Key Points

The total market capitalization of global cryptocurrencies is $3.02 trillion, up from $2.77 trillion last week, with a weekly increase of 9.03%. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $38.43 billion, with a net inflow of $3.06 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.4 billion, with a net inflow of $157 million this week.

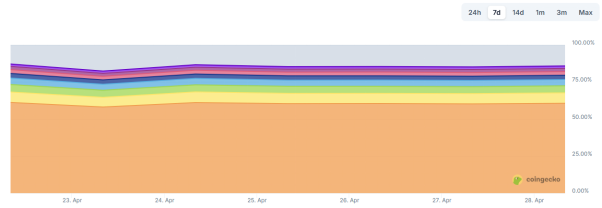

The total market capitalization of stablecoins is $242 billion, with USDT having a market cap of $145.7 billion, accounting for 60.2% of the total stablecoin market cap; followed by USDC with a market cap of $62.1 billion, accounting for 25.7% of the total stablecoin market cap; and DAI with a market cap of $5.37 billion, accounting for 2.22% of the total stablecoin market cap.

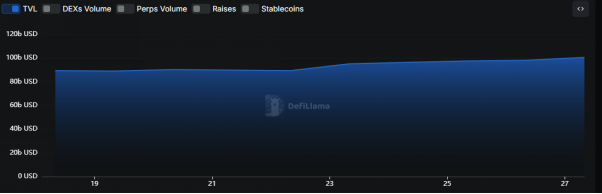

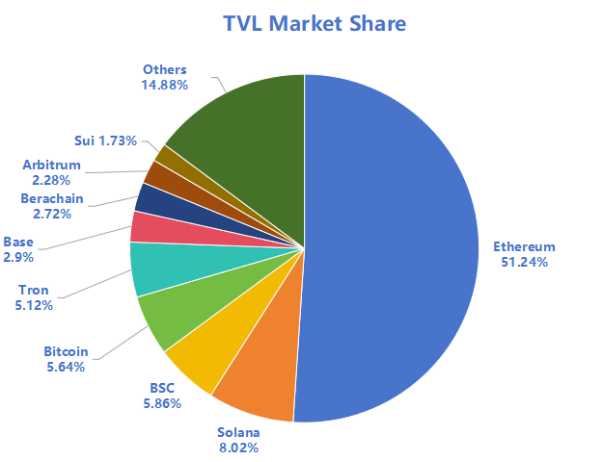

According to DeFiLlama, the total TVL of DeFi this week is $100.6 billion, up from $89.4 billion last week, with a weekly increase of 12.5%. By public chain, the top three public chains by TVL are Ethereum with a share of 51.24%; Solana with a share of 8.02%; and BNB Chain with a share of 5.86%.

From on-chain data, the daily transaction volume of Layer 1 public chains has increased this week, with Sui showing significant growth, up 95.5% from last week. Ethereum follows with a 44.6% increase; in terms of transaction fees, Solana and Sui have seen some growth, with Sui showing the most significant increase of about 116% from last week. In terms of daily active addresses, most public chains have seen some growth except for Solana, with Aptos showing the most significant increase of 126% from last week. In terms of TVL, most public chains have seen growth, except for Solana, which decreased by 9.8% from last week.

Innovative projects to watch: Halo is a digital dollar protocol based on Hyperliquid, with its issued HUSD being a stablecoin backed by the treasury, usable on HyperCore and HyperEVM. Users can trade HUSD with USDC through the spot order book and use it in integrated DeFi applications; Communa.world is a platform for the RWA ecosystem, accessible only to token holders in a closed community; Polyester is a decentralized trading platform that supports users trading any token on any chain, featuring spot, margin, perpetual contracts, and more. Currently, the project is still in a very early stage.

Table of Contents

1. Total Market Capitalization of Cryptocurrencies/Bitcoin Market Cap Ratio

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD Exchange Ratios

5. Decentralized Finance (DeFi)

7. Stablecoin Market Cap and Issuance Situation

II. This Week's Hot Money Trends

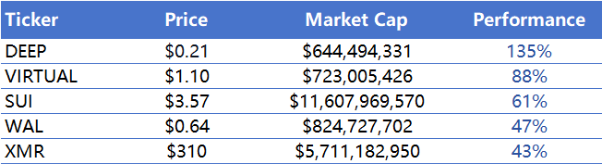

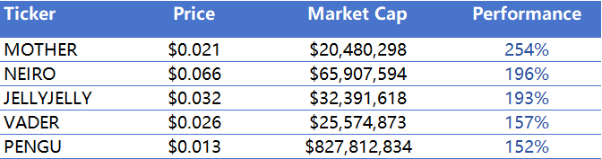

1. Top Five VC Coins and Meme Coins by Weekly Increase

1. Major Industry Events This Week

2. Major Events Happening Next Week

3. Important Financing and Investment from Last Week

I. Market Overview

1. Total Market Capitalization of Cryptocurrencies/Bitcoin Market Cap Ratio

The total market capitalization of global cryptocurrencies is $3.02 trillion, up from $2.77 trillion last week, with a weekly increase of 9.03%.

Data Source: cryptorank

As of the time of writing, Bitcoin's market cap is $1.85 trillion, accounting for 61.17% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $242 billion, accounting for 7.99% of the total cryptocurrency market cap.

Data Source: coingeck

2. Fear Index

The cryptocurrency fear index is 54, indicating a neutral sentiment.

Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $38.43 billion, with a net inflow of $3.06 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.4 billion, with a net inflow of $157 million this week.

Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Ratios

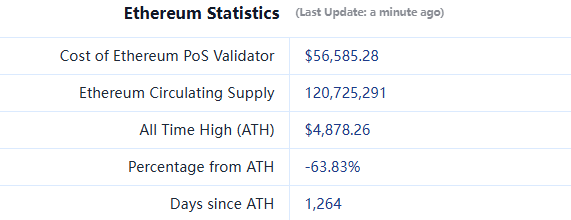

ETHUSD: Current price is $1,766, with a historical high of $4,878, down approximately 63.83% from the peak.

ETHBTC: Currently at 0.018976, with a historical high of 0.1238.

Data Source: ratiogang

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $100.6 billion, up from $89.4 billion last week, with a weekly increase of 12.5%.

Data Source: defillama

By public chain, the top three public chains by TVL are Ethereum with a share of 51.24%; Solana with a share of 8.02%; and BNB Chain with a share of 5.86%.

Data Source: CoinW Research Institute, defillama

Data as of April 27, 2025

6. On-Chain Data

Layer 1 Related Data

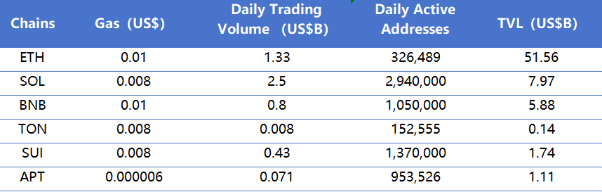

Mainly analyzing daily transaction volume, daily active addresses, and transaction fees for major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of April 27, 2025

● Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. This week, daily transaction volumes have increased, with Sui showing significant growth, up 95.5% from last week. Ethereum follows with a 44.6% increase; in terms of transaction fees, Solana and Sui have seen some growth, with Sui showing the most significant increase of about 116% from last week.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, most public chains have seen some growth except for Solana, with Aptos showing the most significant increase of 126% from last week. In terms of TVL, most public chains have seen growth, except for Solana, which decreased by 9.8% from last week.

Layer 2 Related Data

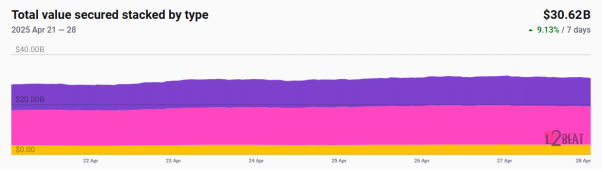

● According to L2Beat, the total TVL of Ethereum Layer 2 is $30.62 billion, up from $27.76 billion last week, with an overall increase of 9.13%.

Data Source: L2Beat

Data as of April 27, 2025

● Base and Arbitrum occupy the top positions with market shares of 34.67% and 32.93%, respectively. This week, Base surpassed Arbitrum, ranking first in TVL among Ethereum Layer 2.

Data Source: footprint

Data as of April 27, 2025

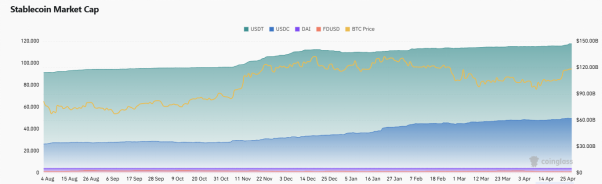

7. Stablecoin Market Cap and Issuance Situation

According to Coinglass, the total market cap of stablecoins is $242 billion. Among them, USDT has a market cap of $145.7 billion, accounting for 60.2% of the total stablecoin market cap; followed by USDC with a market cap of $62.1 billion, accounting for 25.7%; and DAI with a market cap of $5.37 billion, accounting for 2.22%.

Data Source: CoinW Research Institute, Coinglass

Data as of April 27, 2025

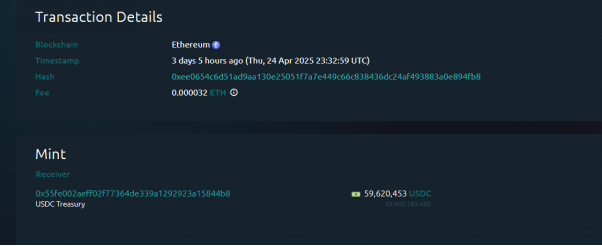

According to Whale Alert, this week, USDC Treasury issued a total of 760 million USDC, and Tether Treasury issued a total of 2 billion USDT. The total issuance of stablecoins this week is 2.76 billion, compared to 463 million last week, representing an increase of approximately 496% in stablecoin issuance this week.

Data Source: Whale Alert

Data as of April 27, 2025

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Weekly Increase

The top five VC coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of April 27, 2025

The top five Meme Coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of April 27, 2025

2. New Project Insights

Halo: A digital dollar protocol based on Hyperliquid, with its issued HUSD being a stablecoin backed by the treasury, usable on HyperCore and HyperEVM. Users can trade HUSD with USDC through the spot order book and use it in integrated DeFi applications.

Communa.world: A platform for the RWA ecosystem, accessible only to token holders who can join the closed community.

Polyester: A decentralized trading platform that supports users in trading any token on any chain, featuring spot, margin, and perpetual contract functionalities. Currently, the project is still in a very early stage.

III. Industry News

1. Major Industry Events This Week

Berachain's liquid staking protocol Infrared launched a points program called Infrared Points. This points system tracks users' long-term interactions with Infrared; the longer the staking and liquidity provision to the treasury, the more points accumulated. Points participation is automatic and traceable, with early mainnet users already accumulating points.

Polygon announced the launch of the Agglayer Breakout program, aimed at supporting the development of aggregation chains and bringing value to POL stakers through token airdrops. The first selected projects include PrivadoID (formerly Polygon ID), which has begun deploying privacy identity infrastructure, with an airdrop ratio of about 5%; 0xPolygonMiden, which is about to go live, is expected to have an airdrop of about 10%, etc. Polygon stated that this program will enhance the activity of Agglayer and the Polygon network, and increase the utility of POL tokens through airdrops, network effects, and cross-chain applications.

Celestia's ecosystem liquid staking protocol MilkyWay tweeted that it will airdrop 100 million MILK tokens (10% of the total supply) to mPoint holders, Moolitia NFT holders, and milkINIT testers.

Ripple's RLUSD stablecoin has launched on the Aave V3 Ethereum market, allowing Aave users to supply and borrow Ripple's RLUSD stablecoin in the V3 Ethereum core market, with a supply cap of 50 million RLUSD and a borrowing cap of 5 million RLUSD.

Babylon lifted restrictions on the first phase of Cap-1 staking on April 24, allowing new Bitcoin staking and remaining Phase-1 staking to enter Babylon Genesis for permissionless Bitcoin staking.

2. Major Events Happening Next Week

The AI on-chain trading and whale tracking platform Delulu will distribute Lulu points, cash vouchers, and other rewards to beta traders before April 29 (for a period of 21 days).

Hyperliquid announced the introduction of staking levels, which will be determined by the amount of HYPE staked. The benefits of staking levels include reduced trading fees, with this update expected to go live on or after April 30.

The application deadline for the sixth Ethereum scholarship program is April 30. The sixth phase will take place from June to November 2025, during which two sponsored offline events will be held at EthCC in Cannes and Devconnect in Argentina. Participants will have the opportunity to connect with mentors from the core development community, and selected participants will receive a monthly stipend to enable them to focus on the program.

The second airdrop season for the Ethereum liquidity restaking platform Kelp DAO (with airdrops accounting for 5% of the total supply) will run from January 1, 2025, to April 30, 2025. Restaking before January 15, 2025, will earn an additional 15% loyalty reward.

The token EDGE for the on-chain transaction execution platform Definitive will be available for claiming until May 1, 2025.

3. Important Financing and Investment from Last Week

Symbiotic completed a Series A financing round, raising $29 million, with investors including Pantera Capital and Coinbase Ventures. Symbiotic is a universal remortgaging system designed to enable decentralized networks to build robust and fully autonomous ecosystems. It provides a mutually protective way for decentralized applications (referred to as AVS) to secure their assets. Users can remortgage assets they have deposited in other crypto protocols to help secure these AVS and earn rewards. (April 23, 2025)

Theo raised $20 million, with investors including Hack VC, Mirana Ventures, Amber Group, Manifold Trading, and Selini Capital. Theo is a decentralized trading infrastructure that connects on-chain capital with global markets and institutions. Theo's core innovation lies in its global balance sheet and dedicated settlement network, which enables proprietary execution, strategy, risk, and custody architecture. (April 24, 2025)

Nous Research completed a Series B financing round, raising $50 million, with investors including Paradigm. Nous Research is a decentralized AI accelerator company and research institution focused on developing AI models and tools, emphasizing deep integration of AI with blockchain technology. (April 25, 2025)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。