Author: Botanix Labs

Original link: https://botanixlabs.xyz/en/blog/the-current-landscape-of-bitcoin-scaling

During the development of Botanix, we constantly ask ourselves a question: Can systems built on Bitcoin truly be called sidechains or Layer 2 (L2)? This is a complex question because, from a technical perspective, Bitcoin cannot serve as a true L1 to support L2 like other ecosystems can, given its current capabilities. Typically, L2 relies on smart contracts deployed on the underlying layer to validate proofs. For example, in the Ethereum ecosystem, L2 validation is performed by deterministic functions in smart contracts, executed by all Ethereum nodes when processing transactions.

The situation with Bitcoin is both simpler and more complex. Discussions about L2 on Bitcoin are often confusing. Unlike Ethereum, which natively supports Turing completeness and expressiveness, Bitcoin's current capabilities are extremely limited, and the nuances of what is technically feasible versus what is not are abundant. Because of this, systems built on Bitcoin do not strictly possess L2 or sidechain functionalities. So why do we prefer to call them "Bitcoin Chains" rather than extensions or L2? The reason is that these chains built on Bitcoin typically have independent operational logic and build their own ecosystems around it.

Bitcoin does not support smart contracts like Ethereum does. Any complex logic must be implemented through structures built on top of it. Therefore, Bitcoin itself cannot directly validate proofs or maintain the state of smart contracts. Most types of proofs are too large to be included on-chain—Bitcoin transactions only allow for 80 bytes of arbitrary data. Solutions like Starkware's m31 are highly specialized and closed. Even if you manage to publish some proof or state update to Bitcoin, the process resembles optimistic rollups. However, waiting an entire week to resolve fraud proofs is neither realistic nor acceptable; relying on third-party bridges introduces delays and trust assumptions, both of which are not ideal in the native Bitcoin environment.

Interactions with Bitcoin are limited to unspent transaction outputs (UTXO) with ScriptPubKey and BTC transfer transactions. The OPRETURN instruction can only carry 80 bytes of data, which cannot support interactions with complex data structures. Because of these limitations, it is difficult to give Bitcoin full L1 support for L2 functionalities unless there are significant protocol changes (such as a hard fork). Such modifications not only require a high level of community consensus but may also undermine Bitcoin's uniqueness and value proposition as an asset. For example, proposals to introduce new instructions like OPCAT (such as CatVM) have yet to achieve widespread consensus. Even with consensus, a Bitcoin Improvement Proposal (BIP) often takes years from proposal to activation.

For this reason, Botanix's goal is to build based on "current Bitcoin" rather than trying to forcibly transform it into L1 or push for radical protocol changes. This path is possible because we have adopted Spiderchain technology and a network composed of coordinators. So, what stage has the ecosystem currently being built on Bitcoin reached?

Background: The Emerging Landscape of Bitcoin Chains (L2)

Despite the objective existence of the above limitations, most projects still prefer to call themselves "L2," using this term as a generic label. One of the earliest projects to claim itself as Bitcoin L2 is Stacks. Although Stacks anchors data on Bitcoin and interacts with BTC, it is essentially an independent blockchain with its own consensus mechanism. Another example is BounceBit, which is classified as Bitcoin L2 because it uses BTC in its consensus mechanism (along with its native token). However, this is not entirely accurate. Architecturally, it is closer to a restaking model, operating on its own chain, with Bitcoin's role limited to indirect participation.

However, the vision of making Bitcoin "come alive"—transforming it from merely a value storage tool into an asset that can "do more things"—has long attracted the attention of many developers. With the new super cycle that began in 2022, this vision has become increasingly important. While Ethereum has seen a roughly 4x increase from bottom to top in this cycle, Bitcoin, despite its slower and "heavier" movements, has increased by 6x. This dynamic is quite interesting, isn't it? It further reinforces Bitcoin's position as the dominant asset in the Web3 world.

Source: https://app.artemis.xyz/

From value utilization metrics like Total Value Locked (TVL)—which indirectly reflects the degree of use of the underlying asset in the ecosystem—the comparison between Bitcoin and other networks becomes more pronounced. TVL represents the value-carrying capacity of an ecosystem, including both the applications built on top and the utilization of the underlying asset in L2 running on that base chain.

Currently, Bitcoin's TVL in decentralized applications is only $5.5 billion, while its Fully Diluted Valuation (FDV) is an astonishing $1.74 trillion. This means that only a very small portion of Bitcoin's value is truly realized on-chain. In contrast, Ethereum has a TVL of $48.9 billion in DeFi applications and staking infrastructure (such as Lido, EigenLayer, Rocket Pool, etc.), which is a significant proportion of its $228 billion FDV actively participating in ecosystem operations.

The gap is clear in comparison. Solana's TVL is also at a relatively high level compared to its FDV—$8.25 billion versus $76 billion. You can see the difference! Solana is $8.25 billion vs. $76 billion, while Bitcoin is $5.8 billion vs. a staggering $1.73 trillion valuation! This reflects the enormous growth potential of the Bitcoin ecosystem in terms of value utilization.

Public Chain

Fully Diluted Valuation (FDV)

Total Value Locked (TVL)

TVL/FDV Ratio

Ethereum

$228 billion

$48.9 billion

≈ 21.45%

Solana

$76 billion

$8.25 billion

≈ 10.86%

Bitcoin

$1.74 trillion

$5.8 billion

≈ 0.33%

Source: DefiLlama, Coinmarketcap

It is indeed a very stark contrast, isn't it? This highlights the significant upside potential in the Bitcoin ecosystem—this very potential is what attracts protocol developers like Botanix to build projects on Bitcoin.

At the same time, there are factors that, while driving technological innovations like Botanix, may conversely slow down the overall development of the Bitcoin ecosystem. This "paradox" is reflected in the typical mindset of BTC holders: they are accustomed to storing assets in cold wallets for the long term rather than frequently interacting with protocols like Ethereum's DeFi users. Compared to Ethereum users who actively participate in staking, lending, liquidity mining, and other activities, BTC holders place greater emphasis on asset security, self-management, and are highly committed to Bitcoin's fundamental values.

This is also one of the reasons why many "synthetic BTC" or "cross-chain BTC" versions based on non-Bitcoin native chains have struggled to gain mainstream adoption. Bitcoin users generally lack trust in ecosystems on non-native chains, believing that they do not truly "anchor" the Bitcoin network.

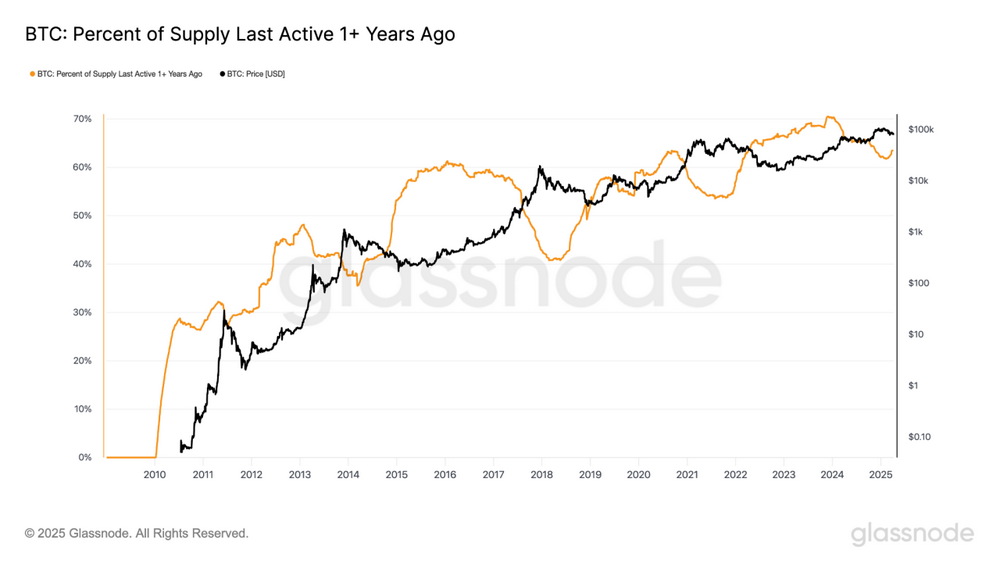

The intrinsic value of BTC is primarily reflected in its "long-term value storage" function. Data shows that currently, about 60% to 70% of Bitcoin has not undergone any on-chain transfers in the past year, and this proportion continues to rise, reflecting the solid presence of long-term holders (HODLers). In November 2024, this proportion reached a new high of 70.54%, although it slightly decreased during the subsequent rise in BTC prices.

Source: https://studio.glassnode.com/charts/supply.ActiveMore1YPercent?a=BTC&category=&zoom=all

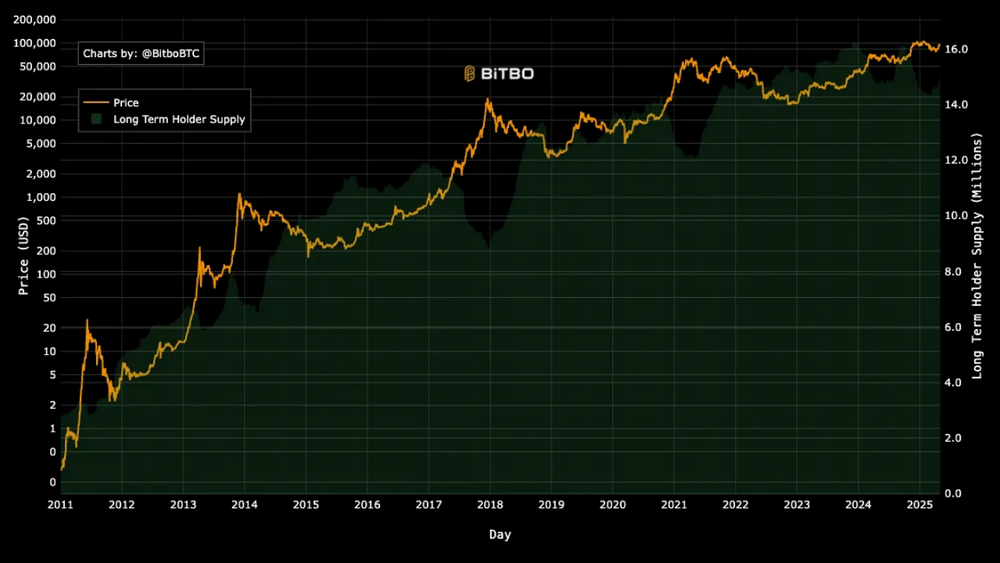

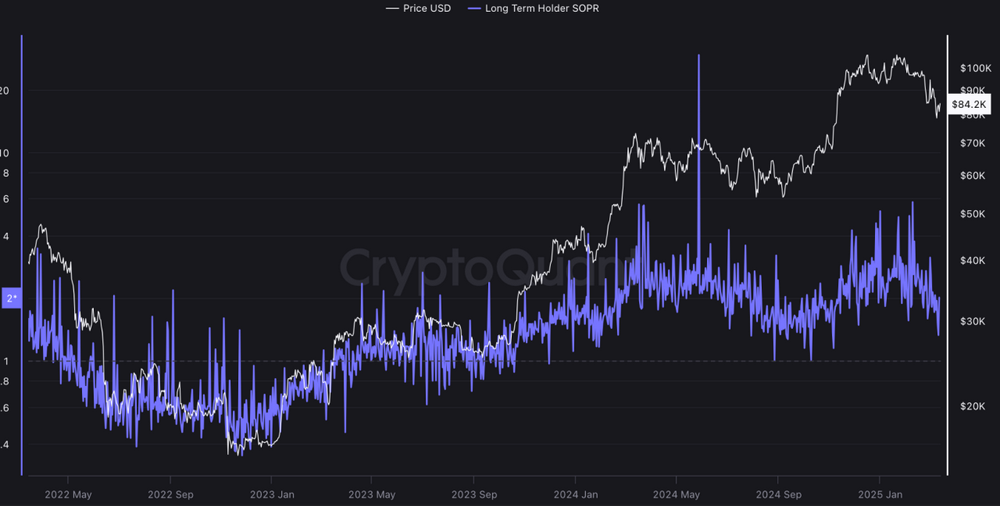

Additionally, the global trend charts for Long-Term Holder Supply and Spent Output Profit Ratio (SOPR) also show a continuous growth trend. This indicates that Bitcoin is attracting more and more long-term holders, further solidifying BTC's value as a "long-term wealth storage tool." The root of this trend lies in the fact that the Bitcoin blockchain is currently the most decentralized, robust, trustless, and censorship-resistant network, and it is these characteristics that ensure BTC becomes one of the safest assets globally.

Source: https://charts.bitbo.io/long-term-holder-supply/

Source: https://charts.bitbo.io/long-term-holder-supply/

From another perspective, these dynamic changes also suggest that new Bitcoin holders may begin to view BTC as a "liquid asset" rather than merely a store of value. But the question arises: Are these users willing to deal with packaged assets (like WBTC), or do they still prefer to use "native Bitcoin" more directly? To answer this question, we need to look at the current development trends of the Bitcoin Chains (L2) ecosystem in the aforementioned context.

The Bitcoin Chains (L2) Ecosystem is Taking Off

Initially, the ecosystem on Bitcoin developed long before Ethereum's history of scaling through Layer 2. The Lightning Network appeared three years before Plasma and five years before the earliest rollups, making progress in decentralized payment scalability. However, it inherited many design limitations, such as interactivity (users must be online to receive payments), payment routing complexity in multi-party scenarios, and complex liquidity requirements for deposits and withdrawals.

Some issues were alleviated by another Layer 2 protocol called ARK. ARK introduced ASP (Ark Service Providers) to settle payments privately between users while still allowing for trustless redemption of Bitcoin on the main chain. However, due to the lack of a covenant mechanism, ARK still faces interactivity limitations, and its high demand for capital also makes the protocol inefficient.

Previously, these Bitcoin-based chains had their uses in payment scenarios but still faced scalability bottlenecks and made almost no attempts to add additional functionalities to Bitcoin. Subsequently, more complex and functional designs emerged. Meanwhile, some intricate solutions were also developing in parallel: Rootstock was launched in 2015, and Stacks can be traced back to 2013. However, their development paths have been long.

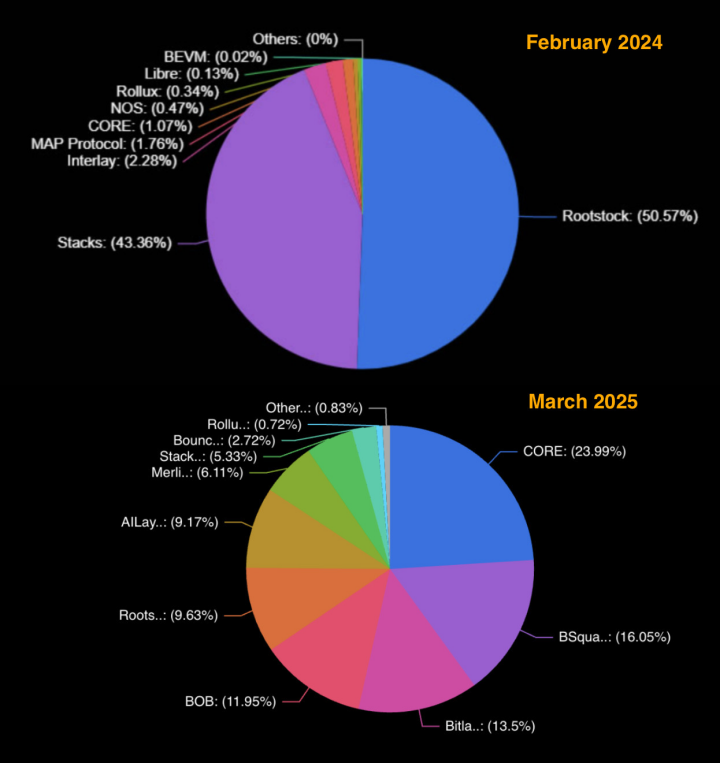

Until two years ago, Bitcoin's presence in decentralized applications was still weak. At the beginning of 2023, only a few hundred million dollars of BTC were deployed in DeFi—this was just a drop in the bucket compared to Bitcoin's massive market capitalization. But by 2024, everything changed. The earliest projects attempting to introduce programmability to Bitcoin included Rootstock and Stacks. According to data from DefiLlama, in the first half of 2024, Rootstock held approximately $294 million in BTC, while Stacks held about $289 million, totaling $570 million. In 2024, with the entry of new players, the landscape of the Bitcoin ecosystem underwent significant adjustments. In February 2024, Rootstock and Stacks accounted for over 94% of the total locked value (TVL), but by March 2025, this landscape had diversified significantly.

Source: DefiLlama data, en.coin-turk.com

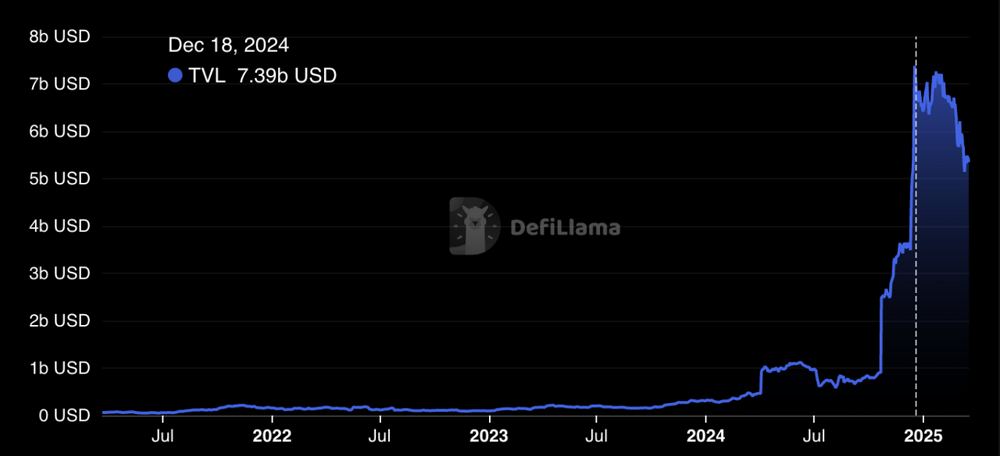

Against this backdrop, by the end of 2024, Bitcoin's total on-chain locked value (TVL) surged over 20 times—from $307 million in January 2024 to $6.5 billion in December, skyrocketing over 2000% within a year. This was not just growth; it marked a true explosion of Bitcoin in the on-chain finance sector. TVL began to rise in October 2024 and peaked at $7.39 billion in December. Why did all this happen?

Source: DefiLlama

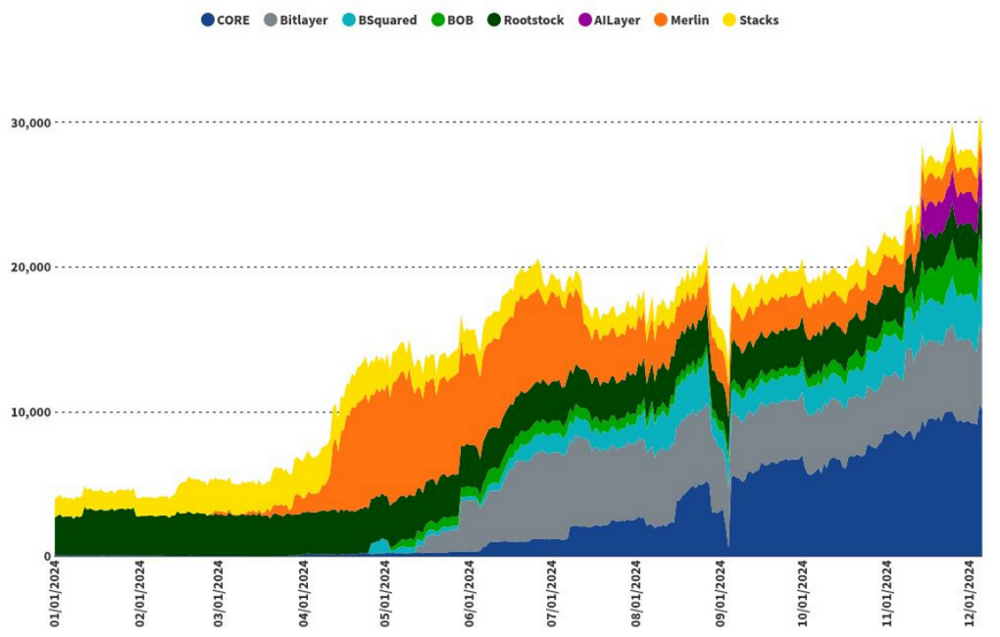

In 2024 alone, the growth of the Bitcoin ecosystem reached 600%, with the total locked BTC surpassing 30,000 coins, equivalent to nearly $3 billion in assets actively used for various scaling solutions. The message is clear—Bitcoin is evolving. It is no longer just a means of value storage; it is gradually becoming an indispensable part of the on-chain economy.

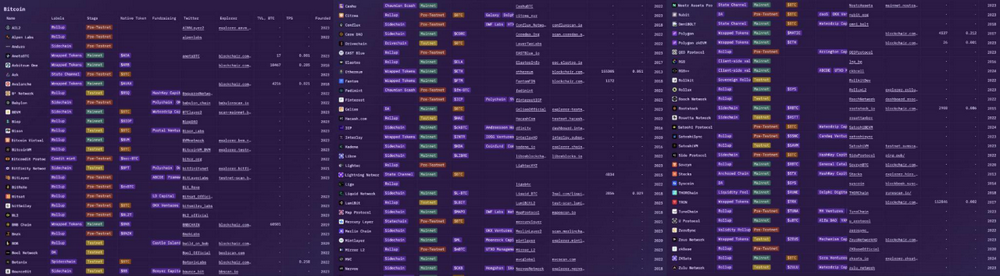

At the same time, the market positions of Rootstock and Stacks began to decline, gradually being replaced by more advanced and functional protocols. Bitcoin's programmable layer solutions rapidly exploded, ushering Bitcoin DeFi into a new era. According to data from L2Watch, there are now over 75 Bitcoin-based projects in development, covering EVM-compatible chains, rollup solutions, and newly designed sidechains. The common goal of these projects is singular: to unlock Bitcoin's vast liquidity and integrate it into a broader DeFi ecosystem.

Source: L2.Watch data

With the diversification of protocols, the capacity of the Bitcoin ecosystem has also grown. This field has come a long way—from the initial network overlay layers used for payments (like Lightning) to the complex chain ecosystems that now offer various capabilities. But the key challenge is not just to build chains that provide new possibilities for Bitcoin users; it is also about how to retain Bitcoin's native characteristics and security in the process. This is far more complex than simply establishing cross-chain bridges or synthetic assets through minting and burning mechanisms. Botanix addresses this issue through Spiderchain technology and a network of coordinators, maintaining a direct connection and continuity with the Bitcoin mainnet.

The evolution of these technologies is pushing Bitcoin from "holding (HODL)" to "yield": entering DeFi and real-world asset (RWA) scenarios. Botanix's goal is to achieve this "intelligent use of Bitcoin" without straying from the Bitcoin main chain itself. Bitcoin chain solutions equipped with smart contracts now support on-chain lending, trading, and yield generation, gradually replicating Ethereum's DeFi system. This allows BTC holders to earn yields or use BTC as collateral without relying on centralized custodians. As VanEck pointed out, such chains and abstract technologies will transform Bitcoin from a passive store of value into an active participant in decentralized ecosystems, further unlocking liquidity and driving cross-chain innovation.

Conclusion

Therefore, Bitcoin is no longer just "digital gold" stored in cold wallets. We are standing at the starting point of a new era for Bitcoin. An era where Bitcoin's liquidity, security, and trustlessness collectively reshape the decentralized finance landscape.

And the most exciting part is—this is just the beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。