict that if economic downward pressure increases, the Fed may even implement "significant rate cuts" in the second half of 2025. The expectation of rate cuts has sparked investors' imaginations regarding liquidity-driven market trends, with some viewpoints suggesting that the Fed's dovish turn could replicate the scenario following the massive monetary easing in 2020, leading to a new bull market. Overall, the Fed's policy shift provides a favorable macro backdrop for this round of bottom formation, although short-term noise may still cause temporary disturbances in capital flows.

2. Global Economic and Geopolitical Factors: Trade Policies, Recession Expectations, etc.

Another recent macro factor is the changing trade environment. After Trump's return to the White House, he adopted a tough stance on tariffs, and in early April, the Trump administration unexpectedly announced large-scale tariffs on foreign goods, causing a surge in market risk aversion and triggering tension in financial markets. However, after several days of volatility, the White House introduced a 90-day tariff delay measure, leaving room for negotiations. This erratic policy has led to significant fluctuations in traditional markets, which have also affected the crypto market. Bitcoin demonstrated a certain degree of safe-haven properties during this event: as trade frictions escalated and global stock markets fell, whales viewed Bitcoin as a store of value and accelerated their purchases. This "risk hedging" behavior reflects a shift in investor sentiment—an increasing number of people see BTC as an asset to hedge against macroeconomic turmoil rather than purely a speculative risk.

Recession expectations are also a significant current macro topic. The IMF recently downgraded its global growth forecasts, with most economies showing signs of slowing under high interest rate conditions. In the U.S., the inversion of short- and long-term bond yields continues, exacerbating the likelihood of an economic recession in 2025-2026. For the crypto market, a mild recession may not necessarily be a bad thing: central banks are likely to respond with rate cuts and possible quantitative easing, which would benefit liquidity-sensitive Bitcoin. However, if a severe economic crisis or systemic financial risk occurs, it could lead to a liquidity squeeze in the short term, prompting investors to sell off all assets, including cryptocurrencies. If a situation similar to the Silicon Valley Bank incident in early 2023 were to reoccur, or if European banks faced issues, it could undermine investor confidence and trigger large-scale on-chain sell-offs.

3. Policy and Regulatory Environment

In the first half of 2025, crypto regulation has shown a dual nature: on one hand, the U.S. SEC's scrutiny of altcoins and exchanges remains strict; on the other hand, policies related to Bitcoin ETFs and institutional reports are becoming increasingly friendly. For example, after the SEC approved the first Bitcoin spot ETF at the end of 2024, several similar products are queued for listing in 2025, providing a convenient channel for traditional capital to enter the market. As a result, Bitcoin has gained more favor among institutional investors, and an increase in ETF shares equates to an indirect increase in on-chain holdings. Europe has also implemented the MiCA regulation, and after establishing a clear framework, some compliant asset management firms have begun to allocate Bitcoin.

At the national level, on March 7, 2025, President Trump signed an executive order establishing a "Strategic Bitcoin Reserve," designating approximately 200,000 seized Bitcoins as reserve assets, and authorized the Treasury and Commerce Departments to develop budget-neutral strategies to acquire more Bitcoin. El Salvador became the first country in the world to adopt Bitcoin as legal tender, implementing this policy since September 2021 and actively purchasing Bitcoin under President Nayib Bukele's leadership. The government has implemented a plan to "buy 1 BTC daily," continuously increasing its holdings regardless of market prices. According to a report from March 2025, El Salvador holds approximately 5,800 BTC. Bhutan holds Bitcoin through its government-owned Druk Holding & Investments fund, with about 13,029 BTC as of February 2025.

Overall, the current policy environment is easing and leaning towards favorable conditions. The promotion of central bank digital currencies and the relaxation of institutional entry permissions are all beneficial for Bitcoin's long-term value proposition.

VI. Conclusion and Outlook

First, the on-chain capital flows, whether from whales, large institutions, or the behavior of small and medium investors, exhibit typical bottom characteristics: chips are shifting from short-term speculators to long-term value investors. Traditional financial institutions are also taking advantage of the adjustment to position themselves, with Bitcoin integrating into a broader institutional asset portfolio. The continued accumulation by firms like BlackRock and Strategy indicates that institutions and companies are optimistic about BTC's long-term value.

Second, the correlation between price trends and on-chain indicators validates the bottoming judgment: Bitcoin found strong support in the $74K-$75K range, with multiple indicators showing that an important "value consensus" was formed at this price level. Subsequently, the price rebounded above $80K and consolidated, during which time the market digested previous selling pressure and solidified the bottom. On-chain activity has moderately increased without overheating, indicating that market participants are gradually returning but remain rational and cautious. As time progresses, the market is expected to complete energy accumulation during high-level consolidation, initiating a new upward trend.

The macro environment provides a "tailwind" for bottom formation. The Fed's pause in rate hikes and expectations of rate cuts, along with the Trump administration's tariff delays, have alleviated systemic risks in the market. Global liquidity is expected to loosen again, and market sentiment has rebounded from extreme fear, currently sitting in a neutral but slightly cautious state. Historical experience suggests that periods of extreme fear often precede turning points.

However, several potential variables still need attention. First, if new macro shocks occur (such as escalating geopolitical conflicts or financial crises in major economies), they could interrupt the bottoming process and lead to further declines. Second, the technical trend needs confirmation: only when Bitcoin effectively breaks above the 200-day moving average on the daily chart and consistently holds above key resistance can the bottom be fully confirmed. Until then, the possibility of range-bound fluctuations cannot be ruled out. Third, continuous monitoring of on-chain indicators is necessary: if signs emerge that whales are starting to reduce their holdings or if there is a sudden increase in BTC on exchanges, caution should be exercised.

In summary, various signs indicate that Bitcoin has largely completed its bottoming process by April 2025, and the market is transitioning from panic to a rebuilding of confidence. Meanwhile, both macro and internal market conditions are gradually improving, with the potential to restart an upward trend and reach new highs in the near future.

About Us

Hotcoin Research, as the core research and investment hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a "trend judgment + value excavation + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and all-day market volatility monitoring. Combined with our weekly live strategy broadcasts of "Hotcoin Selection" and daily news updates from "Blockchain Today," we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。