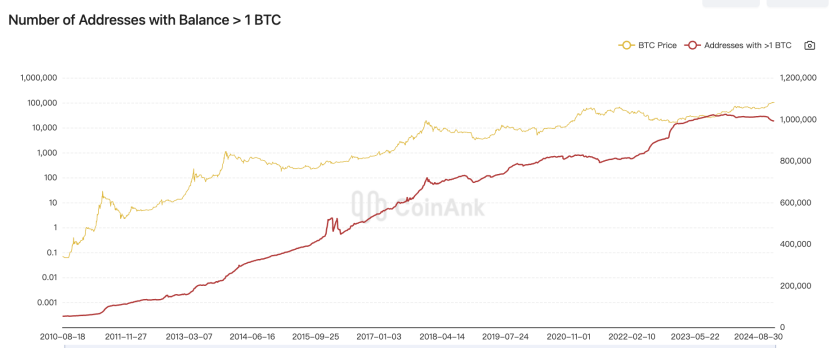

Analysis of Two Major Anomalous Data: Addresses Holding at Least 1 BTC Decreased by 5,000, and Bitcoin Search Volume Hits Six-Month Low!

Macroeconomic Interpretation: As Bitcoin's price continues to fluctuate above $100,000, the market is experiencing some complex changes. Deutsche Bank's latest report indicates that the Federal Reserve may maintain interest rates until December before starting a rate-cutting cycle. This "long-term high-pressure" monetary policy resonates subtly with global capital flows. The U.S. Senate is about to pass the "GENIUS Act," which removes controversial provisions targeting the Trump family, clearing obstacles for establishing a federal regulatory framework for stablecoins. This paves the way for institutional capital to enter and suggests that crypto assets are being incorporated into the traditional financial regulatory landscape.

Notably, former U.S. President Trump has recently been sending diplomatic signals, claiming that an agreement with Iran is imminent. If this trend of geopolitical easing materializes, it could weaken the dollar's status as a safe-haven asset, prompting more capital to seek alternative value storage tools like Bitcoin. Arthur Hayes' predictive model shows that if 10% of the $33 trillion global investment portfolio is allocated to Bitcoin, it could fundamentally change the market liquidity structure—currently, there are only $30 billion worth of BTC on exchanges, facing a potential buying demand of $330 billion, which could trigger a nonlinear price explosion.

On-chain data reveals intriguing market differentiation: despite the continuous rise in Bitcoin's price, the number of wallets holding 1 BTC has decreased by 5,000 in two months, suggesting that whale accounts are diversifying their holdings across multiple addresses. Some analyses using the STH-MVRV indicator estimate that when this value reaches 1.25, corresponding to $118,000, it will trigger the first round of significant selling pressure, resonating with the potential policy shift timeline of the Federal Reserve.

Market sentiment indicators show a stark contrast. The weekly trading volume of Solana's DEX surged by 48% to $27.5 billion, indicating that new capital is flowing into innovative protocols. However, Google searches for "Bitcoin" have hit a six-month low, exposing retail investors' cautious attitude towards the current high prices. This divergence in behavior between institutions and retail investors resembles the composite patterns seen at the peak of the 2017 bull market and the institutional bull market of 2021, suggesting that this round of market activity may exhibit more complex volatility characteristics.

On the regulatory front, there are undercurrents. The latest speech by the SEC Chairman clearly states the intention to establish a complete regulatory framework for the issuance, custody, and trading of crypto assets. In the accelerated trade negotiations between the EU and the U.S., a digital currency clearing system may become a technological breakthrough to break the tariff deadlock. The gradual formation of this regulatory framework not only brings convenience for compliant capital inflows but may also change the anonymous characteristics of cryptocurrencies through KYC/AML requirements.

When we connect these clues, we find that institutional investors are quietly positioning themselves through stablecoin channels, the space for regulatory arbitrage is gradually narrowing, and geopolitical games are creating new hedging demands—these three forces intertwining may make mid-June a critical time point. At that time, the STH-MVRV indicator may reach warning levels, the Federal Reserve's policies may become clearer, and the realization of geopolitical agreements could resonate with multiple factors, potentially triggering a technical adjustment of 10-15%. However, in the medium to long term, the reconstruction of purchasing power brought about by capital migration remains the dominant trend. This new cycle of crypto, driven by regulatory arbitrage, geopolitical changes, and technological evolution, is reshaping the underlying logic of global asset allocation.

BTC* Data* Analysis:

As Bitcoin's price continues to fluctuate above $100,000, CoinAnk's on-chain data shows that the activity of addresses holding less than 0.01 BTC has decreased by 16% from its peak. In the past two months, the number of wallets holding at least 1 BTC has decreased by 5,000, indicating that funds are concentrating towards professional investors. Google search volume has also recently dropped to a six-month low, shrinking by 38% compared to the same period in 2024, creating a significant "price-attention divergence." This anomalous phenomenon reflects a deep structural change in the market: institutional investors are leading the capital flow through compliant tools like ETFs (BlackRock's IBIT holds over 250,000 BTC), while traditional retail investors' enthusiasm has significantly cooled due to heightened risk awareness (leverage usage has decreased by 42%) and historical cycle experiences (losses from entering at the 2024 peak).

The lack of retail interest may delay the formation of a market top, but it also exacerbates liquidity stratification risks—Bitcoin's market cap share has risen to 62%, and small to mid-cap tokens may face more severe selling pressure. Historical patterns show that retail investors typically concentrate their entries one week after prices break previous highs (for example, a 380% surge in search volume in November 2024). If the current cycle follows this pattern, Bitcoin's breakthrough above $109,000 may trigger a short-term FOMO rally. However, the structure of the derivatives market has undergone a qualitative change: institutional-led quarterly contract positions have surged threefold, causing the volatility center to drop from 82% to 56%, indicating that the market is transitioning from "emotion-driven" to "fundamentals-based pricing." While this shift reduces the risk of a short-term crash, it may weaken the high elasticity premium of crypto assets, forcing investors to reassess their risk-reward ratios.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。