In the past two days (April 20-21, 2025), Bitcoin has shown remarkable resilience against the backdrop of a continuous decline in the U.S. stock market, rising consecutively and breaking through $88,500, setting a new monthly high. Meanwhile, the S&P 500 and Nasdaq indices have plummeted significantly due to escalating tensions in the U.S. trade war, with the U.S. Dollar Index (DXY) falling to its lowest level since March 2022. This phenomenon of "hard decoupling" has sparked heated discussions in the market: Is Bitcoin breaking free from its long-term correlation with U.S. stocks and transforming into a global safe-haven asset? This structural shift may mark a critical moment for Bitcoin as it faces a significant change in the global liquidity landscape since its inception.

Historic Shift: Bitcoin Breaks Free from Stock Market Constraints

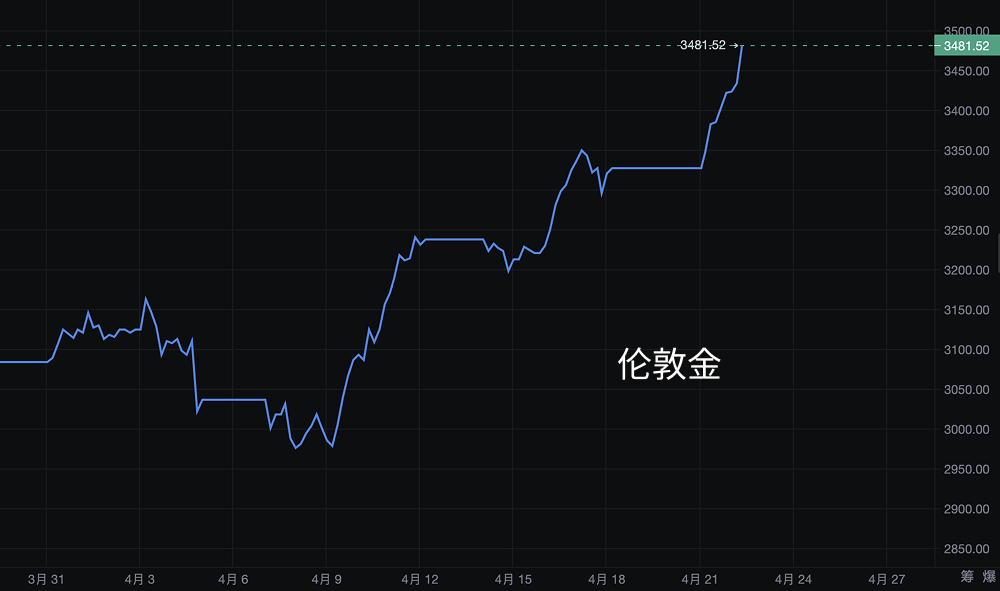

For years, Bitcoin's price movements have often synchronized with the tech-heavy Nasdaq index, as institutional investors viewed it as a high-risk "speculative asset," with capital flows highly correlated to the stock market. However, recent market dynamics present a starkly different picture. According to Cointelegraph, on April 21, the S&P 500 index fell due to concerns over U.S. tariff policies, while Bitcoin rose 4.06%, demonstrating rare independence. Analysts on platform X (such as @coinTJG) pointed out that this decoupling trend coincides with a weakening dollar and soaring gold prices, suggesting that some funds may be shifting from the gold market to Bitcoin, as its fixed supply of 21 million coins becomes more attractive amid inflation concerns.

This is not a short-term anomaly. Analysts note that over the past 10 days, the correlation between Bitcoin and the stock market has significantly weakened, with BTC prices continuing to rise while the S&P 500 index has fluctuated downward (X user @big_hunter11). What drives this? Macroeconomic turmoil and Bitcoin's unique attributes. The U.S. Dollar Index (DXY) has fallen to its lowest level since March 2022 due to criticisms of the Federal Reserve's independence by the Trump administration, raising market concerns about monetary policy easing. Bitcoin's fixed supply makes it a potential hedge against currency depreciation, aligning with gold's "safe-haven" properties, and investor recognition of it as "digital gold" is warming up.

From Tech Stocks to Global Assets

Bitcoin is transitioning from a tech-driven speculative asset to a global store of value. In the past, its high volatility and correlation with the stock market were often likened to high-beta tech stocks. However, a January 2025 report by Forbes pointed out that Bitcoin's decentralized, borderless, and highly liquid characteristics are making it increasingly attractive. Compared to the stock market, which is constrained by corporate earnings and domestic economic factors, Bitcoin's value is driven more by global demand and macro trends. Its global 24/7 trading market offers unparalleled flexibility, especially during times of economic uncertainty.

This characteristic is particularly crucial in the context of global economic deleveraging. The International Monetary Fund's 2022 report indicated that global economic growth has slowed to 3.6%, with high debt levels limiting central banks' ability to tighten policies. As the economy gradually stabilizes post-deleveraging, Bitcoin is poised to be the biggest beneficiary. Its decentralized structure and resistance to currency manipulation make it an alternative to fiat currencies, especially in economically turbulent regions like Argentina and Venezuela, where Bitcoin adoption has significantly increased.

Why Now? The Perfect Storm for Bitcoin

Multiple factors are driving Bitcoin's rise. First, institutional adoption continues to deepen. The Bitcoin ETF launched by BlackRock in 2024 has attracted significant capital inflows, with Bernstein analysts predicting that by the end of 2025, spot Bitcoin ETFs will hold 7% of the circulating supply. Institutional participation provides stability and legitimacy to the market, reducing Bitcoin's reliance on retail speculation. Second, the regulatory environment is becoming clearer. The U.S. government announced on March 6, 2025, the establishment of a strategic Bitcoin reserve, which, although initially funded by seized assets rather than new purchases, carries significant symbolic weight. It positions Bitcoin as a strategic asset akin to gold reserves, potentially paving the way for broader acceptance. Forbes noted that Bitcoin's fixed supply makes it more attractive during times of currency overissuance. Geopolitical instability in Europe and Asia further highlights Bitcoin's appeal as a "permissionless" store of value, free from national control.

Risks and Realities

Despite the promising outlook, Bitcoin is not without risks. Its volatility remains a core characteristic, and if global liquidity tightens or regulatory hurdles emerge, it could trigger a pullback. A March 2025 report by Tangem indicated that over the past five years, Bitcoin's correlation with the stock market has reached as high as 70%. If the U.S. economy falls into a severe recession, Bitcoin could be dragged down, as its high liquidity makes it an asset that is easily sold off in times of crisis. Additionally, gold advocates like Peter Schiff argue that gold remains the ultimate safe-haven asset during market crashes, which could undermine Bitcoin's appeal.

Outlook: Structural Opportunities

Bitcoin's recent divergence from U.S. stocks marks a turning point. From being the "shadow" of tech stocks to transforming into a global asset, Bitcoin stands on the threshold of its first structural opportunity since its inception in 2009. As global deleveraging stabilizes, its unparalleled liquidity and institutional support make it a focal point for investment.

For investors, the signal is clear: Bitcoin is no longer a mere appendage to Wall Street volatility but a global asset poised to redefine wealth preservation. As the global economic landscape evolves, Bitcoin's independence may make it a shining star in 2025.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。