The core emphasis is on Ethereum's stable uptime and decentralized validator set over the past decade, to prove its capability to secure trillion-dollar value.

Written by: Bao Yilong

Source: Wall Street Insights

Ethereum is undergoing a public "self-reinvention," hoping to solidify its position as the future settlement layer through the "Trillion-Dollar Security Plan," betting on the tokenization of real-world assets.

On May 14, Ethereum announced the Trillion-Dollar Security Plan on its official blog, aiming to position Ethereum as the future settlement layer for individuals and institutions, in response to the mainstream trend of real-world asset tokenization (RWA). The core of this initiative is to emphasize Ethereum's stable uptime and decentralized validator set over the past decade, to prove its capability to secure trillion-dollar value.

According to the official announcement from Ethereum, the "Trillion-Dollar Security Plan" consists of three parts:

- Mapping the security advantages and attack vectors across various fields and layers of the Ethereum technology stack. We will gather opinions from the entire ecosystem and compile them into a security overview report to help us identify key focus areas.

- Implementing improvements in the key areas identified in the mapping overview. We will work closely with the ecosystem to implement high-priority fixes in the short term and allocate funds for long-term improvement projects.

- Communicating Ethereum's security more effectively. Various users should be able to understand, utilize, and benefit from Ethereum's robust security foundation. Anyone should be able to assess Ethereum's security standards and compare them with other blockchains and traditional systems.

However, this ambitious vision has also raised questions. Katie Talati, research director at Arca, believes:

This feels more like a marketing strategy than a true technological innovation. Simply relying on this statement is not enough to re-attract the attention of developers and users. Nevertheless, Ethereum's long-term development remains worth watching, especially after improvements in user experience and user interface, which may attract more developers.

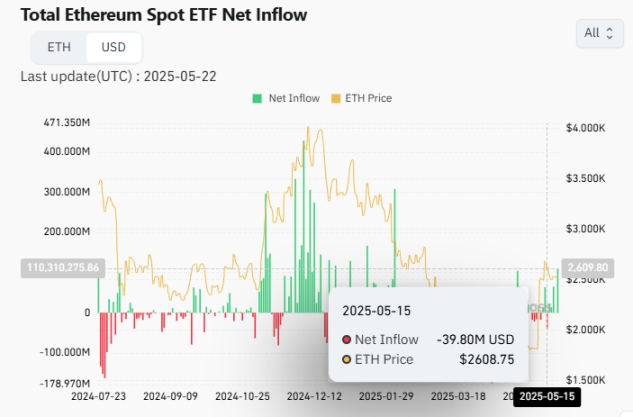

Some media have pointed out that it remains uncertain whether institutional investors will buy into this. The U.S. spot Ethereum ETF has not yet gained widespread recognition among institutions, with nearly $40 million net outflow as of May 15, while 12 spot Bitcoin funds saw a net inflow of $8 billion during the same period.

Although ETFs and staking yields are expected to enhance Ethereum's appeal, it remains to be seen whether institutional buyers will be swayed by abstract security narratives. They may be more interested in yields, price increases, and assurances regarding Ethereum's development roadmap.

Ethereum's Dilemma: Facing Challenges from Solana

According to media reports, despite continuous technical advancements, Ethereum's native token Ether has underperformed.

Since the merger of the original Ethereum mainnet (ETH1) with the Beacon Chain (ETH2) in 2022, Ethereum's performance has lagged behind Bitcoin. Worse still, Ethereum's appeal among developers and users is waning, while more attractive competitors like Solana are rising.

Reports citing data from Electric Capital indicate that in 2024, the number of active developers on Solana grew by 83%, while Ethereum lost 17%. Solana has attracted a younger, more experimental user base with lower fees, active collaborations, and the promotion of meme coins, also winning investor interest and driving its token price to new historical highs.

Supporters of Ethereum are seeking change. A new organization called Etherealize, supported by Ethereum co-founder Vitalik Buterin and led by Vivek Raman, aims to give voice to Ethereum among Washington and institutional investors. Raman stated:

The security of blockchain is the most important quality to ensure trust. Ethereum's goal is to become "digital oil," complementing Bitcoin's "digital gold" to form a balanced digital asset investment portfolio.

Reports indicate that Ethereum is trying to position itself as a solid, secure, but "boring" infrastructure. In the long run, this may be feasible. However, in a market filled with a "degen culture" (high-risk, high-reward) chasing short-term gains, Ethereum's "trillion-dollar" vision may be premature.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。