The practice of the Sui chain proves that compliance is not only a necessary condition for public chains to respond to external pressures but also a key bridge to promote the deep integration of blockchain technology with the real world.

Written by: Crypto Miao

A public blockchain is a decentralized, distributed ledger technology that allows anyone to participate in transaction verification and network maintenance. Compliance is crucial for public chains to be widely applied in regulated industries such as finance, requiring them to meet legal and regulatory standards, such as KYC (Know Your Customer) and AML (Anti-Money Laundering). Compliance not only enhances trust in public chains among users and regulatory bodies but also effectively reduces the risks of illegal activities such as money laundering and fraud. Globally, public chains must also comply with regulations like the EU's General Data Protection Regulation (GDPR) to ensure legality and sustainable development.

Global Public Chain Regulatory Policies and Trends

As the core application of blockchain technology, the regulatory environment for public chains is rapidly evolving. From initial widespread skepticism to cautious acceptance today, the international community's attitude towards public chains is gradually changing. The decentralization, transparency, and immutability of public chains are seen as having revolutionary potential, but they also bring challenges such as market volatility, financial crime, and regulatory difficulties. In response, global regulatory bodies are striving to establish frameworks that balance encouraging innovation with controlling risks.

Regulatory Trends: Countries are increasingly strengthening their regulatory efforts on public chains and crypto assets. For example, the EU passed the Markets in Crypto-Assets Regulation (MiCA) in 2023, becoming the world's first comprehensive legal framework for regulating crypto assets.

Policy Divergence: There are significant differences in regulatory strategies among different countries. China has completely banned cryptocurrency trading and mining, while the US and EU are gradually regulating through legislation. The EU implements bank-like regulations on stablecoins and cryptocurrencies to protect financial stability and consumer rights; the US tends to support stablecoins to maintain the global status of the dollar.

Innovation and Risk Coexist: Despite tightening regulations, many countries still recognize the potential of public chains in finance, supply chains, and healthcare. For instance, Singapore and Japan allow space for blockchain innovation while maintaining strict regulations.

The Paradox of Compliance and Development

The Web3 industry is unique due to its decentralization and anonymity, but this also makes it face complex compliance requirements from various countries. These requirements aim to ensure the legal operation of projects but often restrict their free development and global expansion. Compliance not only increases operational costs but may also bring legal risks, leading project founders or core members to face lawsuits, hefty fines, or even imprisonment.

1. Rising Operational Costs

Compliance requirements force blockchain projects to invest significant resources in legal consulting, compliance audits, and regulatory reporting to ensure adherence to various national laws. This high cost directly pressures the financial status of projects, especially for startups, which may become a heavy burden for development.

Binance: In 2023, Binance was fined $4.3 billion by the US Department of Justice for money laundering and violations of the Bank Secrecy Act. This hefty fine not only weakened its financial strength but could also lead to a loss of market share.

2. Increased Legal Risks

The complexity of compliance requirements and the inconsistency of regulatory policies across countries make it difficult for project teams to fully foresee and address legal risks. Once regulatory red lines are crossed, projects may face lawsuits, fines, or even business interruptions, severely impacting their development progress.

Ripple: The issue of whether XRP is a security led to a lawsuit with the US Securities and Exchange Commission (SEC). In 2023, the court partially ruled in favor of Ripple but still imposed a $125 million fine. During the litigation, Ripple expended significant resources, and the market performance of XRP and the development of the project ecosystem were noticeably hindered.

3. Market Access Restrictions

Compliance requirements may lead to projects being banned from operating in certain regions, limiting their global expansion. If tokens are deemed unregistered securities, they may be delisted from exchanges, harming the user base and market share.

Solana: In 2022, Solana faced a class-action lawsuit due to its token SOL being labeled as an unregistered security, hindering its promotion in certain markets.

Polygon: In 2023, the SEC listed MATIC as an unregistered security in its lawsuit against Binance, leading to its delisting from platforms like Robinhood, directly impacting market share and user growth.

4. Innovation Constraints

Compliance requirements may limit the exploration space for project teams in technological innovation and business models. To avoid regulatory risks, projects may have to adjust their development direction or abandon certain cutting-edge attempts, thereby weakening their competitiveness and long-term development potential.

Cardano: In 2023, the SEC classified ADA as a security in lawsuits against Kraken and Binance. This label may restrict Cardano's application promotion in certain markets, forcing it to adopt a more conservative strategy in ecosystem development, thus slowing its pace of innovation.

5. Core Member Risks

Compliance issues not only affect the projects themselves but may also impact founders or core members, exposing them to legal lawsuits, fines, or even imprisonment. This not only undermines project stability but may also negatively affect the reputation of the entire industry.

Binance founder Changpeng Zhao: In 2023, Zhao pleaded guilty to compliance issues and resigned as CEO of Binance, subsequently being sentenced to four months in prison. This incident directly affected Binance's operations and could weaken its leadership position in the industry.

6. Other Typical Cases

Tether

/USDT: Tether settled with the US Commodity Futures Trading Commission (CFTC) over misleading reserve statements, paying a $40 million fine and continuing to face potential regulatory sanctions from federal investigations. These events pose threats to its market credibility and business expansion.

Compliance requirements impose multifaceted constraints on the development of blockchain projects, especially during critical stages of exploring new markets and increasing market share, where compliance may become a "tightening spell" for blockchain projects. Therefore, project teams need to prioritize compliance challenges while pursuing innovation and expansion, formulating strategies that balance development and compliance.

Current Regulatory Status and Market Position of the Sui Chain

Sui, a public chain project launched in May 2023, has quickly emerged in the blockchain field due to its unique technical architecture and user-friendly design.

Compared to many other public chain projects, Sui has demonstrated remarkable robustness in its nearly two years since launch, particularly in regulatory compliance and network security. To date, Sui has not faced any lawsuits or accusations due to regulatory issues or security incidents, highlighting the rigorous attitude of its development team towards technology and compliance, and earning trust and reputation in the competitive blockchain market.

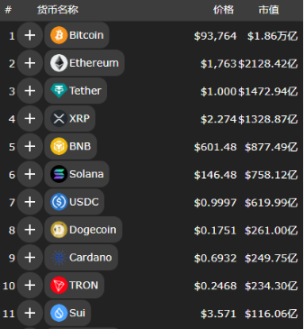

At the same time, Sui's recent performance further proves its market potential. With the rapid development of the Sui chain ecosystem and the continuous increase in community enthusiasm, Sui's market capitalization has soared to over $11 billion, firmly ranking among the top 11 in the global virtual currency market capitalization leaderboard. This market cap not only reflects the high recognition of Sui's technological innovation and application prospects but also signifies its important position in the competition within the public chain sector.

Figure 1 Crypto Market Capitalization Ranking

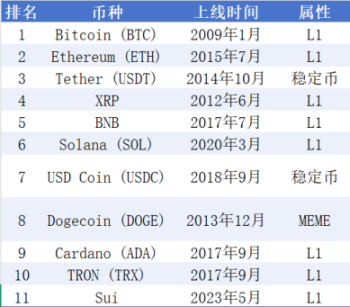

Among the top ten projects in global cryptocurrency market capitalization, USDT and USDC as stablecoins, and DOGE as a MEME coin occupy unique positions. Excluding these three, Sui ranks 8th in public chain market capitalization. This achievement is particularly noteworthy, as the youngest project in the top ten is Solana, which has been running for five years since its launch in March 2020. In contrast, Sui, which only launched in May 2023, has entered the global market cap TOP11 in just two years. This achievement is undoubtedly remarkable, fully demonstrating Sui's extraordinary development speed and potential in the blockchain field.

Figure 2 Token Launch Time and Attributes

So, how has Sui managed to grow rapidly and establish a foothold in the fierce WEB3 competition while maintaining compliance?

Characteristics of the Sui Chain

The Sui chain is an emerging L1 blockchain platform developed by Mysten Labs, designed to provide fast, secure, and scalable solutions for Web3 applications. It uses the Move programming language, emphasizing high transaction speed and low latency, prioritizing fast and secure transaction execution, especially suitable for real-time applications like gaming and finance. Sui offers a familiar user experience, such as logging in via network credentials (zkLogin), and supports large-scale applications by expanding network capacity according to demand.

The modular design of the Move language allows developers to organize code into reusable modules, supporting formal verification to ensure that smart contract behavior meets expectations. Compared to the more widely adopted EVM language, the Move language has more advanced advantages that are better suited to current blockchain development.

1. Security: Resource Model and Vulnerability Prevention

Sui has significant advantages in security, primarily due to its resource model. In Move, each data object (Object) has clear ownership, ensuring that resources cannot be accidentally or maliciously copied or destroyed.

2. Performance and Scalability: Parallel Execution and High TPS

Another key advantage of the Move language is its performance and scalability. Move supports parallel execution of transactions, while EVM uses sequential processing, which can lead to transaction congestion and rising fees under high load.

3. Developer Experience: Modularity and Learning Curve

The modular design of Move gives it an edge in developer experience. Move programs are organized into modules that share resources and functionalities, facilitating upgrades and combinations.

Recently, Ethereum (ETH) founder Vitalik also suggested replacing the Ethereum Virtual Machine with RISC-V. RISC-V shares many similarities with the Move language, the most important being modularity and scalability. Both RISC-V and Move emphasize modularity and scalability in their design, supporting user-defined instruction extensions, making them adaptable to various application scenarios for easier expansion in different blockchain applications. This further highlights the technical superiority of the MOVE language.

Figure 3: Vitalik proposed replacing the Ethereum Virtual Machine (EVM) with RISC-V

Operational Direction of the Sui Chain

1. Community Incentives

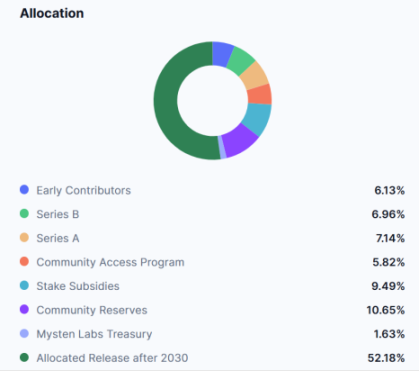

Figure 4: Sui Token Distribution Ratio

From Figure 4, we can see the distribution model of Sui tokens, with three uses aimed at supporting the construction of the Sui ecosystem community:

Community Access Program: 5.82%

Stake Subsidies: 9.49%

Community Reserves: 10.65%

The proportion of tokens used to support the construction of the Sui ecosystem community is 26%, which accounts for 54.37% of the announced release plan (47.82% to be released by 2030), representing more than half of the total circulating tokens.

Among them, the 5.82% for the Community Access Program is used for project incentives, supporting on-chain projects, and addressing the high customer acquisition costs in the early stages, encouraging users to participate in on-chain DeFi. For example, in on-chain lending projects, the initial lending pool funds are relatively small, and incentives are provided to encourage users to participate in deposits and loans.

The 10.65% for Community Reserves focuses more on the long-term construction of the Sui ecosystem, such as funding the development of DApps using the Move language, supporting community governance, or reserving funds for future expansion.

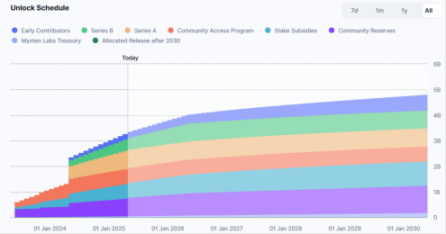

Figure 5: Sui Token Unlocking Plan

In Figure 5, we can see the unlocking plan and unlocking ratio for Sui tokens. Apart from a large unlocking in May 2024, the remaining tokens are gradually unlocked according to their respective distribution ratios, with the unlocking speed gradually decreasing.

At the beginning of a public chain's launch, there are relatively few projects and users, so a small amount of tokens is released first. As the number of projects and users increases, the demand for tokens rises, and the supply gradually increases according to the unlocking plan to match the demand. This unlocking mechanism ensures a balance between supply and demand, as well as the stability of token prices.

2. Building Key Projects

In some key projects, such as on-chain infrastructure or projects with slow returns on investment, construction is carried out by the official operation of Mysten Labs.

For example:

Sui Name Service (SNS): Provides human-readable naming services to simplify wallet address management.

SuiPlay0x1: Next-generation handheld gaming device that supports WEB2 + WEB3 games.

Walrus: Decentralized storage protocol.

Seal: Decentralized secret management service for protecting sensitive data through on-chain access control policies.

Deep Book: Centralized central limit order book (CLOB) that offers parallel execution and low transaction fees, providing a high throughput and low-latency trading experience.

Officially operated projects by Mysten Labs, such as the Deep Book order book project, provide liquidity and rapid transaction matching for on-chain trading; the Sui Name Service offers domain name services for the Sui chain, facilitating user interaction and the entry of WEB2 companies; the Walrus decentralized storage protocol and Seal centralized secret management service enable builders to store information and encrypt sensitive data through these two projects.

The SuiPlay0x1 handheld gaming device, due to its hardware design and mass production requirements, as well as the need to adapt to games on various platforms, supports WEB2 + WEB3 games. It is a project with high initial investment and slow returns. Without a complete ecosystem and the integration of WEB2 game developers, it is challenging for WEB3 game companies (which are generally smaller in scale) to develop it. Therefore, the official team has led the research and development of the SuiPlay project from the very beginning.

3. Offline Activities

Sui's offline activities aim to promote Sui blockchain technology, bridge the gap between WEB3 and WEB2, attract developers, investors, and partners to join the ecosystem, enhance community cohesion, and increase brand awareness. Leveraging Sui's high performance and scalability to solve traditional problems, the focus is on education, collaboration, and innovation.

The activities take various forms, including global conferences, industry summits, community gatherings, technical workshops, and hackathons. The content covers Sui's technological advancements, Move language education, ecosystem project showcases, industry trend discussions, and developer practices, helping participants gain in-depth knowledge of Sui, learn development, and build connections. The activities span regions such as North America, Asia, and Europe, collectively promoting the development of the Sui ecosystem.

Compliance Solutions

The Sui blockchain has implemented several measures to ensure compliance with regulatory requirements, including anti-money laundering (AML) and other legal compliance. However, as a decentralized blockchain, Sui does not directly enforce AML or KYC but provides the necessary tools and infrastructure for projects built on the platform to meet regulatory standards.

1. Compliance and Legal Requirements

According to Sui's Terms of Service, users must comply with all applicable laws when using the platform, including AML, anti-terrorism financing, and sanctions regulations. The terms explicitly prohibit engaging in illegal activities such as money laundering, terrorism financing, or violating OFAC sanctions. Users are responsible for their own tax compliance, including maintaining records and reporting transactions to tax authorities. Sui may report user activities as required by law to ensure transparency.

2. Partner Support

The decentralized nature of Sui makes it difficult to implement AML/KYC directly like traditional financial institutions, but by providing transparent transaction records and partner tools, it supports projects in meeting regulatory requirements. For example, the Sui blockchain collaborates with Ant Digital to utilize its ZAN platform to provide KYC and AML tools to support the compliant tokenization of real-world assets (RWA). ZAN operates as an RPC node for Sui, integrating with Sui's infrastructure. This means that ZAN's tools can seamlessly communicate with Sui's blockchain network, enhancing its scalability and security.

Additionally, Sui's Terms of Service allow for the freezing of funds or restrictions on use to comply with legal requirements, ensuring overall compliance. (If the $1.46 billion stolen from Bybit occurs on the Sui chain, the terms may allow for the freezing of the stolen funds).

3. Project-Level Compliance

Sui itself does not enforce KYC (Know Your Customer) or AML (Anti-Money Laundering) because it is a decentralized blockchain network. Research shows that Sui DeFi tools typically only require a connection to a Sui wallet for use, without the need for KYC, bank cards, or email registration. However, when it comes to fiat deposits or withdrawals, such as selling Sui tokens through exchanges, it may trigger multi-level KYC verification. This indicates that compliance is primarily implemented by project teams or third parties, with Sui providing supportive tools rather than direct enforcement.

Specific Compliance Measures

The Sui chain enhances compliance levels and isolates compliance risks through on-chain infrastructure support, compliance partners, and project reviews.

1. Supporting Compliance through Infrastructure

Innovative technologies are adopted to enhance compliance. For example, Walrus, Seal, and zkLogin significantly improve compliance with the EU's General Data Protection Regulation (GDPR). GDPR is an important data protection regulation in the EU aimed at protecting the personal data privacy of EU citizens, requiring organizations to adhere to strict rules regarding data collection, processing, and storage, including data minimization, purpose limitation, storage limitation, integrity and confidentiality, and ensuring the rights of data subjects (such as access, correction, deletion, etc.).

Walrus: Supports Data Deletion, Meeting the "Right to be Forgotten"

Walrus is a decentralized storage protocol designed for handling large binary files (blobs), allowing sensitive personal data to be stored on independent sub-chains for quick deletion, meeting the GDPR's "right to be forgotten" (Article 17 GDPR).

Seal: Secure Management of Sensitive Data

Provides secure storage and access control for sensitive data. Seal ensures that personal data is protected during storage and processing, complying with GDPR requirements for data security and privacy.

zkLogin: Privacy-Protecting Authentication, Supporting Data Minimization

zkLogin is a native feature of Sui that allows users to log into decentralized applications (DApps) using familiar Web2 credentials (such as Google, Facebook) without managing private keys or seed phrases. By not disclosing user credentials and using zero-knowledge proofs, it supports the data minimization principle of GDPR (Article 5 GDPR). It reduces the amount of personal data stored on-chain while ensuring user privacy is protected. Additionally, the design of zkLogin avoids the complexities of traditional private key management, reducing the risk of data breaches.

2. Collaboration with Third Parties

The Sui chain enhances compliance through its community-driven Sui Guardian program, collaborating with third parties like Chainalysis. Sui Guardian tracks scams and phishing websites, while Chainalysis's analytical tools can monitor and analyze on-chain transactions, identifying addresses or patterns associated with known illegal activities. By analyzing transaction patterns, Chainalysis can identify potential phishing attack victims, helping exchanges and users take preventive measures. This helps Sui comply with global AML and KYC regulatory requirements, such as the EU's Fifth Anti-Money Laundering Directive (5AMLD) and the US Bank Secrecy Act (BSA).

3. Self-Restraint by Project Teams

Through various tools, developers are assisted in self-restraint and ensuring compliance, such as geographic restrictions. For example, Sui collaborates with Netki to launch DeFi Sentinel, a compliance oracle that provides developers with automated compliance tools, including real-time KYC/AML (Know Your Customer / Anti-Money Laundering), wallet screening, and financial transaction monitoring. These tools can help dApps verify users' locations, ensuring that only users in compliant regions can access services.

For example, the Doubleup gambling project is only open to users in compliant gambling regions.

4. Risk Isolation

In the blockchain ecosystem, public chains typically serve as the foundational layer, while application development is primarily carried out by project teams, including DeFi, DApps, DePin, etc. Users interact through smart contracts written by the project teams, with stakeholders mainly being the project teams and users (contract participants). Currently, most legal disputes and judicial cases involve the project teams and their participants; unless there is a significant flaw in the public chain that directly leads to user losses, public chains are rarely named as defendants.

For instance, Sui recently announced a partnership with xMoney and xPortal to launch a digital Mastercard supporting SUI tokens in Europe. Sui itself, as a technology platform, is mainly responsible for building the infrastructure and asset ecosystem, while the payment side is handled by the licensed institution xMoney, and the user experience on the application side is managed by xPortal.

Analysis of Sui Chain's Compliance Path

From Sui Chain's practices, we can see that compliance has been regarded as an important development direction from the very beginning and has been integrated into the top-level design of the public chain.

The layout of the public chain should start from an overall perspective, adapting to future development directions based on underlying logic. As a public chain project, it should not plan its development from the perspective of a single project but should consider diverse application scenarios and development trends, making arrangements in advance.

Governance of the chain is akin to governance of a country; only with a complete infrastructure on-chain, leading the development of high-investment projects, and reasonably distributing incentive measures can it attract more developers and users, gradually developing a rich on-chain ecosystem.

Conclusion

As a rising star in the public chain field, Sui Chain has successfully found a balance between compliance and development through its unique technical architecture and well-thought-out operational strategies.

By integrating compliance into the top-level architecture from the design phase, it not only meets global regulatory requirements but also builds a vibrant and robust ecosystem through community incentives, key project development, and offline activities. Its specific measures for user compliance, partner support, and project-level compliance, such as collaborating with third parties to provide KYC/AML tools and adopting innovative technologies to support GDPR compliance, demonstrate its foresight and execution in addressing regulatory challenges.

Sui Chain's practices prove that compliance is not only a necessary condition for public chains to respond to external pressures but also a key bridge for promoting the deep integration of blockchain technology with the real world. Compliance serves not only regulatory needs but also the needs of on-chain users and everyone in the real world.

Although the Web3 world advocates that "The code is the law," excessive jungle law is rejected by regulators and mainstream society in various countries, which may confine Web3 to the virtual world. Only through compliance can we truly cross the boundaries between the virtual and the real, providing global users with safer and more convenient services, unleashing its revolutionary potential.

Considering how to integrate Web3 with the real world is both the starting point and the endpoint of compliance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。