Author: Frank, PANews

Recently, a financial technology company named Antalpha submitted its prospectus to Nasdaq, planning to go public with the code "ANTA." Antalpha is a financial solutions provider in the Bitcoin mining sector. However, the close ties disclosed in its prospectus with mining giant Bitmain, as well as the intricate connections with Bitmain co-founder Jihan Wu, make this IPO worthy of further investigation. Beyond the surface of a fintech company going public, is this a key step in Bitmain's expansion of its financial landscape?

The "Financial Lifeline" Behind Bitcoin Mining

Founded in 2022, Antalpha provides little information about itself on its official website, only emphasizing its strategic partnership with Bitmain. According to its prospectus and public information, Antalpha's core business is to provide financing, technology, and risk management solutions for digital asset institutions, especially Bitcoin miners. Its goal is to help miners scale their operations and better manage the impacts of Bitcoin price volatility through financing solutions, such as supporting miners' "HODLing" strategies.

Antalpha's core products and services are primarily realized through its technology platform, Antalpha Prime. This platform allows clients to initiate and manage their digital asset loans and monitor collateral positions in near real-time. Its main sources of revenue include two aspects.

One is supply chain financing, which is reflected as "technology financing fees," serving as the main revenue pillar for Antalpha. This includes: mining machine loans, providing financing for the purchase of Bitcoin mining machines (usually pre-owned machines from Bitmain) with the purchased machines as collateral. Hashrate loans: providing financing for mining-related operational costs (such as hosting fees), with the collateral typically being mined Bitcoin. According to data disclosed by Antalpha, as of December 31, 2024, it has facilitated a total of $2.8 billion in loans, with approximately 97% of supply chain loan clients' loans being BTC-backed.

In addition to directly providing financing loans, another major business for Antalpha is Bitcoin loan matching services, reflected as "technology platform fees." Antalpha provides Bitcoin margin loan services for its non-U.S. clients through the Antalpha Prime platform. Notably, the funding for these loans has historically been primarily provided by its affiliate, Northstar. In this model, Antalpha acts as a technology and service provider, earning platform fees without bearing the credit risk of these loans.

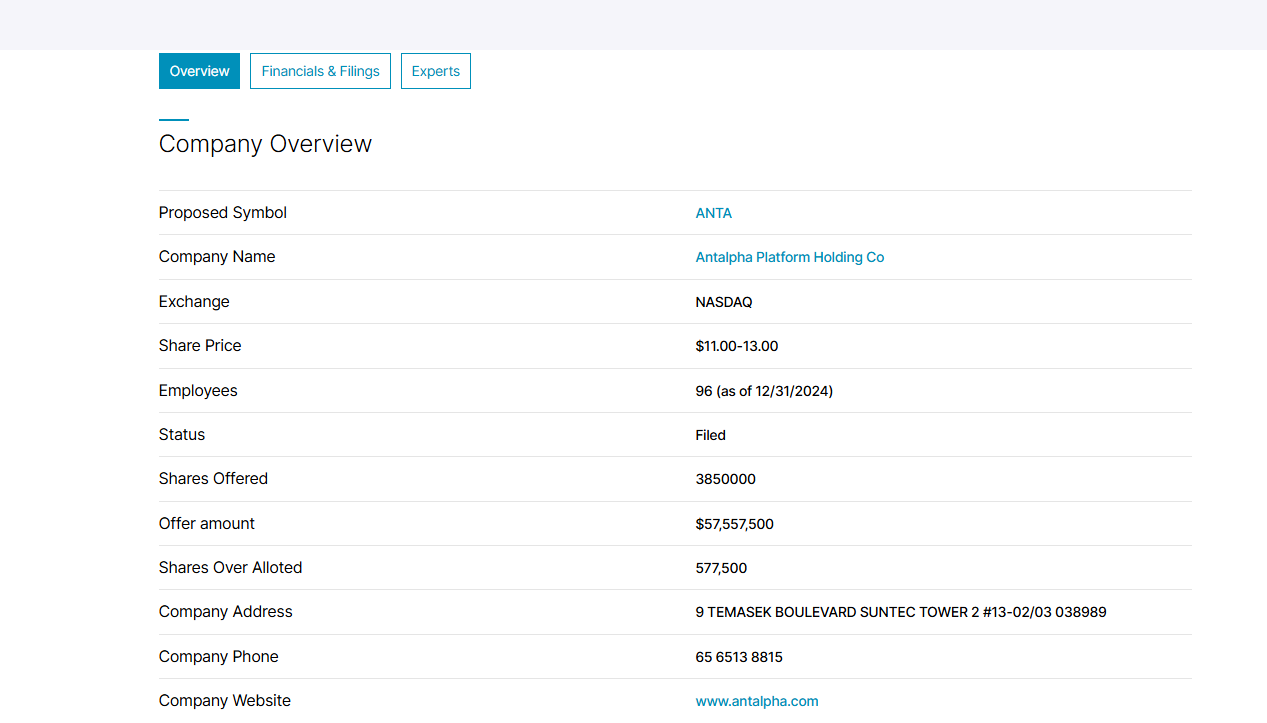

Financial data shows that Antalpha's total revenue reached $47.45 million in the most recent fiscal year (ending December 31, 2024), a year-on-year increase of 321%. Among this, technology financing fees amounted to $38.7 million, up 274% year-on-year; technology platform fees reached $8.8 million, soaring 859% year-on-year. The company also successfully turned a profit, achieving a net profit of $4.4 million, compared to a net loss of $6.6 million in the previous fiscal year.

In terms of loan scale, as of December 31, 2024, Antalpha's total loan book reached $1.6 billion. The supply chain loan portfolio (mining machine loans and hashrate loans) issued by Antalpha grew from $344 million at the end of 2023 to $428.9 million, a year-on-year increase of 25%. Meanwhile, the scale of Bitcoin loans serviced for Northstar surged from $220.8 million at the end of 2023 to $1.1987 billion, a staggering year-on-year increase of 443%. Geographically, its loan business is highly concentrated in Asia, with 77.4% of loans (approximately $1.26 billion) directed to Asian clients by the end of 2024.

Bitmain's "Financial Special Forces"

Antalpha does not shy away from its close relationship with Bitmain in its prospectus, referring to itself as "Bitmain's primary lending partner." The two parties have even signed a memorandum of understanding, agreeing that Bitmain will continue to utilize Antalpha as its financing partner, with both parties recommending clients to each other. Furthermore, as long as Antalpha offers competitive terms, Bitmain grants Antalpha the right of first refusal to serve its financing clients.

This right of first refusal means that Antalpha can access Bitmain's vast customer base for mining machine purchases, significantly reducing customer acquisition costs and ensuring a steady flow of business. The prospectus also mentions that Antalpha collaborates closely with Bitmain at all levels, from sales to operations to senior management, making it an indispensable part of Bitmain's sales and business initiation processes.

However, the connection between Antalpha and Bitmain goes beyond mere business cooperation. A deeper association exists with Bitmain co-founder Jihan Wu.

The prospectus outlines the complex relationship between Antalpha and Northstar. Historically, Northstar has provided nearly all the funding for loans issued by Antalpha and offers Bitcoin margin loans to Antalpha's non-U.S. clients through the Antalpha Prime platform. Crucially, Antalpha and Northstar were initially sister companies under a parent company ultimately controlled by Jihan Wu.

After the "2024 restructuring," Antalpha was spun off and transferred to the current listed entity, Antalpha Platform Holdings. Subsequently, the original parent company disposed of all its equity in Northstar. Currently, Northstar is owned by an irrevocable trust, with Jihan Wu as the trustee and beneficiary, managed by a professional trust company. The prospectus emphasizes that Jihan Wu does not participate in the operations of Northstar.

Despite the restructuring, Northstar remains an important funding provider for Antalpha's Bitcoin loan services. As the ultimate beneficiary of the Northstar trust, Jihan Wu's economic interests are still indirectly linked to Northstar's business performance and even Antalpha's business scale.

Therefore, although legally, Antalpha Platform Holdings may have distanced itself from Jihan Wu's direct control, from the perspectives of business logic, capital flow, and strategic synergy, Antalpha can still be viewed as an important part of Bitmain's financial landscape. It resembles a carefully designed and spun-off "financial special forces," focused on providing financial ammunition for Bitmain's mining empire.

Bitmain's Strategic Piece in the Post-Halving Era

The deeper strategic significance of Antalpha's IPO is closely tied to the industry environment and Bitmain's strategic adjustments following the Bitcoin halving in 2024.

The Bitcoin halving in April 2024 has, as expected, compressed miners' block rewards, posing a direct challenge to the profitability of the entire mining industry. For Bitmain, this means that market demand for its products will increasingly focus on high efficiency and low power consumption. Over the past year, Bitmain has accelerated the launch of a new generation of efficient mining machines represented by the Antminer S21 series to solidify its leadership position in the mining hardware sector. It has signed procurement agreements for the S21 series mining machines with partners such as BitFuFu and Hut8. By continuing to deepen cooperation with large mining farms, Bitmain strives to ensure substantial orders for its latest mining machines.

On one hand, the mining industry has become increasingly competitive post-halving, and miners must enhance the performance of their mining machines to maintain profitability, which significantly raises operational costs. This poses a potential business growth risk for Bitmain in the future. On the other hand, as Bitcoin prices rise, more external companies, including publicly listed companies, are entering the mining industry, presenting new opportunities for Bitmain, although these opportunities also depend on fluctuations in Bitcoin prices. Therefore, Antalpha provides loan support for Bitmain's customers purchasing new generation mining machines like the S21. This not only directly boosts Bitmain's sales performance but also indirectly helps the mining community navigate the capital challenges arising from equipment upgrades.

Antalpha's IPO has also attracted some well-known investors, including Tether, which expressed interest in subscribing to $25 million of Antalpha's common stock at the offering price. Based on a midpoint offering price of $12 per share, this investment would account for approximately 54.1% of the total number of shares in the base offering, equivalent to about 2.08 million shares. According to the prospectus, Antalpha's loan business is typically settled in USDT, and this investment is another move in Tether's multi-faceted strategy, although the prospectus also states that this intention "is not a binding purchase agreement or commitment."

Additionally, Antalpha mentioned in its prospectus plans to explore financing solutions for GPUs needed in the AI field. For Bitmain, Antalpha's expansion capabilities also serve as a barbell strategy to mitigate the risks of uncertainty in the crypto industry. If Antalpha can succeed in new areas like AI GPU financing, its own growth will indirectly enhance the resilience of Bitmain's entire ecosystem.

Thus, Antalpha's IPO is not merely a simple listing of a fintech company; it is more like a crucial step for Bitmain in the post-halving era to consolidate its mining empire, optimize its financial tools, and reserve strength for its long-term strategic development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。