Abstract: Is Chasing Airdrops Not as Good as Chasing Alpha?

The times have changed again and again.

After the tariff turmoil, the market has shifted from bear to bull in small cycles. Besides the fluctuations in coin prices and sporadic project hotspots, there is a recent main task that runs through the daily lives of crypto users — How many Alpha points do you have on Binance today?

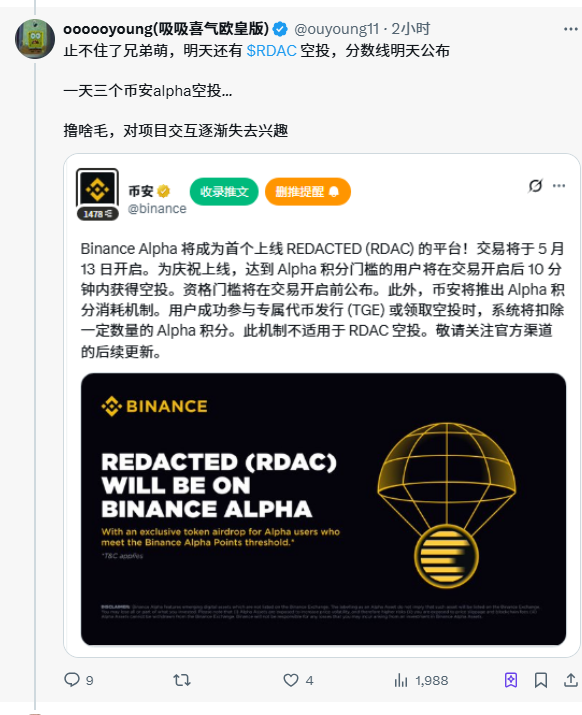

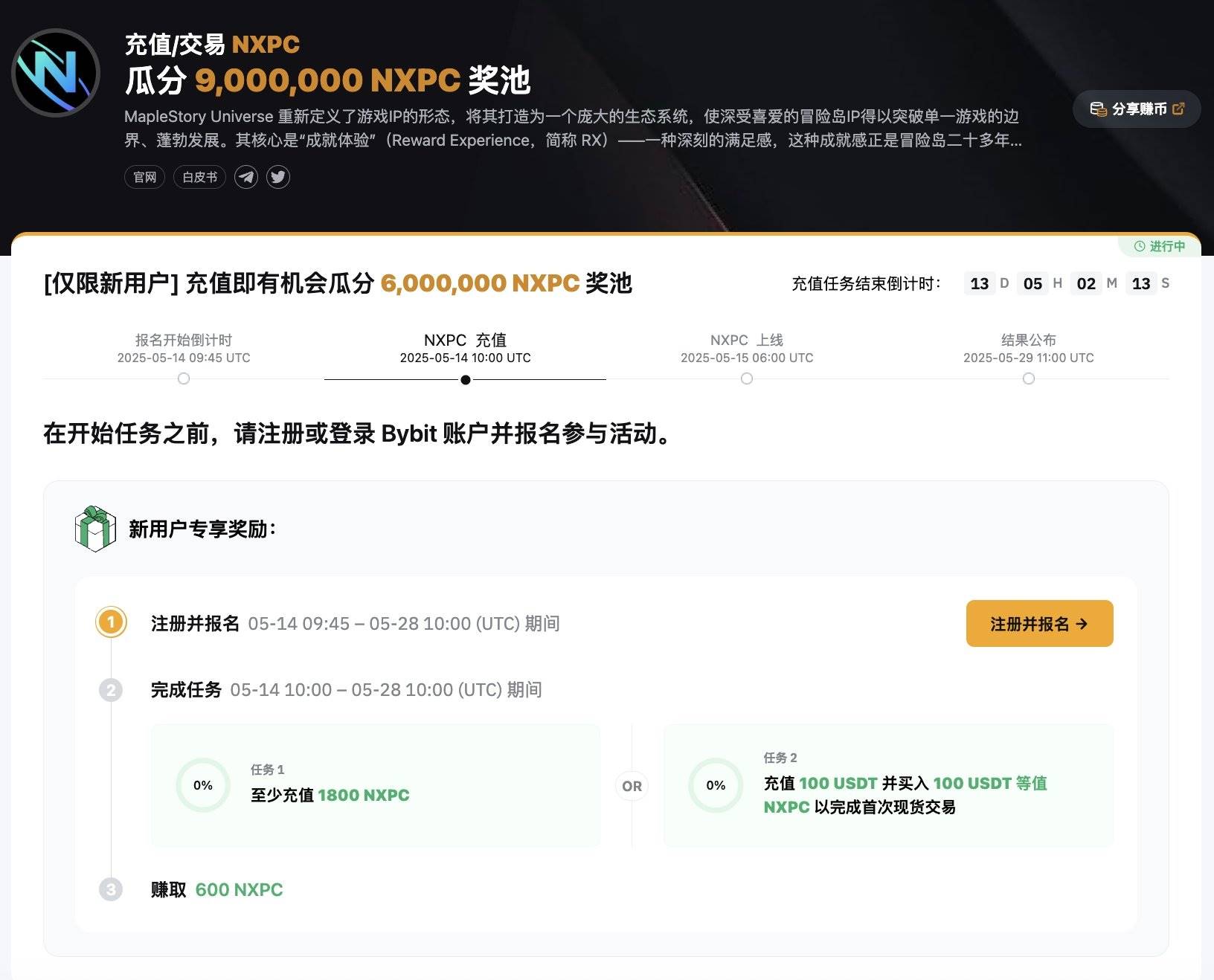

According to X user @btguagua, since the points system was launched on April 25, Binance has conducted 15 "money-spraying" events for users in the form of "airdrops + TGE activities" by May 15. Yesterday, the airdrop of $NXPC could yield around $700 per account at its peak price.

If you have been consistently tracking and participating in Alpha and maintaining your score, based on the peak price of the Alpha token at launch, the profit for a single account in twenty days is close to $2000. Even after deducting trading costs, it is still a considerable profit.

In less than a month, the short-term returns from participating in Binance Alpha have already outperformed the current airdrop projects that are gradually losing market favor.

From Being Unpopular to Being Hot

When "Binance Alpha 1.0" was first launched, the initial excitement brought by the "Binance Spot Candidates" concept led to a surge in the tokens listed on the Alpha list. However, the overall positioning of the Alpha sector soon appeared to be quite unappealing, either listing some popular meme tokens at the time or tokens from their own wallet TGE activities. Many meme players and project parties regarded Binance Alpha as the last stop for liquidity in a short period. Eventually, "listing on Binance Alpha" could no longer be considered a clear positive, and the trading volume in the Alpha sector quickly dwindled, seemingly moving further away from Binance's initial goal of "growth."

Although "Binance Alpha 2.0" has migrated the Alpha interface to the exchange, the data shows that this move has had little effect. The real qualitative change in data has been the "points admission system" that has been on everyone's mind.

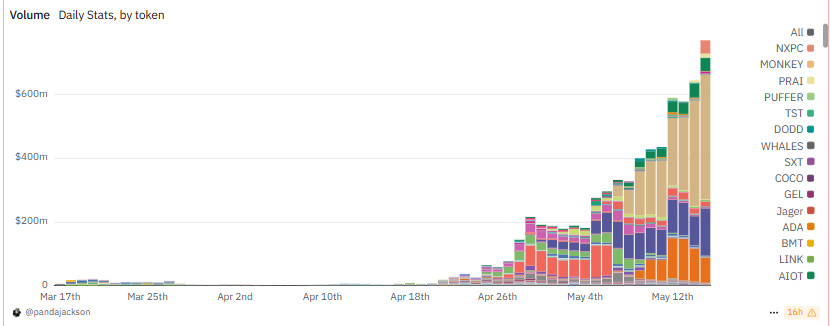

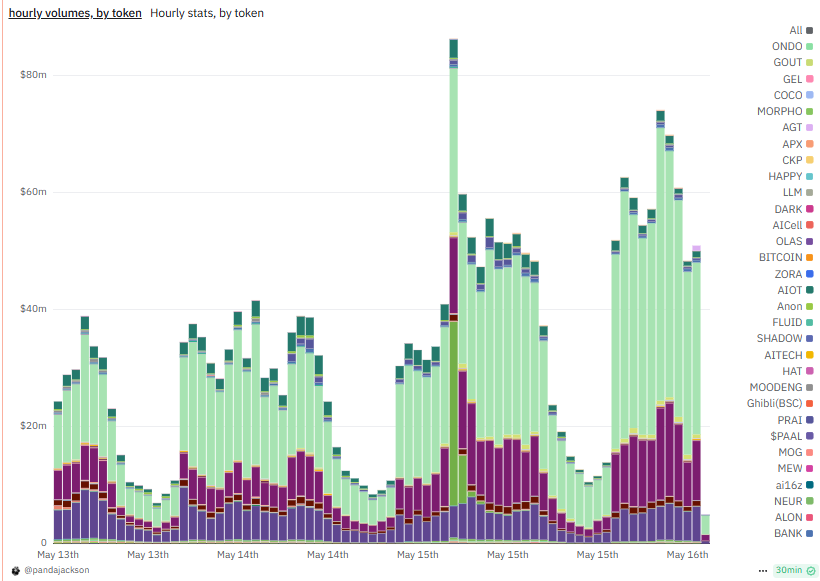

According to the data panel created by Dune user @pandajackson, since the launch of the points system, the trading volume of Binance Alpha 2.0 has increased exponentially, reaching $771 million in daily trading volume by May 15.

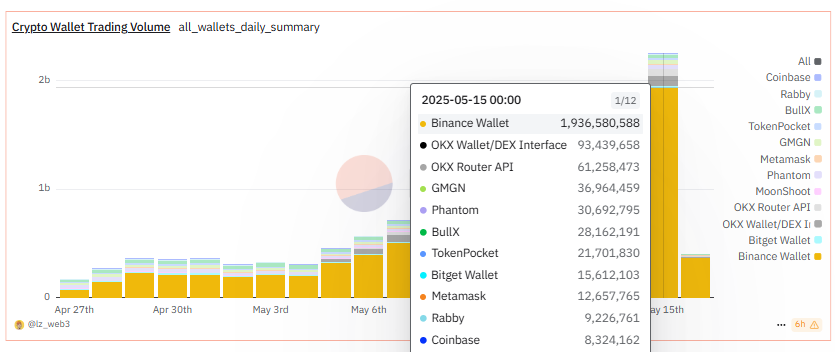

According to Dune user @lz_web3 and their data panel, the short-term trading volume of Binance Wallet has also topped the entire wallet sector.

From the trading data alone, Binance's growth strategy has successfully made it a hot topic for market attention and funds.

Who Wins and Who Loses in the Market?

From market discussions and user feedback, Binance's money-spraying activities have satisfied most people, and many market participants have enjoyed this dividend. Users who meet the points criteria are the most direct beneficiaries. Whether retail investors or cluster studios, from certain perspectives, they have all capitalized on this wave of Binance's artificial hype to earn the first wave of dividends from the "new asset issuance method."

For individuals who continue to participate, daily discussions, checking, and earning Alpha points have become a fixed task. Watching the steadily increasing Alpha points feels like holding a guaranteed income asset firmly in hand.

The returns from Binance Alpha for individuals can be considered "steady happiness" in the short term. However, for the group of airdrop studios with the ability to create accounts in bulk, this seems to be a real opportunity.

"Many projects are now reducing manpower and financial input, and are fully focused on Binance Alpha," said a studio operator named Lu (pseudonym) to Deep Tide TechFlow. A net profit of nearly $2000 per account in twenty days, with a return cycle and yield far exceeding over 90% of crypto projects. Compared to most crypto projects that require "six months to start, with no upper limit" and unknown returns, Binance Alpha's "instant feedback, one order recouped" profit model is precisely the participation method that airdrop studios dream of. Even various "top-tier" projects that have yet to launch seem dim in comparison to the current high-density money-spraying.

From the feedback of many airdrop bloggers, the consensus has emerged that chasing Alpha is better than chasing projects…

For project parties, launching on Binance Alpha has now become an excellent opportunity for traffic exposure. It can also serve as a "points brushing target" to gain long-term liquidity, with trading volumes of popular assets like $ZKJ and $B² continuing to grow.

According to X user @_FORAB, the schedule for the first batch of coins on Binance Alpha has already been pushed to mid-June. Although there are many rules and restrictions, project parties are still willing to compete for this massive traffic.

For competing exchanges, Binance's series of money-spraying strategies and their growth data are indeed enviable. While the Binance Alpha activity is booming, other exchanges are also launching their own money-spraying growth activities.

Of course, even as everyone celebrates the profits, some are still trudging along and "losing money."

The most direct losses are incurred by those who suffer trading costs to earn points but still do not receive airdrop rewards due to insufficient scores.

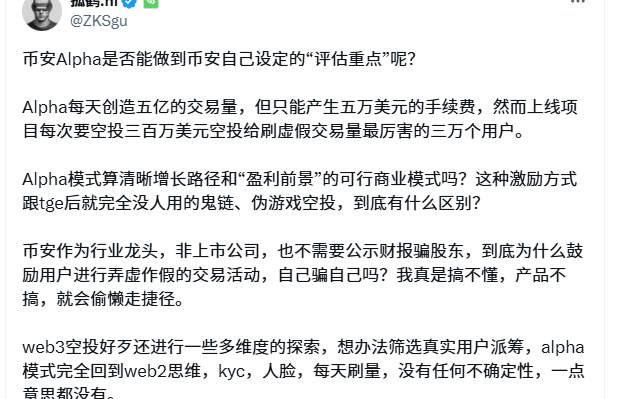

According to X user Guhe.hl (@ZKSgu), under the catalyst of the Alpha points mechanism, many users choose to brush points without considering the costs, and during this process, if they do not select the right trading assets and set the slippage properly, they may incur significant losses. At the same time, the difficulty of obtaining trading points has increased exponentially; the difference between hundreds of thousands in trading volume and a few thousand can result in only a few points, but the losses could amount to hundreds or even thousands of dollars.

Additionally, apart from the users who are directly losing money by brushing points, many airdrop users who genuinely participate in project interactions are also bearing some "invisible losses" under the coverage of Binance Alpha activities: to ensure the profits of users participating in Alpha activities, projects launching on Binance Alpha need to provide a considerable share of tokens + lock liquidity. To cover the "cost of going Alpha," some project parties choose to deduct part of the tokens originally reserved for the community and transfer them to Binance Alpha for airdrop activities. In this transfer, some funds that should belong to "project community users" have shifted to the pockets of "Binance Alpha users." This behavior directly hinders the user growth of Web3 projects, instead centralizing native users within the exchange.

When Will This End?

I remember before, everyone was criticizing the points system for project airdrops, which kept users' time, energy, money, and expectations hanging, leading to a frenzy of competition among participants that was considered improper. Perhaps because the positive feedback comes quickly and genuinely, the market has become less critical of Binance Alpha's extensive points system, with more praise for the profits.

On the positive side, Binance Alpha has, to some extent, guided market enthusiasm in an environment lacking a main narrative, and the money-spraying activities have benefited ordinary users. Meanwhile, the activities of listing tokens on the assembly line have gradually demystified the process of "listing on Binance."

From a negative perspective, the current main way to earn Alpha points is still through mechanical point brushing, which, in essence, has little significance beyond providing data for wallets and project parties. Many people spend money and endure high slippage losses on-chain, yet do not receive any returns in this frenzied competitive environment.

According to the current development momentum, the threshold for obtaining Alpha rewards will continue to rise in terms of the points required for participation. Furthermore, as the Alpha activities progress, they will tend to become actuarial and intensive, where missing a single point could mean losing eligibility to participate, making it increasingly difficult for small-fund ordinary users to engage.

Summary

The overwhelming momentum of Binance Alpha reminds one of the Qin state in "Records of the Grand Historian" — 'sweeping the six directions, capturing the feudal lords, splitting the world, and swallowing the eight wastelands', with a fierce momentum and rapid expansion in scale and influence.

However, this expansion seems to be happening too quickly. There is a saying: “The momentum of a prairie fire may not burn long.” Any model that rapidly burns market expectations must face the test of sustainability. The current short-term high returns resemble Binance paying for user education; as long as it can attract users' time, money, energy, and attention, future planning can be considered in the long term.

The difficulty for users to earn returns has indeed increased. The current points deduction system is testing participants' research and investment capabilities. The days of effortlessly earning airdrops through point brushing are over; in the future, those who wish to obtain suitable returns from activities may be players skilled in evaluating projects.

From the perspective of user participation, opportunities like Binance Alpha that offer a high degree of certainty and positive expected value (EV) are rare even throughout an entire bull-bear cycle, making the control of the dividend window crucial. As for how long this dividend period can last and whether Binance Alpha will have a negative impact on the market in the future? “If it really gets to the point where there are no dividends left, then look for the next opportunity. No one can predict what will happen next, but when there is an opportunity, it must be seized.” said Lu, an operator of an airdrop studio, in an interview.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。