Author: Patti, ChainCatcher

Editor: TB, ChainCatcher

A force from the East is stirring up a wave of NFT trends.

This Thursday evening, Moriusa (すとぷり) NFT launched on Opensea, with a starting price of 0.05 ETH, and the market was exceptionally hot, with its floor price soaring to 0.44 ETH at one point.

While users in the Chinese community were still puzzled, Moriusa was already trending in the Japanese and English-speaking communities, even raising the ETH chain gas fees due to its popularity.

The Moriusa NFT character was born from the popular Japanese IP—STPR's virtual idol group もりうさ (strawberryprince), serving as a peripheral derivative of this virtual idol group. Mofees is a collection of Moriusas, each with its own unique emotions and outfits.

YouTube's related page shows that the strawberryprince channel currently has 3.63 million subscribers, and the large number of buy orders primarily comes from its offline IP audience, concentrated in Japan and Europe and the United States.

Chinese NFT player Yellen revealed that the Chinese community had almost no participation in the Moriusa collaboration, but the popularity of Moriusa NFT in Japan and the English-speaking community was exceptionally high.

In fact, this is not the first time NFTs have collided with Japanese anime culture. As a global industry, anime culture's derivative products are a timeless topic. Using the currently popular NFT format to connect offline fans with online communities has become a breakthrough for many cultural IPs to create economic value. Numerous IPs, including "One Piece," "Bleach," "Attack on Titan," and many from Studio Ghibli under Hayao Miyazaki, have already derived their own IP products. However, most of these are released on domestic Japanese platforms, such as LINE NFT and Fantop, making them relatively unfamiliar to Chinese users, thus limiting their impact and economic effects.

Moriusa NFT capitalized on this pain point. As early as January this year, STPR announced to fans that it would launch an "overseas development project," and choosing to release it on the overseas platform Opensea could leverage the enthusiasm of local Japanese fans to drive the on-chain popularity of NFTs, thereby attracting overseas market attention to this local IP.

Moriusa Breaks the Circle and Ignites OpenSea: Can NFT Revival Return to Its Peak?

Currently, the overall activity level of the NFT market remains low, with leading NFT trading platforms like OpenSea and Magic Eden facing severe challenges. According to CryptoSlam data, global NFT sales in the first quarter of 2025 were only $1.5 billion, a 61% decrease from $4.1 billion in the same period of 2024.

In August 2024, the U.S. Securities and Exchange Commission (SEC) issued a "Wells Notice" to OpenSea, accusing some NFTs on its platform of potentially constituting "unregistered securities" and threatening to file a lawsuit. This news was like adding fuel to the fire, causing the already weak NFT market to cool down even further. Data shows that OpenSea's market share in the Ethereum NFT market dropped from 97% at the beginning of 2022 to around 20% by the end of 2024, putting its platform status in jeopardy.

However, a turning point began at the start of this year when OpenSea launched the public beta version of its next-generation platform OS2. At the same time, the SEC announced a pause in its investigation of OpenSea, temporarily alleviating regulatory pressure and giving the platform some breathing room. With these dual benefits, OpenSea quickly revitalized itself and regained its dominant position in the NFT trading market.

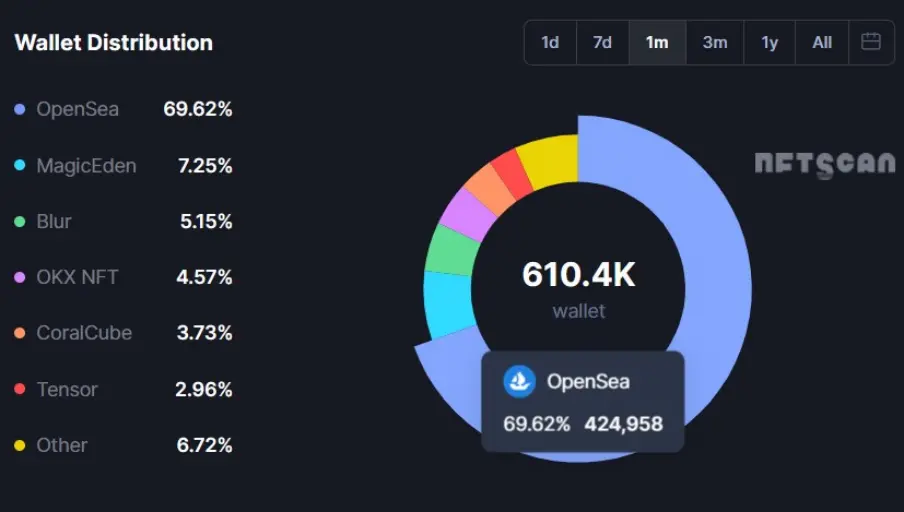

According to the latest data from NFTScan, OpenSea's trading volume has remained at the top for the past 30 days, with a market share exceeding 40%, far surpassing its competitors Blur (23%), Magic Eden (7.69%), and OKX NFT (5%).

Additionally, wallet interaction data shows that nearly 70% of NFT trading users choose to complete transactions through OpenSea, while the combined share of Magic Eden, Blur, and OKX NFT is less than 17%.

As the overall heat of the NFT industry rises, trading activities are also showing signs of recovery. CryptoSlam data indicates that the number of NFT buyers in the past week exceeded 359,000, a 52% increase from the previous week; among them, the leading NFT series CryptoPunks saw sales soar by 82% year-on-year, with monthly sales rebounding to $20 million.

A 7-Fold Increase: Can Morius Break Out of Its Independent Market?

The NFT market seems to be emerging from its winter.

Currently, Morius has announced a partnership with Memeland, and both parties will connect Web2 and Web3 communities to open up new content distribution channels. According to Opensea data, the current floor price of Moriusa is 0.38 ETH, which is already seven times the initial price of 0.05 ETH. Most of the buy orders come from local Japanese and European and American communities, while interest from the Chinese community is relatively sparse.

As of the time of publication, Moriusa's trading volume has reached 374 ETH, ranking among the top ten in 24-hour trading volume on Opensea. Can Moriusa turn the tide on Opensea amidst the NFT market's recovery? Will the overall heat of the NFT market continue to rise?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。