Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Inflow of $1.805 Billion

Last week, the U.S. Bitcoin spot ETFs saw a net inflow over four days, totaling $1.805 billion, with a total net asset value of $113.15 billion.

Four ETFs experienced net inflows last week, primarily from IBIT, BTC, and HODL, which saw inflows of $2.48 billion, $41.9 million, and $19.2 million, respectively.

Data Source: Farside Investors

U.S. Ethereum Spot ETF Net Inflow of $106 Million

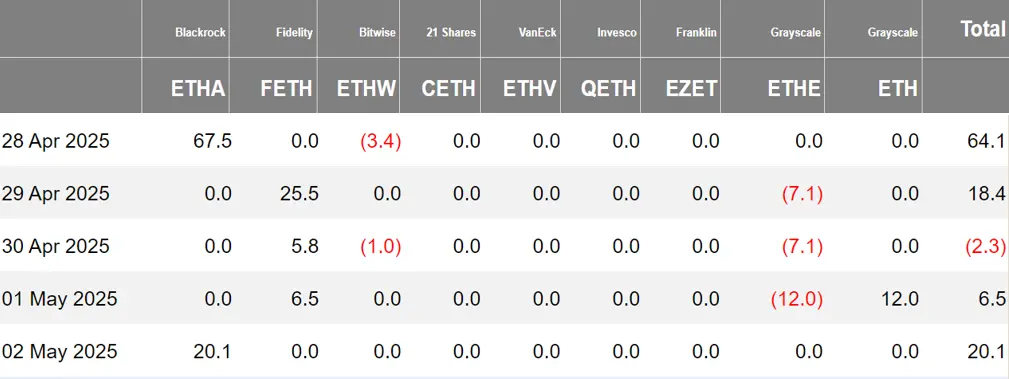

Last week, the U.S. Ethereum spot ETFs had a net inflow over four days, totaling $106 million, with a total net asset value of $6.4 billion.

The inflow last week primarily came from BlackRock's ETHA, with a net inflow of $87.6 million. A total of four Ethereum spot ETFs had no fund movement.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Inflow of 25.73 Bitcoins

Last week, the Hong Kong Bitcoin spot ETFs saw a net inflow of 25.73 Bitcoins, with a net asset value of $39.7 million. The holdings of the issuer, Harvest Bitcoin, decreased to 302.29 Bitcoins, while Huaxia increased to 2,180 Bitcoins.

The Hong Kong Ethereum spot ETFs had no fund inflow, with a net asset value of $3.666 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of May 2, the nominal total trading volume of U.S. Bitcoin spot ETF options was $910 million, with a nominal total long-short ratio of 3.01.

As of May 1, the nominal total open interest of U.S. Bitcoin spot ETF options reached $13.11 billion, with a nominal total open interest long-short ratio of 2.10.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 51.89%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

According to The Block, Ivy League school Brown University disclosed in its institutional investment manager holdings report submitted to the U.S. Securities and Exchange Commission (SEC) that it holds approximately $5 million in shares of BlackRock's spot Bitcoin ETF.

21Shares Submits S-1 Registration for SUI ETF to U.S. SEC

According to CoinDesk, Swiss asset management company 21Shares has submitted an S-1 registration for the SUI ETF to the U.S. Securities and Exchange Commission (SEC). 21Shares President Duncan Moir stated at Sui's annual Basecamp conference, "Since we first researched Sui, we have believed it could become one of the most exciting blockchains in the industry, and we are witnessing that assertion come to fruition."

U.S. Wealth Platforms with Over $31 Trillion in Capital Unable to Access Bitcoin ETFs

According to data from Tephra Digital, multiple wealth management platforms in the U.S. currently have a total capital exceeding $31 trillion but are still restricted or prohibited from accessing Bitcoin ETFs.

Grayscale Launches Grayscale Bitcoin Adopters ETF

According to official news, Grayscale announced the launch of the Grayscale Bitcoin Adopters ETF (BCOR), providing exposure to companies that have adopted Bitcoin as a treasury reserve asset.

These companies span multiple industries but are all promoting Bitcoin adoption.

21Shares Submits DOGE ETF Application to Nasdaq

According to market news, 21Shares has submitted a DOGE ETF application to Nasdaq.

Documents submitted by Nasdaq to the SEC indicate that Nasdaq intends to list the 21Shares Dogecoin ETF for trading under rule 5711(d), with the trust managed by 21Shares US LLC and Coinbase Custody holding the Dogecoin assets, tracking the DOGE-USD reference rate index published by CF Benchmarks. The ETF will only allow cash subscriptions and redemptions, with each basket unit consisting of 10,000 shares, and the trust will not use leverage or derivatives, nor will it engage in staking or yield generation.

South Korea Plans to Introduce Seven Crypto Policies, Aiming to Open BTC Spot ETF Trading This Year

According to Edaily, South Korea's ruling party, the People Power Party, announced seven new policies to cultivate the digital asset ecosystem, planning to open BTC and other spot ETF trading within the year and abolish the "1 Exchange - 1 Bank" restriction to encourage institutional funds to enter the market.

Other policies include introducing a stablecoin regulatory framework, advancing STO legislation, and formulating a basic law for digital assets. The party also plans to establish a special committee on virtual assets under the direct supervision of presidential candidates to coordinate related reforms.

ETF Issuer Teucrium to Launch Inverse XRP ETF

According to CoinDesk, ETF issuer Teucrium announced plans to launch an inverse XRP ETF to allow investors to profit from a decline in XRP prices, pending demand assessment.

Additionally, Teucrium has launched the first XRP exchange-traded fund in the U.S., the Teucrium 2x Long Daily XRP ETF, aimed at providing double daily returns on XRP through swap agreements and referencing European exchange-traded products as the benchmark rate.

According to Bitcoin.com, asset management company Grayscale met with the SEC's crypto working group on April 21, requesting permission for its Ethereum ETF (ETHE and ETH) to engage in staking operations. The company stated that due to regulatory restrictions, its managed assets of $8.1 billion have missed approximately $61 million in potential earnings from the product's launch until February 2025.

Grayscale presented three arguments:

1) Similar products have been successfully implemented in Europe and Canada; 2) Staking can enhance the security of the Ethereum network; 3) Risk control measures, including a "liquidity reserve," have been established.

Coinbase Custody will provide technical support to mitigate confiscation risks. Currently, U.S. spot Ethereum exchange-traded products (ETPs) cannot fully reflect the underlying asset value due to the prohibition of staking. Grayscale calls on the SEC to update regulatory rules in line with traditional financial products.

According to Cointelegraph, nearly 16 months after the launch of spot Bitcoin ETFs, Grayscale's GBTC continues to dominate in revenue generation, with an implied annual revenue exceeding $268 million—this figure surpasses the total revenue of all other Bitcoin ETFs combined ($211 million).

U.S. SEC Delays Approval of Franklin XRP Spot ETF to June 17

U.S. SEC Delays Decision on Bitwise Spot DOGE ETF Application

Views and Analysis on Crypto ETFs

According to The Block, Bitwise Chief Investment Officer Matt Hougan stated that four major financial institutions—Merrill Lynch, Morgan Stanley, Wells Fargo, and UBS Group (managing over $10 trillion in client assets)—are expected to fully support Bitcoin ETF products by the end of this year.

Despite the inflows into Bitcoin ETFs being lower this year compared to the same period in 2024 (attracting only about $4 billion so far, compared to $11.8 billion last year), Hougan still predicts that 2025 will set a new record for net inflows.

He pointed out that institutional participation is on the rise—nine out of the top ten hedge funds globally now hold Bitcoin, including institutional investors like Emory University and the Texas Teacher Retirement System, as well as large asset management companies like BlackRock entering the market. These factors will drive more investors into the Bitcoin market.

According to The Block, Robert Mitchnick, head of digital assets at BlackRock, stated at the Token2049 event in Dubai that there is a significant inflow of funds into Bitcoin ETFs, and the investor composition is shifting from retail to institutional.

Mitchnick noted that in the early stages of the ETF launch, participation was mainly from retail clients, including high-net-worth individuals with holdings exceeding $100 million. However, the proportion of retail clients has gradually decreased each quarter, while the share of institutional and wealth management clients has been steadily increasing. Regarding altcoin ETFs, he mentioned that current market interest remains primarily focused on Bitcoin, as Bitcoin's attributes as a portfolio hedging tool differ from those of other cryptocurrencies.

Matrixport: Bitcoin ETF and Futures Funds Flowing Back, Long-Term Holding Demand Rebounding

Matrixport released a chart today indicating that since March 19, Bitcoin ETF funds have been continuously flowing out, and the open interest in the futures market has also declined. From January to April, the cumulative net outflow of ETFs approached $5 billion.

However, recently we have observed a large inflow of nearly $3 billion, with an increase in open futures contracts as well. Interestingly, the funding rates remain at a low level.

This indicates that the current new inflows are primarily driven by genuine long-term holding demand, contrasting with the ETF buying driven by arbitrage funds at the beginning of the year, resulting in a more positive overall bullish signal.

Bloomberg Analyst: Approval Probability for Spot Crypto ETFs like LTC and SOL at 90%, XRP at 85%

According to the latest data shared by Bloomberg analyst @JSeyff, several institutions have submitted applications for spot crypto ETFs for LTC, SOL, XRP, and others.

Bloomberg Intelligence estimates that the approval probability for Litecoin, Solana, and crypto asset basket/index ETFs is 90%, while XRP is at 85%, and DOGE and HBAR are at 80%. Projects like DOT, AVAX, and ADA are at 75%.

All 19b-4 filings for these projects have been confirmed by the SEC, with the final approval deadlines concentrated in the second half of 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。