The ultimate significance of PayFi is far more than efficiency improvement or cost reduction; it is a declaration that payment behavior itself allows ordinary people to take control of financial sovereignty.

In the traditional financial system, "payment" is often seen as the endpoint of value transfer, while "PayFi" redefines the starting value of payment. When Visa processes tens of thousands of transactions per second but takes days to complete cross-border settlements, and when small and medium-sized enterprises bear a 6.5% cost for cross-border payments yet still need to advance funds, this financial revolution triggered by on-chain payments is gradually fermenting through innovative PayFi protocols—PolyFlow endows payment behavior with "time alchemy," making every transaction a credit certificate and every payment an accumulation of financial potential.

"PolyFlow is building an open network that allows everyone globally to easily consume with cryptocurrency, earn rewards, and have a financial identity." In our conversation with PolyFlow CFO Chuck, we look forward to witnessing a future where instant settlement is achieved, allowing 1.4 billion underbanked individuals to bridge the gap of bank accounts and transform consumption data into interest-bearing assets.

How PayFi Turns Payments from a Cost Center into a Revenue Engine

Reporter: As a CFO with 15 years of international investment banking financial management experience, what insights from traditional finance have inspired your leadership in the strategy of a Web3 project?

PolyFlow CFO Chuck: During my time as the financial director in the Americas division of an investment bank, I deeply recognized two core bottlenecks in traditional cross-border payments: the disconnection between information flow and capital flow. Taking SWIFT as an example, while its messaging system achieves efficient information transfer, capital flow is still constrained by various countries' clearing systems and foreign exchange controls, resulting in an average cross-border payment time of 3-5 days and fees as high as 6%-10%. This disconnection is particularly evident in emerging markets—Philippine merchants can face comprehensive costs of up to 9% when receiving payments in USD.

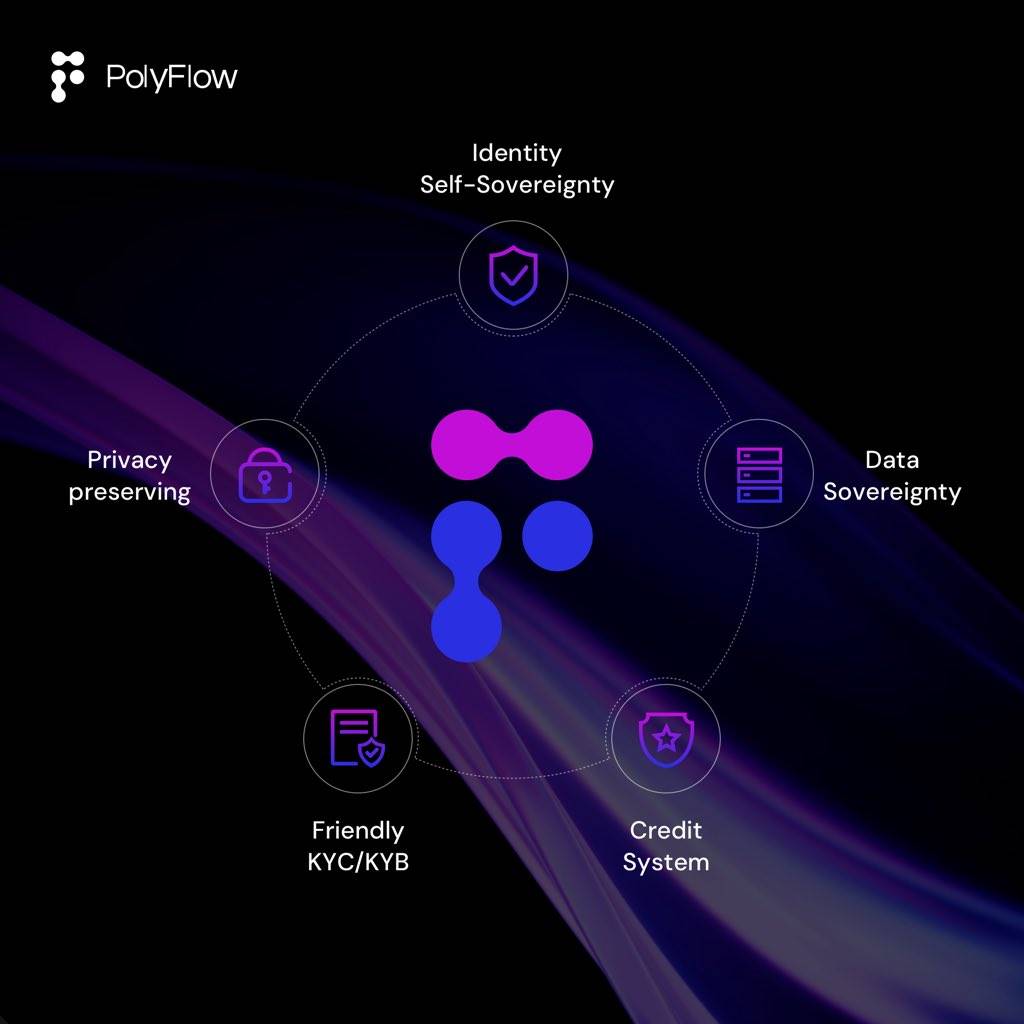

The underlying design of PolyFlow stems from this insight. We separate information flow (PID) and capital flow (PLP) through a modular architecture, allowing blockchain to become a "highway" for value transfer rather than a "toll booth." PID (Payment ID) will build an on-chain identity system for users, making each cryptocurrency payment not just "spending money," but "record-keeping," turning consumption into a certificate for future credit applications, unlocking data benefits, and participating in financial services; PLP (PolyFlow Liquidity Pool) attempts to seamlessly connect RWA and DeFi, linking on-chain financial scenarios to create a PayFi financial service ecosystem accessible to everyone in the future.

For example, trade settlements from Brazil to China can achieve T+0 arrival through the PLP pool's smart contracts, reducing costs by 50%-80%. This "compliant self-custody" model retains the composability of DeFi while avoiding the risks of centralized custody and allows for earnings generated from real-world payments, reflecting the integration of traditional financial risk control thinking and Web3 technological paradigms.

Thus, in PayFi, payment is not the endpoint but the starting point.

Reporter: What are the essential differences between the so-called PayFi and traditional payments currently on the market?

PolyFlow CFO Chuck: Traditional payment networks resemble "consumptive pipelines," charging 1.5%-6% in fees without creating derivative value. The breakthrough of PayFi lies in constructing a "value-added pipeline."

Taking PolyFlow's blueprint as an example, we hope that in the future, when Brazilian coffee farmers receive payments through the PLP pool, they can achieve T+0 arrival while also generating an annualized return of over 4.5% from DeFi protocols. This "interest-bearing payment" model not only allows hundreds of millions of cross-border workers to save tens or even hundreds of billions of dollars in exchange losses each year but, more importantly, every payment record they have will be solidified as on-chain credit through PID. When a certain amount of on-chain credit is accumulated, farmers from Africa can obtain loans through on-chain credit via DeFi, using the seeds they purchase on their Arabica coffee plantations.

Key Battles for PayFi Implementation

Reporter: In your view, what innovations and attempts are currently being made in PayFi? How do you anticipate the growth drivers in the next 6 to 12 months?

PolyFlow CFO Chuck: Payments represent a trillion-dollar market. We believe that the growth of PayFi needs to shift from output concepts to practical application scenarios, closely linking both B-end and C-end. Taking PolyFlow as an example, we are building a three-layer growth matrix.

Infrastructure Layer Penetration: PID, as an on-chain identity protocol, will integrate with mainstream public chain ecosystems such as Solana, BNB Chain, Stellar, and Ripple in the future, creating a more complete on-chain identity system for users. At the same time, we plan to achieve steady growth in PLP pool TVL within six months to support future scenarios like cross-border settlements and supply chain finance.

Application Layer Explosion: We have been exploring practical landing scenarios for PayFi, and a pilot collaboration with Brazilian banks is about to begin, expected to bring in tens of millions of dollars in incremental monthly revenue. Additionally, we hope that crypto card merchants can significantly improve review efficiency through PID-KYC while reducing chargeback rates.

Ecosystem Layer Expansion: We are about to officially launch the PolyFlow Dapp, with the core function being Scan to Earn, turning every payment into a force for building the future. We launched the PolyFlow Points Activity (Seed Season) in early April, attracting over 1 million uploads of consumption certificates within two weeks, solidifying 1.4 million transaction data points to fuel the training of the on-chain credit model. The enthusiasm of users and the community is a significant driving force for us.

Reporter: How does PolyFlow's points mechanism differ fundamentally from other projects' "point farming"?

Chuck: Traditional points systems have three major ailments: data sovereignty belongs to the platform, incentives are disconnected from real value creation, and there are cross-ecosystem circulation barriers. In this regard, PolyFlow has made unique attempts:

Behavior Attribution: In the PolyFlow DAPP, user consumption behavior is tracked through PID binding, and every uploaded receipt generates a verifiable credential (VC), forming a "digital footprint." For example, Starbucks customers can scan their receipts to earn points while also choosing to authorize desensitized data such as consumption frequency and amount range to brands that need it, earning data benefits.

Scenario Integration: Points acquisition covers both B2C and B2B scenarios. C-end users can use Scan-to-Earn to record each consumption while earning points and building on-chain credit identity; B-end merchants, after integrating PolyFlow payment tools, can convert the flow of invoices and factoring financing in the supply chain into "corporate credit points," enjoying better rates and liquidity support.

Dual-Track Economy: Points can be redeemed for future airdrop rights or used as "on-chain credit certificates" to obtain loan limits.

Reporter: How does PID differ from traditional DID? What problems do you think PID can effectively solve?

PolyFlow CFO Chuck:

Compliance Dimension: Through integration with various ecosystems, PID can achieve "light compliance," significantly reducing KYC costs while compressing verification time, promoting user adoption of cryptocurrency. We can envision a future scenario where an Indonesian merchant initiates a $50 million transaction with a Saudi client, and the system automatically retrieves compliance certificates from both parties' PIDs, completing atomic-level settlement on the Solana chain, avoiding the repeated reviews of 5-7 intermediaries in traditional pathways.

Currency Dimension: The mixed liquidity algorithm of the PLP pool reduces reliance on fiat currency transfer paths for traditional currency exchange, while dynamically matching the optimal path through PID credit ratings. We hope to lower the exchange costs and price volatility of emerging market currencies through the innovations of PayFi in the future.

Time Dimension: The consumption data captured by Scan-to-Earn is recorded through PID, and users have control over whether to authorize it. For instance, when a user scans to purchase Starbucks, their consumption frequency, amount range, and other data can be desensitized and authorized to Visa for credit assessment, earning data benefits—this allows ordinary consumers to become participants in the data capital market for the first time.

The Gradual Payment Revolution of PayFi

In Chuck's narrative, PolyFlow demonstrates a unique strategic determination: it neither creates "financial Legos" detached from real needs nor gets caught up in short-term traffic competition of "PVP." PolyFlow builds the foundational layer of value exchange through the two key modules of PID/PLP, attempting to reshape the data production relationship with the DAPP Scan to Earn. This gradual innovation of "from payment to finance" may be the true key for PayFi to traverse cycles and achieve inclusivity.

The ultimate significance of PayFi is far more than efficiency improvement or cost reduction; it is a declaration that payment behavior itself allows ordinary people to take control of financial sovereignty. When Indonesian fishermen leverage a fish catch settlement record to unlock DeFi loans, when African coffee farmers' sales data transforms into on-chain credit limits, and when 1.4 billion underbanked individuals can connect to participate in the global financial market—this payment revolution led by PolyFlow is pushing Satoshi Nakamoto's vision of "peer-to-peer electronic cash" into broader territories.

The greatness of technology lies not in its speed of disruption but in the power it grants to ordinary people. The PayFi infrastructure built by PolyFlow is rewriting the underlying code of financial civilization with the logic of "payment as infrastructure, data as capital, credit as power": "In the next decade, everyone will be amazed at how they once tolerated such an inefficient financial system—just as today we cannot imagine a world without smartphones."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。