As the U.S. regulatory environment remains friendly, more and more fintech giants are entering the stablecoin space.

Author: PolyFlow

Despite ongoing discussions in the market about PayFi, its underlying foundation still heavily relies on the large-scale application of stablecoins. From the market perspective in April, as the new regulatory framework in the U.S. gradually becomes clearer, an increasing number of fintech giants are entering the field, whether by participating in stablecoin issuance, building their own stablecoin payment networks, or entering the space through investments and acquisitions. Fintech companies are expected to dominate the future stablecoin market, further promoting the implementation of PayFi scenarios. Here are the key observations for this month.

Data Insights

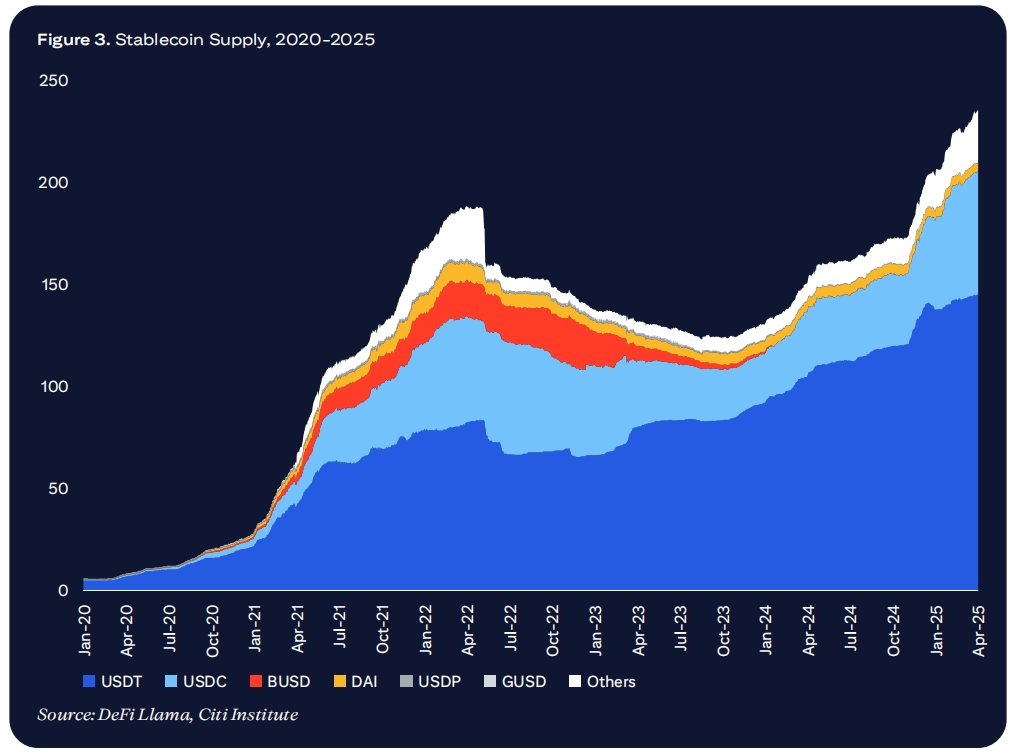

A recent report from Citi GPS shows that as of April 2025, the total circulation of stablecoins has surpassed $230 billion, a 54% increase compared to April 2024. The market is currently dominated by two major players, Tether (USDT) and USD Coin (USDC), which together account for over 90% of the market share in terms of trading volume and transaction value.

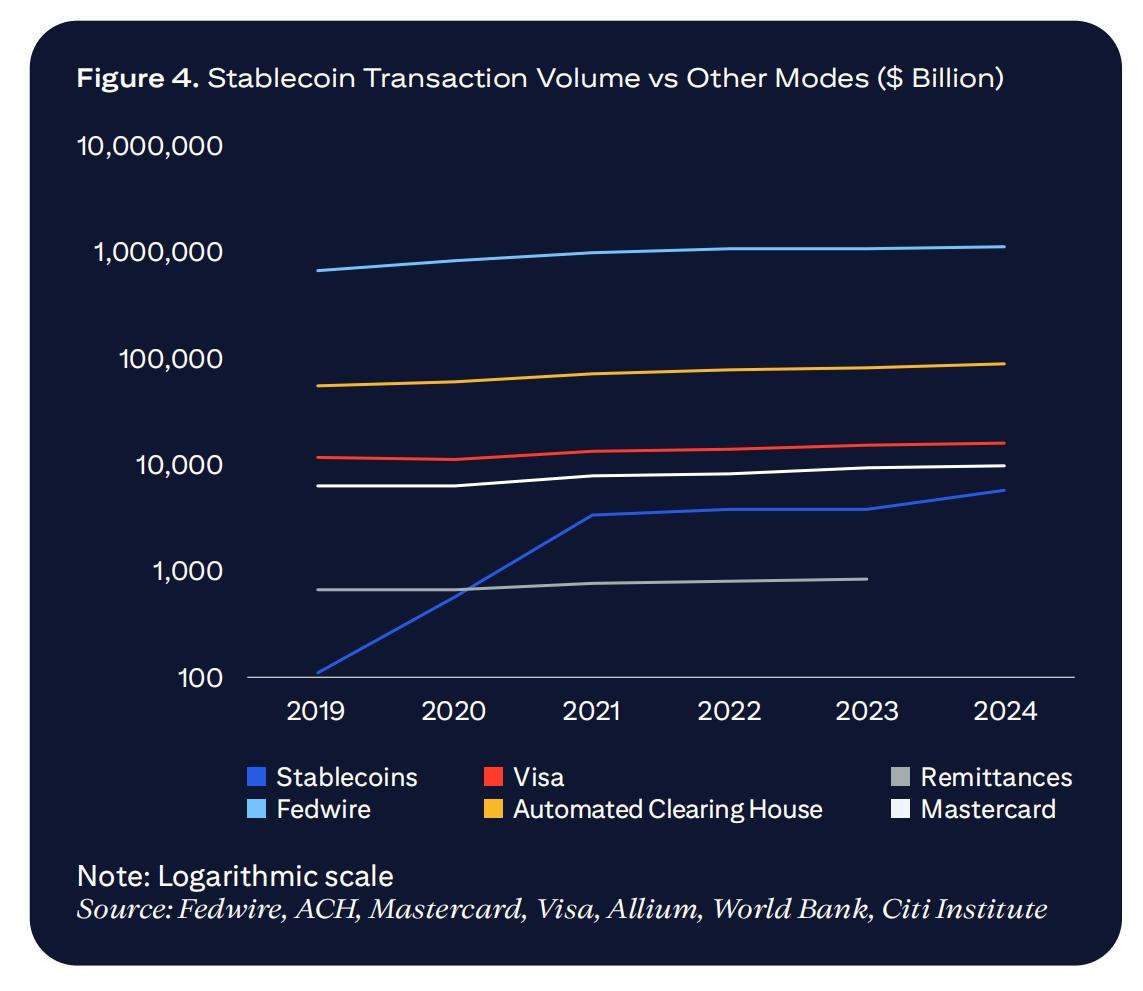

In recent years, the trading volume of stablecoins has continued to grow rapidly. Adjusted data shows that in the first quarter of 2025, the monthly trading volume of stablecoins reached $650 billion to $700 billion, nearly double the levels seen in the second half of 2021 to the first half of 2024, with the primary applications still concentrated in supporting the cryptocurrency trading ecosystem.

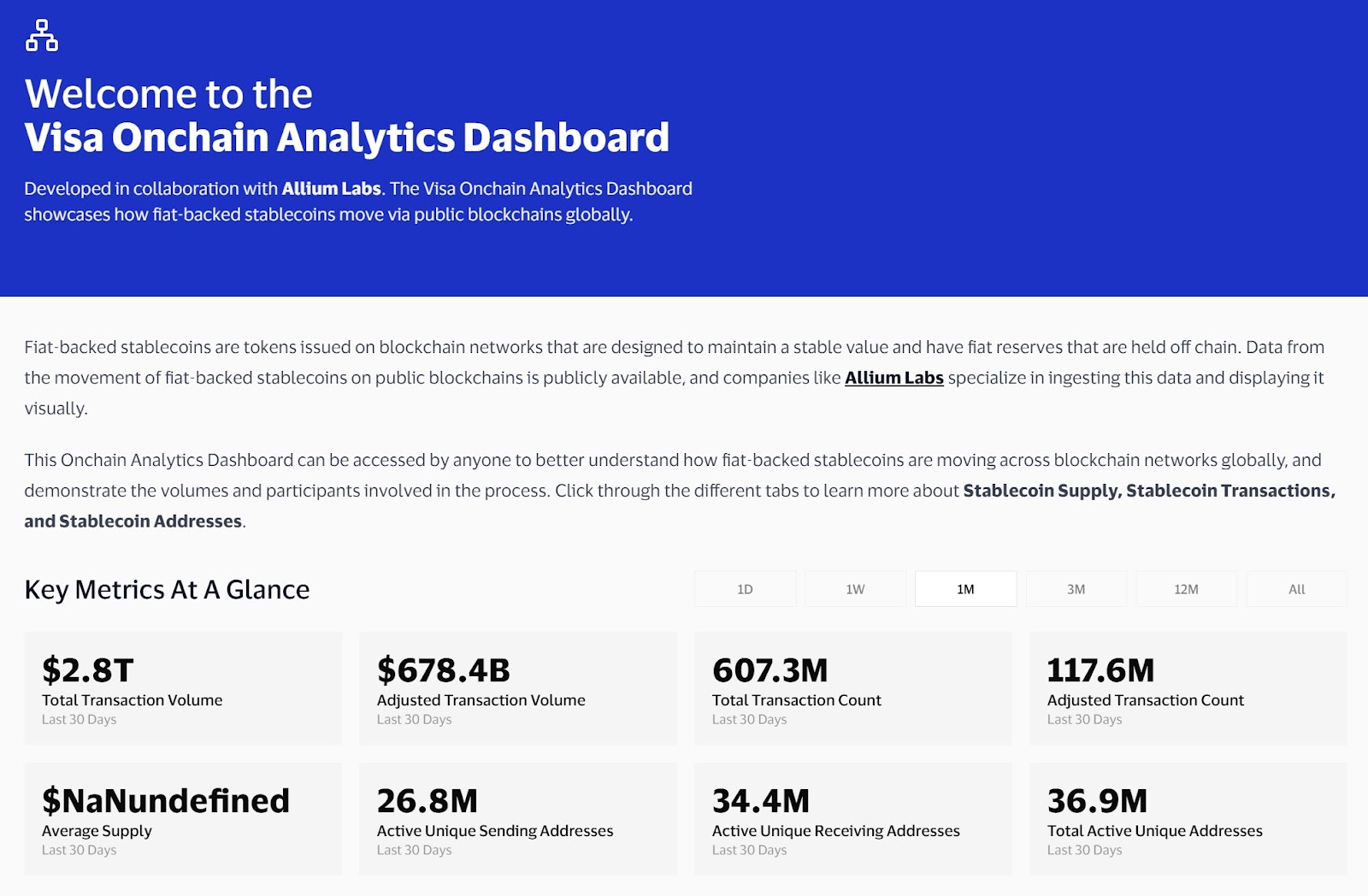

In addition to their role in cryptocurrency trading, stablecoins are gradually becoming a key tool in the cross-border payment system. The Citi GPS report indicates that the trading volume of stablecoins is expected to exceed the current transaction volumes of VISA and Mastercard in the future. Although still in the early stages of development, the trend is clear.

As Matt Blumenfeld, PwC's U.S. and Global Digital Assets Leader, stated, more banks and traditional financial institutions are expected to enter the market. U.S. dollar stablecoins are anticipated to continue to dominate, while the number of participants will depend on the diversity of products that meet different scenario needs. The competitive landscape of the future stablecoin space may surpass the existing card organization system.

Fintech Giants Accelerate Layout

The changing regulatory environment for digital assets in the U.S. is profoundly impacting how companies handle payments, capital flows, and asset management. The new SEC Chairman, Paul S. Atkins, is expected to bring clearer regulatory expectations to the crypto industry, which has been positively welcomed by the sector.

a16z states that stablecoins have reached a level of popularity that could fundamentally change the global payment system, similar to how WhatsApp disrupted international communication. Currently, financial giants are gathering to compete for the stablecoin payment market.

Circle Payment Network

The issuer of USDC, Circle, has officially launched the Circle Payments Network (CPN), aimed at addressing long-standing issues in cross-border payments, such as multiple intermediaries, complex compliance, and fragmented jurisdictions, particularly targeting emerging markets with efficient, modern payment solutions.

CPN creates an internet-style payment experience, enabling real-time global settlement of funds while ensuring compliance, including licensing, AML/CFT, cybersecurity, and risk management. The first batch of partners includes banks, fintech companies, payment and remittance service providers, and USDC strategic partners, with future plans to directly compete with traditional payment networks like Mastercard and Visa.

Additionally, CPN supports third-party developers in building diverse financial service scenarios based on smart contracts and modular APIs, and has already partnered with major global banks such as Banco Santander, Deutsche Bank, Société Générale, and Standard Chartered.

Circle CEO Jeremy Allaire stated that CPN will simplify remittances to the ease of sending an email, which not only solidifies Circle's position in the global financial services sector but also validates the transformative value of stablecoins for efficient, compliant, real-time payments.

Stripe Stablecoin Application

Stripe has launched a new product suite based on AI and stablecoins to support business payment growth. Its Payments Foundation Model leverages billions of transaction data points to enhance fraud detection and payment authorization rates, particularly excelling in identifying card testing attacks.

At the same time, Stripe has introduced Stablecoin Financial Accounts, allowing businesses to use stablecoins (currently supporting USDC and USDB, with plans to expand to more currencies) for payments in 101 countries. Additionally, through the Bridge platform in partnership with Visa, it has issued debit cards linked to stablecoin wallets, enabling users to spend stablecoins directly at Visa merchants. Bridge CEO Zach Abrams stated that this innovation is an important step in integrating stablecoins into everyday payments.

Stripe CEO Patrick Collison emphasized that AI and stablecoins are rapidly unlocking business benefits. In 2024, AI capabilities are expected to help Stripe's total payment volume grow by 38%.

Global Dollar Network (USDG)

Visa is planning to join the Global Dollar Network (USDG) alliance led by U.S. compliant stablecoin issuer Paxos, becoming the first traditional financial institution to participate in the alliance. This alliance includes leading companies such as Robinhood, Kraken, Galaxy Digital, Anchorage Digital, Bullish, and Nuvei, focusing on enhancing the interoperability, liquidity, and revenue-sharing mechanisms of stablecoins.

USDG launched a dollar-pegged stablecoin in November last year, aiming to increase the global adoption rate of stablecoins while providing economic benefits to partners. Currently, stablecoins are evolving from tools for cryptocurrency trading to practical financial infrastructure for B2B payments, capital market settlements, and treasury management. Visa's move also aligns with its long-term strategy in the digital payments space.

Banking License Competition

As traditional banks tighten services for crypto clients, leading companies like Circle, Paxos, and Coinbase are applying for banking licenses, planning to enter the regulated banking system to obtain customer deposits, custody stablecoin reserves, and provide banking services. Stripe has also applied for a special banking license, continuing the path explored earlier by Fiserv.

Payment companies are seeking licenses to reduce transaction costs, expand business boundaries, and circumvent restrictions imposed by traditional banking systems. Once crypto companies become compliant banks, they will find it easier to gain the trust of large corporate clients, and in the future, Fortune 500 companies may engage in deeper collaborations with stable, regulated crypto service providers. Corporate decision-makers need to pay attention to the trend of integration between crypto assets and traditional finance and prepare for strategic positioning.

April Investment Trends

- Tether Invests in Fizen

On April 15, 2025, Tether made a strategic investment in Fizen, a fintech company focused on self-custody wallets and digital payments, to help optimize the digital asset payment experience. Fizen aims to address the payment challenges faced by the unbanked population, enhance blockchain infrastructure, and integrate stablecoins into more payment scenarios, enabling real-time fiat settlement via QR codes and POS machines. By 2024, the global QR code payment scale is expected to exceed $3 trillion, and the collaboration between Tether and Fizen is likely to accelerate the adoption of stablecoin payments.

- Inflow Completes $1.1 Million Seed Round Financing

Inflow has received investments from AllianceDAO, Rockstart, GnosisVC, and others, aiming to provide low-cost, real-time global payment solutions for freelancers and small businesses in emerging markets. Its platform will significantly reduce international payment fees and settlement times, ensuring users' financial freedom.

- Zar Raises $7 Million

Zar has secured investments from Dragonfly Capital, a16z, and others, planning to provide cash-to-stablecoin services at 280,000 global mobile payment agent points to meet cross-border payment and anti-inflation needs. Currently, nearly 100,000 customers and 7,000 merchants have registered for the service, covering 20 countries including Pakistan, Bangladesh, Indonesia, Nigeria, Lebanon, and Argentina. Customers can exchange cash for stablecoins by scanning QR codes, with funds directly credited to their digital wallets.

April Summary

As the U.S. regulatory environment remains friendly, more fintech giants are entering the stablecoin space. Circle maintains over 25% market share in stablecoins and continues to expand its payment network; after acquiring Bridge, Stripe is fully integrating stablecoin payments.

The stablecoin market is transitioning from the "new players jockeying for position" phase to a competition for "control of payment channels." The advantages of stablecoins extend beyond the issuers; the key lies in controlling the currency usage scenarios. Funds are rapidly flowing towards practical payment applications, and whoever can dominate the payment scenarios will occupy a leading position in the stablecoin ecosystem.

About PolyFlow

PolyFlow is an innovative PayFi protocol that connects real-world assets (RWA) with decentralized finance (DeFi). As the infrastructure layer of the PayFi network, PolyFlow integrates traditional payments, crypto payments, and DeFi to serve real payment scenarios, providing compliant, secure, and scalable financial infrastructure, and promoting the establishment of new financial paradigms and industry standards.

Learn more: X|Telegram|Medium| DAPP| Official Website

Media Contact

E-mail: media@polyflow.tech

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。