Bitcoin (BTC) experienced a strong rebound from a low of $75,000 to above $95,700 in April 2025, with a cumulative increase of nearly 28% for the month. The current price is forming a high-level platform in the $94,000-$95,000 range, with technical indicators and capital flows showing a complex situation of intertwined bullish and bearish battles, approaching a turning point in the trend.

April Market Review: Fluctuating Rise After Deep V Reversal

- K-Line Pattern Analysis: Strong Rebound + High-Level Consolidation

Bitcoin's performance in April can be roughly divided into three stages:

- Stage One (April 1-4): Influenced by the strengthening risk aversion sentiment in traditional markets at the end of March, BTC rebounded from the early month's low of $74,508, forming a key support bottom.

- Stage Two (April 5-18): Entering the moving average convergence area, bulls gradually took control of the rhythm, with prices slowly rising and trading volume moderately released.

- Stage Three (April 19-29): A short-term rise to a peak of $95,758, followed by a consolidation in the high-level platform area, with MACD showing a death cross and RSI fluctuating, leading to increased capital hesitation.

The K-line structure presents a typical "Deep V Reversal - Flag Pattern" shape, consistent with the characteristics of the accumulation phase in a large-scale upward cycle.

- Trading Density and Main Force Cost Area Analysis

By observing the volume profile, we find:

The $84,500-$86,000 range is the main force's accumulation area, characterized by dense horizontal trading and strong support attributes. The current price is near $95,000, entering a thin area of high positions; if a breakout occurs, there is potential for a rapid upward movement; conversely, if support is broken, it may trigger profit-taking sell-offs.

Capital and Technical Indicator Overview

- OBV: Capital Momentum Slightly Exhausted

The OBV (On-Balance Volume) indicator rose rapidly at the beginning of April, reflecting positive net capital inflow. However, after reaching high levels, OBV began to flatten, indicating that there has been no continuous large capital involvement. If OBV continues to decline in the coming days, it will further weaken the upward trend momentum.

- MACD: Momentum Convergence, End of Fluctuation Approaching

The MACD indicator currently shows a high-level convergence trend: the DIF line and DEA line are aligning near the zero axis, with a noticeable contraction in the red and green bars' momentum. This state is commonly seen before a trend continuation or top reversal, indicating that the price is about to choose a direction.

- RSI and KDJ: Entering Decision Critical Zone

The RSI value is currently around 52, in a neutral to bullish area, indicating that neither bulls nor bears have yet determined a winner. The KDJ shows signs of the J line repeatedly flattening at a high level and the K line turning down, warning of a possible technical pullback in the short term.

- Moving Average System: Bullish Arrangement Still Exists

Although the short-term MA5, MA10, and MA30 have slightly converged, they remain in a bullish arrangement overall. The medium to long-term MA60 and MA120 maintain an upward trend, supporting the mid-term upward logic.

Market Structure and Sentiment Analysis: Increasing Divergence Between Bulls and Bears

- ETF Capital Flow: Incremental Momentum Strengthens

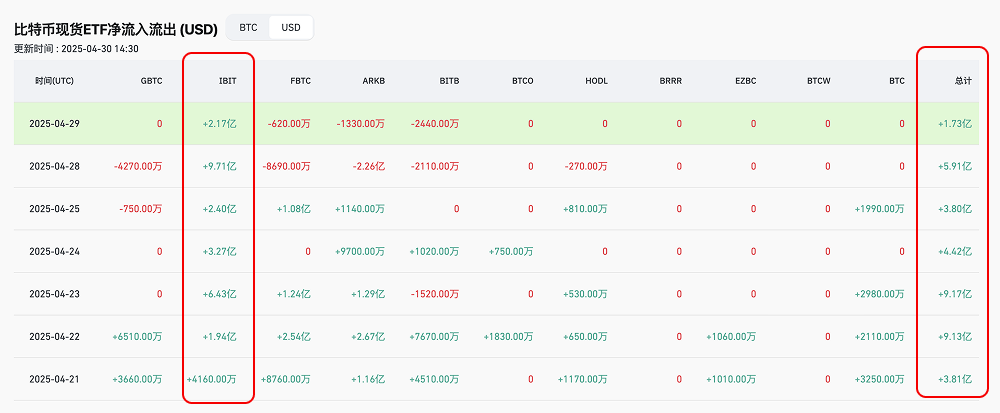

After mid to late April, the net inflow speed of Bitcoin spot ETFs accelerated. In particular, the inflow from BlackRock (IBIT) shows a willingness for new buying in the market, providing momentum for subsequent price increases.

- Derivatives Market: Implied Volatility of Options Declines

From the data of Deribit and Binance, the implied volatility (IV) of May BTC options has been continuously declining since mid-April, indicating that traders are cautious about a major market breakout in the future. In terms of positions, the Call/Put ratio is trending towards neutrality, with the market generally expecting continued fluctuations.

May Trend Forecast: Two Key Paths Emerge

Scenario One: Break Above $96,000, Initiating a New Round of Main Uptrend

If the price effectively breaks out above the $96,000 platform high with increased volume, accompanied by a rebound in OBV and a MACD golden cross, it will open up upward space, with target levels as follows:

- First Resistance: $102,000 (Fibonacci 1.272 extension)

- Second Target: $105,000 (Round number)

Fundamental catalysts may include a renewed acceleration of ETF net inflows, enhanced dovish expectations from the Federal Reserve, or news of mainstream institutions entering the market.

Scenario Two: Break Below $90,000, Entering a Deep Correction Period

If it breaks below the MA30 and the lower edge of the platform area, or triggers a large amount of profit-taking and liquidations, short-term support will shift down to:

- First Support: $88,000

- Core Support Area: $84,500-$86,000 (Main force cost area)

In this scenario, attention should be paid to macro risk events (such as a rapid surge in U.S. Treasury yields or tariff policies) that may lead to risk aversion.

Conclusion: May is the "Decision Month" for the Yearly Trend

Currently, Bitcoin's price is at a critical point of balance between bulls and bears, with technical patterns, indicator performances, and capital structures all indicating that the market is about to break out of the fluctuation range. May may determine the direction of the mid-2025 trend.

As the technical analysts say: "When all indicators are silent, the real change is about to begin."

In the current context of macro uncertainty and market hesitation, rationality, systematic thinking, and discipline remain key to long-term success in the digital asset market.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram Community: t.me/aicoincn

Chat Room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。