Hong Kong regulators have conducted certain oversight and testing of the operational plans of three issuers in the stablecoin sandbox.

Written by: Weilin, PANews

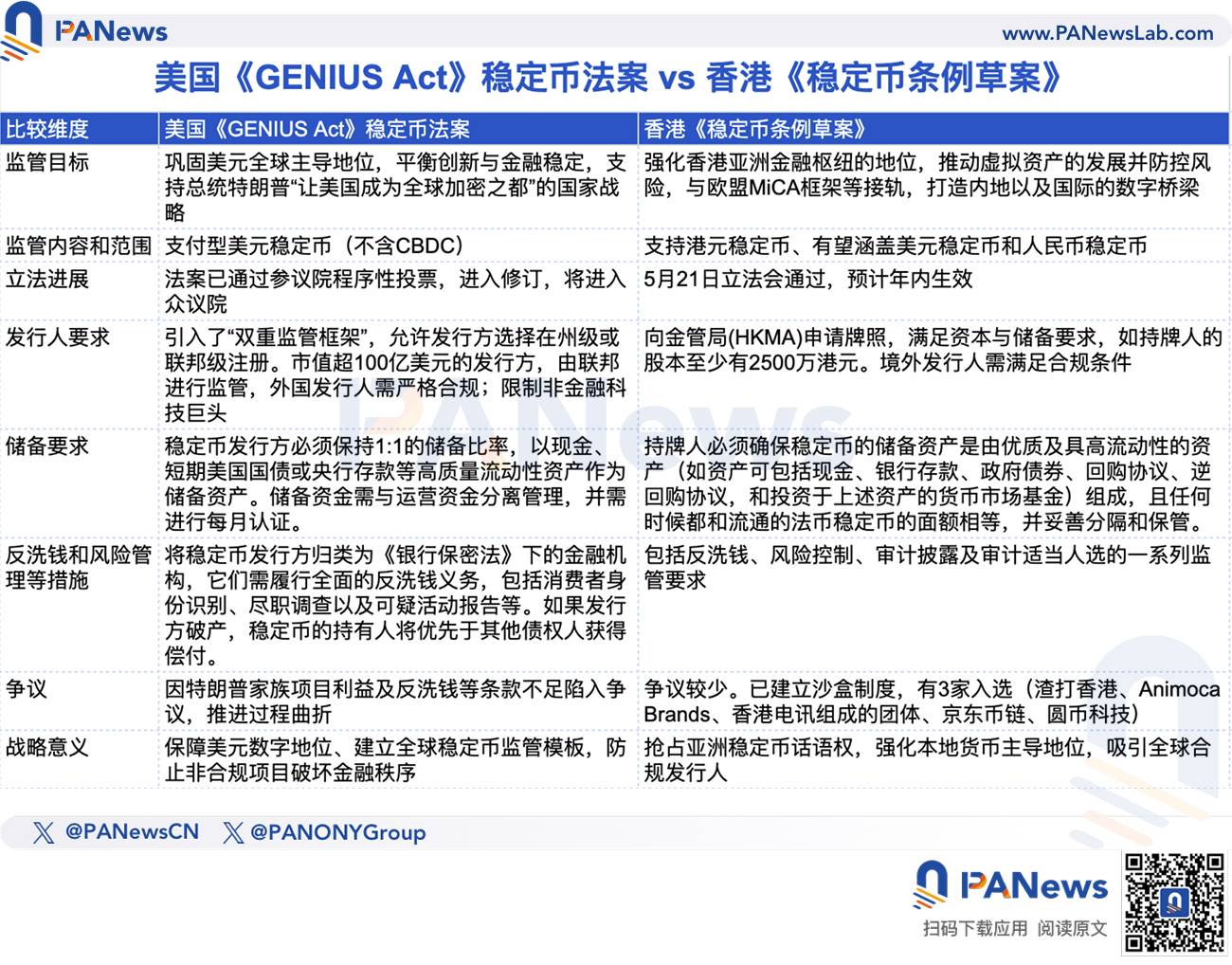

While the U.S. stablecoin bill is making progress in the Senate, Hong Kong has officially passed legislation on stablecoins.

On May 21, the Hong Kong Legislative Council passed the "Stablecoin Ordinance Bill," further establishing a licensing system for fiat stablecoin issuers in Hong Kong, improving the regulatory framework for virtual asset activities in Hong Kong to maintain financial stability while promoting financial innovation. The Hong Kong SAR government expects the ordinance to take effect within this year.

Currently, regulators have conducted certain oversight and testing of the operational plans of three issuers in the sandbox. The chairman of the "Stablecoin Ordinance Bill" committee, legislator Qiu Dagen, expressed support for establishing stablecoins pegged to the Hong Kong dollar and the renminbi, strengthening Hong Kong's role as a digital bridge connecting the mainland and other countries, while advocating for government flexibility in licensing and accelerating the approval process.

Three types of stablecoin-related activities require licensing, and reserves must consist of high-quality, highly liquid assets

The "Stablecoin Ordinance Bill" specifies that the following three types of activities require a license:

Issuing fiat stablecoins in Hong Kong

Issuing Hong Kong dollar stablecoins in Hong Kong or outside of Hong Kong

Actively promoting the issuance of fiat stablecoins to the public in Hong Kong

According to "Caixin," citing the sandbox participant "Yuan Coin Technology," the draft outlines four important requirements for issuers: First, regarding reserves, license holders must maintain a robust stablecoin mechanism, ensuring that the reserve assets for the stablecoin consist of high-quality and highly liquid assets (such assets may include cash, bank deposits, government bonds, repurchase agreements, reverse repurchase agreements, and money market funds investing in the aforementioned assets), and at all times equal the face value of the circulating fiat stablecoins, properly segregated and safeguarded.

Second, stablecoin holders have the right to redeem stablecoins from the issuer at face value, with redemption requests not incurring fees and to be processed within a reasonable time. Third, compliance with a series of requirements related to anti-money laundering, risk management, disclosure, and appropriate audit candidates is necessary. Fourth, transactions must occur on licensed virtual asset trading platforms.

The draft indicates that regarding issuer qualifications, license holders must have sufficient financial resources and liquid assets, with a requirement for the license holder's capital to be at least HKD 25 million. The license does not have a fixed validity period, meaning it remains valid unless revoked, or the license holder is liquidated or deregistered from the Hong Kong Companies Registry.

To protect the public and investors, the draft stipulates that only designated licensed institutions are allowed to sell fiat stablecoins in Hong Kong, and only fiat stablecoins issued by licensed issuers can be sold to retail investors. The designated licensed institutions allowed to sell stablecoins in Hong Kong include: stablecoin issuers licensed by the Financial Management Commissioner, banks, institutions holding a Type 1 license (securities trading) issued by the Hong Kong Securities and Futures Commission, and licensed virtual asset trading platforms in Hong Kong.

To serve as an effective deterrent, the draft sets clear penalties for violations. Engaging in regulated stablecoin activities without a license: fines of up to HKD 5 million and imprisonment for seven years; selling stablecoins by non-designated licensed institutions: fines of up to HKD 5 million and imprisonment for seven years, etc.

Three stablecoin institutions are in the sandbox, with JD's stablecoin poised for launch

The Hong Kong SAR government published the "Policy Declaration on the Development of Virtual Assets in Hong Kong" in October 2022, expressing its determination to improve the regulatory framework for virtual assets. In response to the policy declaration, the "Anti-Money Laundering and Terrorist Financing Ordinance" (Chapter 615) was amended in December 2022 to introduce a licensing system for virtual asset service providers, ensuring that virtual asset trading platforms comply with international regulations on anti-money laundering and terrorist financing, and protect investors. Following the implementation of the licensing system for virtual asset trading platforms in June 2023, Hong Kong is committed to further improving the regulatory framework for virtual asset activities, including introducing a licensing system for fiat stablecoin issuers.

In December 2023, Hong Kong announced plans to establish new legislation to implement the licensing system for fiat stablecoin issuers. Subsequently, the regulatory sandbox approved three institutions for testing on July 18, 2024, with the draft text announced in December of the same year, and ultimately passed by the Legislative Council on May 21, 2025.

Currently, the Hong Kong Monetary Authority (HKMA) has launched a stablecoin issuer sandbox to understand the business models of institutions intending to issue fiat stablecoins in Hong Kong, communicate regulatory expectations, and provide guidance. The first batch of three participating institutions was approved to enter the sandbox on July 18, 2024. This includes a group consisting of Standard Chartered Hong Kong, Animoca Brands, Hong Kong Telecom, JD Coin Chain Technology (Hong Kong), and Yuan Coin Innovation Technology. Currently, regulators have conducted certain oversight and testing of the operational plans of issuers in the sandbox.

It is worth mentioning that JD Technology Group recently released multiple job postings related to RWA, clearly stating that product design must seamlessly integrate with JD's stablecoin and digital renminbi. Additionally, JD Technology Group is also hiring for a position focused on "Overseas Financial Business Development," emphasizing the promotion of stablecoin business, which indicates that with the implementation of the bill, JD's stablecoin may be ready for launch.

Once the licensing system for stablecoin issuers in Hong Kong officially takes effect, there will be a six-month transition period for stablecoin issuers already engaged in the aforementioned three licensed activities in Hong Kong, allowing some existing issuers to apply for licenses within the first three months after the licensing system takes effect.

Competing in the global stablecoin market: Potential development of renminbi-pegged stablecoins, legislators call for "flexible" licensing

While the Legislative Council was conducting the third reading of the "Stablecoin Ordinance Bill," the legislative process for the U.S. GENIUS Act stablecoin bill was underway. On May 22, the U.S. Senate voted 69 to 31 to proceed with discussions on the "GENIUS Act," marking the formal entry of this stablecoin regulatory bill into the amendment discussion stage. The previous motion to terminate debate was passed with 66 votes. This is expected to become the first federal-level stablecoin regulatory framework in the United States.

The draft of Hong Kong's stablecoin ordinance also referenced existing stablecoin regulatory regulations and those under review during its formulation.

In the Legislative Council, legislator Qiu Dagen expressed his pleasure at hearing the government clarify that, in addition to the Hong Kong dollar and U.S. dollar, it would also consider including the renminbi as one of the future fiat stablecoin currencies.

"I strongly support including the renminbi in the locally issued stablecoin system, as we can serve as a digital bridge connecting the mainland and other countries. Additionally, through renminbi-based stablecoins, we can attract more blockchain projects and institutional investors to settle in Hong Kong, forming a digital financial ecosystem driven by both the Hong Kong dollar and renminbi, further strengthening Hong Kong's position as a financial hub, and accelerating the internationalization of the renminbi," he stated. Especially in light of the global trend of de-dollarization, the renminbi is likely to become a choice for many countries, including our friendly Belt and Road Initiative partners and countries in the Middle East, diversifying their trade, investment, and reserve options, which will also help enhance the renminbi's status in international trade and as a safe haven.

Regarding licensing policy, legislator Qiu Dagen urged the government to maintain an open and flexible mindset, allowing more capable and resourceful institutions to participate in competition. He stated, "I hope the government can consider future licenses with a flexible mindset, allowing more issuers to compete in Hong Kong, which is a normal process. Currently, there are mainly two stablecoins in the world that dominate most of the trading, but we have a flourishing market with many that have gone through elimination, resulting in the current situation of two stablecoins in the U.S. dollar space. Therefore, we hope that in the future in Hong Kong, we can strive for stablecoins with different proportions of the Hong Kong dollar and renminbi to allow more participants."

In his view, as long as issuers can demonstrate financial stability and sufficient regulatory capability, through healthy competition, there is an opportunity for Hong Kong to develop an internationally accepted stablecoin market, potentially for currencies other than the U.S. dollar, which would have significant meaning and impact on Hong Kong's financial development.

Legislator Qiu Dagen called for the HKMA to quickly initiate licensing work to attract more interested and qualified potential operators to launch and test stablecoins with different currencies and collateral in Hong Kong after the draft ordinance is passed. While application scenarios are certainly important, he hopes the government can maintain flexibility in approval requirements and other aspects, allowing different solutions to be tested in Hong Kong.

With the implementation of the regulatory system for virtual asset trading platforms and stablecoin issuers, the Hong Kong Monetary Authority stated that the government will continue to support the development of the virtual asset industry. The government will soon consult on over-the-counter trading and custody services for virtual assets and will publish a second policy declaration on the development of virtual assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。