After this halving, Bitcoin has only risen by about 46%, and the surge that the market anticipated post-halving has not occurred.

Author: Green But Red

Translated by: Deep Tide TechFlow

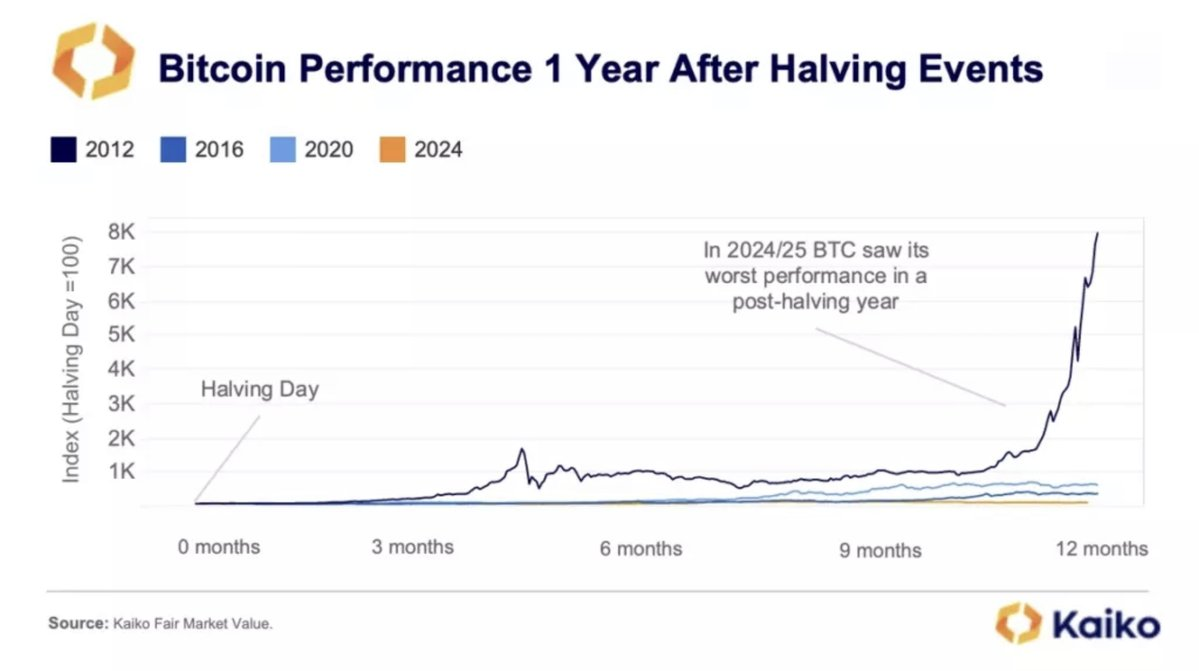

A full year after Bitcoin's fourth halving, its performance has been surprising: the price of Bitcoin has only increased by 46%, and it is currently about 10% lower than its historical peak. This is the weakest performance following any halving to date.

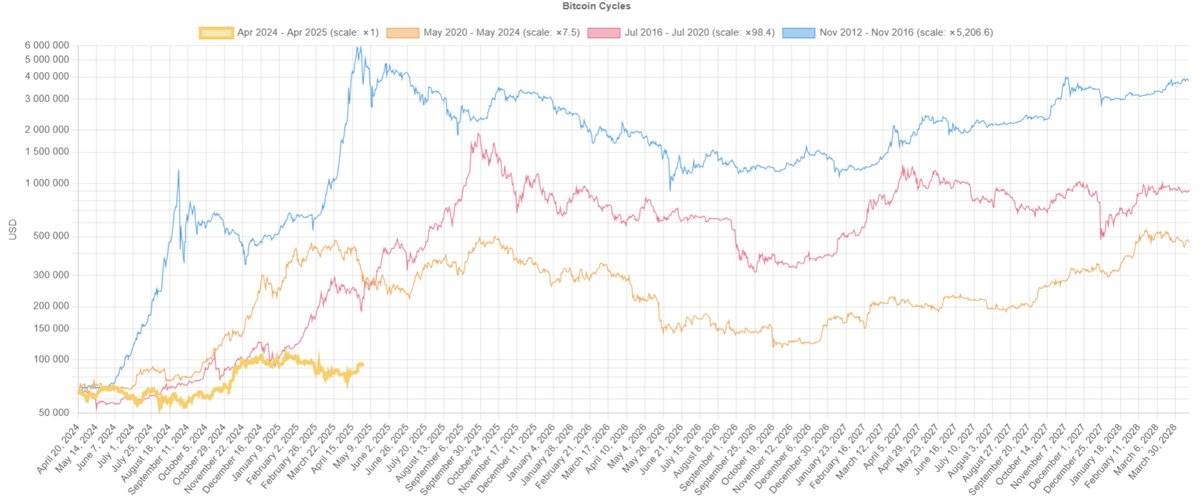

Historical Cycles Compared to the Present

Looking back at history, after the halving in 2012, Bitcoin's price skyrocketed by 7000%; the halvings in 2016 and 2020 brought increases of 291% and 541%, respectively. However, this time, Bitcoin has only risen by about 46% post-halving, and the anticipated surge has not materialized.

Market Maturity and Macroeconomic Influences

One reason for this lackluster performance is the increased uncertainty in the macroeconomic environment. Global tensions and new tariff policies have made investors more cautious. The Economic Policy Uncertainty Index (EPU) is significantly higher than in previous cycles, reflecting a market that is increasingly risk-averse.

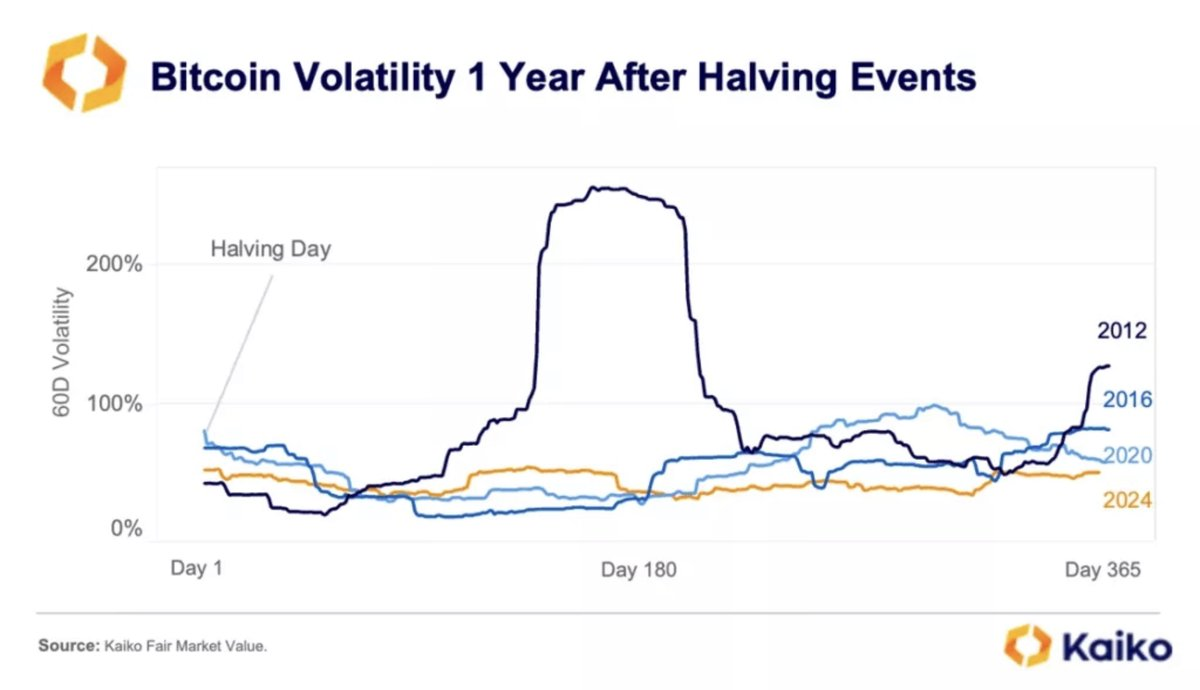

At the same time, the Bitcoin market is gradually maturing. Compared to earlier days, its volatility has significantly decreased, and the profit potential for long-term holders is no longer as pronounced. Nowadays, driving a significant price increase requires more capital, and the market's sensitivity to price changes has weakened.

Institutionalization and Changing Market Structure

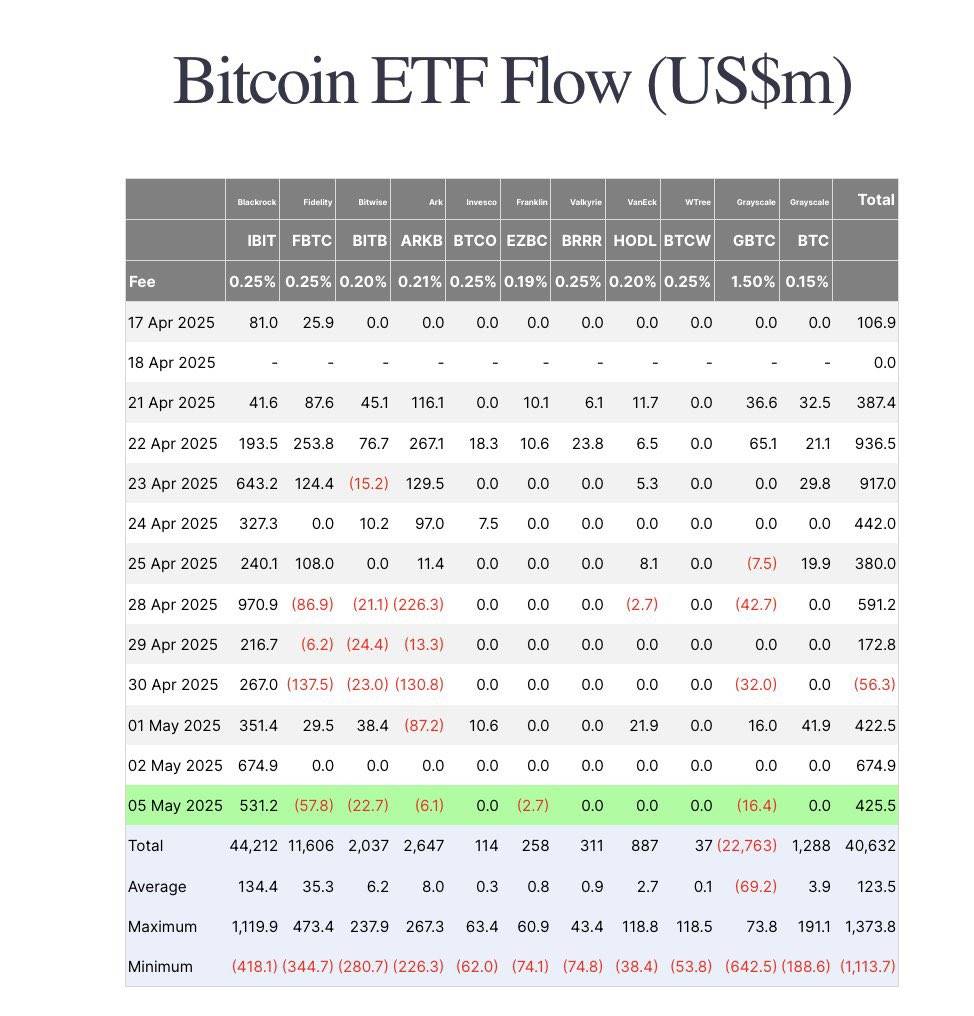

Institutional investors are playing a larger role than ever before. The rise of spot ETFs and corporate investments has made the market more stable but also more sensitive to macro trends.

Institutional investors buy in when prices drop and take profits during rebounds, thereby smoothing out Bitcoin's price volatility. For example, in early May 2025, Bitcoin ETFs attracted $425.5 million in inflows, indicating ongoing institutional interest in Bitcoin.

Mining and Production Costs

Bitcoin mining still has profit potential. The average cost to mine one Bitcoin is currently about $49,887. The pace of hardware efficiency improvements has slowed, allowing miners to use existing equipment for longer periods, thus reducing the pressure to frequently upgrade.

Outlook and Predictions

Experts have differing views on future developments. Some predict that Bitcoin may experience a period of consolidation or adjustment before returning to a sustainable bull market—this may only happen after breaking through the $100,000 mark. Others are more optimistic, expecting Bitcoin's price to reach between $120,000 and $200,000 by the end of 2025.

Although the explosive growth seen in past cycles has not materialized, Bitcoin is entering a new phase of more stable and sustainable growth, which may represent a healthier long-term development path.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。