Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.67 trillion, with BTC accounting for 62.95%, which is $1.68 trillion. The market cap of stablecoins is $234.4 billion, with a recent 7-day increase of 0.47%, of which USDT accounts for 61.85%.

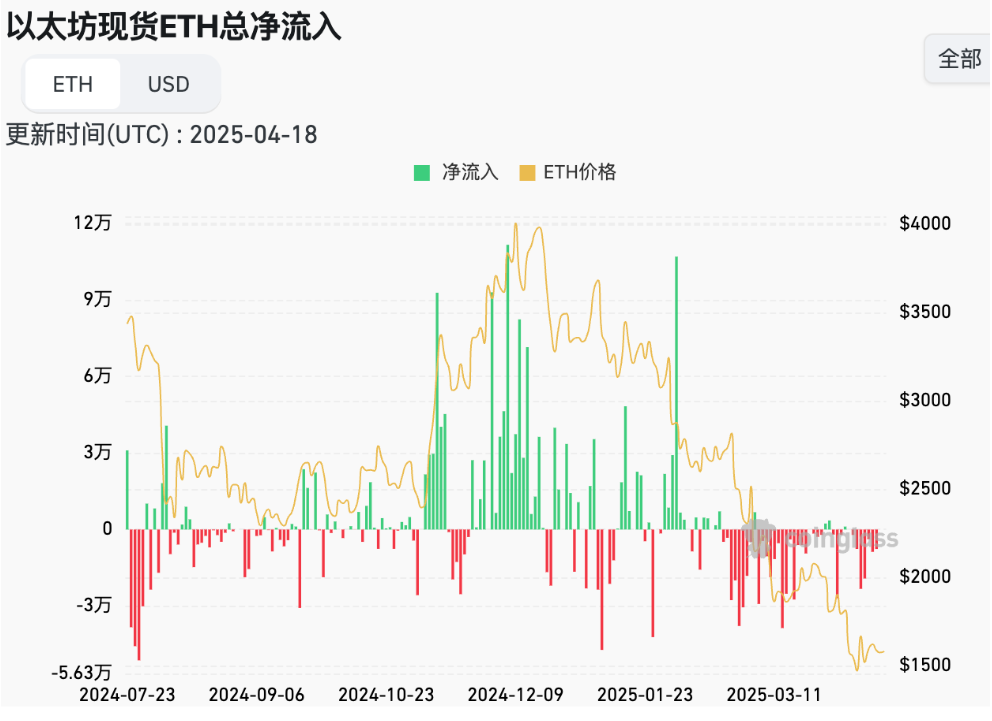

This week, BTC's price has shown range-bound fluctuations, currently priced at $85,107; ETH has also shown range-bound fluctuations, currently priced at $1,603.

Among the top 200 projects on CoinMarketCap, most have declined while a few have increased, including: CORE with a 7-day increase of 29.36%, RAY with a 7-day increase of 23.51%, DEEP with a 7-day increase of 41.51%, and T with a 7-day increase of 36.69%.

This week, the net inflow for Bitcoin spot ETFs in the U.S. was $13.9 million; the net outflow for Ethereum spot ETFs was $32.3 million.

On April 19, the "Fear & Greed Index" was at 32 (lower than last week), with this week's sentiment: 1 day neutral, 6 days fear.

Market Prediction: This week, the market continues to see an increase in stablecoin issuance, with a small net inflow for U.S. Bitcoin spot ETFs and a net outflow for Ethereum ETFs. The U.S. hopes to achieve strong negotiations globally through increased tariffs, but the current prediction is that U.S. tariffs will have limited impact on cryptocurrencies. This week, BTC and ETH prices are in a narrow range of fluctuations, with the market gradually recovering. The market remains in a state of panic, the U.S. dollar index has fallen below 100, and gold prices have reached new highs, indicating a high level of investment risk aversion. The probability of a 25 basis point rate cut by the Federal Reserve in May is 9.1%, lower than last week. It is expected that the market will gradually bottom out in April-May, with BTC fluctuating between $80k-90k.

Understanding Now

Review of Major Events of the Week

On April 14, Jupiter co-founder meow tweeted, "In the coming months, we will launch a large number of products, governance concepts, experimental metadata, thought fragments, and new technical concepts";

On April 15, according to Pionex monitoring, the perpetual contract DEX KiloEx was attacked today, resulting in a loss of approximately $7.5 million (of which $3.3 million was on the Base network, $3.1 million on the opBNB network, and $1 million on the BNB Chain). KiloEx has currently suspended operations;

On April 15, OpenSea announced that Solana token trading has been launched on OS2 for some closed beta users and will gradually roll out to more users in the coming weeks. Currently, tokens can be traded, with NFT trading to be launched later;

On April 15, Circle's euro stablecoin EURC reached a historic high in supply, potentially driven by increased demand for euro-denominated digital assets amid escalating U.S.-China trade tensions and a weakening dollar;

On April 15, Bo Hines, Executive Director of the White House President's Digital Asset Working Group, stated that the U.S. may use tariff revenues to purchase Bitcoin;

On April 15, ZKsync hackers attacked the account of the airdrop distribution administrator, minting an additional 111 million ZK tokens;

On April 17, the U.S. Securities and Exchange Commission announced details of its third cryptocurrency policy roundtable, with the April 25 meeting focusing on custody issues, featuring two panel discussions—one on broker-dealer and wallet custody, and another on investment advisor and investment company custody;

On April 16, MANTRA released a statement regarding the OM price drop, stating that the MANTRA team is currently operating normally and is committed to taking all necessary measures to address the current market turmoil. During the OM price drop, the MANTRA team did not conduct any sell-offs, and the token allocations for the MANTRA mainnet OM team and advisory team are all locked;

On April 17, Federal Reserve Chairman Powell stated that cryptocurrencies are gradually becoming mainstream, and establishing a legal framework for stablecoins is a good idea. Stablecoins may have broad appeal and consumer protection measures should be established;

On April 16, Raydium launched a token issuance platform called LaunchLab, designed for creators, developers, and communities. Tokens are released through the JustSendIt model, raising 85 SOL, with liquidity immediately migrating to Raydium's AMM. Creating on-chain tokens incurs no migration fees and no permission reviews;

On April 18, on-chain data analyst Yu Jin monitored that Blur, which unlocks tokens monthly, transferred 23.8 million BLUR (approximately $2.3 million) unlocked this month to Coinbase Prime one hour ago.

Macroeconomics

On April 14, the U.S. SEC postponed its decision on Grayscale's ETHE adding staking functionality;

On April 14, Japan's 20-year government bond yield rose to 2.435%, the highest level since 2004;

On April 17, Federal Reserve Chairman Powell stated that the Fed's two goals have not yet conflicted, but the current trend is that unemployment and inflation levels will rise;

On April 18, the European Central Bank cut interest rates by 25 basis points as expected, marking the seventh rate cut in the past year, with this decision being unanimous;

On April 18, U.S. President Trump expressed confidence in reaching a tariff agreement with China. Trump stated, "I think we will reach an agreement with China, and we will reach agreements with everyone. If we don't reach an agreement, then we set a goal, and that's it, which is also fine. Things should be settled in the next three to four weeks";

On April 18, according to CME's "FedWatch" data, the probability of a 25 basis point rate cut by the Fed in May is 9.1%, while the probability of maintaining the current rate is 90.9%.

ETF

According to statistics, from April 14 to April 18, the net inflow for U.S. Bitcoin spot ETFs was $13.9 million; as of April 18, GBTC (Grayscale) had a total outflow of $22.736 billion, currently holding $16.152 billion, while IBIT (BlackRock) currently holds $48.598 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $96.936 billion.

The net outflow for U.S. Ethereum spot ETFs was $32.3 million.

Envisioning the Future

Upcoming Events

TOKEN2049 Dubai 2025 will be held from April 30 to May 1, 2025, in Dubai;

Canada Crypto Week will take place from May 11 to 17, 2025, in Toronto, Canada.

Project Progress

The Lorentz mainnet upgrade will go live on opBNB on April 21;

The Japanese cryptocurrency exchange coinbook has been fully acquired by BACKSEAT Co., Ltd. and will be renamed "BACKSEAT Cryptocurrency Exchange Co., Ltd." on April 21;

The token sale deadline for DoubleZero on the CoinList platform is April 22;

The interoperability protocol Hyperlane airdrop will take place on April 22, with 57% of the token distribution allocated to users, while the remaining circulating tokens will be allocated to the core team (25%), investors (10.9%), and the foundation treasury (7.1%).

Important Events

- Coinbase Derivatives announced that it has submitted an application to the U.S. Commodity Futures Trading Commission (CFTC) to launch XRP futures contracts, with the official expectation that the contract will go live on April 21, 2025.

Token Unlocking

Bittensor (TAO) will unlock 216,000 tokens on April 21, valued at approximately $59.53 million, accounting for 1.03% of the circulating supply;

Scroll (SCR) will unlock 40 million tokens on April 22, valued at approximately $9.32 million, accounting for 4% of the circulating supply;

Coin98 (C98) will unlock 16.53 million tokens on April 23, valued at approximately $920,000, accounting for 1.65% of the circulating supply;

Altlayer (ALT) will unlock 195 million tokens on April 25, valued at approximately $5.32 million, accounting for 1.95% of the circulating supply;

Axelar (AXL) will unlock 13.51 million tokens on April 27, valued at approximately $3.97 million, accounting for 1.13% of the circulating supply.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We build a "trend analysis + value discovery + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and 24/7 market volatility monitoring, combined with weekly updates of the "Hotcoin Selected" strategy live broadcast and "Blockchain Today" daily news briefings, to provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。