🧐 Testing this Cookie event | Research report on @sparkdotfi: "More than just lending": How does http://Spark.fi become the stable heartbeat of the RWA track?

While testing the Cookie @cookiedotfun event, I spent a day researching the @sparkdotfi project;

I unexpectedly found that it is not just an ordinary lending protocol, but a carrier of the hottest concept right now: RWA.

Amid a bunch of "TVL dinosaurs" and "yield illusion" projects, its approach is as calm as a lucid dream: modular, stablecoins, government bonds, SubDAO, a set of combo punches hitting the deepest waters of DeFi.

It's not a "new story of high yield," but rather "the old logic of capital efficiency," applied to a new sector: real assets (RWA).

This research report covers aspects such as platform overview, core products, governance mechanisms, ecological strategy, token economics, and risk assessment.

1️⃣ Project Background

http://Spark.fi is a modular DeFi protocol matrix under the Sky (formerly MakerDAO) ecosystem, dedicated to enhancing the ecological value capture capability of the decentralized stablecoin USDS.

The platform achieves a balance between capital efficiency and stability by building lending, savings, and liquidity infrastructure.

As of May 2025, its total locked value (TVL) has exceeded $7.3 billion, making it one of the leading projects in DeFi lending protocols.

2️⃣ Key Data (as of May 2025):

TVL: $7.3 billion (some sources claim $2.6 billion; data may vary due to different statistical standards);

Core Business: Stablecoin lending, savings, liquidity provision;

Affiliated Ecosystem: Sky (formerly MakerDAO);

Open Source Code: Spark Foundation has 36 public repositories on GitHub, covering smart contracts, reward distribution, etc.;

Community Activity: Frequent user interactions on Discord and X platform, with recent activities including the Snaps reward program.

3️⃣ Core Business and Products:

Spark's business revolves around the stablecoin ecosystem, mainly including the following modules:

1) SparkLend

SparkLend is Spark's core lending protocol, allowing users to borrow against stablecoins like USDS, DAI, USDC.

The protocol is known for its high capital efficiency and low slippage, attracting a large number of institutional and retail users.

As of 2025, SparkLend ranks among the top in the DeFi lending market.

Features: No platform fees, instant redemption, multi-chain operation support.

Case: In March 2024, Spark collaborated with Morpho Blue to allocate $100 million DAI liquidity to the sUSDe/DAI and USDe/DAI markets through the Metamorpho vault, significantly enhancing market depth.

2) Stablecoin Savings (sUSDS)

Spark offers the Sky Savings Rate (SSR) mechanism, allowing users to earn annual percentage yield (APY) by depositing stablecoins like USDS.

The SSR Oracle serves as a cross-chain public resource, ensuring interest rates are transparent and verifiable.

Advantages: Combines yield with capital efficiency, suitable for users seeking low-risk returns.

3) Liquidity Provision

Spark collaborates with protocols like Morpho to provide deep liquidity for the DeFi ecosystem. Its capital allocation strategy emphasizes cross-protocol synergy rather than direct competition, empowering other DeFi projects.

Example: Spark manages over $2.6 billion in liquidity, supporting the widespread use of USDS and DAI.

4) Reward Mechanism

Spark distributes rewards through smart contracts, and the recent Snaps event in collaboration with Cookie DAO provides incentives for users, enhancing community participation. 📷📷

4️⃣ Market Positioning and Competitive Advantages

Spark positions itself as a provider of DeFi infrastructure, focusing on capital efficiency and liquidity optimization within the stablecoin ecosystem.

As the capital deployment arm of the Sky ecosystem, it has committed an additional $1 billion for tokenized U.S. government bonds, increasing its total exposure in this area to $2.4 billion.

This move positions http://Spark.fi as a leader in the rapidly growing niche of decentralized finance, specifically in the tokenization of real assets (RWA), with the protocol currently holding over two-thirds of the $3.5 billion tokenized government bond assets in the market.

Major competitors include DeFi lending and liquidity protocols such as Aave, Compound, and Curve.

In comparison:

Aave/Compound: Offer broader asset support, but lack the capital efficiency and stablecoin focus of Spark.

Curve: Focuses on stablecoin trading with strong liquidity depth, but has weaker lending functionality. Spark avoids direct competition through complementary collaborations with these protocols (like Morpho Blue), creating a differentiated advantage.

5️⃣ Risk Assessment:

Risk Factors —

1) Governance Risk: Interest rates and key parameters are set by community governance, which may be susceptible to governance attacks or decision-making errors.

2) Market Risk: The high volatility of the crypto market may affect asset values and user confidence.

3) Technical Risk: Despite multiple audits, there may still be undiscovered vulnerabilities in smart contracts.

Conclusion —

After reviewing the structure and layout of http://Spark.fi, I realized that this is not a protocol sustained by narrative; it is the kind of project that gradually permeates the market and ultimately becomes an underlying infrastructure—

Just as USDT is to exchanges, http://Spark.fi may eventually become the "settlement layer" for RWA.

If you are interested in SubDAO, stablecoin yields, and real assets, now might be a good entry point.

Investment Advice —

http://Spark.fi has demonstrated strong innovation capabilities and market influence in the DeFi space, particularly in stablecoin lending and real asset tokenization.

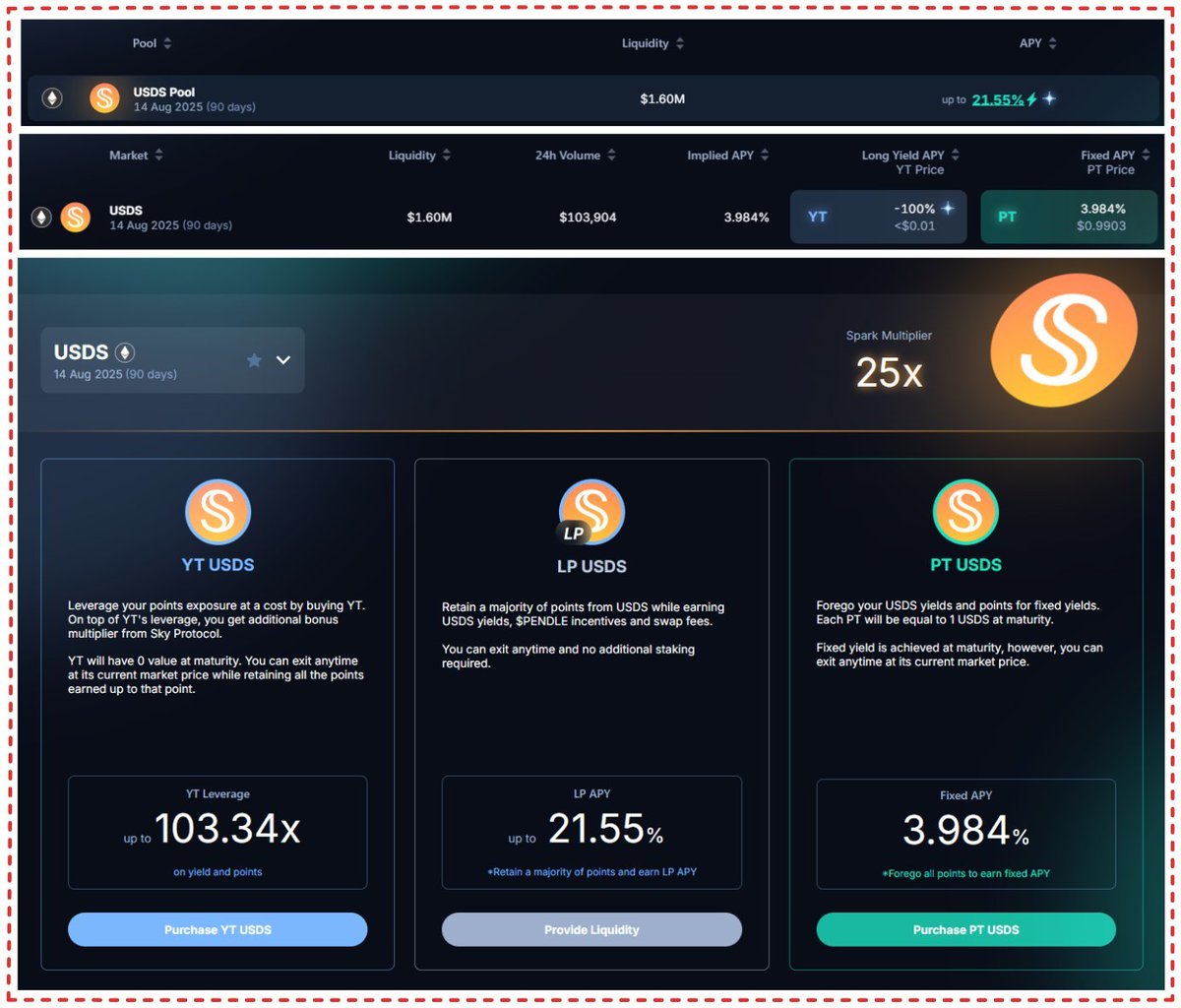

You can stake to participate or join the Points Markets and yield boosts on @pendle_fi!

Its transparent governance mechanism and multi-layered security measures provide users with trust assurance. However, investors should pay attention to governance and market risks, and it is recommended to participate cautiously based on a thorough understanding of the platform's mechanisms and risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。