"Now it's better to focus on trading platforms than on project teams." Arez's profit-seeking studio has shifted 80% of its efforts this year towards arbitrage on trading platforms. Before the May Day holiday, the information circulating in the group about "registering on Coinbase to receive a 200U airdrop" also confirms this trend of shift.

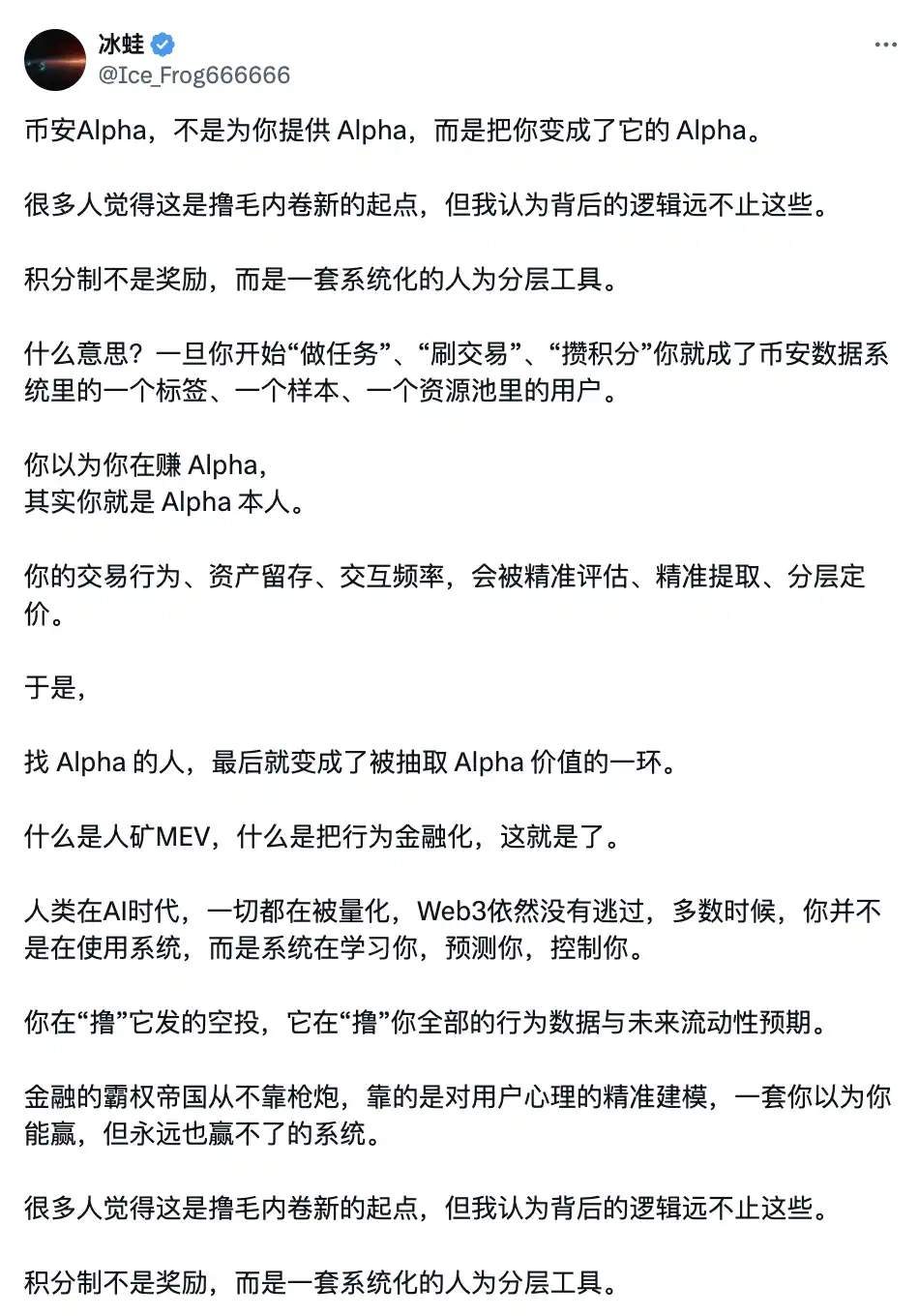

This cycle is one where profit-seekers are being countered; most of the profit-seeking studios that have gained nothing have already closed down, and most of the profit-seeking KOLs have transitioned to other fields. For example, veteran profit-seeking KOLs like Ice Frog have transformed into "project rights protection bloggers."

In this context, Rhythm BlockBeats has noticed that some more perceptive studios have already turned their focus: some have switched to trading platforms, precisely targeting opportunities in liquidity overflow; some have returned to traditional IPOs, turning the Hong Kong stock market into a new cash machine; and others have quietly started businesses in selling water and infrastructure, earning more stable cash flows.

CEX: A New Hunting Ground Under Liquidity Overflow

"Project teams now wish their own people would distribute all the Tokens." Arez said with a wry smile.

In the previous cycle, studios were accustomed to revolving around project teams—testing networks, airdrops, community activities. However, as overall market liquidity tightens, to ensure control after launch and save limited budgets, project teams generally adopt strategies to compress community quotas: airdrop rewards have significantly shrunk, and the proportion of Tokens that retail investors can receive has decreased repeatedly.

The standardization and reduction of rewards for testing networks and airdrops have made it increasingly difficult for ordinary profit-seekers to make a profit. This change has directly led to the elimination of many small studios, accelerating the internal competition within the profit-seeking ecosystem. Faced with the depletion of profit-seeking channels from project teams, studios have had to seek new battlefields.

"In the past, working on projects was very profitable, but this cycle is different." Arez lamented, "Now many project teams are actually working for trading platforms and market makers. Where is there any meat left for outsiders?"

Trading platforms still control the largest pools of funds and active users. Therefore, trading platforms have become the new targets in the eyes of profit-seekers.

To promote new listings, introduce new products, and cultivate user habits, trading platforms continue to spend money, releasing a large number of incentives. Whether it's IDO IPOs, trading volume rewards, or volume arbitrage, the liquidity overflow from trading platforms has become a new opportunity hotspot. This has also provided new hunting grounds for profit-seeking studios.

Wallet IDO IPOs

"We can easily create 200 accounts for each Binance wallet IDO," Arez said. If calculated at a profit of $30 to $50 per account, their team's earnings from one IDO would be equivalent to half a year's salary for a white-collar worker in China.

Not only Arez, but also Old Zhang's studio has found opportunities in profit-seeking on trading platforms.

As early as the Worldcoin period, Old Zhang accumulated a batch of KYC resources and has now smoothly entered various activities on trading platforms.

Typically, studios collaborate with KYC providers, brushing platforms, etc., to form a profit-sharing mechanism: the supply chain provides identity resources, the studio handles bulk operations, and they share the profits from airdrops or new coin arbitrage.

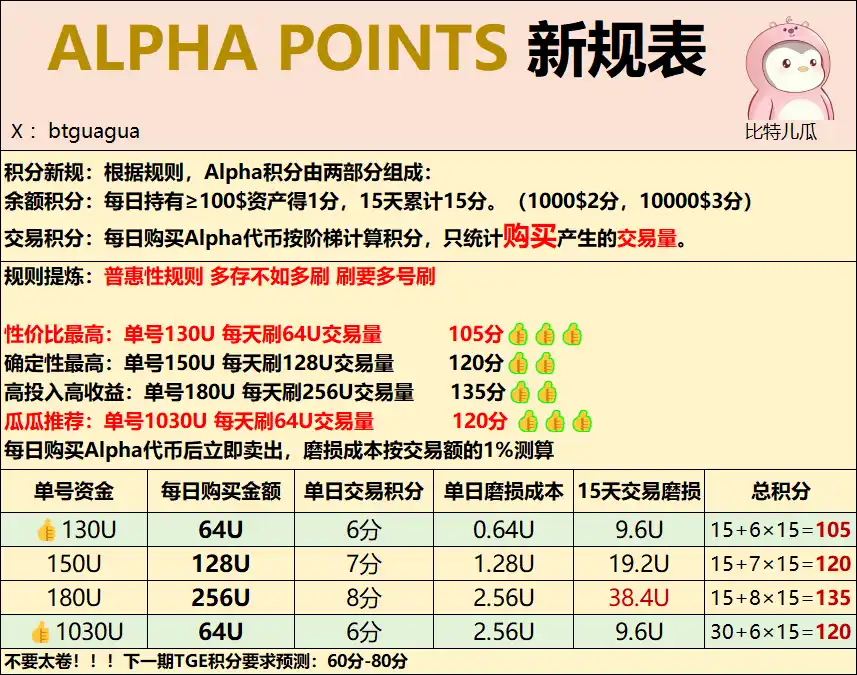

Taking Binance wallet Launchpool as an example, the early-stage dividends were extremely generous, with each account earning nearly $100 from one activity. However, as the number of players surged, the platform continuously raised the thresholds: for example, the trading volume of wallets within a month, introducing KYC facial recognition, restricting operation times, Alpha points, etc.

Image source: BitErGua

"At first, we mainly used KYC resources from Vietnam and the Philippines, which were relatively low-cost," Old Zhang recalled. But as Binance wallet IPOs introduced more complex facial verification and short operation limits, overseas KYC resources became increasingly difficult to apply on a large scale.

"So now, we basically negotiate KYC resources ourselves and no longer rely on channel providers," Old Zhang said.

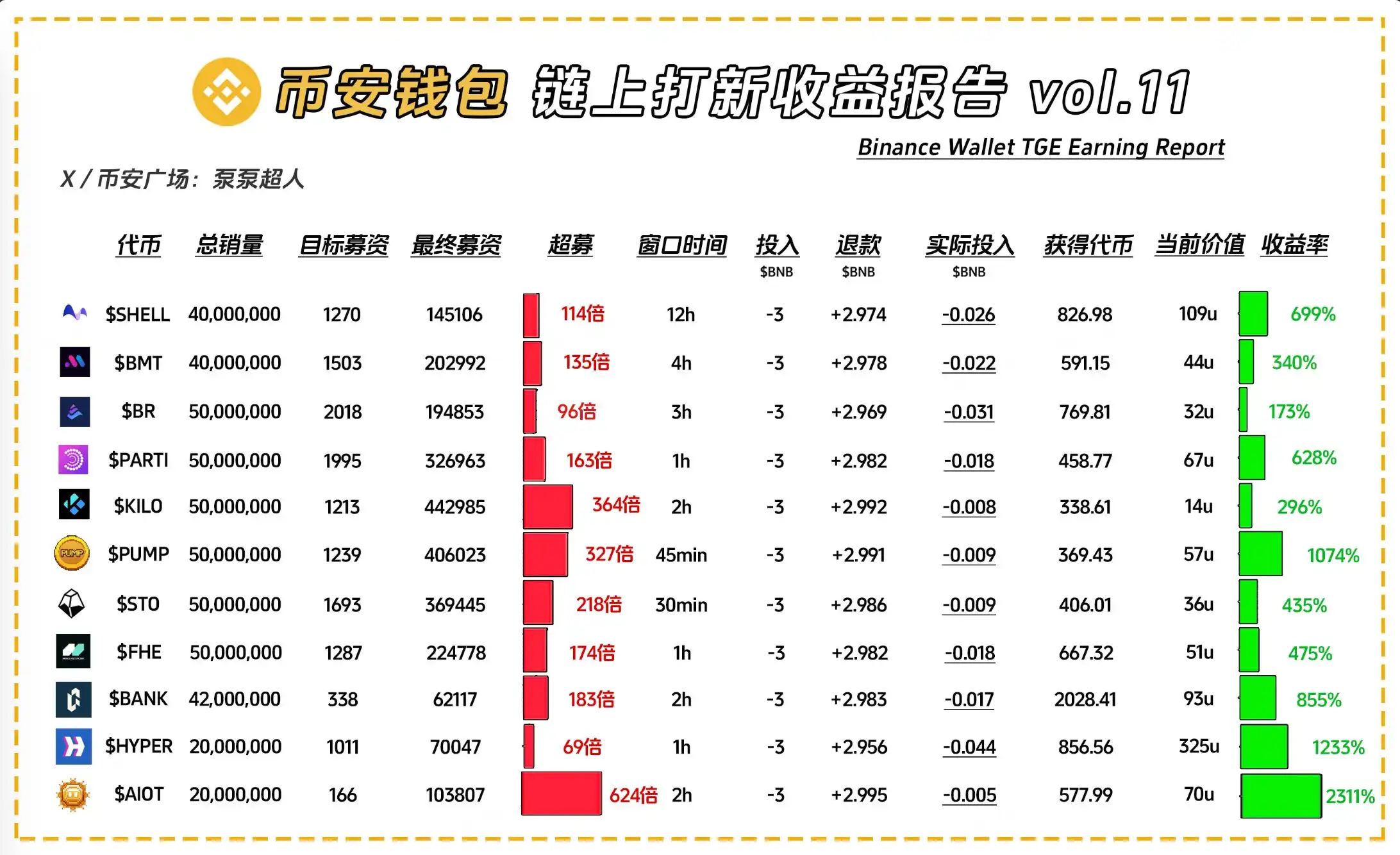

Image source: Pump Pump Superman

However, even with more flexible resource allocation, Arez admitted that as the thresholds continue to rise and the oversubscription multiples hit new highs, the preparation and costs required for a Launchpool have also increased significantly.

"It's become competitive now, with many monks and little porridge, as profits are decreasing with each round," he said. Therefore, studios are constantly seeking new opportunities and no longer solely relying on the IDO IPO path.

"What the platform promotes, we profit from."

"The reward logic of trading platforms is essentially buying data with money," Arez summarized.

In addition to IDO IPOs, trading platforms often launch various trading rewards or airdrop activities to promote new products. These are usually concentrated in the early stages of new product launches, requiring users to complete a certain trading volume or deposit amount, with generous and rapid rewards.

"The reasoning is quite simple; wherever the platform lacks trading volume, there will be the largest activity subsidies," Arez told Rhythm BlockBeats. They have dedicated personnel monitoring announcements from major trading platforms daily, ready to capture any opportunities immediately.

To accurately seize major opportunities, Arez has spent a lot of time analyzing the strategic styles of various trading platforms. He likens the competitive landscape of trading platforms to the fragmented power struggles of the Spring and Autumn period and the Warring States period.

"Each platform is like a feudal state; the conditions differ, and the strategies vary. Our task is to find our opportunities in these small wars," Arez said with a smile, citing an example frequently mentioned within the team: "When Shang Yang reformed, he had to establish rewards and punishments. He offered ten gold to anyone who could carry a log to the north gate. As no one went, the reward kept increasing until it reached fifty gold, and then someone went and claimed the reward."

In his view: Coinbase's recent generous launch of a 200U registration airdrop is precisely to support its contract trading sector, filling a long-standing gap; Bybit is vigorously promoting its payment card feature, accompanied by a series of cashback activities; and Gate is pushing some new meme features… "The reasoning is the same; it's essentially like the Qin state offering ten gold for reforms today and the Zhao state offering five gold for reforms tomorrow."

"My goal is to be the first person to carry the log," Arez said. In this new round of competition among trading platforms, he prefers to be the first to test the waters and eat the meat: "Whatever the platform promotes, you profit from it, follow the platform to eat meat."

As project teams' airdrops have devolved into black box games, trading platforms have become the new "money-spending main force" in this cycle: from Binance Launchpool's IDO to Coinbase's real cash in the contract sector, and to Bybit's competition for payment card traffic, perceptive studios have already turned their focus. In the liquidity overflow of these trading platforms, perceptive studios have once again found their path to survival.

One Fish, Multiple Benefits: Low-Risk Arbitrage + Airdrop

In addition to participating in activities and IDO IPOs, some more specialized studios have already explored a dual profit model of arbitrage + airdrop on trading platforms. Backpack trading platform is a typical case.

Here, we also strongly recommend the interview article released by Cookie last week—"Backpack + AI, even coding novices can script low-risk profits." The article features an interview with a high-level player, CJ, who creates arbitrage scripts on the Backpack platform, sharing many practical techniques and ideas that can be directly applied:

For example, using multiple strategies in combination, such as buying SOL in the spot market while shorting SOL in the futures market, then transferring the spot to the chain to participate in liquidity pools (LP Farming) to earn fees, while also stacking different platforms' airdrop expectations to achieve multiple benefits; or conversing with AI assistants (like Cursor) to continuously refine and optimize logic, ultimately building an automated trading and interaction script system that significantly enhances the efficiency of arbitrage and airdrop collection.

On trading platforms with liquidity overflow, trading arbitrage while collecting airdrops has become an important weapon for the new generation of studios. Especially platforms like Backpack, which have both token issuance expectations and support for multi-strategy arbitrage, have become a battleground for profit-seeking studios.

Hong Kong Stock "Small Spring," Studios Return to Old Business

In addition to seeking opportunities in liquidity overflow on trading platforms, some quicker profit-seeking studios have also turned their attention to IPOs in the Hong Kong stock market.

"Since it's hard to profit in the crypto space, why not look for opportunities in the traditional market?" Arez told Rhythm BlockBeats. This year, their studio has specifically established a small team for Hong Kong stock IPOs, dedicated to handling IPO subscription projects. Since the second half of 2024, Hong Kong stock IPOs have performed exceptionally well, ushering in a "small spring" market, which has become a new source of cash flow for many profit-seeking studios.

Among these new stocks, the performances of Mixue Ice City and Mao Ge Ping are particularly outstanding: Mixue Ice City surged over 47% on its first day of listing, with a net profit of nearly 10,000 HKD for one lot. Mao Ge Ping, a well-known high-end beauty brand, saw a first-day increase of nearly 58%, with a single account requiring only 2,880 HKD in principal to subscribe for 10 lots, ultimately yielding an average profit of over 16,000 HKD per account.

"When it comes to Hong Kong stock IPOs, I focus on a few points: good fundamentals, high market enthusiasm, large-cap stocks, low issuance valuations, and high subscription multiples. The win rate can be over 70%," Arez stated, noting that their current win rate and certainty in Hong Kong stock IPOs far exceed those in the crypto space.

In the crypto space, the airdrop standards set by project teams have also become completely "black-boxed"; most projects no longer disclose any standards, and even manipulate lists directly in the background: the proportion of self-retained addresses has significantly increased; standards are vague, and scoring systems are privatized, leaving ordinary profit-seekers with almost no predictability; the success rate of "drinking soup behind the project team" has plummeted. Some resource-based studios leverage private relationships with project teams: project teams directly allocate airdrop standards to partners; studios produce interactive addresses in bulk as agreed, ensuring interaction data meets standards; after airdrops are distributed, profits are shared proportionally. But clearly, such opportunities only belong to a few players with resources and connections, while ordinary studios are largely excluded.

In contrast, Hong Kong stock IPOs seem to be purely advantageous.

At the same time, just like the competition among trading platforms in the crypto space, Hong Kong brokers are also aggressively attracting new clients: brokers like Yao Cai, Hua Sheng, and Tiger Brokers are offering "commission-free" promotions, along with stock giveaways for transferring accounts. Some brokers are giving away 100 shares of Tencent Holdings, while others are offering Buffett's heavily invested stock, Occidental Petroleum…

As a result, the financing leverage provided by brokers for IPOs has also increased. "In the past, brokers offered a leverage of 10 times, with a few able to provide 20 or 30 times. However, since the second half of last year, brokers can now offer leverage of 50 times or even 100 times," Arez said.

(Note: 10 times financing leverage means that the cost of a single account for IPOs is compressed to 1/10 of the original.)

Selling "water," renting servers, making money from profit-seekers

Where there are many "profit-seeking players," there are businesses to profit from.

As project teams tighten their scrutiny of IP sources and interaction environments, using rampant IPs (commonly known as "thousand-person riding IPs") for profit-seeking is no longer realistic. Domestic IPs are frequently blocked by project teams, and overseas IPs have become a hard requirement for some projects; operating multiple accounts requires a large number of independent IPs to prevent account bans; node-type and挂机-type projects (like Nillion, Grass, etc.) have very high requirements for server stability and IP purity.

Thus, professional server and IP suppliers have emerged.

A typical service process of a server IP supplier includes: providing overseas cloud servers (such as ByteDance's Volcano Engine, AWS, Hetzner, Tencent Cloud International, etc.); configuring stable independent IPs; pre-installing the basic environment needed for interaction (system, wallet, scripts, toolkits, etc.); some high-end services even offer customized solutions for node optimization, traffic distribution, and script deployment.

Byteplus.Pro is engaged in such business. Since the Grass project, Byteplus.Pro's founder Miko has noticed this small opportunity, bringing traditional Web2 server, IP, and GPU resources to start Web3 business.

"We are the infrastructure providers for Web3," Miko introduced. "We are backed by resources from major companies like ByteDance and Tencent Cloud. We are their overseas agents, even having official node lines for TikTok live streaming."

For profit-seeking studios, instead of building cumbersome environments themselves, it is better to directly purchase a complete set of services, saving time and increasing success rates. "We are like the water, electricity, and gas in the profit-seeking industry; any industry and field needs infrastructure service providers like us to operate," as founder Miko stated.

The business-savvy individuals in this field have also "sunk down," with the "selling water" (testing tokens) business being the most direct manifestation.

In the past, testing tokens were mainly distributed for free by project teams for users to conduct testing interactions. However, today, this segment has been highly commercialized and formalized, and the selling water industry has basically been squeezed out by mature products.

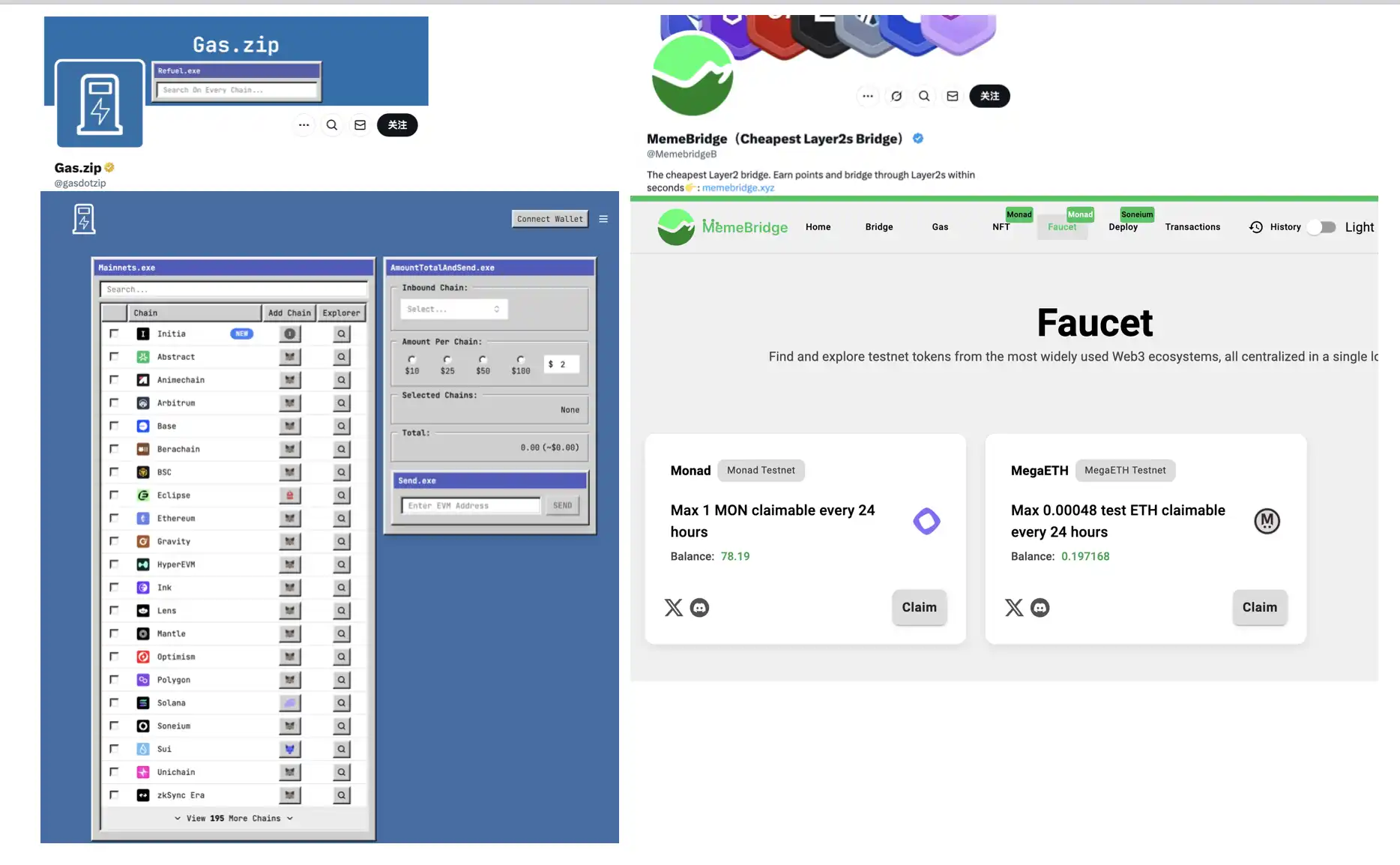

For example, service providers like gasdotzip and memebridgeb can now offer one-stop services for purchasing testing tokens and cross-chain transfers, with mature operations and complete systems.

In addition to these mature "selling water" products, when searching for popular profit-seeking projects on Twitter, one can always find personal "selling water" tweets, and such messages are often seen in various WeChat groups. Testing tokens should be part of on-chain testing, but nowadays, it has become difficult to distinguish between mainnet and testnet.

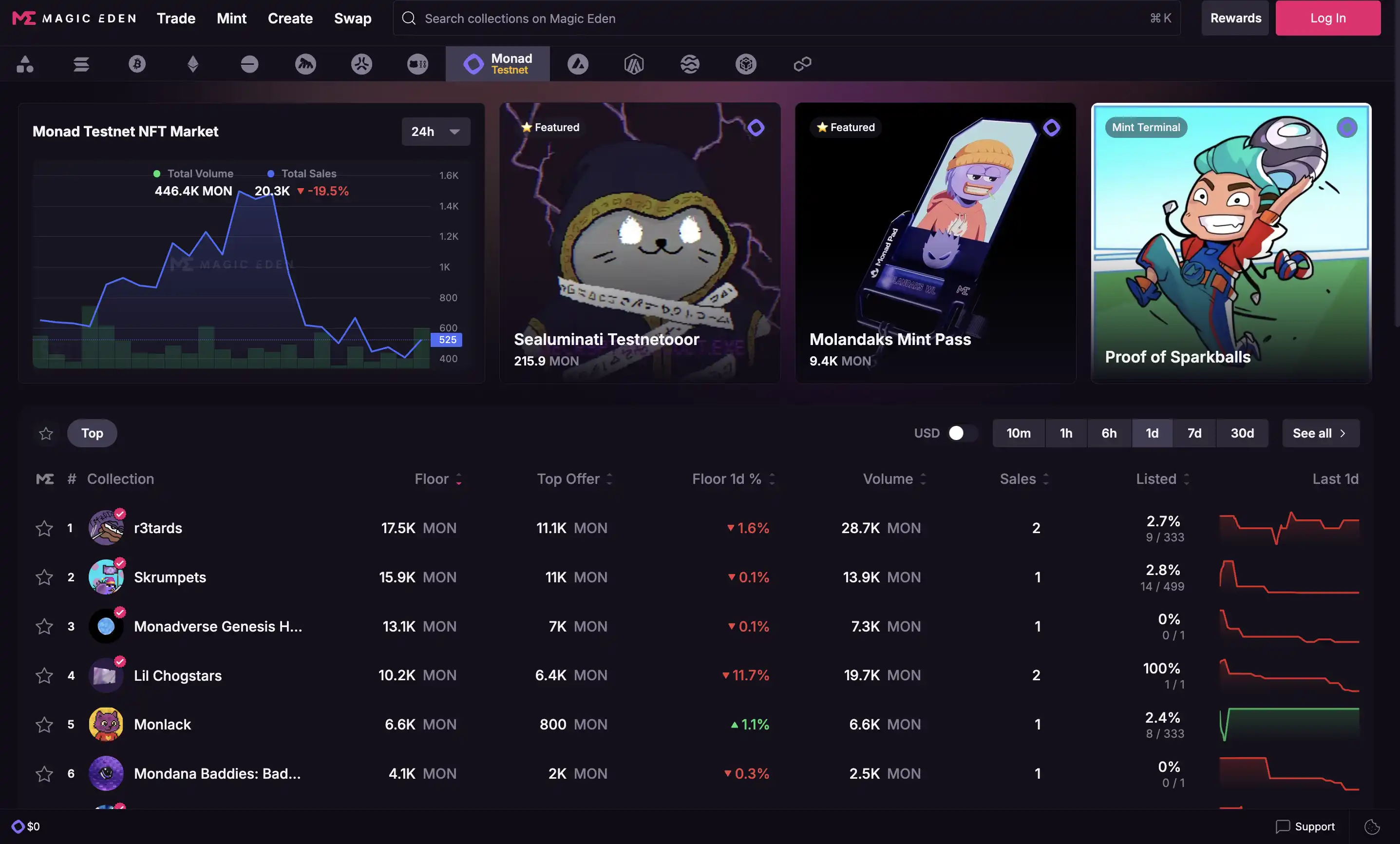

A typical example is Monad; although the mainnet has not yet launched, there are already a large number of NFT assets on the testnet, which are widely traded on Magic Eden, appearing almost indistinguishable from real mainnet assets.

Testing tokens, which initially give the impression of being "worthless," actually present an arbitrage opportunity; opportunities in the crypto space are truly everywhere.

This is a new cycle, a new hunting ground, and new survival rules.

The world of profit-seeking has never lacked smart people. The real difference lies not in the quality of the environment but in who can adapt to changes the fastest.

In this round of market changes, project teams have tightened airdrops, liquidity has shifted to trading platforms, and traditional arbitrage paths have been continuously compressed. The era when one could easily profit from airdrops by burning gas and brushing interactions is long gone. In the new cycle, those who can truly survive are often not the fastest runners but those who can clearly see the situation and actively adapt.

After all, in the crypto space, survival and evolution have always been the top abilities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。