Two venture capital funds directly purchased WLD tokens at market price without any discount.

Written by: 1912212.eth, Foresight News

On May 21, 2025, World Foundation announced that its subsidiary World Assets Ltd. sold $135 million worth of WLD tokens to early supporters Andreessen Horowitz (a16z) and Bain Capital Crypto at market price. Following the announcement, the price of WLD briefly surged over 13%, reaching a high of $1.29, with trading volume spiking by 70%.

In response, Bitwise Chief Investment Officer Matt Hougam tweeted, "The WLD tokens purchased by a16z and Bain at such a high price have dropped 90% over the past 14 months. I've never seen anything like this before. To be honest, it's quite interesting."

Two Venture Capital Funds Purchase Tokens Without Discount

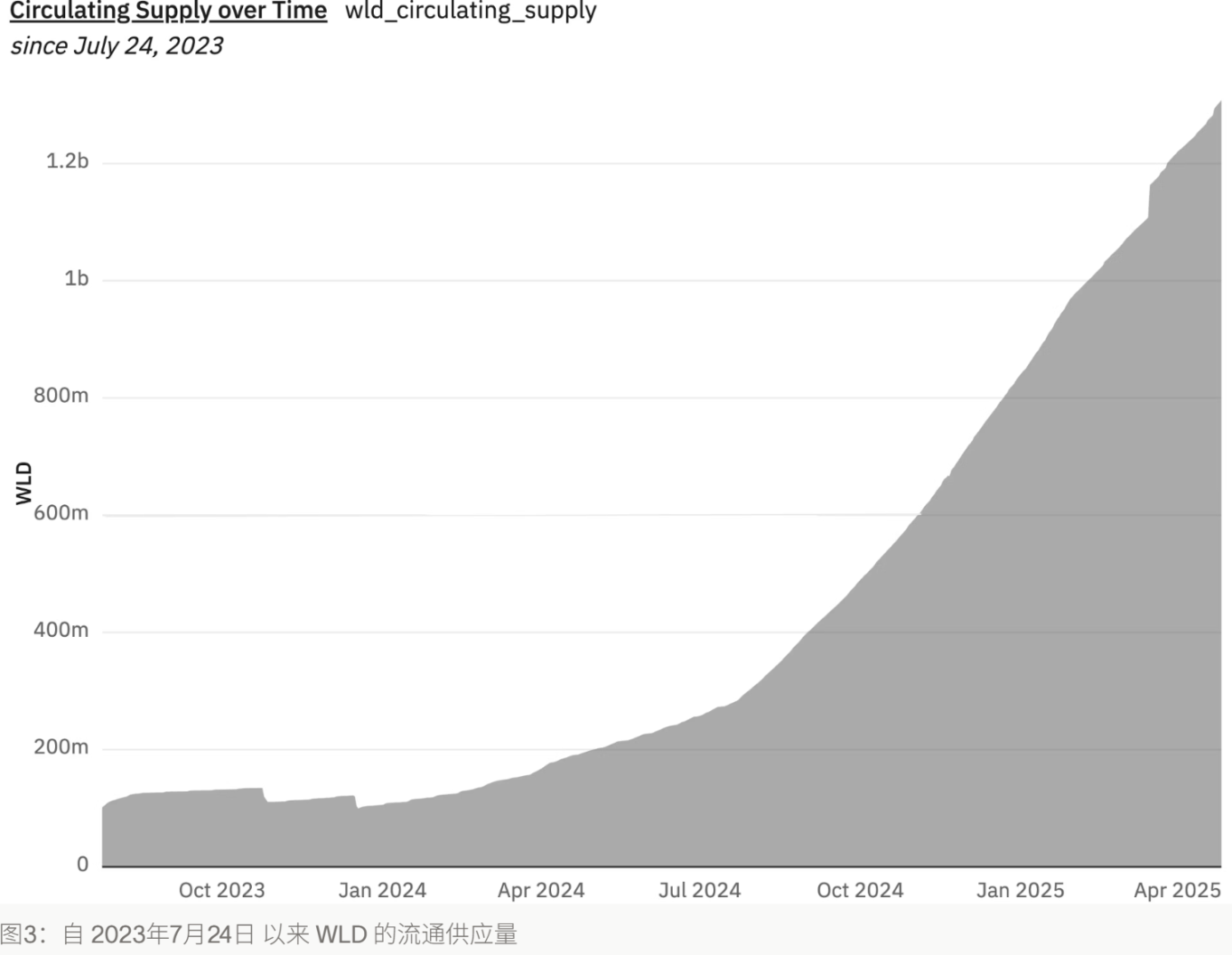

According to the official announcement from Worldcoin, this is not a new round of venture capital investment, but rather two venture capital funds completing the purchase of WLD tokens directly at market price, including well-known venture capital firms a16z and Bain Capital Crypto. The funds will primarily be used to accelerate the expansion of the World network, particularly to support its layout in the U.S. market, including the construction of an Orb manufacturing facility in Richardson, Texas, for mass production of identity verification devices used for iris scanning. According to the official blog, as of April 28, 2025, the circulating supply of WLD was 1.3 billion tokens, accounting for 13% of the total supply.

It is worth mentioning that this is another significant token purchase by a16z this year. The last one dates back to April, when a16z spent $55 million to purchase LayerZero's ZRO tokens, with a lock-up period of three years.

Worldcoin was co-founded in 2019 by OpenAI CEO Sam Altman and others, aiming to build a global verification system called "World ID" through iris scanning technology to distinguish humans from AI and address the growing demand for digital identity. In May 2023, Worldcoin's development company Tools for Humanity completed a $115 million Series C funding round, led by Blockchain Capital, with participation from a16z, Bain Capital Crypto, and Distributed Global.

As of May 2025, the Worldcoin network has attracted over 26 million users, with 12.5 million having a World ID verified by Orb. Worldcoin has established a certain user base globally, showing strong appeal, especially in emerging markets.

The sale of tokens coincides with an overall recovery in the cryptocurrency market. Bitcoin recently hit an all-time high, driving up the prices of various tokens, including WLD. Worldcoin chose to conduct a large-scale token sale at this time, seizing the market momentum while securing funding for its expansion in the U.S. market.

So why did the two venture capital firms choose to purchase WLD tokens at this time?

a16z and Bain are typical long-term investors whose goal is usually to seize platform-level opportunities rather than engage in short-term speculation. Although WLD is currently at a low point, from a technical, team, and strategic perspective, it may represent a moment of "undervalued potential." Market panic and valuation mismatches present opportunities; a 90% drop has caused many investors to panic and exit, but for seasoned institutions, this may indicate that "the price is significantly below intrinsic value." They may believe the market has overreacted, making this an ideal time for strategic accumulation.

Additionally, Worldcoin's strong defense of privacy controversies at the Consensus 2025 conference further boosted investor confidence. The team emphasized that its iris scanning data is stored locally and complies with privacy protection requirements, which somewhat alleviated market concerns about data security.

Expanding U.S. Market Layout and Technological Innovation

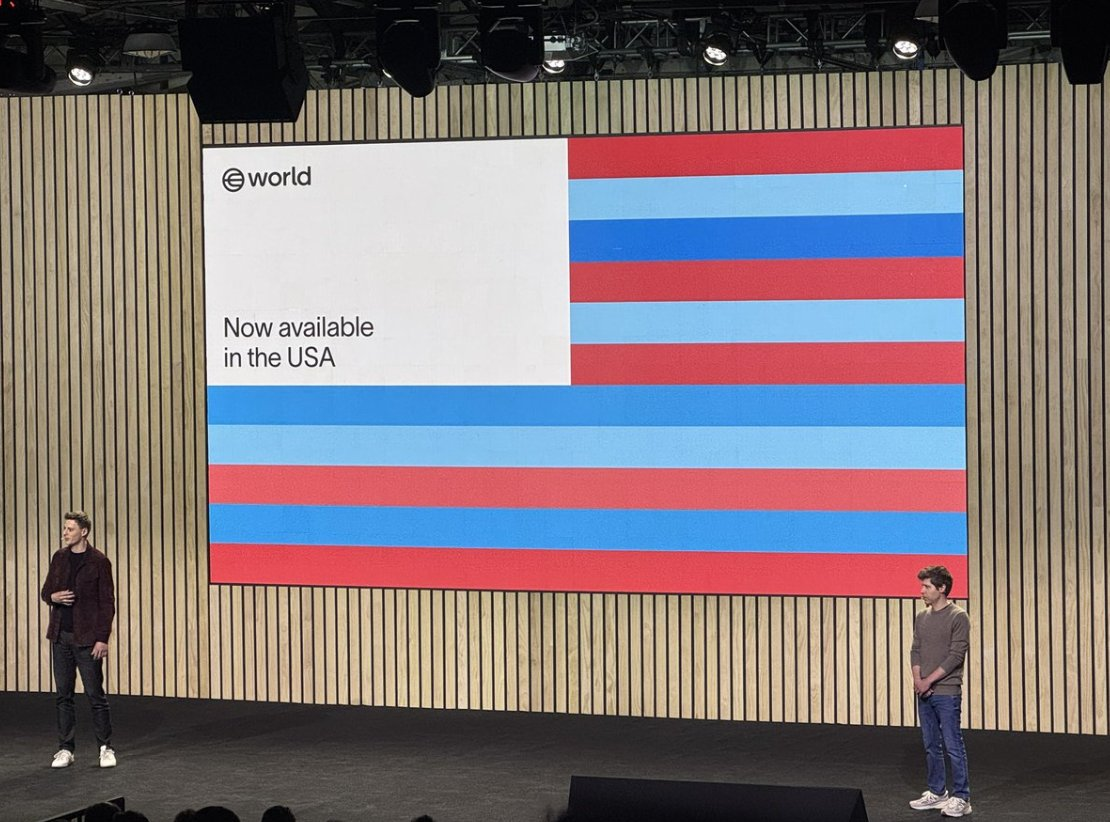

One of the core objectives of this venture capital token purchase is to support Worldcoin's expansion in the U.S. market. Worldcoin launched its verification system "World ID" in the U.S. on May 1 and has opened iris scanning service points in six cities, including San Francisco, Los Angeles, and Miami.

Moreover, the World App debit card project in collaboration with Visa and the age verification pilot on Tinder with Match Group demonstrate Worldcoin's continuous activity in the financial and social sectors, enhancing Worldcoin's brand influence and providing support for the practical use cases of its WLD token.

On the technological front, the launch of Worldcoin's Orb Mini device and World ID 3.0 version marks its ongoing innovation in blockchain and biometric technology. The Orb device, powered by NVIDIA technology, efficiently performs iris scans and generates privacy-protecting digital identities, which is significant in the context of combating AI-generated content. Worldcoin has also introduced the World Chain blockchain, prioritizing transactions verified by humans, further strengthening the integrity of its technological ecosystem.

Summary

Despite promising prospects, Worldcoin still faces significant challenges. First is the privacy issue. Although the team repeatedly emphasizes its data protection measures, iris scanning technology has sparked controversy in various regions worldwide. In early May 2025, Indonesia suspended Worldcoin's operations due to privacy concerns, and Spain and Portugal have also investigated its data collection methods. These regulatory pressures may limit Worldcoin's expansion speed in certain markets. Lastly, Worldcoin's business model has not yet fully matured. While its user base is growing rapidly, how to convert iris scanning technology and WLD tokens into sustainable business value still requires time for validation.

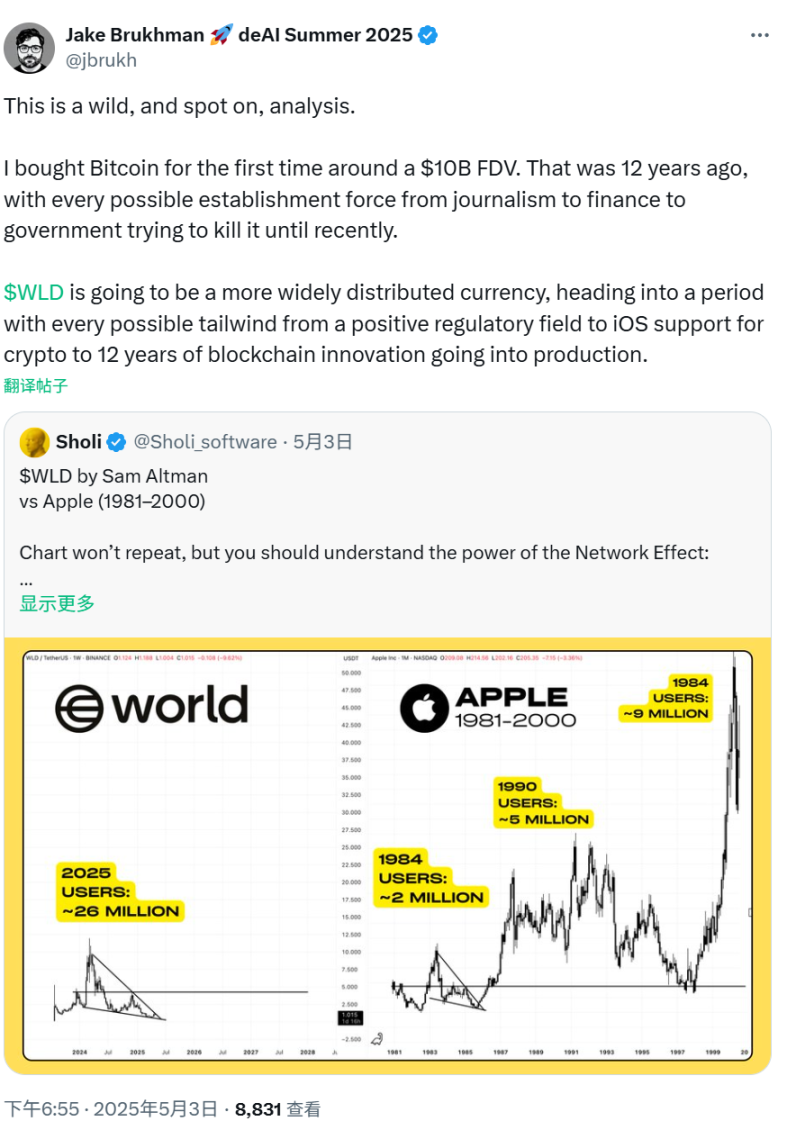

However, Jake Brukhman, co-founder of CoinFund and one of Worldcoin's earliest investors, is very optimistic. In sharing a post that is bullish on WLD, he stated, "I first bought Bitcoin when its fully diluted valuation (FDV) was about $10 billion. That was 12 years ago, and various vested interests, from news media to financial institutions to governments, were almost all trying to stifle it, until recently when things began to change. WLD will become a more widely distributed currency and will advance in an era with various tailwinds: including a positive regulatory environment, iOS support for crypto, and the blockchain innovations of the past 12 years entering the practical application stage."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。