Author: Coinbase & Glassnode

Compiled by: Felix, PANews

As we enter the second quarter of 2025, the crypto market is undergoing significant adjustments. Against a backdrop of increasing macro uncertainty, investor sentiment has turned defensive, with funds flowing into high market cap assets like Bitcoin. While the altcoin market faces pressure, core infrastructure continues to strengthen, and on-chain fundamentals remain robust, with institutional interest stable through ETF channels and platform development.

This report, jointly produced by Coinbase and Glassnode, focuses on market structure, position trends, and key indicators in a complex and rapidly evolving environment. Here are the highlights of the report:

Crypto Market Correction Highlights Defensive Positioning

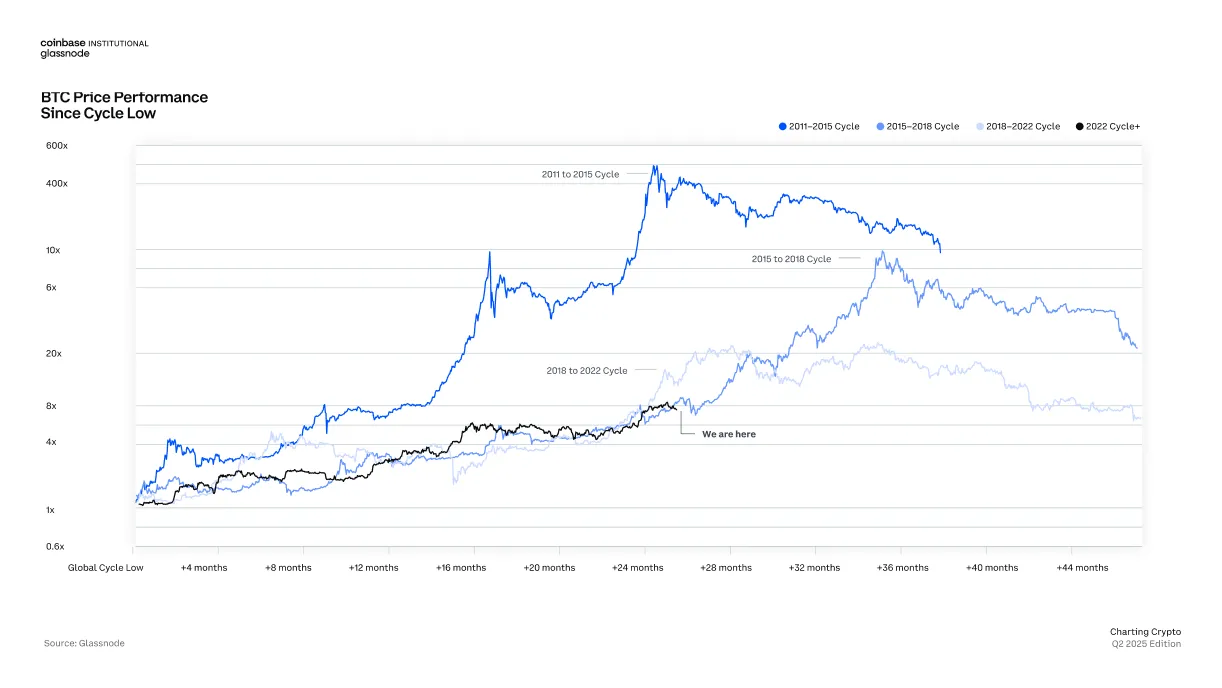

Bitcoin's 2022 and Beyond Cycle Differs from Previous Trends, with a Slower Recovery Process Amid Macro Uncertainty

Since the beginning of 2025, there has been a significant shift in investor sentiment. Concerns over a potential economic recession in the U.S., fiscal tightening, and global trade frictions have triggered a risk-averse sentiment in the digital asset market. Excluding BTC, the total market cap of cryptocurrencies stands at $950 billion, a substantial drop of 41% from the $1.6 trillion peak on December 1, 2024, and a 17% decline year-on-year. Venture capital inflows have also reverted to levels seen in 2017-2018. Both Bitcoin and the COIN50 index have fallen below the 200-day moving average, indicating that the current correction may extend into mid-2025.

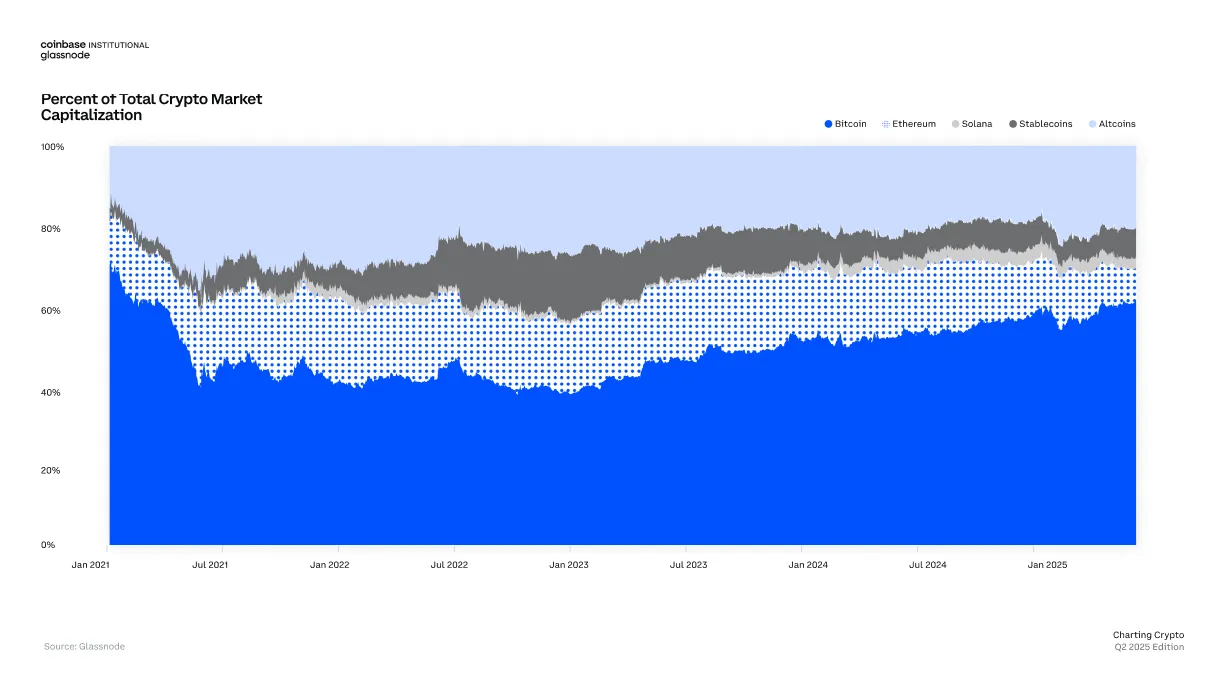

Bitcoin Regains Dominance in a Risk-Averse Environment

As Investors Shift to High-Confidence Assets, Bitcoin's Dominance Rises to 63%, Reaching Its Highest Level Since Early 2021

During turbulent times, capital tends to flow towards perceived quality assets—Bitcoin benefits from this trend. Bitcoin currently accounts for 63% of the total crypto market cap, the highest level since early 2021. Meanwhile, Ethereum's share of the total crypto market cap has decreased over the past six months, while Solana's share has remained stable since early 2024.

Bitcoin's dominance reflects investors' preference for assets with the highest institutional accessibility and macro relevance. Despite the price decline, long-term Bitcoin holders are still accumulating, as evidenced by the reduced liquidity supply and a significant increase in the number of Bitcoin held at a loss, indicating that strategic allocators have rekindled their confidence.

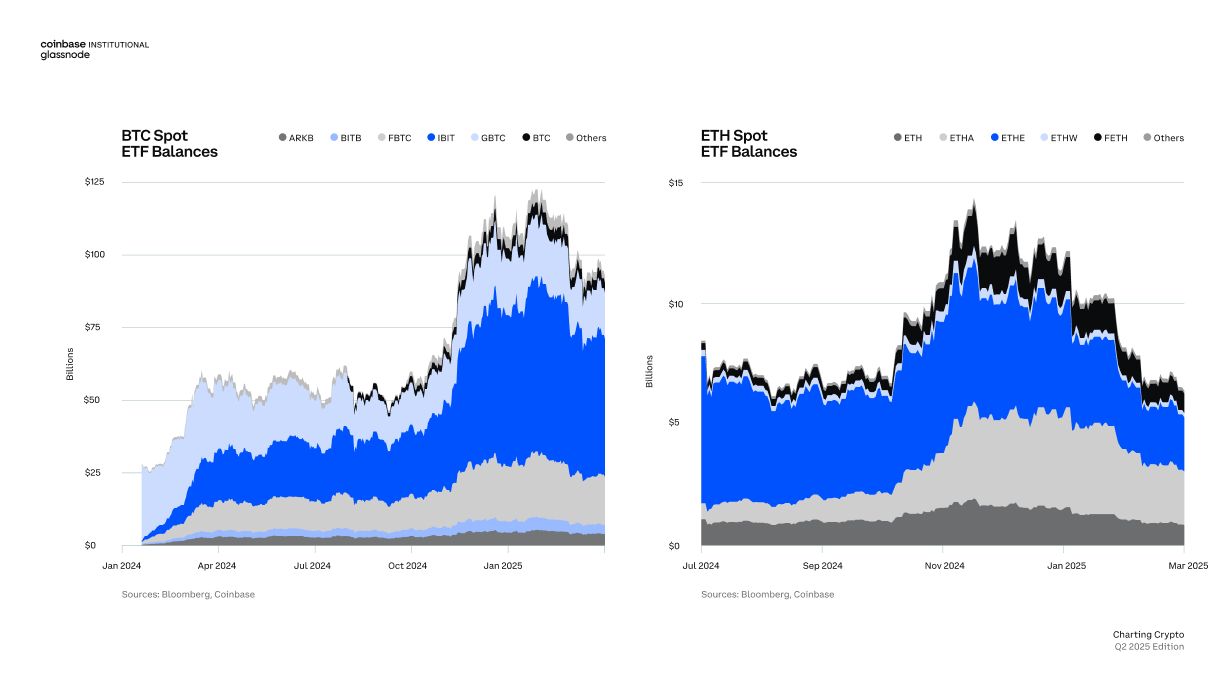

Spot ETFs Remain Crucial to Market Structure

Despite Recent Capital Outflows, Bitcoin and Ethereum ETFs Maintain a Considerable Position, Indicating Continued Institutional Interest

ETF fund flows remain a key indicator of institutional investor sentiment. In the first quarter, while inflows into Bitcoin and Ethereum spot ETFs were sluggish, they continued nonetheless, with the total balance of Bitcoin ETFs nearing $125 billion. Although financing rates in the futures market have decreased, indicating a reduction in speculative interest, the activity in spot ETFs reflects long-term position allocation.

Large brokerages continue to restrict client investments in BitcoinETFs. If these platforms set a 2% allocation limit for Bitcoin, it would imply that the net inflow for ETFs would be 22 times that of 2024.

Notably, the investment restrictions imposed by large brokerages suggest that if access restrictions are eased, a wave of potential demand could emerge.

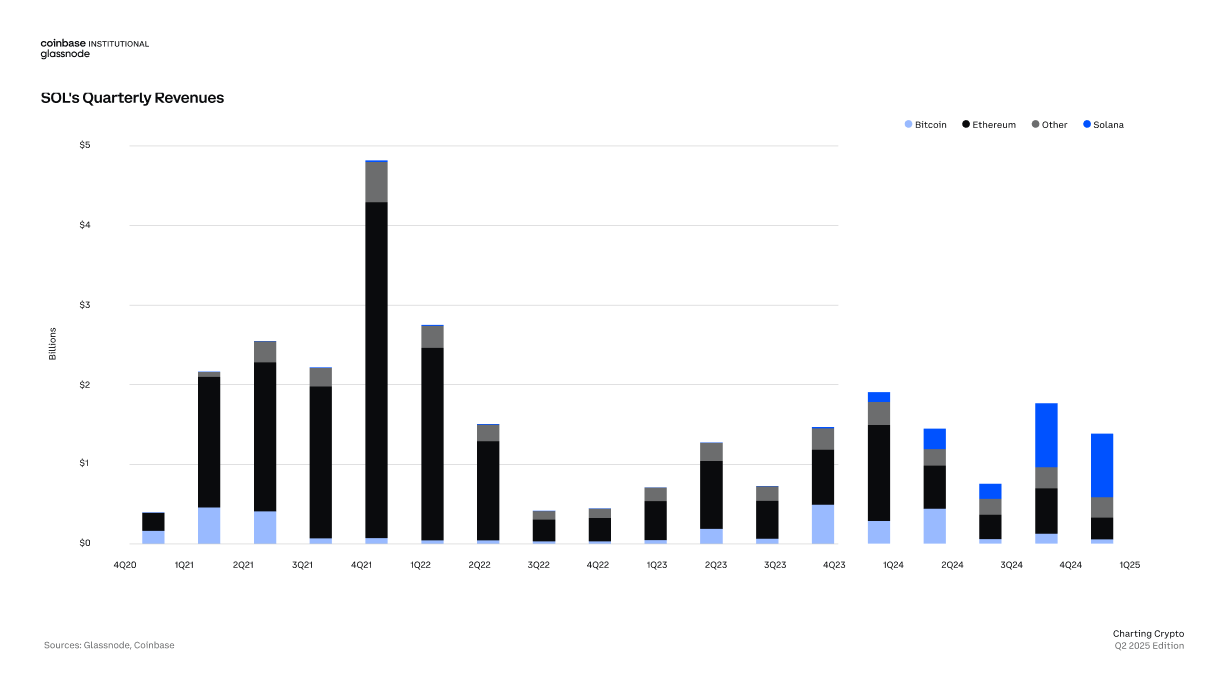

Solana's Revenue Surpasses All Other L1 and L2 Platforms

In the first quarter, Solana surpassed all other blockchains, with revenue exceeding the combined total of Bitcoin, Ethereum, and other blockchains.

Despite the market facing macroeconomic shocks and negative discussions surrounding memecoins, Solana's revenue in the first quarter still exceeded that of all other L1 and L2 networks combined. This revenue highlights the continued stickiness of ecosystem users and indicates that Solana's capital efficiency and developer activity remain strong.

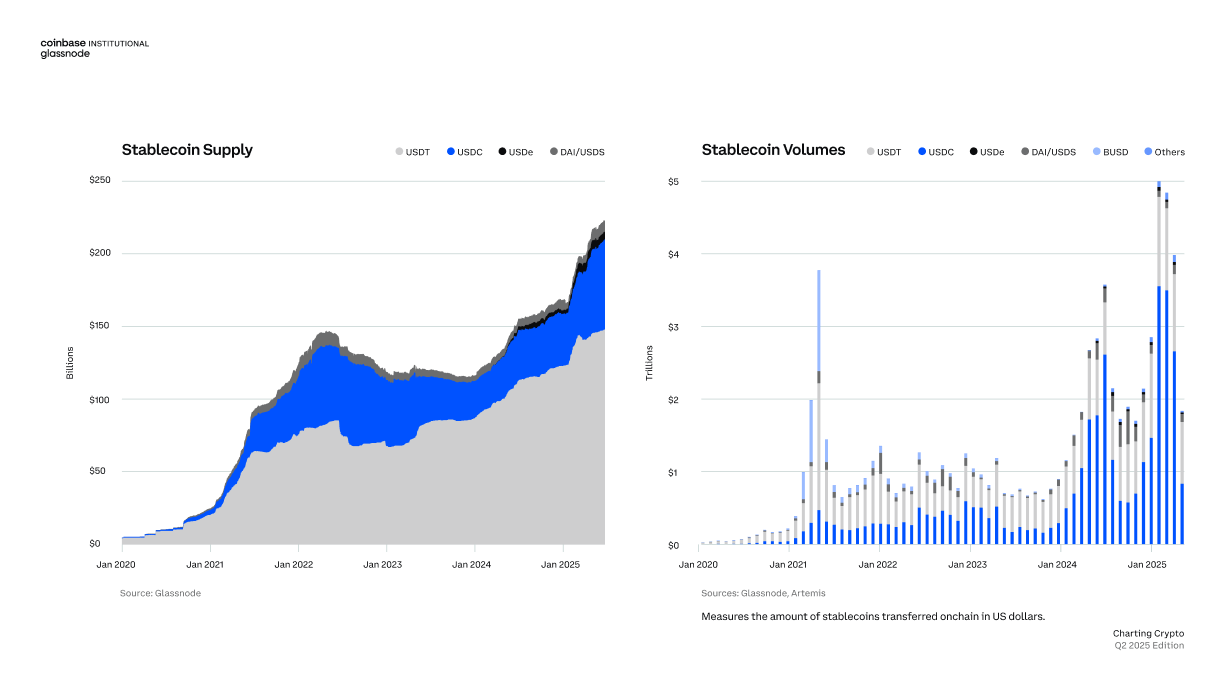

Stablecoins Solidify Their Position as Pillars of Crypto Finance

The supply and on-chain transaction volume of stablecoins have reached all-time highs, underscoring their increasingly important role in the global digital payments landscape.

As a core component of the crypto financial system, stablecoins continue to attract attention. After adjusting for inactive transactions, stablecoin transaction volume hit a record high last quarter. With fees continually decreasing and use cases expanding (from remittances to corporate payments), stablecoins are expected to attract more institutional and retail investors in 2025, especially in high-inflation economies.

Conclusion

The report suggests that the crypto market may bottom out in the latter half of the second quarter of 2025, laying the groundwork for trends in the third quarter of 2025. Overall, the market is expected to exhibit a downward trend in the short term, followed by a rebound in the second half of the year, potentially reaching new highs. However, the above view would be invalidated if the following factors occur:

If the Federal Reserve ends its quantitative tightening policy, it would increase global liquidity and support the crypto market. Similarly, if major economies like the EU or China implement more global fiscal stimulus measures, it could increase M2 money supply and boost available capital in the market.

More concerning is the possibility that further uncertainty in trade relations could prolong negative sentiment in the market, while global shocks could further reduce liquidity.

Related Articles: Q1 2025 Cryptocurrency Industry Report: Trends in DeFi and NFT Ecosystems, CEX and DEX Market Performance

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。