Author: Hedy Bi, OKG Research

When tariffs become a drama in American television, "no new plot today" ironically becomes the news itself. From gold prices hitting new highs to Bitcoin returning above $80,000, risk-averse sentiment is quietly making a comeback. The world increasingly resembles a makeshift stage, where every news push regarding inflation expectations being revised upward, geopolitical tensions escalating, or trade barriers intensifying could ignite market sentiment.

In today's environment where macro uncertainty has become the norm, "certainty" is no longer a taken-for-granted condition but a scarce asset. In an era where black swans and gray rhinos coexist, investors are not only pursuing returns but also seeking assets that can withstand volatility and possess structural support. The "yield-bearing crypto assets" in the on-chain financial system may represent a new form of this certainty.

These crypto assets that promise fixed or floating returns are re-entering the investors' view, becoming anchors for those seeking stable returns in turbulent market conditions. However, in the crypto world, "interest" is no longer just the time value of capital; it is often a product of protocol design and market expectations working together. High yields may stem from real asset income or may mask complex incentive mechanisms or subsidy behaviors. To find true "certainty" in the crypto market, investors need more than just interest rate tables; they require a deep dissection of the underlying mechanisms. This article, as the eighth piece in the "Trump Economics" series, will start from yield-bearing assets to analyze the true sources and risk logic of crypto yield-bearing assets, seeking certainty amid uncertainty.

Since the Federal Reserve began its interest rate hike cycle in 2022, the concept of "on-chain interest rates" has gradually entered the public eye. Faced with a long-term risk-free interest rate of 4-5% in the real world, crypto investors are beginning to reassess the sources of returns and risk structures of on-chain assets. A new narrative is quietly taking shape—Yield-bearing Crypto Assets, which attempt to construct financial products that "compete with the macro interest rate environment" on-chain.

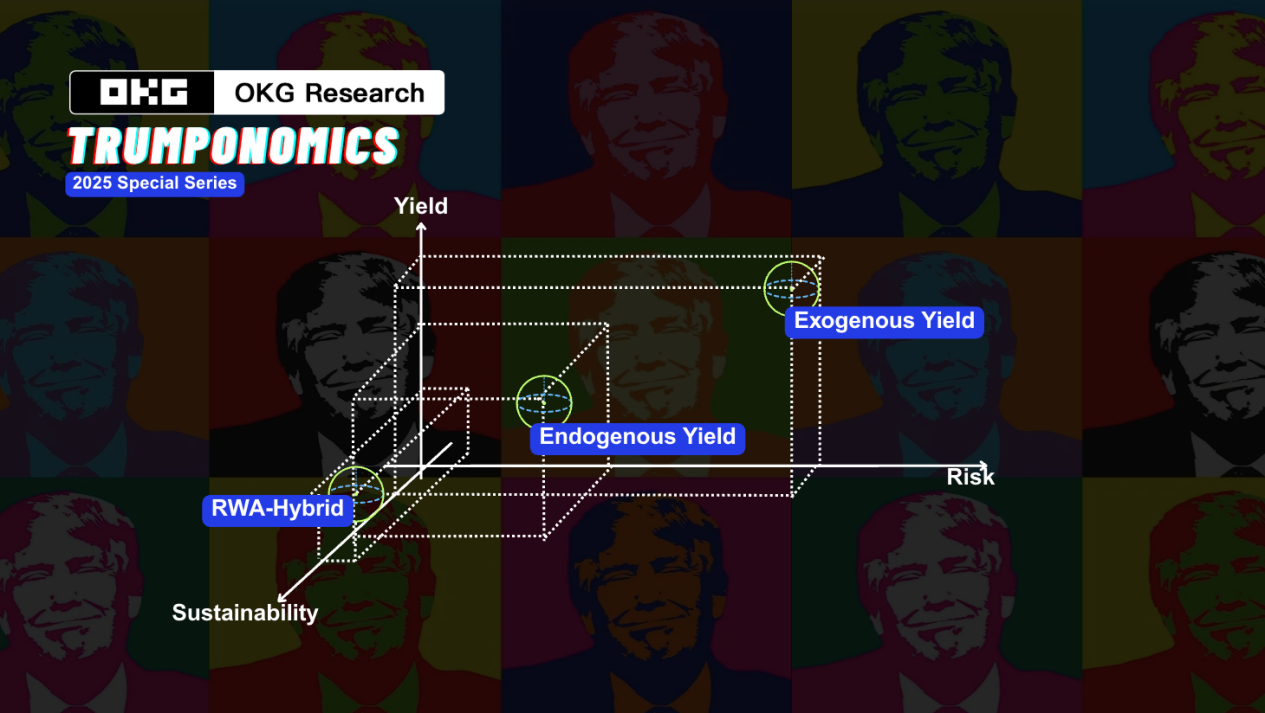

However, the sources of returns for yield-bearing assets vary significantly. From cash flows generated by the protocol itself to the illusion of returns relying on external incentives, and the grafting and transplantation of off-chain interest rate systems, the different structures reflect vastly different sustainability and risk pricing mechanisms. We can roughly categorize the current yield-bearing assets in decentralized applications (DApps) into three types: exogenous returns, endogenous returns, and real-world asset (RWA) linkage.

Exogenous Returns: Subsidy-driven Illusion of Interest

The rise of exogenous returns is a microcosm of the early rapid growth logic of DeFi—without mature user demand and real cash flows, the market substitutes it with "incentive illusions." Just as early ride-sharing platforms used subsidies to attract users, after Compound launched "liquidity mining," ecosystems like SushiSwap, Balancer, Curve, Avalanche, and Arbitrum followed suit with massive token incentives, attempting to buy user attention and locked assets through "yield distribution."

However, these subsidies are essentially short-term operations where the capital market "pays" for growth metrics, rather than a sustainable revenue model. It became a standard feature for the cold start of new protocols—whether Layer 2, modular public chains, LSDfi, or SocialFi, the incentive logic is similar: relying on new capital inflows or token inflation, the structure resembles a "Ponzi." Platforms attract users to deposit money with high yields and then delay redemption through complex "unlocking rules." Those annualized returns in the hundreds or thousands are often just tokens "printed" out of thin air by the platform.

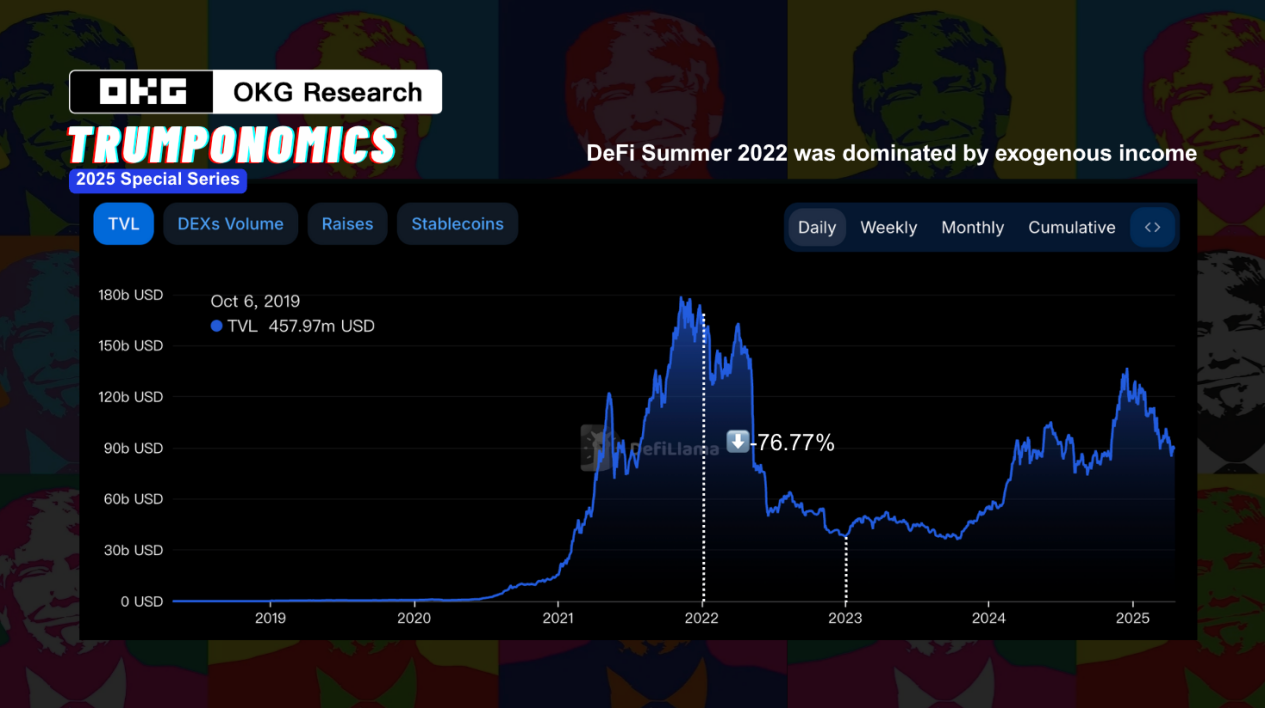

The Terra collapse in 2022 exemplifies this: the ecosystem offered up to 20% annualized returns on UST stablecoin deposits through the Anchor protocol, attracting a large number of users. The returns primarily relied on external subsidies (Luna Foundation reserves and token rewards) rather than real income from within the ecosystem.

Historically, once external incentives weaken, a large number of subsidized tokens will be sold off, damaging user confidence, leading to a death spiral in TVL and token prices. According to Dune data, after the DeFi Summer craze faded in 2022, about 30% of DeFi projects saw their market value drop by over 90%, often related to excessive subsidies.

If investors want to find "stable cash flow" from this, they need to be more vigilant about whether there is a real value creation mechanism behind the returns. Using future inflation promises for today's returns is ultimately not a sustainable business model.

Endogenous Returns: Redistribution of Use Value

In simple terms, the protocol earns money by "doing real work" and then distributes it to users. It does not rely on issuing tokens to attract users or depend on subsidies or external blood transfusions, but rather generates income through real business activities, such as lending interest, transaction fees, or even penalties in default liquidations. These revenues are somewhat similar to "dividends" in traditional finance, hence also referred to as "quasi-dividend" crypto cash flows.

The biggest characteristic of this type of return is its closed-loop and sustainability: the logic of making money is clear, and the structure is healthier. As long as the protocol is operational and users are using it, there will be income coming in, without needing to rely on market hot money or inflation incentives to maintain operations.

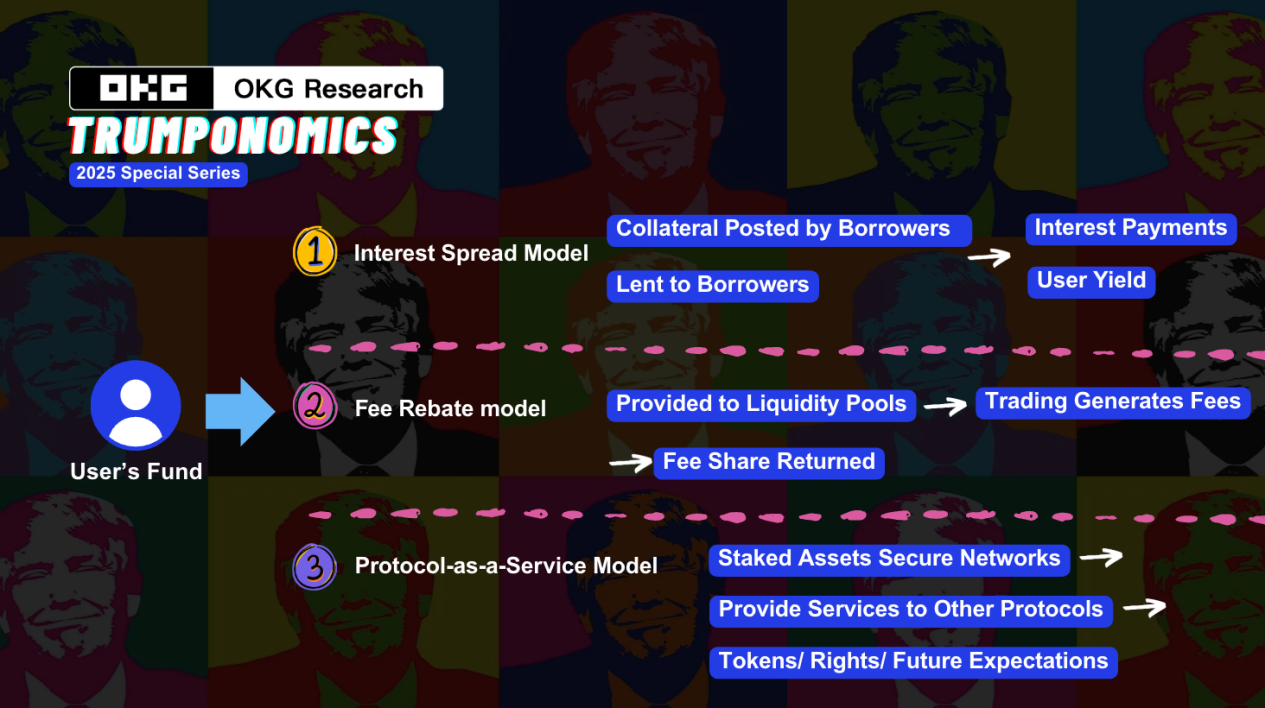

Therefore, understanding what it relies on for "blood generation" allows us to more accurately assess how certain its returns are. We can categorize this type of income into three prototypes:

The first type is "lending interest spread." This is the most common and easily understood model in early DeFi. Users deposit funds into lending protocols like Aave or Compound, where the protocol matches borrowers and lenders, earning a spread from it. Its essence is similar to the traditional bank's "deposit and loan" model—interest in the fund pool is paid by borrowers, and lenders receive a portion as returns. This mechanism is transparent and efficient, but its yield level is closely related to market sentiment; when overall risk appetite declines or market liquidity contracts, interest rates and returns will also decline.

The second type is "fee rebate." This return mechanism is closer to the model of shareholders participating in profit dividends in traditional companies or specific partners receiving returns based on revenue proportions. In this framework, the protocol returns a portion of its operating income (such as transaction fees) to participants who provide resource support, such as liquidity providers (LPs) or token stakers.

Taking the decentralized exchange Uniswap as an example, the protocol distributes a portion of the fees generated by the exchange proportionally to users who provide liquidity. In 2024, Aave V3 provided annualized returns of 5%-8% for stablecoin liquidity pools on the Ethereum mainnet, while AAVE stakers could earn over 10% annualized returns during certain periods. These revenues come entirely from the protocol's endogenous economic activities, such as lending interest and fees, without relying on external subsidies.

Compared to the "lending interest spread" mechanism, which is closer to a banking model, the "fee rebate" returns are highly dependent on the market activity of the protocol itself. In other words, its returns are directly linked to the protocol's business volume—more transactions lead to higher dividends, while fewer transactions cause income to fluctuate. Therefore, its stability and ability to withstand cyclical risks are often not as robust as the lending model.

The third type is "protocol service" returns. This is the most structurally innovative type of endogenous income in crypto finance, with logic similar to traditional businesses where infrastructure service providers offer key services to clients and charge fees.

For example, EigenLayer provides security support for other systems through a "re-staking" mechanism and earns returns from it. This type of income does not rely on lending interest or transaction fees but comes from the market pricing of the protocol's service capabilities. It reflects the market value of on-chain infrastructure as a "public good." This form of return is more diverse and may include token points, governance rights, or even future unrealized expected returns, showcasing strong structural innovation and long-term potential.

In traditional industries, this can be compared to cloud service providers (like AWS) offering computing and security services to businesses and charging fees, or financial infrastructure institutions (like custodians, clearing, and rating companies) providing trust guarantees for systems and earning income. Although these services do not directly participate in terminal transactions, they are indispensable underlying supports for the entire system.

On-chain Real Interest Rates: The Rise of RWA and Interest-bearing Stablecoins

An increasing amount of capital in the market is beginning to pursue a more stable and predictable return mechanism: on-chain assets anchored to real-world interest rates. The core of this logic is to connect on-chain stablecoins or crypto assets to off-chain low-risk financial instruments, such as short-term government bonds, money market funds, or institutional credit, thereby obtaining "certainty interest rates from the traditional financial world" while maintaining the flexibility of crypto assets. Representative projects include MakerDAO's allocation to T-Bills, Ondo Finance's launch of OUSG (linked to BlackRock ETF), Matrixdock's SBTB, and Franklin Templeton's tokenized money market fund FOBXX. These protocols attempt to "import" the Federal Reserve's benchmark interest rate onto the chain as a foundational return structure. This also means

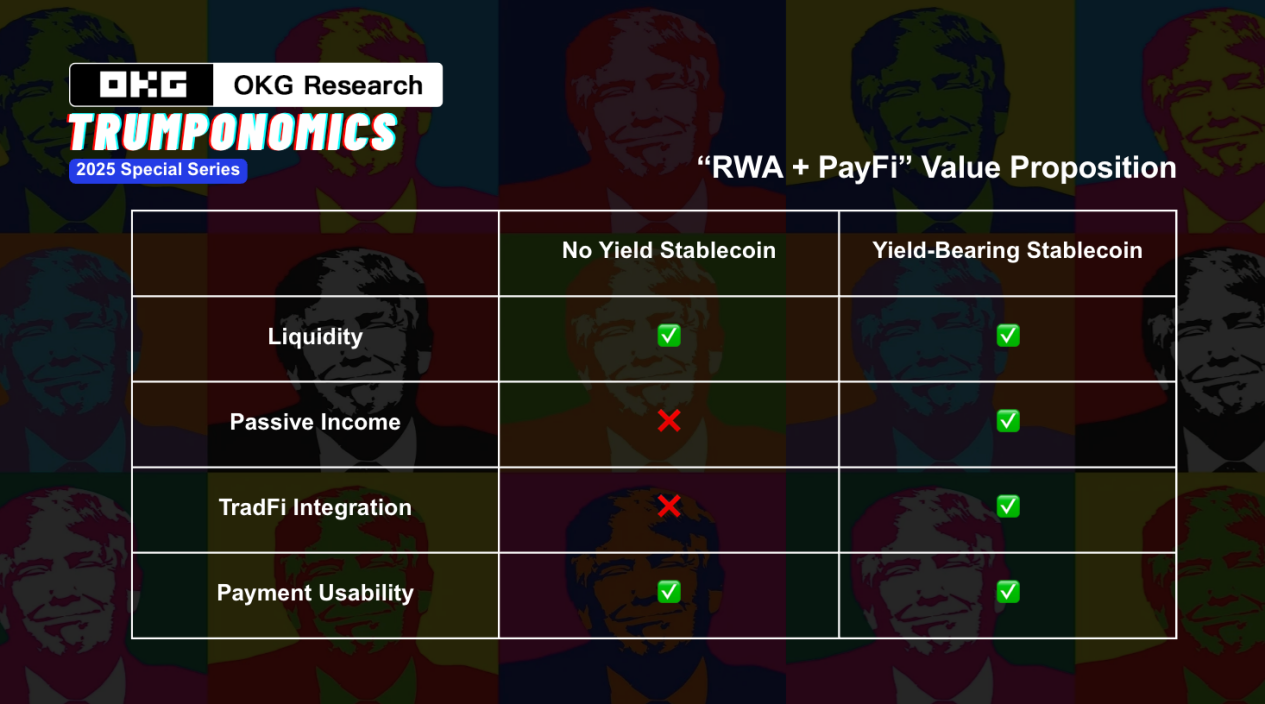

At the same time, interest-bearing stablecoins, as a derivative form of RWA, are also beginning to come to the forefront. Unlike traditional stablecoins, these assets are not passively pegged to the dollar but actively embed off-chain returns into the tokens themselves. Typical examples include Mountain Protocol's USDM and Ondo Finance's USDY, which accrue interest daily, with returns sourced from short-term government bonds. By investing in U.S. Treasury bonds, USDY provides users with stable returns, with yields close to 4%, higher than the 0.5% of traditional savings accounts.

They attempt to reshape the usage logic of the "digital dollar," making it more like an on-chain "interest account."

Under the connectivity of RWA, RWA+PayFi is also a future scenario worth paying attention to: directly embedding stable yield assets into payment tools breaks the binary division between "assets" and "liquidity." On one hand, users can enjoy interest-bearing returns while holding cryptocurrencies; on the other hand, payment scenarios do not need to sacrifice capital efficiency. Products like the USDC automatic yield account on Coinbase's Base L2 (similar to "USDC as a checking account") not only enhance the attractiveness of cryptocurrencies in actual transactions but also open up new use cases for stablecoins—transforming from "dollars in an account" to "capital in active circulation."

Three Indicators for Finding Sustainable Yield-bearing Assets

The logical evolution of crypto "yield-bearing assets" reflects the market's gradual return to rationality and the redefinition of "sustainable returns." From the initial high-inflation incentives and governance token subsidies to the increasing emphasis on self-sustaining capabilities and linking to off-chain yield curves, structural design is moving out of the rough phase of "involutionary capital extraction" towards more transparent and refined risk pricing. Especially in the current environment of high macro interest rates, if crypto systems want to participate in global capital competition, they must build stronger "return rationality" and "liquidity matching logic." For investors seeking stable returns, the following three indicators can effectively assess the sustainability of yield-bearing assets:

Is the source of returns "endogenously" sustainable?

Truly competitive yield-bearing assets should derive returns from the protocol's own business, such as lending interest and transaction fees. If returns primarily rely on short-term subsidies and incentives, it resembles a game of "passing the parcel": as long as the subsidies are there, the returns are there; once the subsidies stop, the funds leave. This short-term "subsidy" behavior, if it turns into a long-term incentive, will deplete project funds and easily lead to a death spiral of declining TVL and token prices.

Is the structure transparent?

Trust on-chain comes from transparency. When investors leave the familiar investment environment of traditional finance, which has intermediaries like banks as endorsements, how should they judge? Is the flow of funds on-chain clear? Is the interest distribution verifiable? Is there a risk of centralized custody? If these questions are not clarified, they fall into black-box operations, exposing the system's vulnerabilities. A financial product with a clear structure and an on-chain, publicly traceable mechanism is the true underlying guarantee.

Do the returns justify the real opportunity cost?

In the context of the Federal Reserve maintaining high interest rates, if the returns of on-chain products are lower than government bond yields, it will undoubtedly struggle to attract rational capital. If on-chain returns can be anchored to real benchmarks like T-Bills, they will not only be more stable but may also become a "rate reference" on-chain.

However, even "yield-bearing assets" are never truly risk-free assets. No matter how robust their return structure is, one must remain vigilant about the technical, compliance, and liquidity risks within the on-chain structure. From whether the clearing logic is sufficient, to whether the protocol governance is centralized, to whether the asset custody arrangements behind RWA are transparent and traceable, all these factors determine whether the so-called "certain returns" have real cash-out capabilities. Moreover, the future market for yield-bearing assets may represent a reconstruction of the on-chain "money market structure." In traditional finance, the money market plays a core role in pricing funds through its interest rate anchoring mechanism. Now, the on-chain world is gradually establishing its own "interest rate benchmarks" and "risk-free returns" concepts, generating a more substantial financial order.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。