Compiled by: Felix, PANews

On May 8, local time, the American cryptocurrency exchange Coinbase announced its first-quarter (Q1) financial report. Due to a cooling market following the post-election surge in the previous quarter, both revenue and net profit fell short of expectations.

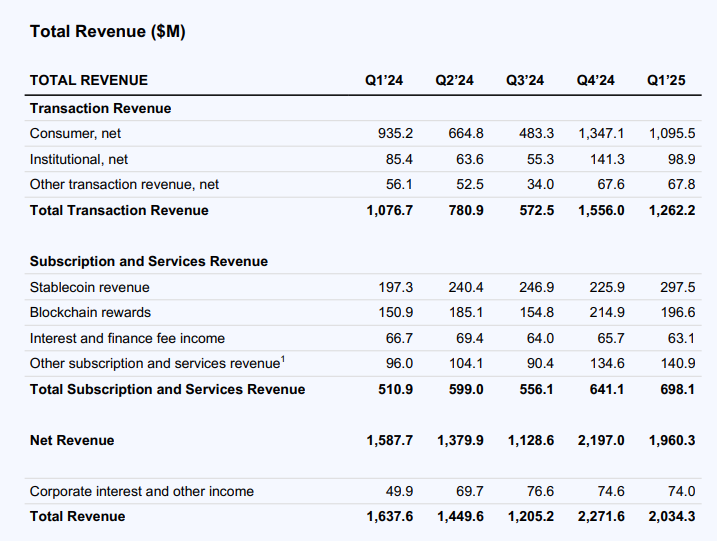

As of March 31, the adjusted net profit was $527 million. Earnings per share were $0.24, significantly lower than the market's expected $1.93. Total revenue was $2 billion, slightly below the expected $2.12 billion, and down from $2.3 billion in Q4 2024. Q1 trading revenue decreased by 19% to $1.2 billion, with trading volume down by 10%.

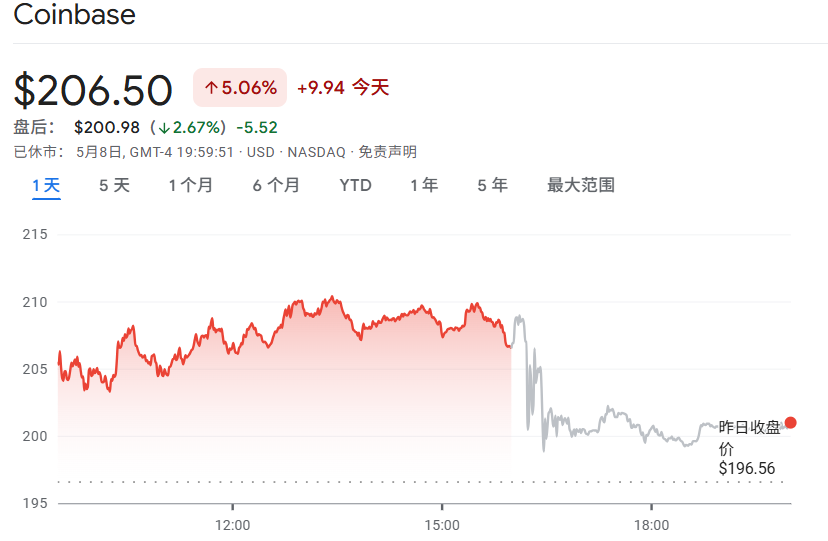

In response to this news, Coinbase (COIN) shares fell by 2.67% in after-hours trading, following a 5% increase on the previous trading day. COIN has dropped 16.83% since the beginning of this year.

Revenue

In Q1, the average volatility of cryptocurrency assets increased, with BTC reaching an all-time high in January. However, due to tariff policies and macroeconomic uncertainties, cryptocurrency prices fell in tandem with the overall market. Compared to the end of Q4, the total market capitalization of cryptocurrencies decreased by 19% to $2.7 trillion by the end of Q1.

Against this backdrop, Coinbase's revenue reached $2 billion, a 10% decrease quarter-over-quarter; net income plummeted 94% to $66 million, primarily due to a pre-tax loss of $597 million in its cryptocurrency asset portfolio, most of which was unrealized losses. Adjusted net profit was $527 million, and adjusted EBITDA was $930 million.

Trading Revenue

Coinbase's financial report shows that trading is its main source of income, accounting for over 60% of total revenue. Q1 trading revenue was $1.3 billion, down 19% quarter-over-quarter. Coinbase's total spot trading volume decreased by 10% to $393.1 billion, but outperformed the global spot market, which saw a 13% decline in trading volume. In terms of derivatives, Coinbase's trading volume reached $803.6 billion, with market share continuing to grow.

Of this, Q1 retail trading volume was $78.1 billion, down 17% quarter-over-quarter. Retail trading revenue was $1.1 billion, down 19%, consistent with the decline in trading volume. For institutional trading, the trading volume was $315 billion, down 9%, and institutional trading revenue was $99 million, down 30%.

In addition to macroeconomic factors, a second reason for the quarter-over-quarter decline in revenue was the derivatives business. The report stated that Coinbase is investing in trading rebates and incentives to build liquidity and attract customers. These rebates and rewards have been deducted from institutional trading revenue.

Other Trading Revenue

Q1 other trading revenue was $68 million, unchanged quarter-over-quarter. The number of transactions on Base increased by 16% quarter-over-quarter, but the average revenue per transaction decreased by 21%.

Subscription and Service Revenue

Q1 subscription and service revenue was $698 million, a 9% increase quarter-over-quarter, primarily due to growth in stablecoin and Coinbase One revenue, with USDC's market cap reaching a historic high of over $60 billion. However, blockchain rewards revenue decreased by 9% quarter-over-quarter, partially offsetting this growth. The decline was mainly due to a decrease in average asset prices, particularly for ETH and SOL.

Q1 stablecoin revenue grew by 32% quarter-over-quarter to $298 million. Coinbase stated that this growth was partially offset by lower average interest rates. The average holding of USDC in Coinbase products increased by 49% quarter-over-quarter to $12.3 billion.

Other subscription and service revenue was $141 million, a 5% increase quarter-over-quarter. The number of subscribers to Coinbase One reached a historic high in Q1, and the Coinbase One Premium service ($300 per month) also saw growth.

Expenditures

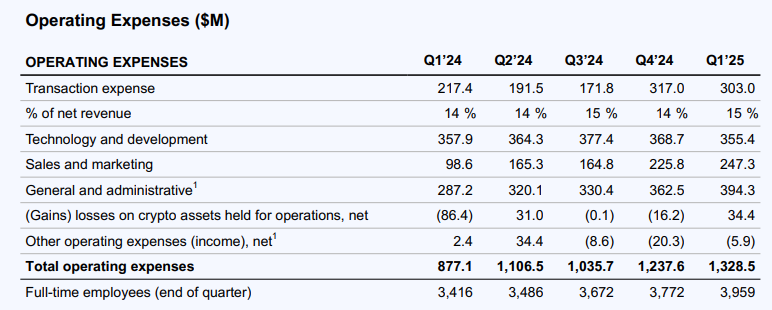

Total operating expenses in Q1 were $1.3 billion, a 7% increase quarter-over-quarter, or $91 million, primarily due to increased variable costs from market activity at the beginning of the quarter and losses from held cryptocurrency assets. Combined expenses for technology and development, general and administrative, and sales and marketing increased by $40 million, a 4% quarter-over-quarter rise, mainly due to increased marketing spending (including performance marketing and USDC rewards) and higher customer support costs. By the end of the quarter, Coinbase's full-time employees increased by 5% to 3,959.

Transaction costs were $303 million, accounting for 15% of net income, down 4% quarter-over-quarter. The decline was mainly due to reduced customer trading activity and lower blockchain rewards costs associated with the decrease in average asset prices.

Technology and development expenses were $355 million, down 4% quarter-over-quarter. The decline was primarily due to a reduction in personnel-related costs despite an increase in total headcount. General and administrative expenses were $394 million, a 9% increase quarter-over-quarter. The growth was mainly due to increased customer support and personnel-related costs. Sales and marketing expenses were $247 million, a 10% increase quarter-over-quarter.

Outlook

In April, Coinbase's total trading revenue was approximately $240 million. Coinbase expects Q2 subscription and service revenue to be between $600 million and $680 million, as the anticipated quarter-over-quarter growth in stablecoin revenue will be offset by a decline in blockchain rewards revenue due to falling asset prices; transaction fees are expected to account for about 15% of net income; and technology and development as well as general and administrative expenses are expected to be between $700 million and $750 million.

Notably, Coinbase is focusing on the derivatives market, announcing the acquisition of Deribit, the world's largest Bitcoin and Ethereum options exchange, for $2.9 billion, which includes $700 million in cash and 11 million shares of Coinbase common stock, subject to customary purchase price adjustments. This transaction is still subject to regulatory approval and other customary closing conditions, expected to be completed by the end of the year. Last year, Deribit had over $30 billion in open contracts and trading volume exceeding $1 trillion.

Coinbase CFO Alesia Haas stated during the earnings call, "We expect Deribit to immediately enhance our profitability and increase the diversity and sustainability of our trading revenue."

Additionally, Coinbase CEO Brian Armstrong mentioned in the investor call that this quarter, Coinbase will launch a pilot program allowing businesses to use stablecoins for payments and expenditures.

Related Articles: Record $2.9 Billion Acquisition: Coinbase Acquires Options King Deribit, Major Changes in the Crypto Derivatives Market

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。