Author: Kaori

Binance Alpha has formed a value consensus among various circles, including project parties, yield farmers, and retail investors. Project parties supply Alpha, yield farmers conduct KYC in bulk to embark on a new round of yield farming, while retail investors navigate between point restrictions, lucky last digits, and trading wear to profit.

From the very beginning, Alpha has served as the best exit window for meme coins, evolving from the early rounds of "violent money distribution" in Alpha 2.0 to implementing a points system to filter users and queuing token issuers for Alpha. Binance has gradually regained traffic and pricing power in the on-chain market. Behind all this is Binance's ambition to reorganize the ecosystem through liquidity discourse after being outpaced by OKX on the product side.

150 days have passed, and Binance Alpha has evolved from a wallet feature into the most influential structural mechanism in the entire crypto market.

What has Alpha done in 5 months?

In 2024, the crypto market is set to welcome a bull market driven by the approval of Bitcoin spot ETFs and a meme frenzy. However, beneath the surface of recovering liquidity lies a deeper issue: the pricing mechanism between the primary and secondary markets is gradually failing. VC project valuations are inflated, the token issuance cycle is repeatedly extended, and user participation thresholds are continuously raised, leaving retail investors with little more than scraps.

Against this backdrop, Binance launched Binance Alpha on December 17, 2024. Initially, it was just an experimental feature in the Binance Web3 wallet for discovering quality projects, but it quickly evolved into a core tool for Binance to reconstruct pricing power in the on-chain market.

Binance co-founder He Yi acknowledged in a Space addressing community disputes that there is a "peak at opening" issue with Binance's token listing, admitting that the traditional listing mechanism is no longer sustainable under current scale and regulatory constraints. Binance had previously implemented mechanisms like voting for listings and Dutch auctions to manage price performance after new tokens go live, but the results were always unsatisfactory.

Thus, Alpha's token listing became a strategically controllable alternative for Binance during that phase.

"Putting these hot projects in the Binance Alpha, projects entering the observation zone cannot guarantee a listing on Binance; a project can only generate income and profit when it is beneficial to society, which may allow it to share profits with users," He Yi promised in the Space.

On December 18, Binance Alpha announced the first batch of project listings. By February 13, Binance Alpha had launched over 80 tokens across ecosystems like BSC, Solana, and Base, primarily focusing on meme and AI tokens. However, the market did not respond as Binance had anticipated, continuing to criticize VC tokens that dropped immediately after listing, and being listed on Alpha instead became the final stop for meme coin expectations.

It wasn't until early February 2025 that the BSC ecosystem, starting with the test token TST, opened the channel between Alpha and traffic. From that period on, Alpha began listing non-meme tokens, such as ONDO, MORPHO, and AERO.

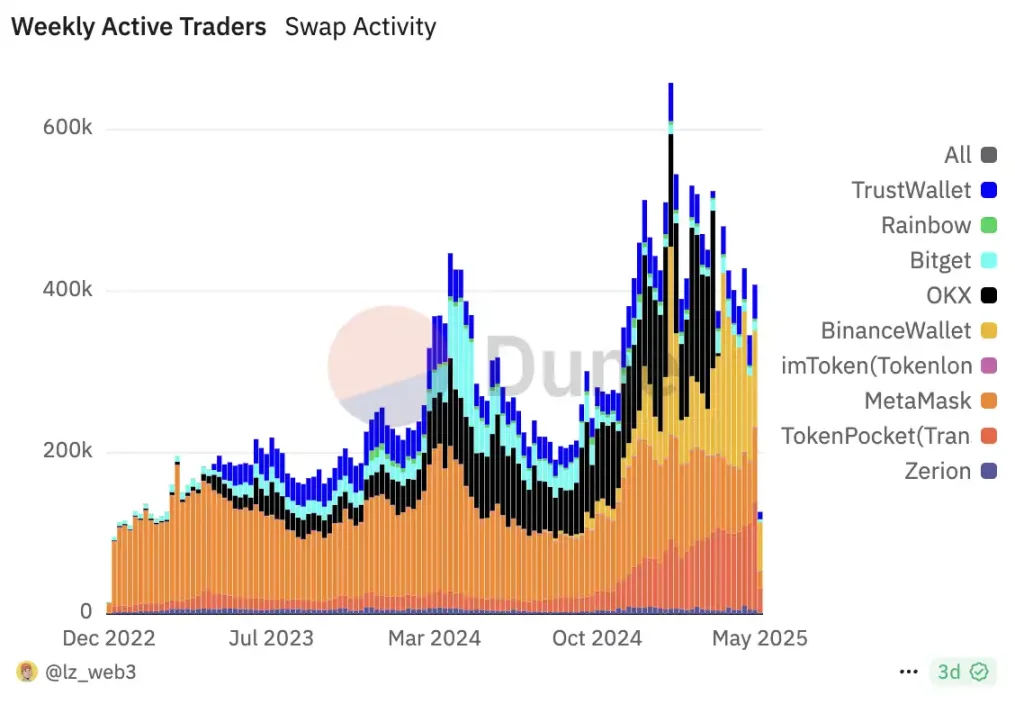

In March, due to the shutdown of OKX DEX, Binance Wallet launched Binance Alpha 2.0, allowing users to directly trade Alpha tokens using funds within the CEX. As a result, Binance Wallet's trading volume and active users surged, capturing 80% of the crypto wallet trading volume, becoming the steepest growth segment in the wallet product curve.

At the same time, Binance's criteria for filtering Alpha users have been continuously evolving. The initial "task-based points system" was no longer sufficient to create effective differentiation, so the platform quickly introduced systems like lucky last digits and point consumption to stimulate more frequent interactions. This mechanism balances user participation continuity and differentiation while providing project parties with a relatively precise target group for airdrops.

Project parties no longer hesitate

From the moment the Alpha mechanism was introduced, the choices for project parties changed.

Faced with the high uncertainty of the main site listing window, the pressure of on-chain community realization, and the inverted valuations on VC books, more and more teams began to realize that merely telling stories, maintaining communities, or waiting for traditional listing processes might not be enough to gain market attention and liquidity support.

Rather than continuing to waste time on an unpredictable path, it is better to actively adapt to the new paradigm brought by Alpha. In the Alpha system, token flow, airdrop amounts, and trading activity can all be directly reflected in observable data on the platform. This data could very well be the prerequisite ticket to a formal listing on Binance, and being listed on Alpha can garner market attention with almost no negative impact.

As a result, project parties began to quickly adjust their strategies, no longer hesitating over whether to launch, when to launch, or how to launch, but instead tailoring a "low-cost listing on Binance" execution model specifically for the Alpha mechanism.

Betraying the community has become the norm

Currently, Binance Alpha offers two options for token listings: either already circulating projects or new projects that are not yet circulating, with different detailed metrics to measure around these two main lines. This makes Alpha a clear entry point with defined systems and standards.

On the execution level, the rhythm of Binance Alpha's access to the main site spot market is extremely restrained, with the number of spot listings in the past five months far below Binance's previous pace. This limited scarcity design has built a typical Web2-style growth flywheel—spending money to acquire traffic, setting thresholds to filter users, and continuously optimizing internal competition rules, ultimately achieving user retention and structural strengthening of the ecosystem.

To enter this system, project parties typically need to make significant adjustments, including but not limited to deploying or mapping tokens to BSC, redesigning incentive structures, and sacrificing part of the originally planned airdrop amounts for the community. To some extent, Alpha is not just a wallet product; it resembles a lightweight, centralized on-chain token issuance protocol, aligning with Binance's data-driven token selection and risk hedging needs.

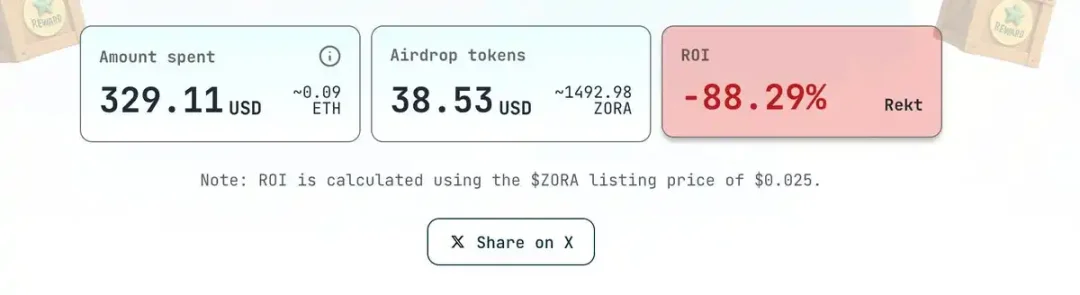

After Zora from the Base ecosystem announced its debut on Binance Alpha, someone in the yield farming group remarked, "Don't set your expectations too high; you might work for years and still not get as much as someone who just plays with Alpha." This turned out to be prophetic, as eligible Binance Alpha users received 4,276 ZORA tokens, worth nearly $90; meanwhile, many community members who had been following and participating in ecosystem activities since Zora's launch reported receiving only $30 in airdrops, with some even getting single-digit tokens.

Screenshots of airdrop earnings shared by Zora ecosystem users in the community; Source: @zkgoudan

Such situations, where existing communities are bypassed to directly serve Alpha users, are not uncommon among projects that have already launched on Alpha.

Taking PRAI as an example, feedback from users participating in its KOL round indicated that "getting into the VC and KOL rounds means a loss." On one hand, the project implemented a lock-up policy for community users, restricting token circulation; on the other hand, Alpha users did not have to bear the costs of early participation or capital lock-up, receiving airdrops worth nearly a hundred dollars solely based on wallet points and interaction records. This stark contrast in incentives disrupted the project's original "internal fairness" within the ecosystem.

Users who participated in the Sui ecosystem lending protocol Haedal told BlockBeats that Haedal's airdrop amounts varied greatly, almost ignoring the participation costs of early depositors, leaving significant returns only for Alpha users.

Before MilkyWay, a liquidity staking derivative protocol on Celestia, launched Alpha, community users not only faced a drop in TIA but also received very little of the share allocated to early users, having to lock up their tokens and complete tasks to unlock them. Moreover, simply holding NFTs without binding to the points system did not qualify for airdrops, and the window period was very short, resulting in returns far below those of Alpha users.

This practice of deviating from the project's original supporting community and reallocating resources to Alpha users has sparked widespread discussion, but for most project parties, it is a realistic choice: under limited resources, prioritizing investment in paths that can bring secondary liquidity and platform exposure is a strategy for maximizing efficiency.

After launching on Alpha

The core metric for token listings on Binance Alpha is how many chips can be provided, which aligns with the philosophy of "embracing the Binance ecosystem and BNB chain."

According to crypto KOL AB Kuai.Dong, Puffer launched on Alpha seven months after its token issuance. Based on on-chain data, the project party mapped about 3.16% of its tokens to the BNB chain, with 1.24% directly allocated to the Alpha user airdrop pool, while also injecting nearly 500,000 USDC in liquidity into PancakeSwap. Overall, it is estimated that Puffer spent nearly $3 million on this Alpha airdrop.

As AB stated, "The cost is not small, but the benefits are evident." By using the Alpha feature, they directly gained access to Binance CEX trading channels, completing liquidity warming and market awareness groundwork before obtaining futures or main site listings.

Similar paths can be seen in the ZK track's star project Polyhedra, whose token ZKJ entered Alpha without being listed on Binance's main site, becoming the first top 100 market cap token included in this mechanism. To support the token price, the project party successively launched staking rewards of up to 150% and point competitions to attract users to engage in trading activities and accumulate wallet activity. Strategically, the project party may aim to leverage internal Alpha metrics to build influence and ultimately drive the decision for a Binance listing.

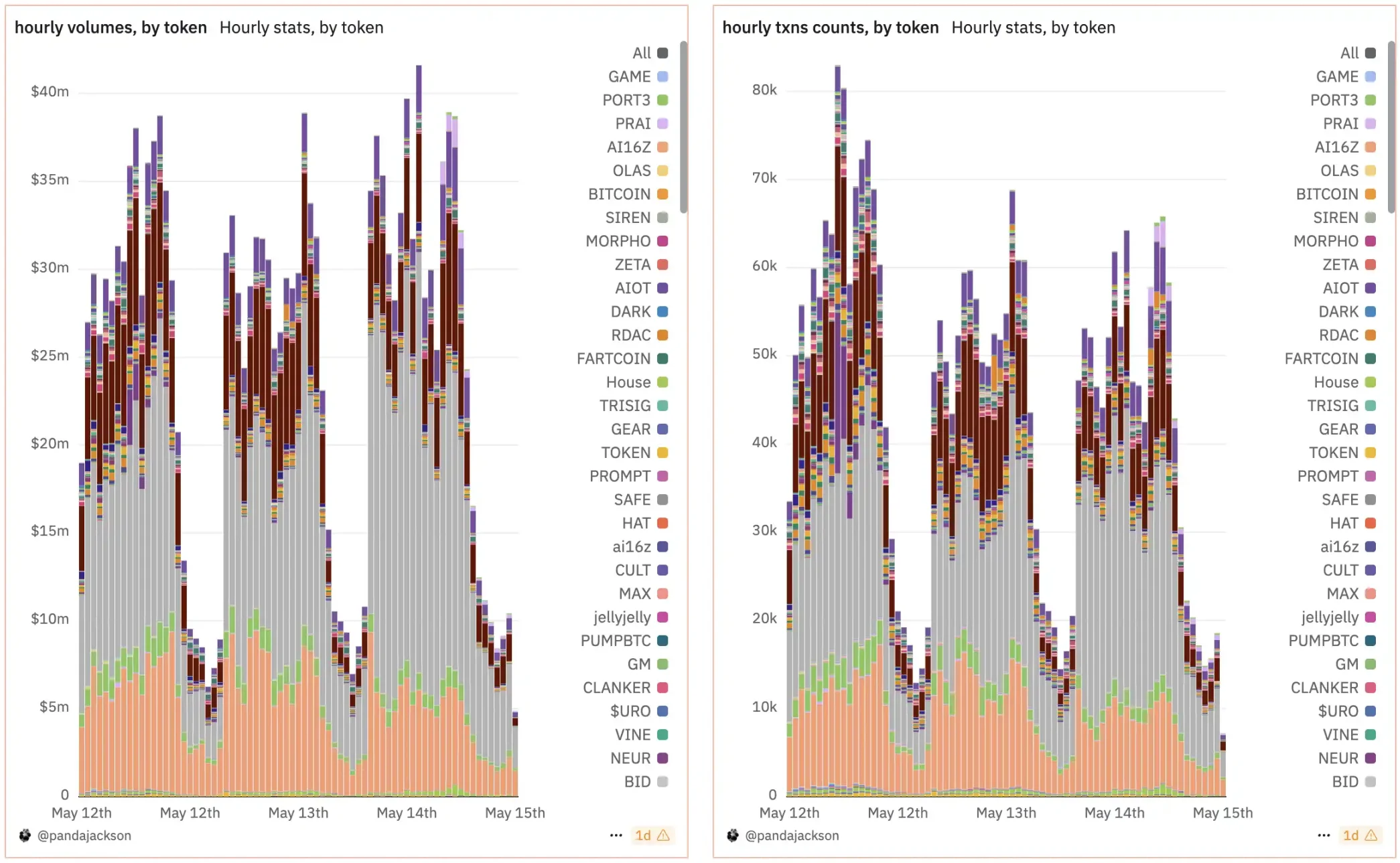

ZKJ has recently maintained the top position in Alpha trading volume; Source: Panda Jackson (@pandajackson42)

This on-chain behavior—point rewards—has reconstructed the game structure between Binance and project parties: in the past, "market cap + community" determined whether a project could be listed, whereas now "on-chain data + Alpha performance" dominates the listing rhythm.

The strategies of new projects have become more aggressive. After Stakestone launched on Binance Alpha in mid-April, it adopted an extremely proactive market approach, first distributing 5% of tokens through wallet IDOs, then covering Alpha users with a 1.5% airdrop, and additionally releasing nearly 4% in incentives to long-time community users, cumulatively distributing over 10% of the total supply.

At the same time, project parties directly invested part of their financing into the secondary market to guide the token price to remain stable during the initial public circulation. This series of operations ultimately led to a listing channel on Binance's main site. As industry insiders familiar with the process stated, "After the changes in Binance's listing standards, projects no longer need to tell stories; they need to showcase data and control."

Retail Investor Psychology

Compared to the well-calculated and meticulously planned strategies of project parties, the role of retail investors appears complex and ambiguous.

In traditional IPO logic, retail investors could seize primary arbitrage opportunities through information sensitivity and capital agility. However, under the point system constructed by Alpha, the profit paths for retail investors have been institutionalized and made transparent, while also becoming highly competitive. What Alpha activates is not the imagination of rising token prices, but rather the on-chain conversion mechanism of "points - airdrops - listing jump-off."

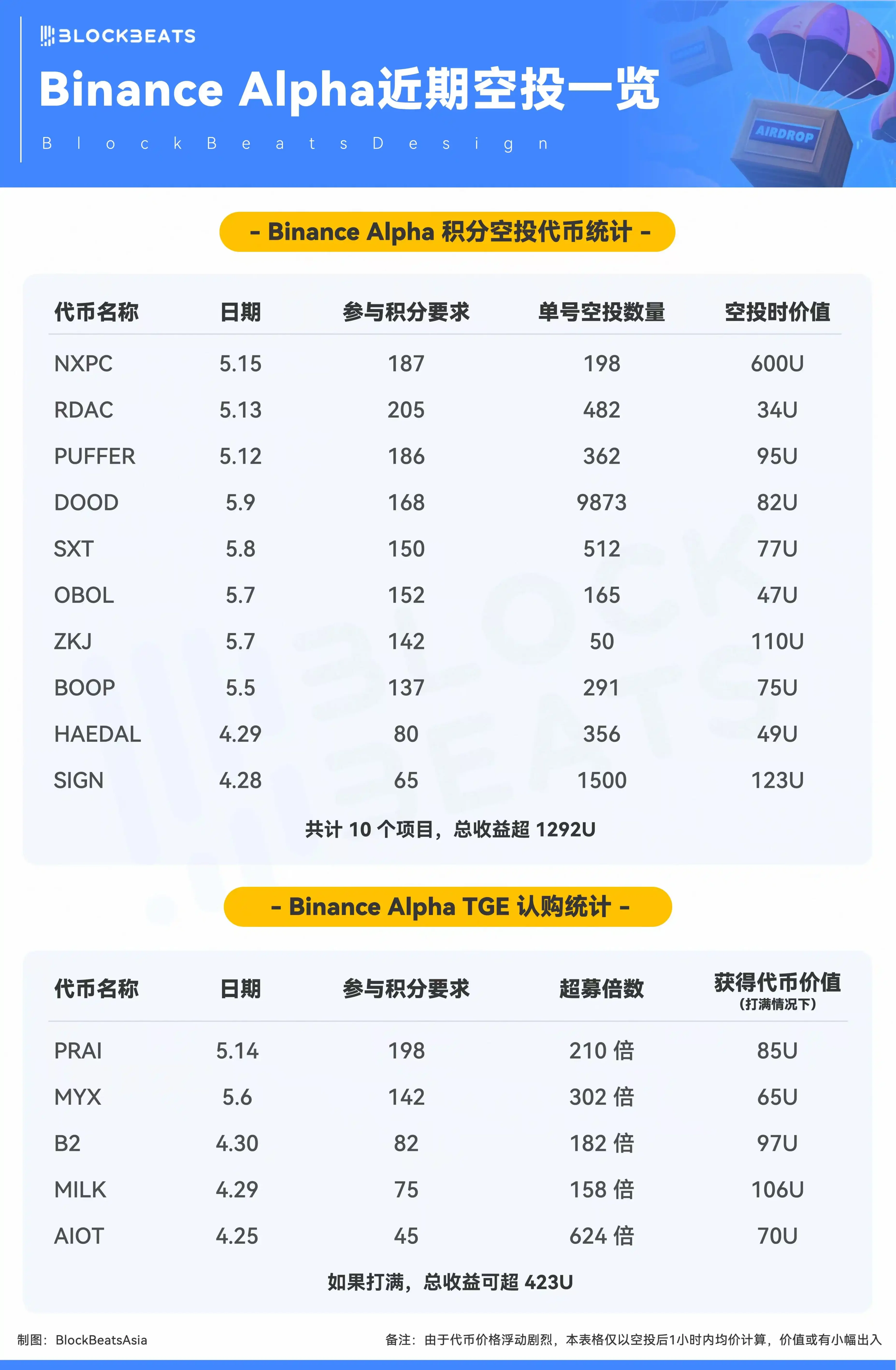

For some users, this mechanism indeed reconstructs the concept of fairness. Small to medium users who have long remained in their wallets can still have the opportunity to gain returns far exceeding their costs from Alpha, as long as they maintain activity, even if their capital is not large. Since the introduction of the points system in Alpha, statistics from BlockBeats indicate that if an average user participates in every Alpha airdrop and wallet IPO activity, they could earn nearly $1,700.

However, the high returns come with a highly structured filtering system. This seemingly participatory points game actually sets implicit thresholds, imposing significant requirements on users' behavioral paths, trading frequency, and even participation continuity.

Binance itself does not directly distribute airdrops but provides infrastructure for point distribution, data filtering, and user classification. Airdrops are borne by project parties, but who receives them and based on what standards is determined by the mechanism of Binance Alpha. The core design of this system is not "rewards," but "filtering." Those identified as "high-value users" can continue to receive airdrops.

Doubts have arisen, with some users pointing out that the trading volume on Alpha does not reflect actual user demand, stating, "Without points and airdrops, there are no trades," leading to inflated data for project parties and superficial user retention. "What difference does this incentive method have from ghost chains or pseudo-game airdrops that no one uses after TGE?"

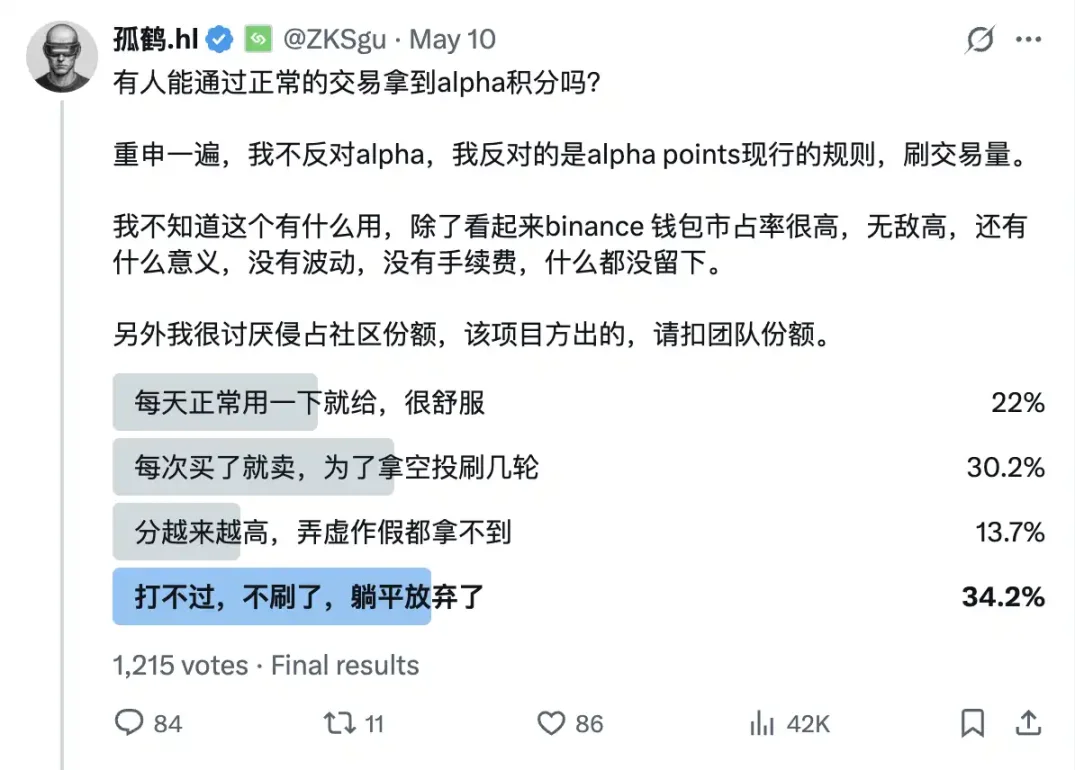

According to crypto KOL Gu He, in the statistical sample, only 22% of users can earn enough points for airdrops by trading normally every day, while the rest need to continuously repeat trades or give up participation due to being unable to keep up with the points rhythm.

However, it cannot be denied that in the current market context of overall liquidity scarcity and a lack of sustained attention mechanisms for projects, Alpha remains one of the few channels where doing something can potentially yield returns. Under the premise of coexistence of returns and certainty, this mechanism still possesses strong appeal. In this system, the participation logic of retail investors shifts from value judgment to mechanism gaming; their earnings no longer depend on their judgment of a project's future but rather on their understanding of and ability to execute within the Alpha mechanism.

Who are the real beneficiaries of Alpha?

Although retail investors and project parties each have their own games within the Alpha mechanism, returning to the overall framework, what Alpha truly reshapes is the underlying relationship between trading platforms and assets.

In terms of product experience and tool ecosystem, Binance does not have a significant advantage compared to platforms like OKX, but through the liquidity entry mechanism built by Alpha, it still retains strong discourse power during the asset launch phase.

Even if a project does not debut on Binance, the traffic filtering and point pathways provided by Alpha are sufficient to allow many new tokens to complete a round of market warming and price anchoring before they are connected to main site trading pairs. It changes the starting point for token issuance and extends Binance's influence on the asset side.

The recently launched chain game NXPC on Alpha serves as a good example. After the on-chain liquidity pool opened, Alpha airdrops were soon distributed to point users, while Binance contracts and spot trading lagged by nearly half an hour and several hours, respectively, and there were also certain price differences on other trading platforms like Bybit and Upbit. The trading windows at different rhythms determine the profits at each stage and reinforce Alpha's preemptive role in liquidity initiation.

In the past, launching a project on Binance meant completing primary pricing and reaching a terminal station. Now, Alpha is the starting point for project listings and the source of pricing; it has moved the cold-start domain that originally belonged to other trading platforms like OKX and Bybit back into the Binance system. Once a project rises on Alpha, there is a reason to connect to Binance contracts and spot trading, and the project is naturally willing to "supply" shares according to the rules, offering token shares and capital injection in exchange for platform exposure and liquidity preparation. This creates a closed loop where traffic feeds back into the platform.

This also relieves Binance from the past burden of public opinion that "listing means peak." CZ has expressed a desire to eliminate the premium effect brought by Binance listings and return the market to fundamentals. Alpha is essentially the path to fulfilling that statement; it no longer directly uses "Binance listing" as authority but establishes a new liquidity filtering mechanism through Alpha, leveling the starting line between projects and then deciding who can continue to move forward based on on-chain data.

Currently, this path appears to be successful. Alpha is no longer just a feature in the Binance wallet; behind this mechanism is Binance's re-understanding of its own role. Its success lies not in whether the product experience is ultimate but in its ability to bring Binance's primary asset organization capability from behind the scenes to the on-chain, public, and quantifiable.

Compared to OKX's product refinement route in the wallet field, Binance chooses to exchange points for traffic and airdrops for attention. Winson, the head of Binance wallet business, has publicly stated that Binance wallet will not replicate any competitor's model but will choose differentiated development, saying, "The market does not need two identical wallets." He believes that rather than redoing the product, it is better to reconstruct the scenario.

In the face of industry issues such as airdrop volume manipulation and distorted trading data, Binance does not attempt to eliminate these behaviors but has built a mechanism that allows projects to first self-validate their attractiveness and then observe whether they can form a stable user base and genuine trading depth. The boundary between volume manipulation and real behavior is postponed for judgment and quantified within Alpha's point system.

However, from another perspective, many still believe that Binance Alpha has merely succeeded in attracting yield farmers without drawing real trading volume, and users still do not consider Binance Wallet as their first choice when selecting on-chain behaviors.

The past cycle was somewhat "to VC," relying on storytelling to raise funds; now it is "to liquidity," and Alpha is the anchor point for Binance to regain control over liquidity. In an era where VCs are no longer reliable, communities have already dissipated, and product competition has fallen into homogenization, Binance Alpha may not be the optimal solution for innovation, but it is the most effective way to absorb bubbles.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。