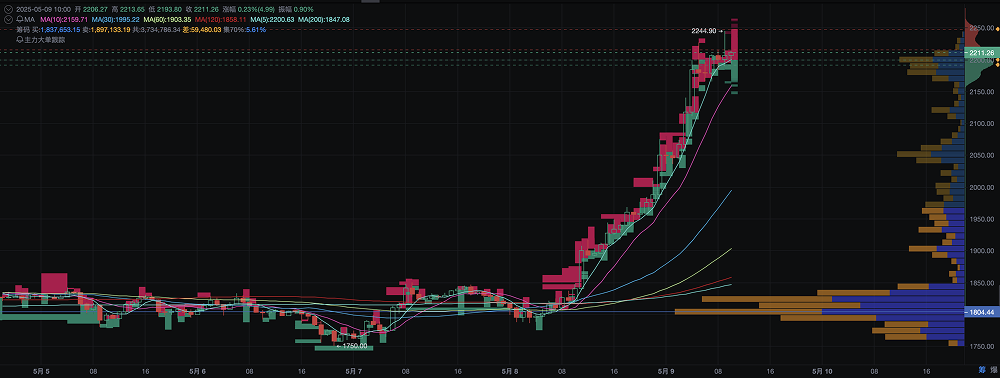

On the evening of May 8, 2025, Bitcoin (BTC) broke through the $104,000 mark, with a 24-hour increase of 6.29%; Ethereum (ETH) surged by 22.15%, returning above $2,200 and reaching a recent high. Market sentiment quickly shifted to greed, with the Fear and Greed Index soaring to 65, and calls on social media for "BTC to hit $150,000" and "ETH to return to $3,000" echoed throughout. However, this surge was not without its signs, as it was directly stimulated by signals from Trump's policies and profound changes in the market's microstructure.

Trump's "Call to Action" Effect: Tariff Agreement and Optimistic Policy Expectations

In the early hours of May 8, U.S. President Trump posted multiple updates on his self-created social platform Truth Social and X platform, announcing a tariff agreement with a major country and stating that this move would "reshape the global trade landscape, benefiting U.S. assets." At 22:00 Beijing time, Trump further stated: "Now is an excellent time to buy stocks and crypto assets; America is about to enter a golden age!" This statement quickly ignited market sentiment, with BTC rising nearly 3% within an hour of the announcement, and ETH surging over 10% in the following hours.

Trump's adjustment of tariff policies was the core catalyst for this surge. Since the beginning of 2025, the high tariff policies promoted by the Trump administration had raised concerns about inflation and economic slowdown, causing crypto assets to plummet in late February due to the "tariff stick," with Bitcoin dropping below $80,000 at its lowest. However, the tariff agreement with the UK on May 8 was interpreted by the market as a "moderation" signal, alleviating investors' fears of escalating global trade frictions. X platform user @NFTbigbanana pointed out that the tariff agreement not only reduced macroeconomic uncertainty but also indirectly facilitated a "handshake" between Trump and the Federal Reserve, leading the market to expect that the Fed might cut interest rates ahead of schedule in 2026, further boosting liquidity expectations and driving up risk asset prices.

In addition, Trump's crypto-friendly stance continued to gain traction. On May 7, he nominated pro-crypto Paul Atkins as SEC chairman and stated that he would push for the "Stablecoin Regulatory Act" to pass in the congressional vote on the evening of May 8. These policy signals reinforced market confidence in the vision of the U.S. as a "crypto capital," accelerating institutional funds into BTC and ETH spot ETFs. Data from PANews showed that on May 7, BTC spot ETF net inflows reached $142.3 million, while ETH spot ETF saw slight outflows, but on the evening of the 8th, ETH long leverage positions surged, indicating that whales and large holders were buying the dip.

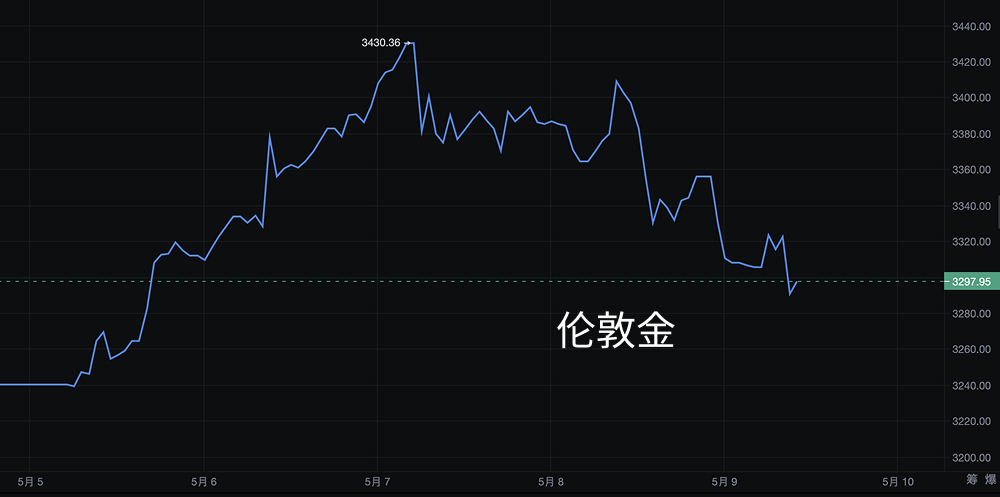

Gold Prices Under Pressure, BTC's "Digital Gold" Narrative Resurfaces

Meanwhile, gold prices saw a significant decline on May 8. Spot gold fell below $3,300 per ounce, down about 2% from the historical high of $3,370 on April 21. Market analysis suggested that the tariff agreement alleviated geopolitical risks, weakening gold's safe-haven demand, while the short-term strength of the U.S. dollar index further pressured gold prices. In stark contrast to gold's weakness, BTC's safe-haven attributes were amplified once again. X user @AlvaApp commented: "Trump's tariff policy has established BTC's 'digital gold' label, shifting safe-haven demand from gold to crypto assets."

Industrial Research previously pointed out that Bitcoin often experiences a substitution effect with safe-haven assets around the halving cycle. 2025 marks the rising window for BTC after its halving, combined with the impact of Trump's policies on traditional safe-haven assets, the "digital gold" narrative for BTC gained widespread market recognition. Data showed that on May 8, the number of active addresses on the BTC chain surged to 850,000, setting a new high for the year, indicating that both retail and institutional investors were accelerating their entry.

Ethereum's Catch-Up Logic: Technical Upgrades and Market Sentiment Resonance

Compared to BTC's steady rise, ETH's 22.15% surge was even more rapid, driven by both catch-up logic and fundamental support. On the morning of May 8, the Ethereum Pectra upgrade successfully went live, optimizing Layer 2 scalability and user experience while reducing Gas fees. This technical advancement boosted market confidence in the long-term development of the ETH ecosystem, especially in the DeFi and NFT sectors.

Additionally, ETH's surge was closely related to the market's microstructure. Coinglass data showed that on the evening of May 8, ETH long leverage positions surged, with a total liquidation amount of $650 million across the network within 24 hours, of which short positions accounted for nearly 90%. X user @cymm66 revealed that a whale purchased 7,000 ETH before the surge, accurately bottoming out and triggering a chain reaction. Compared to BTC's institution-driven rise, ETH's increase was more driven by retail FOMO sentiment and leveraged trading, posing a risk of overheating in the short term.

Risk Warning: Short-Term Overheating and Macroeconomic Uncertainty

Despite the strong upward momentum of BTC and ETH, the market is not without concerns. First, ETH's 22% single-day increase has triggered technical overbought signals, with the RSI index approaching 75, raising the risk of a short-term correction. Secondly, the Federal Reserve's FOMC meeting on May 8 did not clarify a timeline for interest rate cuts; while Trump's "call to action" boosted sentiment, it cannot mask the reality of inflationary pressures and a high-interest-rate environment. Goldman Sachs predicts that U.S. inflation could exceed 3.8% by the end of 2025, potentially forcing the Fed to maintain a tightening policy, posing challenges for the crypto market.

Moreover, there is uncertainty regarding the implementation of Trump's policies. The specific details of the tariff agreement have not been disclosed, and if subsequent negotiations encounter obstacles, it may reignite market risk aversion. On-chain data for BTC and ETH also indicates that some early investors are reducing their holdings at high levels, necessitating caution against the selling pressure from "profit-taking."

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。