In the seemingly bustling "exchange subsidy war," the more points accumulate and the higher the thresholds, the more ordinary users appear to be mere background figures.

Written by: Scof, ChainCatcher

Recently, the takeaway market has suddenly become lively.

With JD.com making moves, Alibaba entering the fray, and Meituan responding, a three-way melee has begun. We can see "free milk tea," "hundred billion subsidies," and "30-minute delivery" rising and falling, but the underlying logic is not complicated: by binding users through high-frequency consumption scenarios (takeaway), they accumulate a foundation for their instant retail business.

This is very similar to the fierce competition among exchanges in the crypto space. Binance's Alpha points system is the most typical example, with point-based new listings, airdrop rankings, and trading rankings—put another way, it is a "subsidy war" in the digital asset field. The goal is not to compete for new users, but to vie for users' attention, trading behavior, and loyalty.

Other exchanges are not idle either. Bybit quickly launched a staking version of the Alpha points airdrop, mirroring Binance's approach, attempting to capture the same group of highly active users; OKX announced a million-dollar airdrop plan.

This is a typical game of existing stock.

Alpha points reach new heights, ordinary users are marginalized

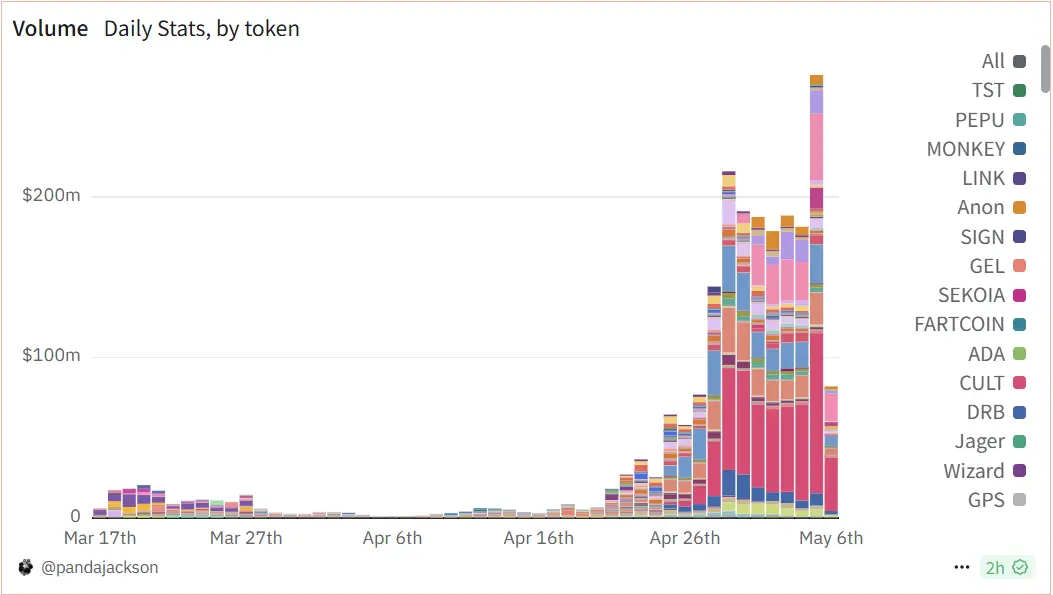

The popularity of the Alpha sector continues to rise. On May 5, Binance Alpha's trading volume surpassed $274 million, with daily transactions exceeding 1 million for the first time. The key to this surge in data is the continuously rising threshold for "Alpha points."

Data source: Dune, @Pandajackson

In the initial stage, 50 points might have been enough to qualify for an airdrop. But the latest round has seen the score line soar to 142 points, requiring nearly 10 points daily over the past 15 days, corresponding to a trading volume of $1,024. Many ordinary players feel caught off guard.

Crypto KOL Xia Xueyi stated that he lost over $10,000 in a month and still "doesn't qualify." Under this mechanism, only continuously active, high-frequency trading whales and studios can maintain competitive points.

Meanwhile, although Binance has introduced consolation prizes like "UID last digit X lucky airdrop," the actual appeal to true retail users is limited. A large amount of subsidies ultimately flows to institutional users and score-farming teams.

This is very similar to the "wool party" in the takeaway war: they flock to new platforms for short-term subsidies, but once the price advantage disappears, most will return to their familiar and trusted platforms.

Binance's open strategy: designing rules, generating traffic

Looking at the strategy behind the Alpha points system: the Stakestone project allocated 5% of tokens for IDO, 1.5% for main site airdrops, and 3.93% to reward old users, totaling 10.43% of tokens. These tokens, priced at $0.06, could create over $5 million in potential selling pressure, and at their peak, even approach $9 million.

However, the project team did not choose to sell immediately but instead guided trading volume and maintained price stability to ultimately meet the "listing requirements" on Binance's main site. This is not a simple market behavior but a "cooperative game with algorithms."

In other words, exchanges do not wait for projects to grow naturally; they design a set of "if you want to go live, you must dance to my rhythm" admission system. Alpha points filter users, trading volume filters project parties, and price performance filters market value management capabilities.

Ultimately completing the closed loop: traffic comes in, data looks good, trading volume surges, and the platform wins.

Who are the winners? Who can hold on until the end?

The war between exchanges is actually similar to that of takeaway platforms: burning money to attract users, subsidizing to seize the market, and creating traffic peaks. But for users, what truly remains after the excitement? Many are struggling to earn points in the Alpha points system, losing money to qualify, only to find they missed out on airdrops and new listings, merely adding bricks to the platform's data.

Platforms can repeatedly change their strategies, but users' choices are always grounded in reality. Many will switch platforms for short-term subsidies, but once the price advantage disappears and the rules become complicated, most will return to their familiar place. Subsidies can only bring traffic; they cannot retain trust.

This also raises a practical question: Alpha is defined as a place to "incubate quality projects," but projects listed do not always perform ideally. Some projects start high and fall low, struggling to enter the spot market on Binance, viewed by users as "temporary project zones." Over time, will the frequent occurrence of low-quality listings damage Alpha's reputation and even affect users' confidence in the entire Binance listing system?

From a broader perspective, does the crypto world still have an "incremental market"? If everything has turned into a battle for existing stock, what will ultimately measure the value of users?

In this era of stock games, exchanges need users' loyalty and behavior; users need the platform's trust and long-term returns. If this relationship begins to tilt, that would be a greater cost than missing an airdrop.

The takeaway war at least brings a cup of "free milk tea," so many users hope the subsidy battle can last a bit longer to save some money. Similarly, seeing Binance, OKX, and Bybit take turns competing for users, users also hope other exchanges can ramp up their efforts—don't just make users "work for points," but truly benefit them, turning competition into a positive game for users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。