Author: Frank, PANews

As the market conditions improve, the whale operations on Hyperliquid have once again attracted market attention.

These mysterious large holders, known as "whales," create ripples on the platform with their strong financial power, unique trading strategies, and precise grasp of market trends. Their every move serves not only as a magnifying glass for market sentiment but also provides us with a window to observe how top traders engage in their games.

This article analyzes their distinct trading styles, risk preferences, and the logic behind their successes and failures. Here, PANews attempts to unveil a glimpse of their wealth secrets and explore what ordinary investors can learn from their experiences and lessons.

Short-term Sniper @qwatio: The Event-Driven and High-Leverage Art of the "50x Guy"

This trader is an industry OG who has been posting about Bitcoin on Twitter since 2014, and his content style appears to be that of a loyal Bitcoin fan. For unknown reasons, @qwatio chose to go silent on social media starting in 2015. It wasn't until March 2025, when he made over $9 million by shorting Bitcoin with high leverage, that he sparked intense discussions on social media. On-chain investigator ZachXBT indicated that his funding sources were related to hackers, prompting @qwatio to reveal his identity in response to the doubts.

@qwatio's trading style is characterized by high risk and high return, often using 50x leverage, and he has a keen ability to capture market movements. For instance, around the Federal Reserve's interest rate decision on March 20, 2025, he shorted BTC at a price of $84,566, closing the position for a profit of $81,500 when the price dropped to $82,000. He then went long at $82,200, closing the position when the price rebounded to $85,000, earning an additional $921,000, totaling a 164% return. He has thus been dubbed the "Hyperliquid 50X Guy" on social media.

From his trading strategy, @qwatio excels at capturing event-driven and fleeting opportunities, showcasing a unique market insight. The aforementioned battle that brought him fame involved leveraging the anticipated Federal Reserve interest rate decision to infer that a brief opportunity would arise, allowing him to make substantial profits through repeated operations. He also decisively enters the market during extreme panic. When Ethereum dropped to around $1,500, the market was bearish on Ethereum. @qwatio chose to spend $5.5 million to buy 3,715 Ethereum (average price $1,493.5) and sold at $2,502, earning $3.74 million.

On May 12, the results of the China-U.S. trade negotiations were announced, and a wave of market fluctuations was anticipated. @qwatio opened a short position on Bitcoin at $104,094, subsequently earning $1.18 million.

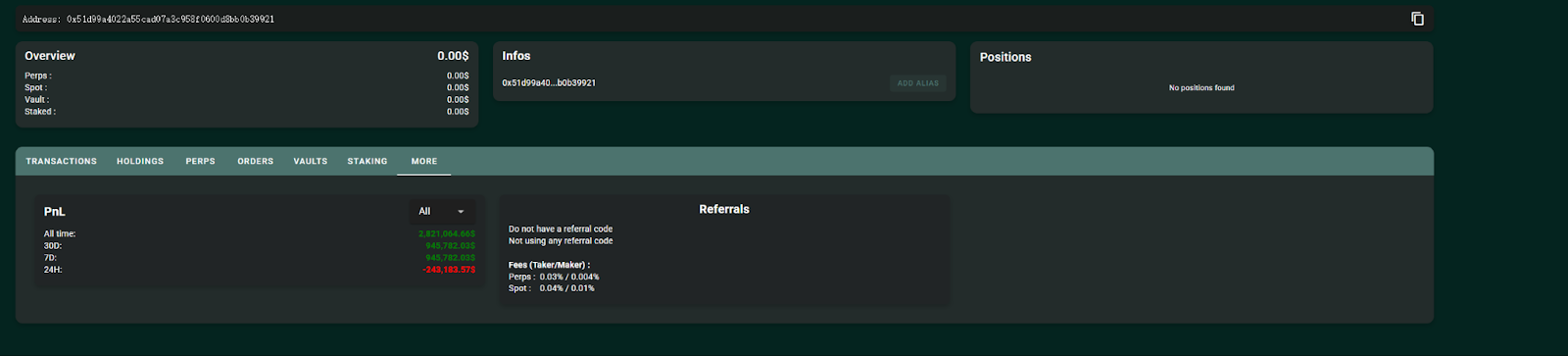

As of May 13, @qwatio had made approximately $2.82 million in profits on Hyperliquid. In summary, @qwatio's operations are not frequent; he has only executed about 3 to 4 trades in two months. However, each trade accurately predicted a short-term trend, and he is bold enough to operate close to liquidation. This style, however, is not suitable for general users to imitate, as he often incurs losses in several altcoin trades.

Legend and Controversy: James Wynn's MEME Coin Hunting and Large Capital Operations

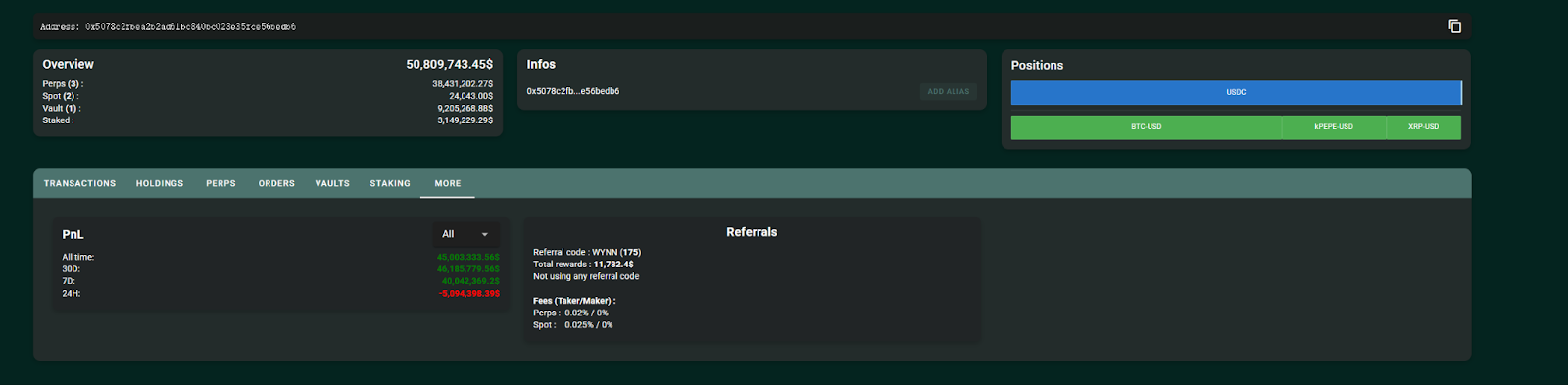

James Wynn has been active on Hyperliquid since March 2025. In terms of trading style, James Wynn tends to favor relatively larger cycles (several days) and, in addition to mainstream tokens, he also enjoys betting on MEME-themed tokens like TRUMP, Fartcoin, and PEPE. The high volatility of MEME tokens seems to be a primary source of his profits.

As of May 13, the PEPE long position he held brought him an unrealized profit of $23 million, far exceeding the returns from other mainstream tokens like BTC.

However, in terms of leverage usage, James Wynn is evidently more conservative; he seems to prefer setting different leverage multiples based on varying volatility. For example, he set a 40x leverage for BTC while only using 10x leverage for PEPE.

Additionally, James Wynn established the largest user vault on Hyperliquid (Moon Capital), but unlike his precise personal operations, the performance of this vault is currently not ideal. He opened a long position on BTC at a price of $103,533, and as of May 13, the yield of this position was approximately a 10% loss, amounting to about $960,000. Over the past month, the overall yield of this vault has been -8%. Despite this, it still attracted $10 million in deposits, of which $9.2 million is James Wynn's own.

Overall, James Wynn has achieved $45 million in profits on Hyperliquid. His trading strategy primarily focuses on long positions, capturing opportunities for market upswings. For instance, he opened a 40x long position when BTC was priced at $94,000, and when the price rose above $100,000, he had an unrealized profit of $5.4 million. Although his trading win rate is not high (around 47%), he still manages to earn substantial profits through large positions and high leverage.

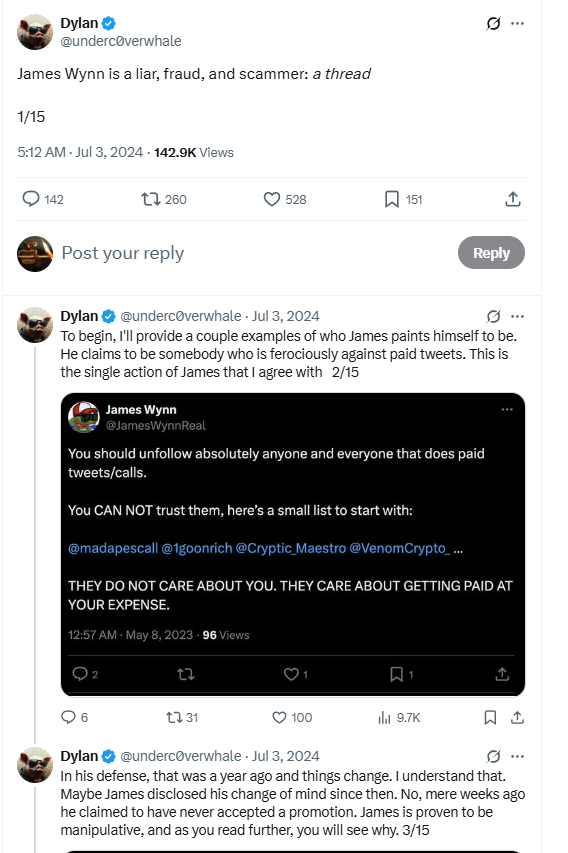

James Wynn is referred to as a "legendary trader" in the community, but his trading success is also accompanied by some controversy. Some community members accuse him of exploiting community trust for profit, such as promoting MEME coins to inflate prices before selling, as seen in the 2024 baby pepe pump-and-dump incident. However, he has dismissed these claims as nonsense. As of now, these controversies and responses remain unverified.

In summary, James Wynn's successful trades are also attributed to his large positions, often amounting to tens of millions or even hundreds of millions. Coupled with his keen insight into market changes, this has led to his high returns. Sufficient margin also allows his liquidation price to be set at a high threshold. This style helps him achieve a relatively high win rate, but if he misjudges the trend, he may also face significant losses.

The Emerging Mysterious Whale: Testing the Waters with Mainstream Coins Under Low Leverage

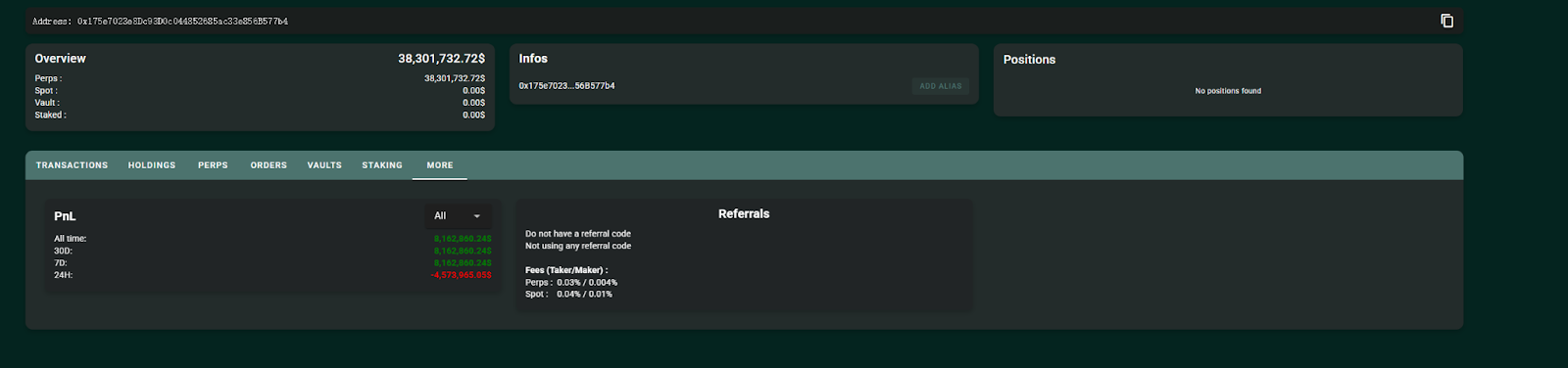

This mysterious whale is another large holder frequently appearing in news flashes. However, this whale has only recently become active on Hyperliquid, initially drawing attention for spending over $8 million to go long on ETH. Subsequently, this address also made over $8.16 million in profits within a week by going long on XRP and SOL.

In terms of trading style, this whale also shares the characteristic of having substantial financial strength, with initial opening funds reaching $36 million. Moreover, this mysterious whale does not seem to engage in extreme speculation for short-term operations but opts for low leverage and extended holding periods to maintain profits.

Regarding the choice of trading varieties, this whale has only traded three mainstream altcoins so far: ETH, XRP, and SOL. Among them, ETH was profitable, while XRP and SOL incurred losses. From the trading strategy perspective, this whale appears to lack decisiveness; initially, it only opened a position in ETH, and only during the market surge did it choose to go long on XRP and SOL at high prices. As a result, with the market correction, this whale may have also experienced psychological fluctuations, leading to the closure of all orders. Although the final outcome was profitable, the trading style and thought process are not worth emulating.

The Market's Staunch Contrarian: Can the Heavy-Betting Bear Whale Laugh Last?

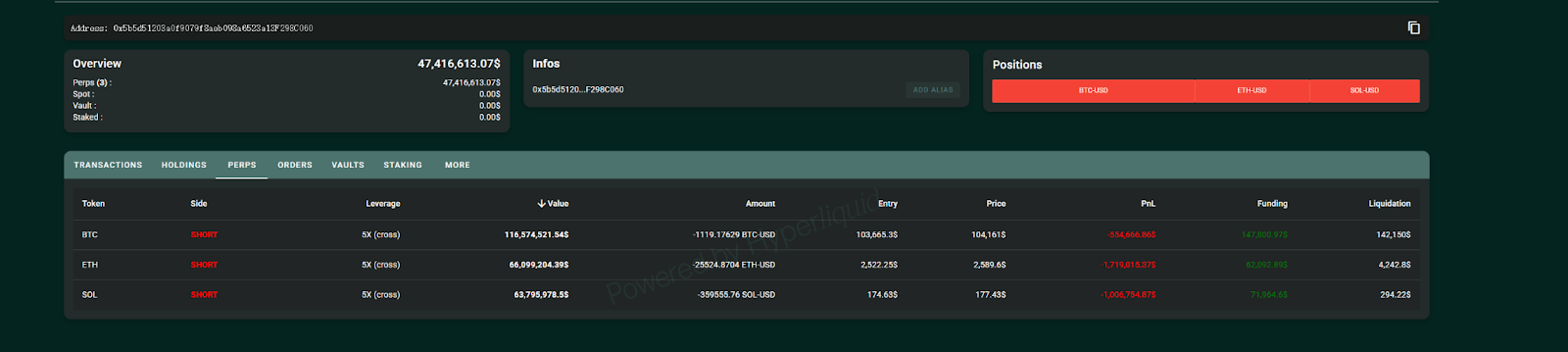

Compared to the whales introduced earlier, this whale can be considered a temporary counterexample. As of May 13, data shows that this address has incurred a floating loss of $3.12 million by shorting BTC, ETH, and SOL.

Starting from May 10, this whale began injecting $50.5 million into Hyperliquid for shorting. The total amount of positions held exceeds $230 million, with over $110 million in BTC positions. This whale seems to be a staunch bear in the market, investing all $50.5 million into positions and holding them for several days without closing any.

However, due to the substantial margin, the liquidation price for this address is also relatively difficult to reach (BTC liquidation price at $142,000, Ethereum at $4,254, and SOL at $294). In terms of overall position profit and loss, the current loss is only about 6%.

Of course, we cannot conclude whether this whale's ultimate direction is right or wrong. We can only continue to observe and see whether this mysterious market contrarian is a prophet who anticipates the market or a reckless player with deep pockets.

Looking at these "powerful whales" on Hyperliquid, we can easily find that their trading tactics are diverse, and there is no universally applicable "holy grail." However, overall, whales generally prefer to choose more liquid tokens like BTC, ETH, SOL, and XRP as their trading targets. In terms of trading styles, everyone has their own set of habits; some are keen on high leverage, while others prefer to anticipate the market in advance. Yet, the positions and investments of these whales clearly favor risky ventures, which is not advisable or replicable for ordinary investors. After all, in the treacherous and turbulent sea of cryptocurrency, only by continuously learning and forming one's own trading system can one navigate steadily through the stormy waves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。