Author: ChandlerZ, Foresight News

On May 22, 2025, the price of Bitcoin surged past 110,000 USDT, breaking the historical high of 109,599 USDT set on January 20. This scene inevitably reminds one of that moment in November 2021. At that time, Bitcoin briefly surpassed the early-year high before quickly retreating, marking the beginning of a long and profound bear market cycle. Now, the market seems to be at another turning point: will it break through again and open up a new round of upward space, or will history repeat itself, falling into a double top pattern after a "false breakout," ultimately leading to a significant correction?

This is a question that cannot be avoided whenever Bitcoin approaches historical highs. In past bull markets, we have repeatedly seen similar structures: a climax arrives, market sentiment soars, and discussions about whether "the cycle peak has been reached" arise. In this round, although the upward momentum and rhythm feel vaguely familiar, the deeper market structure has already undergone significant changes.

The price is replaying, but the market is no longer what it was. In this context, should we continue to believe that the "cyclical law" brought by halving still dominates Bitcoin's fate? Or should we acknowledge that a new rhythm has quietly unfolded in ETF funds, on-chain structures, and macro narratives?

Returning to the most essential observational methods, perhaps on-chain data, historical mirrors, and behavioral traces can still provide us with some cyclical insights. Is the current wave of increase merely the final sprint of cyclical inertia, or is it a new starting point after reconstructing the cyclical structure? Perhaps the answer lies within the data's context.

Is the market repeating historical paths?

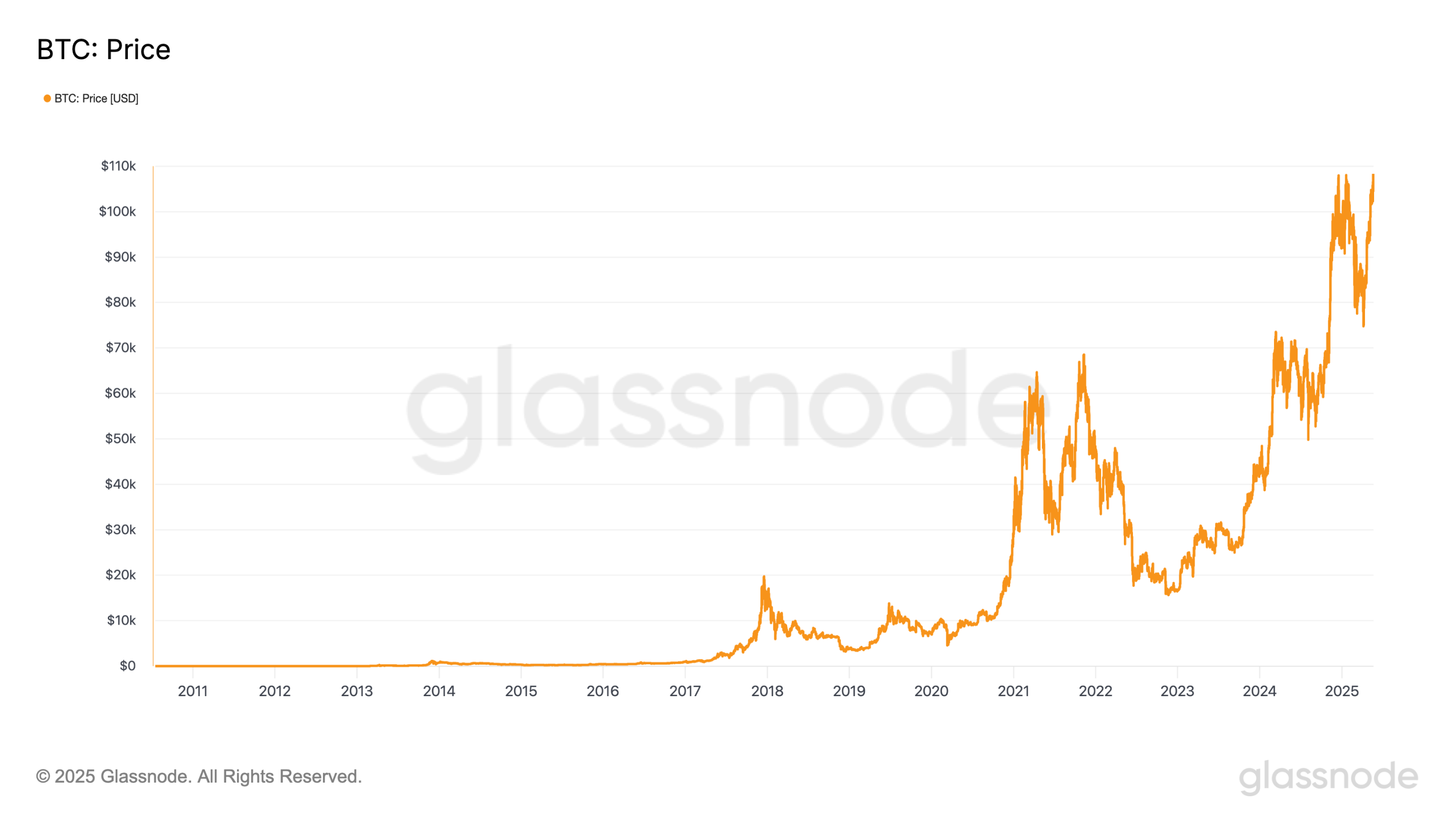

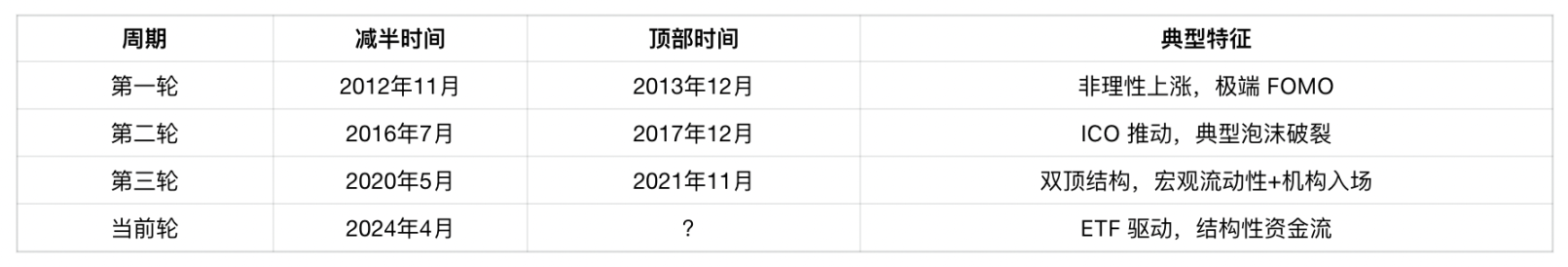

The historical price movements of Bitcoin, although highly volatile, can generally be divided into several typical cycles of "halving-driven + bull-bear rotation":

Since 2011, Bitcoin's price has consistently evolved under the logic of "halving-driven—supply-demand imbalance—bull market explosion—top correction," with each cycle ending at a higher price peak. The double top structure of 2021 is undoubtedly the most cautionary tale.

Bitcoin first reached a phase high in April 2021, stimulated by multiple positive factors such as the favorable listing of Coinbase, the continuation of loose monetary policy, and Grayscale's continuous accumulation of GBTC. Market sentiment was high, and the price first broke through the 60,000 US dollar mark. However, this high point did not last long. In May, as the Federal Reserve signaled tapering and interest rate hikes, combined with the policy risk of China's large-scale crackdown on domestic mining, the Bitcoin market quickly fell into a correction, dropping to around 30,000 US dollars in less than three months, completing a significant mid-cycle adjustment.

A few months later, the market gradually digested negative sentiment and rebounded towards the end of summer. With El Salvador officially adopting Bitcoin as legal tender, global inflation concerns leading some investors to view it as a potential hedge, and strong optimistic expectations for the approval of the first Bitcoin futures ETF in the U.S., positive narratives and capital inflows reignited the upward momentum, briefly pushing the price above approximately 69,000 dollars on November 10, before quickly retreating, forming a clear, months-spanning "double top structure" alongside the April high.

Ultimately, this triple resonance of new price highs, active on-chain realization, and shrinking demand constituted a typical "false breakout" pattern. Bitcoin quickly fell back after briefly surpassing the peak, initiating a downward cycle. This structure technically presents as "local new high + volume divergence + instant reversal," a classic double top signal, providing important lessons for the current market nearing historical highs.

Will history converge?

The current trend's slope and shape are quite similar to those just before November 2021. More importantly, several on-chain indicators are signaling structural convergence.

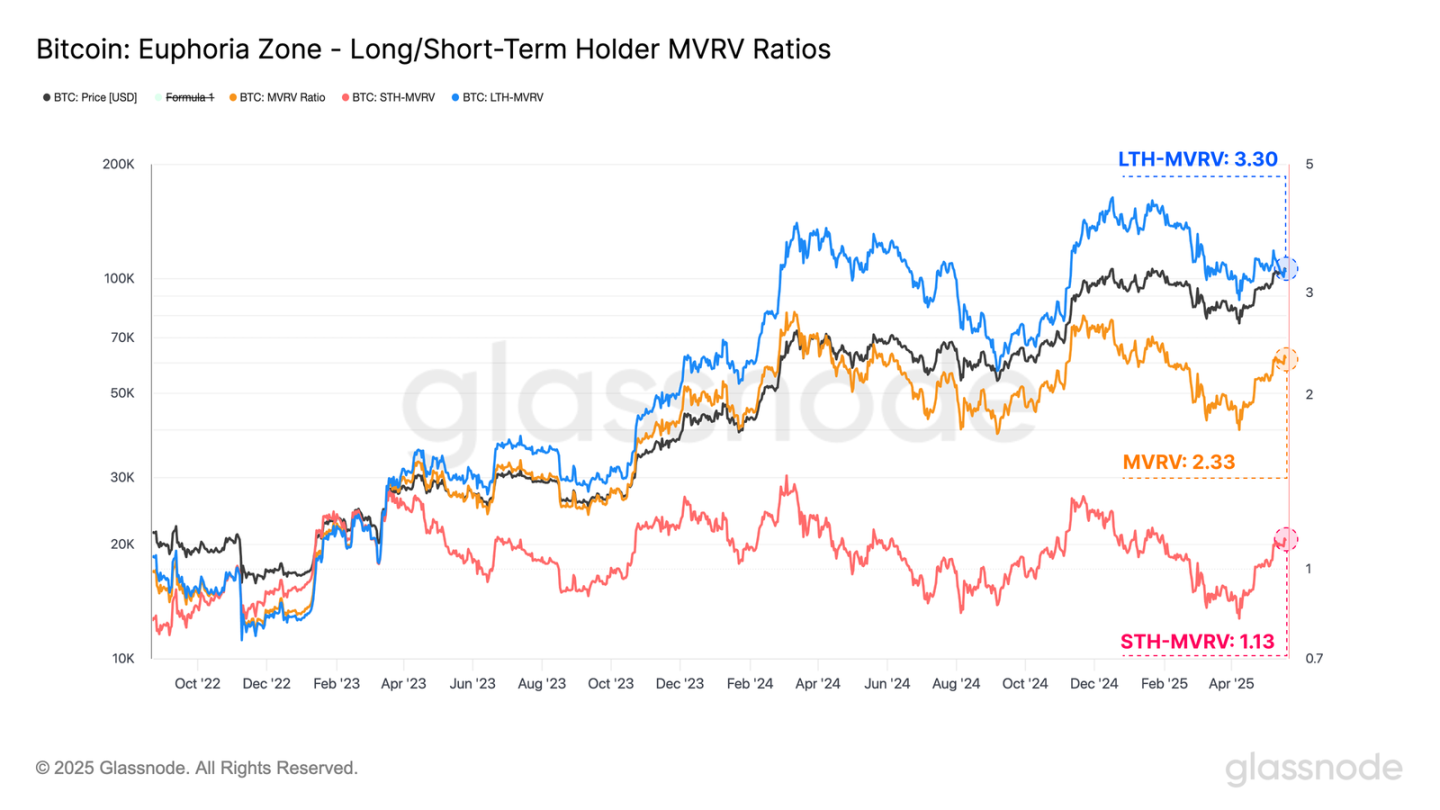

Recent data shows that the MVRV of long-term holders has risen to 3.3, approaching the "greed red zone" defined by Glassnode (above 3.5); the MVRV of short-term holders has also significantly increased from a low of 0.82 to 1.13, indicating that most short-term funds in the market have re-entered the profit zone. From a behavioral finance perspective, this structural change is a necessary condition for forming top pressure: when the vast majority of investors return to a profit state, the desire to realize profits often increases correspondingly.

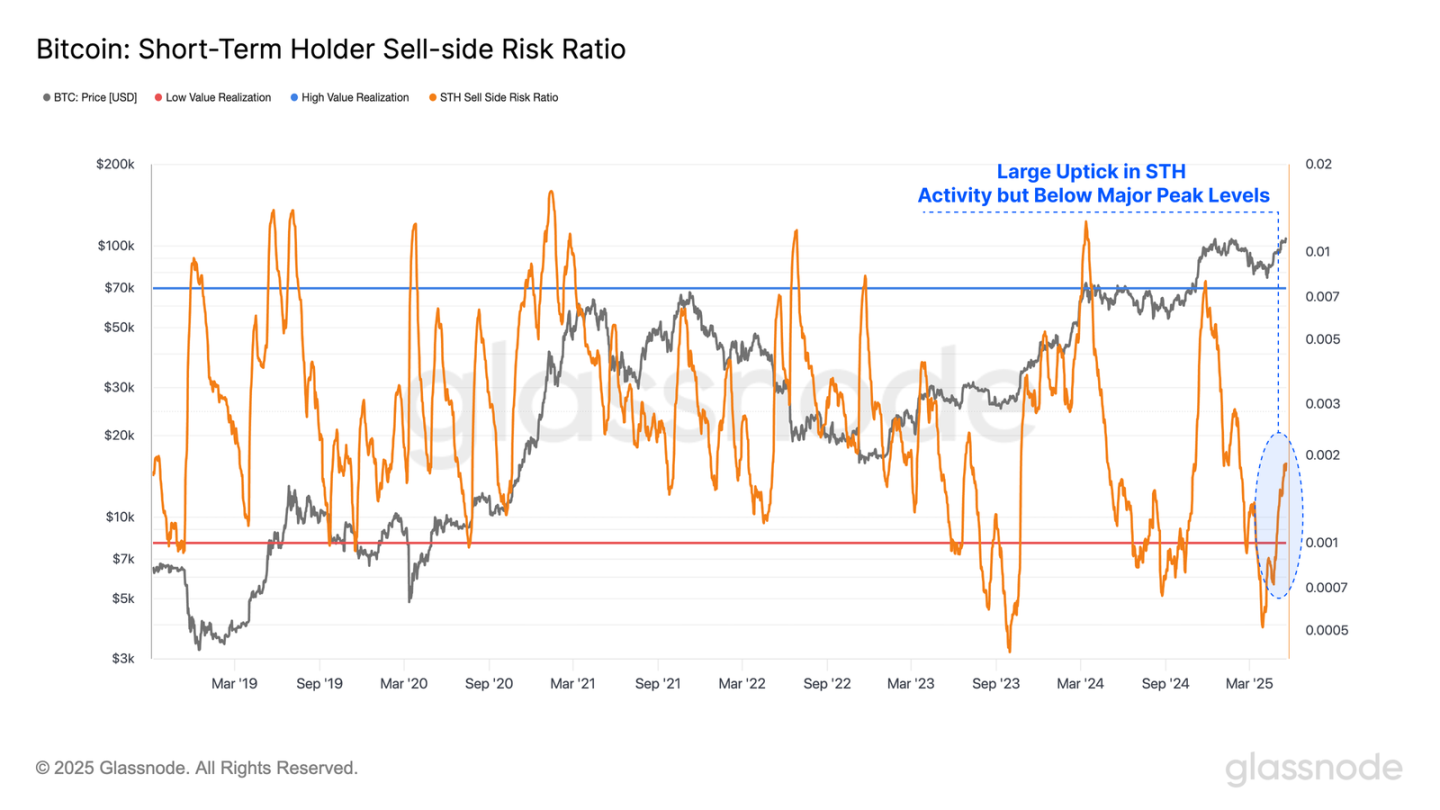

However, if we analyze from the perspective of "selling pressure" in the on-chain structure, the current short-term investors' selling risk ratio has shown a significant increase, indicating that some profit-taking actions have occurred on-chain, but the overall value remains at a historically moderate to low level. This state reflects that: although investor sentiment has warmed, and some funds have chosen to take profits in the profit zone, the overall market has not yet entered an imbalanced state dominated by "collective profit realization."

This means that while the upward space is initially constrained, the market is not out of control. As long as subsequent liquidity remains stable, the market still has the conditions to continue a structural upward trend, rather than being pushed to an ultimate peak.

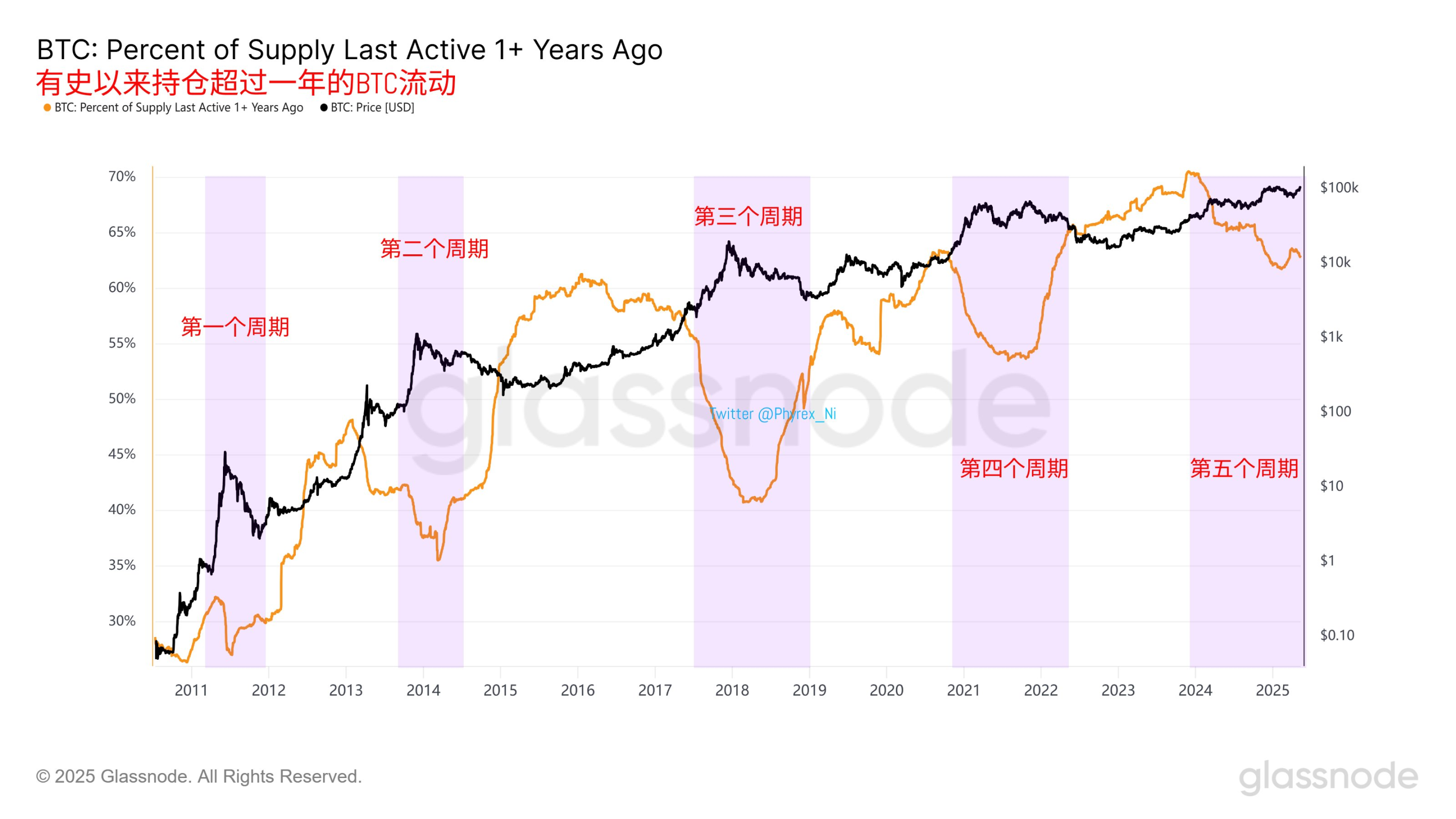

In summary, the behavior of long-term holders has always been the most reliable slow variable signal in Bitcoin cycle judgment. Whether in 2013, 2017, or 2021, the end of each major bull market has almost always been accompanied by concentrated distribution from these investors, while new bull market cycles often begin with their re-accumulation.

The current market has entered Bitcoin's fifth major cycle. If long-term holders have not yet begun a new round of position replenishment, it may indicate that the market is still in the top region or is still constructing a high double top structure.

What does the future trend look like?

According to the calculation method of on-chain analyst @Murphychen, which uses BTC's MVRV for assessment, because MVRV essentially represents the relationship between funds and costs.

For more than a decade, Bitcoin has consistently followed the principle of significant divergence between MVRV and spot price, meaning that once a higher price appears but with a lower MVRV, subsequent indicators cannot break through previous highs, and the price space is then constrained.

The logic behind this is that as the cost of turnover increases, pushing the price higher requires exponential increases in capital.

The highest point of MVRV in this round appeared on March 11, 2024, with BTC priced at 72,000 dollars and MVRV at 2.78; thereafter, whether on December 17 or January 21, even if BTC prices reached new highs, MVRV never broke through 2.78.

Therefore, for BTC to reach for the stars, the first and most important step is to break the significant divergence in MVRV. Based on the current RP dynamic value, BTC's price needs to break through 125,500 dollars.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。