Today, the price of $BTC reached a new high, and the URPD data will take an extra day to update. This is the first time in four months since January that we are encountering this sweet trouble again, which is quite nice. Before and after the new high today, I was out with friends and completely missed the opportunity to post in real-time. After returning, I saw that Bloomberg's view on Bitcoin's new high is due to the stablecoin legislation and regulatory easing.

I don't know if that's true, but what I do know is that the overall buying sentiment for Bitcoin is indeed good. Even though the 20-year Treasury auction caused a drop in the U.S. stock market, BTC's recovery was very quick, surpassing the U.S. stock market and even rising in sync with gold. From the results alone, it seems that investors view both BTC and gold as safe-haven assets.

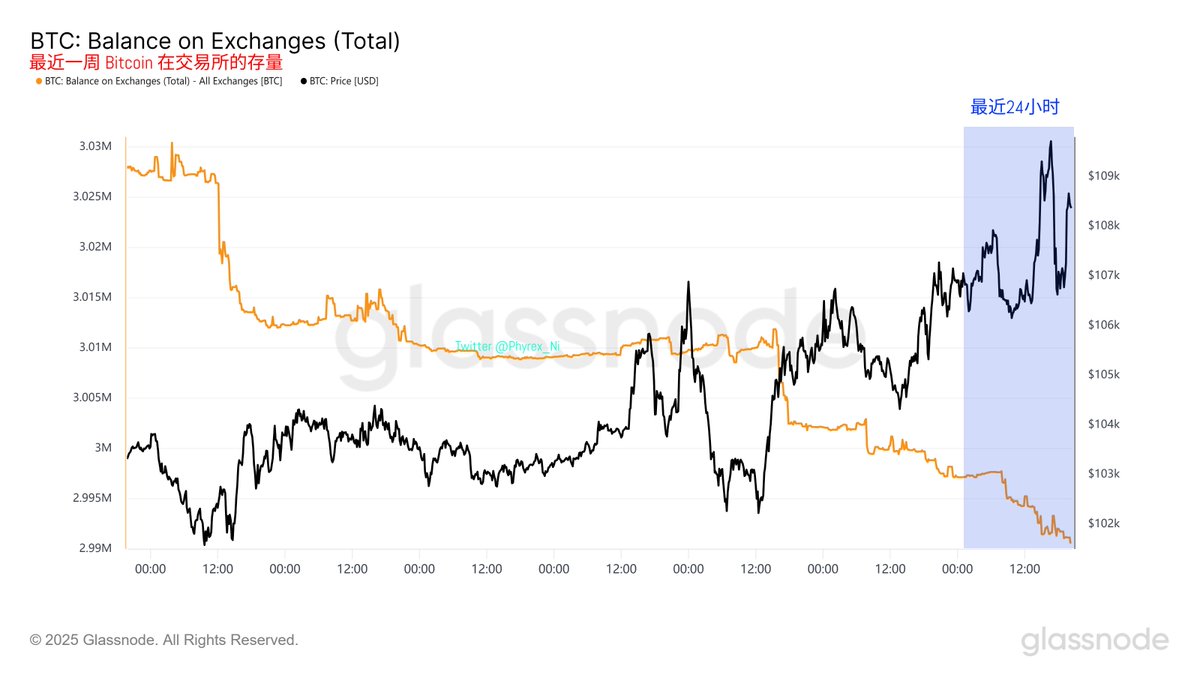

Today, I also discussed with friends how BTC could rise so sharply. My personal view is that the exchange inventory data is the primary reference. It is clear to see that even though BTC's price has reached a new high, the inventory on exchanges is still decreasing, indicating that more investors are transferring BTC out even as prices rise. This suggests that they are either not buying or are moving their inventory out.

Both of these concepts represent a lack of intention to sell in the short term because if they were planning to sell at a high, the best liquidity for BTC spot would still be on exchanges, or in other words, the BTC on exchanges would have a greater impact on BTC's price.

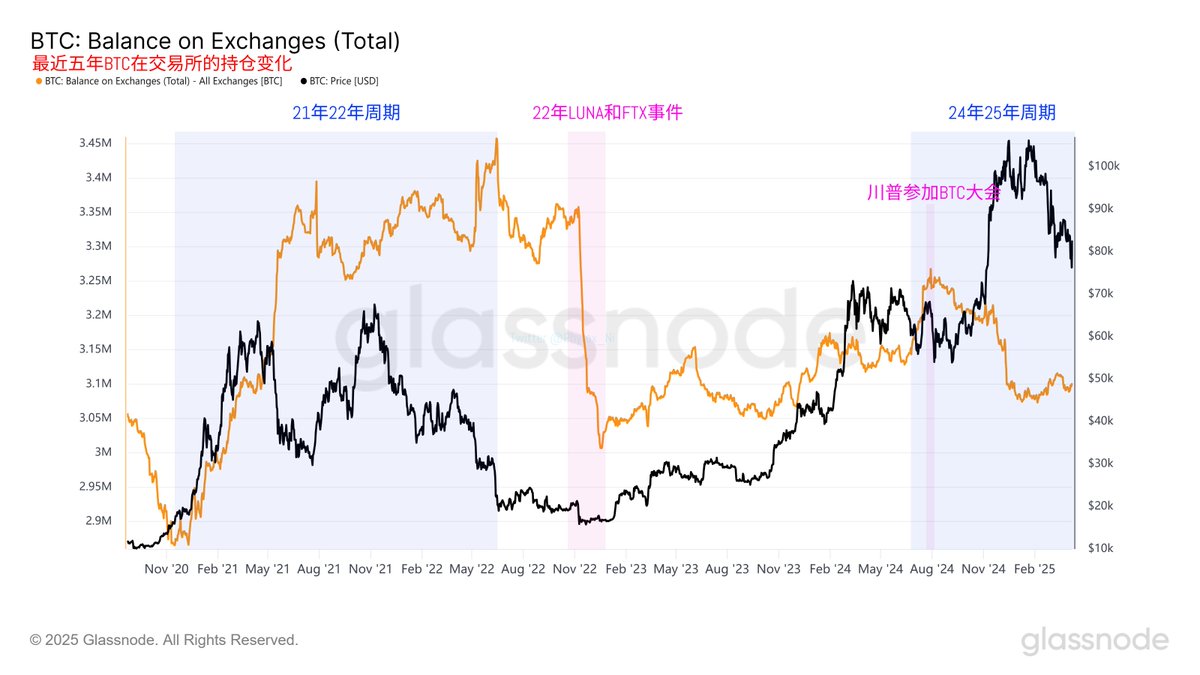

I still want to present the exchange inventory data for BTC over the past five years. It is evident that in the last cycle, as prices rose, more BTC was concentrated on exchanges, aiming for better selling prices, until the collapse of Luna and FTX, when investors began withdrawing BTC from exchanges.

From this cycle's perspective, it is clear that as BTC's price rises, more BTC is actually leaving exchanges. In terms of time cycles, this is somewhat related to Trump's campaign, especially when Trump stated at the BTC Consensus Conference that he would consider BTC as a strategic reserve for the U.S. Since that day, the BTC inventory on exchanges has been continuously declining.

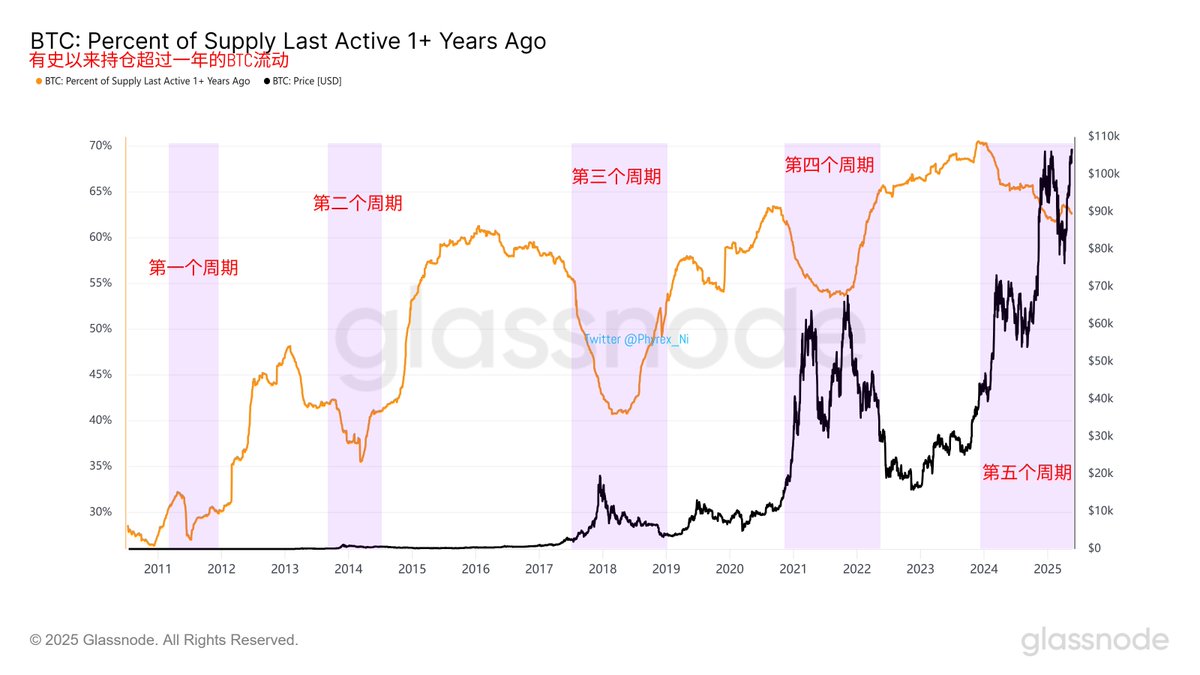

The second point I think needs to be emphasized is the liquidity data of BTC held for over a year. I have mentioned this data multiple times, and it has never been missed. This data shows an inverse relationship between the holding amount and BTC's price, and this data is updated in the weekly reports.

Currently, it is also evident that the BTC held for over a year is still in the distribution phase, especially in the absence of negative macroeconomic factors, making this data highly effective.

From a historical perspective, we are currently in the fifth major distribution cycle, and the fifth cycle is likely to form a double top structure similar to the fourth. In fact, the second top is already being drawn. I don't know if it has ended or when it will end, but as of now, there has been no shift from investors holding BTC for over a year. Therefore, in the absence of new macroeconomic and political negative factors, it cannot be ruled out that BTC may continue to rise.

Of course, this data is also lagging, making it impossible to determine an absolute top, but it is still quite feasible to identify the top range.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。