To understand what is truly happening, we need more than just headlines; we must examine the essence of this larger game.

Written by: TOKEN DISPATCH, THEJASWINI M A

Translated by: Block unicorn

Introduction

Within a week, Coinbase orchestrated the largest acquisition in cryptocurrency history, revealed that they had been quietly accumulating Bitcoin, assisted in solving a murder case, and faced scrutiny due to a $45 million loss for customers—all while their quarterly revenue declined.

Are these calculated risks by a company aiming for a trillion-dollar future, or a desperate strategy by an exchange in turmoil?

CEO Brian Armstrong seems to be building a grand vision that goes far beyond a typical exchange—an entity that could transform Coinbase from a retail-focused trading platform into a financial infrastructure supporting the global cryptocurrency market.

But to understand what is truly happening, we need more than just headlines; we must examine the essence of this larger game.

The Battle of Derivatives

When Coinbase announced its $2.9 billion acquisition of Deribit (comprising $700 million in cash and 11 million shares of Coinbase stock), most analyses focused on the price.

This deal immediately brought Coinbase:

- $30 billion in current open contracts

- Over $1 trillion in trading volume last year

- A leading platform for Bitcoin and Ethereum options

Options trading typically offers more resilience against market downturns than spot trading, as traders use options to manage risk in both bull and bear markets.

Greg Tusar, Vice President of Institutional Products at Coinbase, noted, "We believe that cryptocurrency options are on the verge of significant expansion, similar to the equity options boom of the 1990s. This acquisition positions Coinbase to lead that growth."

Just a week prior, rival exchange Kraken completed a $1.5 billion acquisition of the futures trading platform NinjaTrader. The similar moves by both exchanges indicate a widespread recognition in the industry that derivatives—rather than spot trading—will be the next major battleground.

By acquiring Deribit, which operates outside the U.S., Coinbase immediately gained access to a lucrative derivatives trading market while potentially positioning itself for future regulatory developments that could open these markets in the U.S.

Jeff Park, Head of Bitwise Alpha Strategy, commented, "This may be the most 'valuable' deal I've seen in the cryptocurrency space," calling the acquisition "a coup for Coinbase."

Bitwise Chief Investment Officer Matt Hougan went further, stating, "Coinbase will one day become a $1 trillion company."

Given Coinbase's current market capitalization of about $50 billion, this implies an ambitious twenty-fold growth.

Profits, Security, and Complex Signals

While the Deribit acquisition dominated the headlines, Coinbase's quarterly financial report revealed a more complex picture of the company navigating through turmoil.

Total revenue fell 10% quarter-over-quarter to $2 billion, failing to meet industry expectations as market trading activity slowed. More strikingly, net profit plummeted 95% from a record $1.29 billion in the fourth quarter to $66 million in the first quarter.

This sharp decline was primarily due to a $596 million paper loss on cryptocurrency assets held by Coinbase as market prices fell. Trading revenue dropped 18.9% to $1.26 billion, with trading volume down 10.5% to $393 billion.

However, beneath these surface figures, a more nuanced story emerges. Subscription and services revenue actually grew by 8.9% to $698.1 million, with stablecoin revenue performing particularly well. This growing revenue diversification indicates that Coinbase is steadily reducing its reliance on volatile trading fees.

Meanwhile, Coinbase revealed it had purchased an additional $153 million in cryptocurrency assets, primarily Bitcoin, bringing its long-term investment portfolio to $1.3 billion—approximately 25% of its net cash.

CFO Alesia Haas emphasized during the earnings call, "It is important to clarify that we are an operating company. But we do invest alongside this industry."

There were previous reports that Coinbase had considered adopting a Bitcoin-centric treasury management strategy similar to that proposed by Michael Saylor, but ultimately decided against it.

Armstrong stated in an interview with Bloomberg, "Over the past 12 years, we have indeed considered several times whether to allocate 80% of our balance sheet to cryptocurrency—especially Bitcoin. We have made thoughtful choices regarding risk."

Unlike those companies that explicitly tie their corporate identity to holding Bitcoin, Coinbase has taken a more cautious approach, allocating operational profits back into cryptocurrency assets as a capital recycling strategy consistent with the industry, rather than a balance sheet transformation.

The Dark Side of Growth

As Coinbase expands its institutional products, it continues to face significant security challenges that threaten user trust.

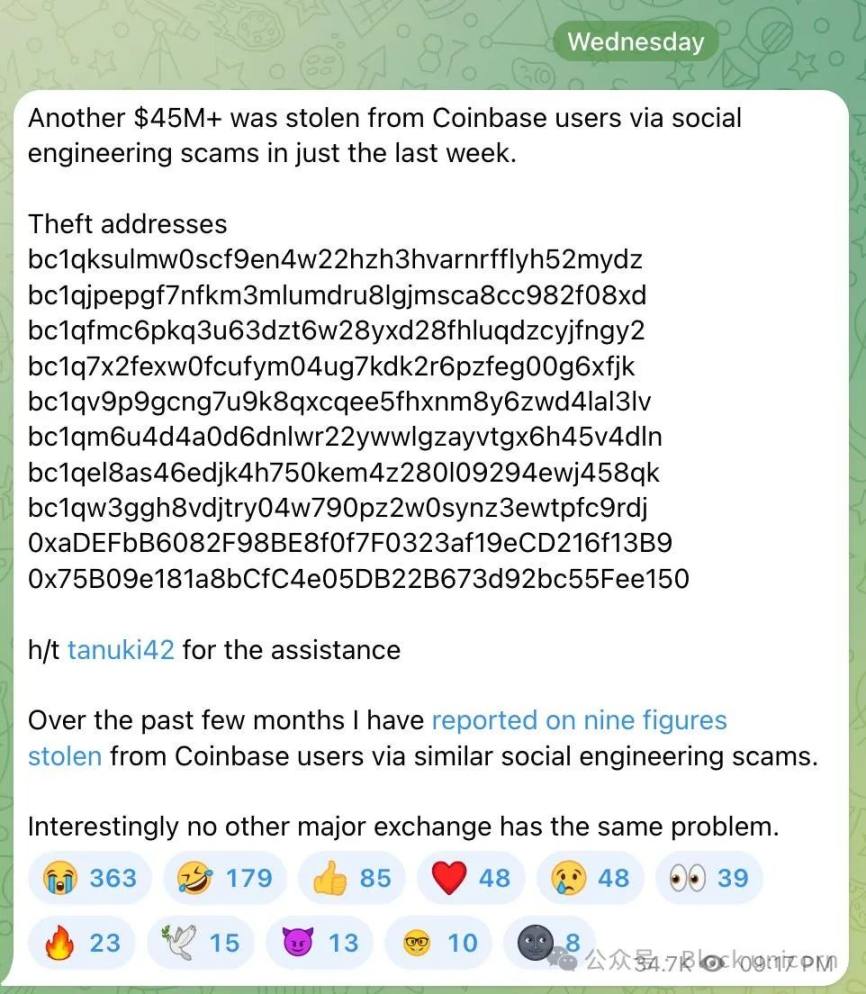

On May 2, on-chain detective ZachXBT discovered that Coinbase users lost approximately $45 million in funds due to social engineering scams within just seven days. More shockingly, he claimed that in recent months, losses incurred by Coinbase users from similar scams had reached "nine figures," describing it as a problem unique to Coinbase among major exchanges.

These claims suggest that the total amount lost by Coinbase users to social engineering scams could be as high as $330 million annually, reflecting the complex attack strategies targeting cryptocurrency holders.

However, Coinbase has also leveraged its security expertise to assist law enforcement in solving major crimes. Chief Legal Officer Paul Grewal revealed on May 6 that the company's blockchain forensics team played a key role in a criminal investigation in New York City, which ultimately led to multiple murder convictions.

The case involved a series of violent robberies where victims—often from the LGBTQ+ community—were drugged outside Manhattan bars and clubs, their phones stolen, and financial and crypto accounts emptied. Several victims were found dead from substances laced with fentanyl, with stolen amounts exceeding $250,000 across multiple platforms, including Coinbase.

Grewal explained, "Our blockchain analysis linked multiple wallets to the same criminal gang, helping to recover evidence across traditional financial and cryptocurrency channels and supporting the convictions of 24 charges, including second-degree murder." He added, "This case shows that cryptocurrency is not the risk—it provides a chain of evidence to bring violent criminals to justice."

This duality—being both a target for scammers and a valuable tool for law enforcement—highlights the complex position Coinbase finds itself in as it expands its operations.

Institutional Game

Taken together, these developments clarify Coinbase's strategic vision.

The acquisition of Deribit is the latest move in a series of strategic acquisitions by Coinbase that systematically expand its institutional capabilities:

- Acquisition of Xapo in 2019, leading to Coinbase Custody

- Acquisition of Tagomi in 2020, leading to Coinbase Prime

- Acquisition of FairX in 2022, leading to Coinbase Derivatives Exchange

- Acquisition of One River Digital in 2023, leading to Coinbase Asset Management

- Acquisition of Deribit in 2025, positioning Coinbase as a global leader in crypto derivatives

Each acquisition fills a specific gap in Coinbase's institutional services, gradually building a system that could become a comprehensive financial infrastructure for cryptocurrency.

This push for institutional infrastructure aligns with reports that Coinbase is considering applying for a U.S. banking license, potentially following in the footsteps of Circle and BitGo to bridge the gap between cryptocurrency and traditional finance through formal banking credentials.

The goal appears to be to create a platform that allows professional traders to access spot, futures, perpetual futures, and options trading in a seamless, capital-efficient environment. This would position Coinbase not just as a retail entry point for cryptocurrency but as a pillar of global institutional crypto trading.

Meanwhile, Coinbase's cautious approach to holding cryptocurrency on its balance sheet indicates that the company is balancing its crypto-native identity with its responsibilities as a publicly traded company.

Our Perspective

In previous crypto cycles, when crypto enthusiasts talked about "institutional adoption," they often envisioned BlackRock and Goldman Sachs buying Bitcoin for their balance sheets or offering crypto products to clients. While the emergence of Bitcoin ETFs has partially realized this vision, a different type of institutional infrastructure is quietly forming.

Coinbase's acquisition of Deribit marks a key moment in this evolution. Traditional institutions have not fully embraced cryptocurrency; rather, crypto-native companies are transforming into institutions.

Reports suggest that Coinbase is actively considering applying for a U.S. banking license, solidifying its transition from outsider to insider—a remarkable turnaround for a company that just a few years ago struggled to maintain basic banking relationships for many of its executives.

This creates an interesting dynamic. Coinbase initially started as a retail exchange, simplifying Bitcoin purchases for everyday users. Now, it is transforming into an entity akin to traditional financial giants—boasting prime brokerage services, custody, asset management, and now advanced derivatives trading.

However, unlike traditional financial institutions, Coinbase retains its crypto-native DNA. It holds Bitcoin on its balance sheet, provides blockchain forensics to law enforcement, and is committed to the potential of cryptocurrency to reshape finance.

This hybrid identity could become Coinbase's greatest strength or most significant weakness. Traditional financial companies are constrained by decades of regulation, which both limits and protects them. Crypto-native institutions are creating new models with few precedents to follow and little protection against unknown risks.

The future of cryptocurrency may depend on whether companies like Coinbase can successfully bridge this gap—developing institutional-level security and compliance while maintaining the innovative potential of cryptocurrency. Their success or failure will determine whether cryptocurrency can fulfill its promise of financial transformation or remain forever on the margins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。