Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Inflow of $13.7 Million

Last week, the U.S. Bitcoin spot ETF had a net inflow of $13.7 million over three days, bringing the total net assets to $94.51 billion.

Last week, six ETFs experienced net outflows, with inflows primarily from IBIT, BITB, and BTC, which saw inflows of $186 million, $23.8 million, and $12.3 million, respectively.

Data Source: Farside Investors

U.S. Ethereum Spot ETF Net Outflow of $32.3 Million

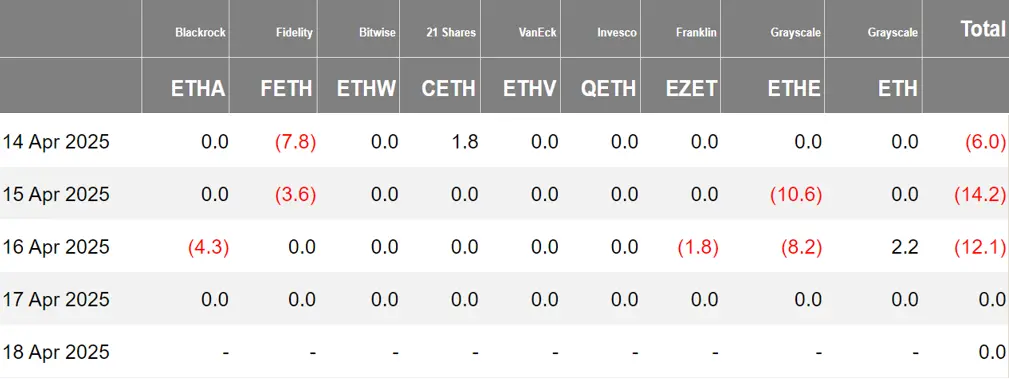

Last week, the U.S. Ethereum spot ETF experienced a net outflow of $32.3 million over three days, with total net assets reaching $5.27 billion.

The outflow was mainly from Grayscale's ETHE, which had a net outflow of $18.8 million. A total of three Ethereum spot ETFs had no fund movement.

Data Source: Farside Investors

No Fund Inflows for Hong Kong Bitcoin Spot ETF

Last week, the Hong Kong Bitcoin spot ETF had no fund inflows, with net assets reaching $34.7 million. The holdings of the issuer, Harvest Bitcoin, decreased to 302.59 BTC, while Huaxia maintained 2160 BTC.

The Hong Kong Ethereum spot ETF had no fund movement, with net assets of $3.204 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of April 17, the nominal total trading volume of U.S. Bitcoin spot ETF options was $618 million, with a nominal total long-short ratio of 1.23.

As of April 16, the nominal total open interest of U.S. Bitcoin spot ETF options reached $12.73 billion, with a nominal total open interest long-short ratio of 1.94.

The market's short-term trading activity for Bitcoin spot ETF options has decreased, with overall sentiment leaning bullish.

Additionally, the implied volatility is at 52.65%.

Data Source: SoSoValue

Overview of Crypto ETF Dynamics Last Week

According to The Defiant, the U.S. Securities and Exchange Commission (SEC) has postponed the decision on the physical subscription and redemption of WisdomTree and VanEck's spot Bitcoin and Ethereum ETFs to June 3, 2025. Physical trading involves the direct exchange of underlying assets, such as Bitcoin and Ethereum, rather than cash. The New York Stock Exchange Arca and Cboe BZX are the exchanges associated with these proposals.

Canada to Launch Spot Solana ETF This Week, Supporting Staking Services

According to Cointelegraph, multiple spot Solana ETFs in Canada are set to officially launch on April 16, offering SOL staking services, as reported by Bloomberg analyst Eric Balchunas. The Ontario Securities Commission (OSC) has approved asset management companies such as Purpose, Evolve, CI, and 3iQ to issue the related ETFs.

This launch marks Canada's first move into the altcoin ETF space. Currently, the U.S. has not approved any crypto ETFs that support staking.

Hong Kong Ethereum Staking ETF Set to Launch, New Crypto Regulations Promote Digital Hub Development

According to Decrypt, after the Hong Kong Securities and Futures Commission (SFC) passed new regulations allowing licensed institutions to provide staking services, the Ethereum staking ETF launched in collaboration with Huaxia Fund (Hong Kong) and OSL Digital Securities has been approved and is set to launch by May 15 at the latest. This Ethereum staking ETF operates through the licensed platform OSL's custody and the node verification of French staking service provider Kiln, allowing investors to indirectly earn Ethereum staking rewards.

Last month, the SFC released the "ASPIRe" roadmap, outlining five key pillars—Access, Safeguards, Products, Infrastructure, and Relationships—aiming to build a complete virtual asset ecosystem. Hong Kong's first Ethereum staking ETF is scheduled to launch on April 25, with the government approving two staking crypto ETFs within three months, indicating a gradually competitive regulatory framework.

VanEck Plans to Launch Crypto Stock Tracking ETF

According to CoinDesk, after receiving approval from the SEC, VanEck plans to launch an actively managed exchange-traded fund (ETF) that will track digital asset stocks.

Matthew Sigel, head of digital asset research at VanEck, stated that the VanEck Onchain Economy ETF (NODE) will aim to hold 30 to 60 stocks, with a management fee of 0.69%.

The fund's stocks will cover areas such as cryptocurrency trading platforms, miners, data centers, energy infrastructure, semiconductors, hardware, traditional financial infrastructure, consumer/gaming, asset management companies, and "balance sheet holders." NODE's maximum 25% exposure will be invested in cryptocurrency trading platform products (ETPs).

Canary Capital Applies to SEC for Staking TRX ETF

According to The Block, Canary Capital submitted a registration application for the Canary Staking TRX ETF to the SEC on Friday local time.

In addition to the TRX ETF, Canary Capital plans to launch several cryptocurrency ETF products related to Pengu, Sui, Hedera, and Litecoin.

U.S. SEC Delays Approval of Grayscale Ethereum Spot ETF Staking Feature

Views and Analysis on Crypto ETFs

Analyst: XRP Spot ETF May Be Easier to Obtain SEC Approval Than Other Assets

According to The Block, Kaiko analysts believe that improved market dynamics and the launch of leveraged products last week give XRP an edge in obtaining SEC approval for a spot ETF compared to other assets. May 22 is the next important date to watch, as the SEC must respond to Grayscale's spot XRP ETF application by that date.

Matrixport released a report stating that the net inflow of funds into Bitcoin ETFs is only slightly above zero, despite a strong performance at the beginning of the year, which saw nearly $5.5 billion in inflows.

This phenomenon is quite surprising, as Bitcoin has outperformed U.S. tech stocks this year, while gold has also reached an all-time high. Notably, the total net inflow into Bitcoin ETFs is $35.5 billion, with BlackRock accounting for $39.6 billion and Fidelity for $11.4 billion, together making up the vast majority of the share.

In contrast, inflows from other ETF issuers are relatively limited. This indicates that the current buying pressure is more likely coming from a specific institutional client base rather than being driven by widespread retail funds—if it were the latter, the inflows would be more evenly distributed among various ETF providers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。