Recently, news about JD.com and Liu Qiangdong personally delivering food has gone viral online. Netizens jokingly remarked, "Brother Dong delivers faster than the delivery guys," while expressing amazement at JD's strong breakthrough in the local life service sector. Behind the food delivery craze, JD has a bigger strategy in play—by 2025, JD Group will officially enter the Hong Kong Monetary Authority (HKMA) stablecoin issuance "sandbox" testing phase, aiming for innovation in global supply chains and cross-border payments.

Stablecoin "Sandbox": JD's New Battlefield in Financial Technology

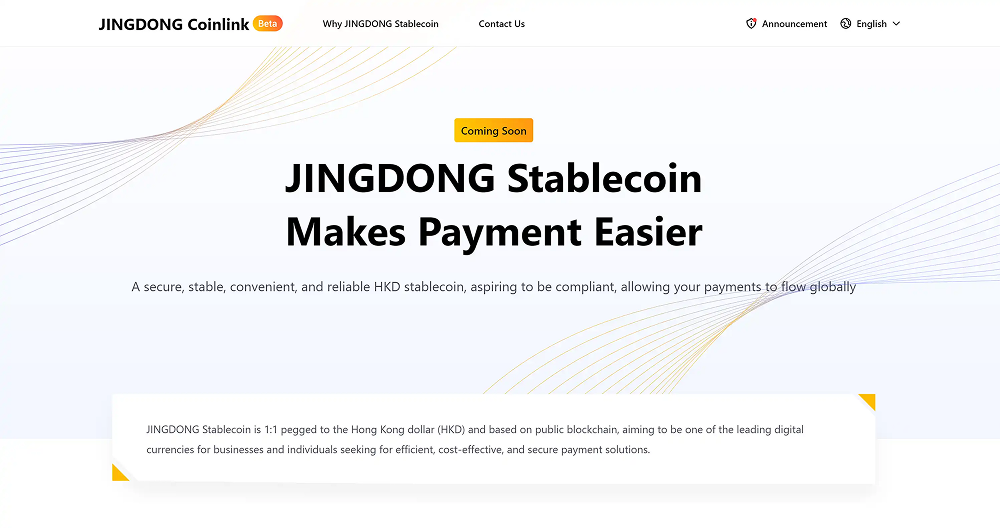

In April 2025, Shen Jianguang, Vice President and Chief Economist of JD Group, revealed in an exclusive interview with the Daily Economic News that JD has officially entered the stablecoin issuance "sandbox" testing phase of the Hong Kong Monetary Authority. The so-called "sandbox" is a regulatory experimental field launched by the HKMA in March 2024, aimed at allowing institutions intending to issue fiat-pegged stablecoins in Hong Kong to test their business models in a controlled environment while directly communicating with regulators to ensure future compliance. JD's subsidiary, JD Coinlink Technology, became one of the first three selected institutions, competing alongside heavyweight players like Standard Chartered Bank Hong Kong.

JD's stablecoin (tentatively named JD-HKD) plans to be pegged 1:1 to the Hong Kong dollar and is developed based on public blockchain technology, targeting two major application scenarios: first, to accelerate cross-border payments and reduce transaction costs for enterprises; second, to optimize supply chain finance and improve capital flow efficiency. Shen Jianguang emphasized that the issuance of the stablecoin aims to enhance JD's competitiveness in global supply chains and cross-border payments, especially in emerging markets like Southeast Asia, where suppliers can settle directly using JD-HKD, avoiding the cumbersome and costly fees of traditional bank transfers.

Why JD? The Unique Advantages of the E-commerce Giant

As a leading e-commerce player in China, JD has accumulated deep advantages in global supply chains and logistics. By 2024, JD's global active users had surpassed 600 million, covering multiple markets including Southeast Asia, Europe, and North America. A stable supply chain network and vast transaction data provide fertile ground for JD to explore stablecoin applications. Compared to traditional financial institutions, JD understands e-commerce scenarios better and can accurately address the pain points of cross-border trade—such as exchange rate fluctuations, long payment cycles, and high financing costs.

Notably, JD is not going it alone. In July 2024, Hong Kong virtual bank Airstar Bank announced a partnership with JD Coinlink Technology to jointly explore the application of stablecoins in cross-border payments. Airstar Bank is jointly invested by Xiaomi Group and Futu Holdings, backed by strong technological and financial resources, adding technical and compliance assurance to JD's "sandbox" testing.

Hong Kong: A Global Benchmark for Stablecoin Regulation

As a global financial center, Hong Kong's regulatory stance on stablecoins is highly anticipated. In 2025, the "Stablecoin Bill" in Hong Kong is still under development, and it is expected that after approval within the year, the HKMA will release specific implementation guidelines. Shen Jianguang specifically mentioned in the interview that JD's stablecoin project will strictly adhere to regulatory requirements in various regions to ensure compliance.

In fact, Hong Kong's "sandbox" mechanism has attracted global attention. By 2025, the global stablecoin market trading volume had surpassed $4 trillion, demonstrating its immense potential in the payment and settlement fields. By attracting institutions like JD and Standard Chartered into the "sandbox," Hong Kong not only solidifies its position as a Web3 innovation center but also provides a regulatory template for other countries and regions.

The Future of Stablecoins: Can JD Spark a Payment Revolution?

JD's stablecoin project has sparked heated discussions in the industry. On platform X, user @JadeJiang_web3 commented: "JD's stablecoin is aimed at making cross-border payments faster and cheaper, and supply chain finance smoother. This could be a new starting point for Web3 payments." Others believe that JD's move is intended to break through the bottleneck of the domestic payment market and compete with WeChat and Alipay. After all, JD Pay has a relatively weak presence in the domestic market, and the low-cost, high-efficiency characteristics of stablecoins may help JD achieve a "curve overtaking" in the global payment arena.

However, challenges also exist. The compliance, technical security, and market acceptance of stablecoins need time to be validated. Additionally, the uncertainty of the global regulatory environment is a significant variable. Nevertheless, JD's entry undoubtedly injects a shot of adrenaline into the commercial application of stablecoins. User @bitcoinyike on platform X asked: "JD is going to issue a stablecoin, do you think Dong can handle it?"

This article represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。