How a public chain defines innovation and inclusivity in a decentralized world is key to measuring its ability to generate value.

Written by: Bright, Foresight News

Wearing a BNB Chain T-shirt I brought back from the Hong Kong Web3 Festival, I was walking up the school stairs when a stranger pointed at the bright yellow-gold "BNB" embroidery on my chest and excitedly said to me, "Life is BNB."

I was momentarily confused, having never heard that phrase before. He eagerly grabbed my arm and started describing BNB and Pancake to me. I suddenly realized that newcomers entering the space today may not have purchased BTC or ETH, but are likely to eagerly switch to BNB after the upcoming Binance wallet TGE announcement, frantically clicking "Deposit" on the PancakeSwap page while silently calculating the returns from the oversubscribed allocation shared by their group friends.

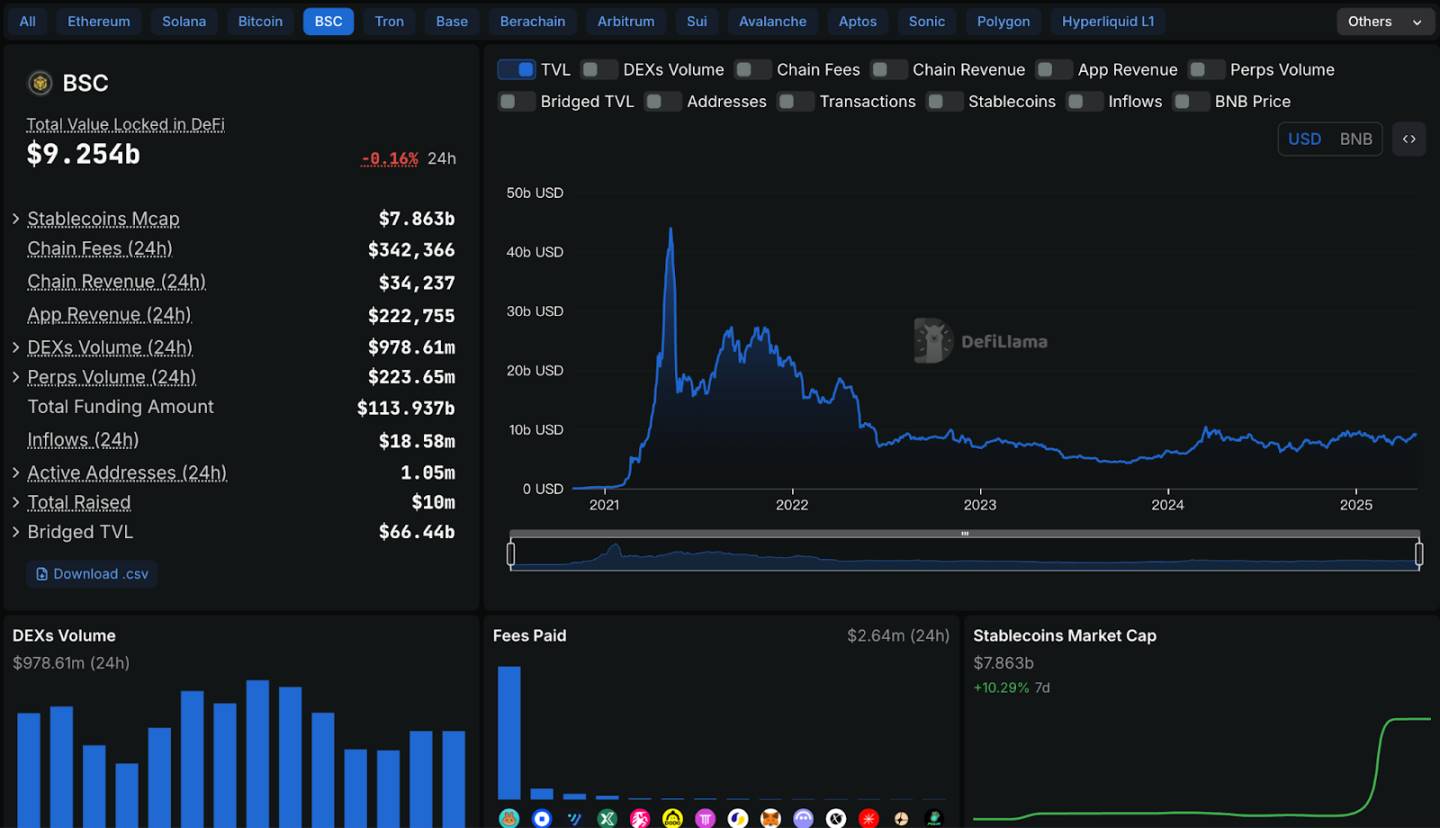

A report released by Messari shows that in the first quarter of 2025, the average daily active addresses on BNB Chain grew by 26.4% month-over-month, surpassing 1.2 million from 941,600. During the same period, BNB Chain's network revenue also surged to $70.8 million, a month-over-month increase of 58.1%. The number of traps dropped by 90% after the launch of the Goodwill Alliance. In the three months following the FOMO craze, this vibrant "health report" became the best proof that BNB Chain remains "HOT."

On April 29, BNB Chain announced the completion of a hard fork upgrade for the BSC and opBNB mainnets, reducing the block time for BSC to 1.5 seconds and for opBNB to 0.5 seconds. BNB is racing forward, breaking free from the dreariness associated with "old-school" public chains. While we discuss and even complain about ETH's "midlife crisis," it's worth noting that BNB only appeared two years later than ETH; BNB Chain was launched in 2019 and has now been around for six years, yet no one has publicly raised the notion of a "midlife crisis" for BNB.

Growth: BNB Riding the Waves

How a public chain defines innovation and inclusivity in a decentralized world is key to measuring its ability to generate value. One of the underlying logics for the wild growth of BNB Chain in DEX is its strong support for new quality projects. These new projects not only enhance user experience but also expand the boundaries of sectors like DeFi (decentralized finance) and DeFAI.

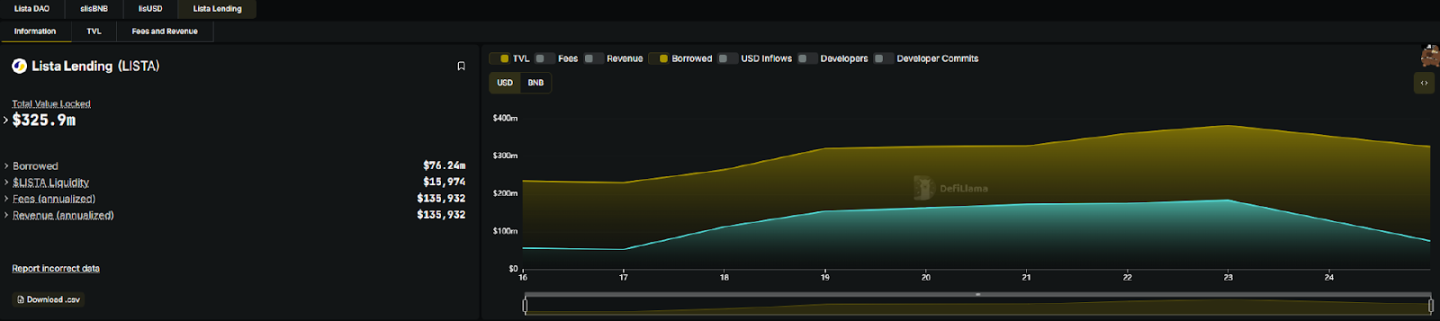

Lista DAO is a DeFi platform operating on BNB Chain that combines liquid staking, CDP systems, and lending. On April 11, Lista DAO officially launched Lista Lending, igniting the BNB chain ecosystem with its innovative P2P Lending model. Within less than an hour of going live, a vault worth over $10 million in BNB was "swept." As of the time of writing, according to Defillama, Lista Lending's TVL has exceeded $389 million, with a peak borrowing amount of $183 million. The BNB Chain Blog also mentioned that by dynamically allocating BNB to validators offering high annual yields (28% APR), the earning potential for DeFi users has been enhanced.

Lista Lending focuses on vaults and markets, supporting BNB and USD1 vaults, allowing users to collateralize BTCB, PT-clisBNB, solvBTC, etc., to borrow BNB, meeting short-term liquidity needs for Binance Launchpool, Binance wallet TGE, and more. As the third largest TVL on the BNB chain, Lista DAO has innovated BNB's growth flywheel with its "user-centric" philosophy.

The BNB Most Valuable Builder (MVB) series is another key to keeping BNB youthful and vibrant. CZ stated at the closed-door meeting for MVB Season 9 in Hong Kong: "A project that can truly go far must have real users, revenue, and profit, so that users can continue to benefit, and the token price can stabilize."

Since its launch in 2021, BNB MVB has built a reputation as the "Web3 Y Combinator." The first eight seasons have incubated about 150 projects, covering mainstream sectors such as DeFi, NFT, gaming, AI, and infrastructure. In the first nine seasons, a total of 147 projects have been incubated, and according to incomplete statistics, 75 of these projects have received investment from top venture capitalists, and 163 projects have successfully issued tokens, with the vast majority listed on mainstream exchanges.

On April 23, the MVB program announced a significant upgrade, transitioning from a traditional quarterly application system to a rolling application system, allowing global entrepreneurs to turn their ideas into reality with the support of BNB Chain at the moment of inspiration.

The upgraded MVB aims to empower all stages, allowing participants to join at any time and providing comprehensive support for innovative projects from product development to market landing and potential financing through tailored courses, one-on-one mentorship, and resource packages worth up to $300,000 in "Launch-as-a-Service" (LaaS).

Maturity: BNB Chain Thriving

On April 16, 2025, the BNB Foundation announced the completion of the 31st quarterly BNB token burn, destroying a total of 1,579,000 BNB, equivalent to approximately $916 million, gradually reducing the total supply to 100 million. BNB Chain continues to mature through the process of burning and cooking over time.

In the first quarter of 2025, BNB Chain generated $70.8 million in revenue, a month-over-month increase of 58.1%, with DEX trading volume surging by 79.3%. BNB Chain experienced a massive ecological explosion in February 2025, quickly taking over from Solana to become a leader in on-chain ecological competition, thanks to the vast resources provided by CZ and Binance. The daily active addresses on BSC stabilized above 1 million, and the number of on-chain contract deployments surged to 250,000, setting a new high for multiple quarters. In the first quarter, BNB Chain had several weeks where its trading volume ranked first, with on-chain liquidity flowing abundantly. On February 13, spurred by TST, PancakeSwap recorded a trading volume of $3 billion within 24 hours, reaching $20 billion in trading volume over the past week. Meanwhile, BNB Chain's TVL grew from $6.26 billion in September 2024 to $9.25 billion on April 29, 2025, an increase of 31.8%.

The maturity of BNB Chain is not just about data accumulation but also about the forward-looking strategic planning of the "golden shovel." From the traffic engine of community meme coins to the value anchoring of AI and DeFi protocols, BNB Chain has launched a $4.4 million liquidity support plan for meme coins and a "100 million dollar support plan" for direct coin purchases.

The activity of stablecoins, like the lifeblood of BNB Chain, continuously supplies nutrients. With the boost from new sectors like Payfi and RWA, the global stablecoin market is growing rapidly, and various forces are eager to take the stage. From September 2024 to April 2025, the market value of stablecoins on BNB Chain rose from $4.916 billion to approximately $9.258 billion, an increase of about 88%, reflecting its core position in stablecoin trading and DeFi applications. The new stablecoin project, World Liberty Financial (WLFI), backed by the Trump family, has also chosen to issue its stablecoin USD1 on BNB Chain. As of now, WLFI's stablecoin USD1 has issued over 2.1 billion on BNB Chain, accounting for over 99.32% of the circulating supply. USD1 has also become the seventh largest stablecoin by market value.

So why choose BNB Chain? Following the 2025 roadmap, BNB Chain is clearly moving forward. The BSC and opBNB mainnets continue to upgrade as scheduled, with block generation times speeding up by over 50% year-on-year, while maintaining a high concurrency processing capacity of 100 million transactions per day. Additionally, the introduction of numerous upgrades to EIP-7702 smart contract wallets has significantly reduced user experience friction on-chain. The efficiency brought about by this "barrier-free" experience is further promoting mass adoption of stablecoins and other Web3 applications among a large number of users.

Running: BNB Trading Flowing Like Water

As an undisputed TOP1 exchange-born platform token, BNB thrives in the CEX field. On April 22, the mainstream American exchange Kraken announced the official listing of BNB, which may represent BNB gradually stepping out of the regulatory shadow. Previously, the innovative move by the special administrative region of Bhutan's Gelephu Mindfulness City to include BNB alongside BTC and ETH in its national strategic reserves, coupled with CZ's recent role as a strategic advisor to the Pakistan Crypto Committee, raises speculation about where BNB's "Silk Road" has extended in the real world.

As of mid-April 2025, according to CoinMarketCap data, BNB's price stabilized around $610, with a 24-hour trading volume reaching $1.69 billion. During the overall correction of the crypto market in the first quarter of 2025, BNB's price demonstrated strong resilience, with a historical high of $793.86 on December 4, 2024, and a low during this correction of $500, representing a decline of 37.1%. Among mainstream coins, this performance was only surpassed by BTC (-32.1%), significantly outperforming ETH (-66.3%), SOL (-67.8%), and XRP (-52.6%).

The practicality of BNB on Binance has further enhanced its appeal. Users can use BNB to pay for transaction fees (for example, using BNB for contracts enjoys a 10% discount), participate in launch pools, and take part in exclusive TGE events for the Binance wallet. Recently, the frequent launches of exclusive TGEs for the Binance wallet have allowed many friends to receive a warm "pork trotter rice" during the turbulent downturn. Among these, the tokens of BNB Chain projects have performed exceptionally well. Statistics show that over 30% of the 12 exclusive TGE projects recently launched on the Binance wallet are BNB Chain projects. For instance, the decentralized exchange KiloEx and the Bitcoin L2 infrastructure Lorenzo Network are both star members from the earlier seasons of BNB MVB.

Behind the hundreds of bowls of "pork trotter rice" is the strong synergy between Binance Alpha and Binance's non-custodial wallet. Binance Alpha is embedded to showcase early-stage projects on Binance, attracting users through airdrop activities and convenient trading features. Since April 21, 2025, the number of trades on Binance Alpha has doubled, with daily trading volumes repeatedly hitting historical highs. On April 28, the total transaction volume of the Binance wallet reached $92 million, surpassing the total trading volume of all other wallets combined. The rapid buy feature of Binance Alpha 2.0, which automatically adjusts slippage and employs anti-MEV mechanisms, has opened up trading channels between CEX and DEX, ensuring efficient trading. This not only provides CEX users with more investment options but also lowers the entry barrier for new users investing in on-chain tokens.

Starting from an exchange, BNB's reach has expanded across public chains, exchanges, wallets, accelerators, and more, touching every corner of Web3. However, BNB still has a long way to go to achieve its goal of reaching "one billion" users. It is hoped that this young pump in Web3 can continue to roar, realizing the true ideal of "life is BNB" through mass adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。