Trump: The market rising is truly wonderful. It will continue to rise, much higher.

On the morning of May 14, the cryptocurrency market warmed up, with the secondary market following BTC's rebound, and many altcoins reached short-term new highs. BTC steadily rose from a low of $100,733 on the 13th to $104,986, an increase of over 4.22%. As of the time of writing, Bitcoin is reported at $103,720.

After a brief consolidation, ETH continued its good upward trend, rebounding from a low of $2,407.09 to break through $2,738.83, reaching a recent high with an increase of over 13.7%. SOL rebounded from $166.14, reaching a high of $184.90, an increase of 11.29%.

The total market capitalization of cryptocurrencies rebounded by over 2%, approaching $3.4 trillion. With altcoins collectively rising, Bitcoin's market share dropped to 61.60%, and the altcoin season index rose to 29, while the fear and greed index climbed to 74, indicating greed. During the same period, the S&P 500 erased its year-to-date losses, and the Nasdaq rose by over 1%. U.S. cryptocurrency stocks also climbed, with Coinbase rising over 24% to a price of $257.90, stimulated by its inclusion in the S&P 500; MicroStrategy rose over 4.13%, closing at $421.60.

In terms of liquidation data, according to Coinglass, over 133,700 people were liquidated in the last 24 hours, with a total liquidation amount of $397 million, including $245 million in short liquidations and $149 million in long liquidations, with the overall focus on short liquidations. The largest single liquidation on CEX was ETH-USDT, occurring on Binance, valued at $12.2041 million.

The gentle curve of the April CPI and the pause in U.S.-China tariffs reshaped liquidity expectations for risk assets, with Bitcoin returning to $105,000 amid institutional accumulation and retail chasing, while Ethereum's 13.7% single-day increase made the hope for a "season of altcoins" even more dazzling.

Tariff Easing Adds More Certainty, Risk Appetite Awakens Again

Following the consensus reached in the U.S.-China Geneva talks on May 9 regarding "mutual tariff reductions," the Trump administration on the 13th again threw out good news, announcing the lifting of export restrictions on AI chips imposed during Biden's term. Chip stocks like Nvidia and AMD rose over 5% in pre-market trading, indirectly boosting the valuation recovery of risk assets in the cryptocurrency market. "This is the most constructive policy combination since the 2024 G20," noted Bitwise Chief Investment Officer Matt Hougan, "The expectations for cross-border capital flows have improved, and Bitcoin's 'digital neutrality' is once again being priced in by the market."

At the same time, the White House announced that the U.S. and Saudi Arabia had reached the largest commercial agreement in history between the two countries, including $80 billion in cutting-edge technology investments from companies like Google, DataVolt, Oracle, a $20 billion AI data center and energy infrastructure investment from DataVolt, a $4.8 billion Boeing aircraft procurement, and nearly $142 billion in the largest arms sales agreement in history. The Saudi Crown Prince stated that Saudi Arabia would strive to push the investment amount in the U.S. to $1 trillion.

In fact, since taking office in January, the Trump administration has been trying to "pull investments" for the U.S. in the Middle East. The scale of the commercial agreement between the U.S. and Saudi Arabia further reveals the Trump administration's attitude towards easing the "tariff stick," reshaping global capital flow expectations once again.

CPI "Perfect Data" vs. Tariff "Lagging Bomb," Fed in a Dilemma

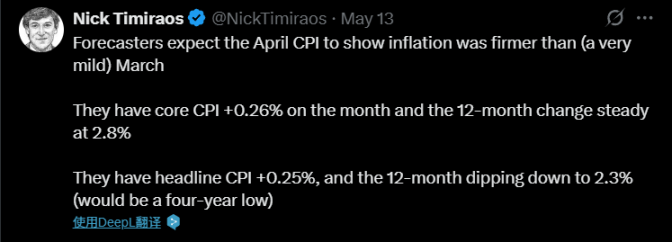

The U.S. April CPI year-on-year was 2.3%, lower than expected, and the core CPI month-on-month was 0.2%, the lowest level since February 2021, leading the market to raise the probability of a 25 basis point rate cut by the Fed in June to 72%.

On the same day, Trump cited the weaker-than-expected inflation report released earlier that day to pressure Fed Chairman Powell again, demanding a rate cut. Trump stated on social media, "The Fed must cut rates like Europe. What is Powell's 'too late' about?" He also claimed that the Fed's strategy was unfair to the U.S. Additionally, Trump mentioned that a potential tax bill could drive the U.S. economy to take off.

However, "New Fed Correspondent" Nick Timiraos poured cold water on this, stating, "The April data is the 'last calm' before the tariffs take effect, with signs of price jumps in imported goods like furniture and auto parts, and the Fed may not act until July."

In summary, as Timiraos wrote in a report he contributed to, "For the Fed, the April inflation data will be seen as observing clear weather before the impending storm, while the amount of rainfall remains highly uncertain."

"Trump-style" Calls Again, What is the Impact?

U.S. President Trump stated at the U.S.-Saudi Investment Forum in Riyadh: A month ago, companies were dissatisfied with me, but as the market has risen, their attitudes have changed. The market rising is truly wonderful. It will continue to rise, much higher.

However, this time after Trump's remarks, cryptocurrencies and U.S. stocks did not experience the same rapid intraday surge as before. On the contrary, in the short term, the S&P 500 index's increase narrowed to 0.8%, the Dow fell by 148 points, with a decline expanding to 0.4%, and the Nasdaq rose by less than 290 points, with an increase narrowing to nearly 1.5%.

Looking back at the trends of cryptocurrencies and U.S. stocks from early April to now, Trump's speeches have had a significant impact on the market: After Trump stated on April 9 that "now is a good time to buy," he announced a pause on some tariffs a few hours later, leading to a nearly 25% rebound in BTC that month and a significant rebound of over 16% in U.S. stocks.

Trump's "buy" call did not stop there: On May 8, Trump emphasized again that if trade agreements combined with tax cuts could achieve results, "you better go out and buy stocks now." Subsequently, according to the joint statement from the U.S.-China Geneva trade talks, the U.S. and China announced a temporary reduction in tariffs. This led to a broad surge in U.S. stocks on Monday, with the S&P 500 index rising 3.3% and the Nasdaq 100 soaring 4%. The upward trend in U.S. stocks continued into Tuesday, with the S&P 500 index recovering all its losses for the year during intraday trading.

However, any rise based on policy compromise needs to be wary of the black swan of a potential agreement breakdown. Before the Fed's June meeting and the July tariff impact data, maintaining a sense of awe towards "Trump-style policy shocks" may be wiser for survival than chasing intraday highs. After all, the speed at which Wall Street analysts revise their economic and market forecasts lags far behind the "face-changing" of the Trump administration.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。