You may never perfectly time the bottom. But you can traverse cycles again and again, buying misunderstood value at reasonable prices.

Written by: Daii

Translated by: Baihua Blockchain

Yesterday, Bitcoin's price broke through the $110,000 mark, igniting enthusiasm in the market, with social media flooded with cheers of "the bull market is back." However, for those investors who hesitated at $76,000 and missed the entry opportunity, this moment felt more like an internal self-interrogation: Am I too late? Should I have decisively bought during the pullback? Will there be future opportunities?

This leads us to the core of our discussion: Is there really a "value investing" perspective in assets known for extreme volatility like Bitcoin? Can this seemingly contradictory strategy, which goes against its "high risk, high volatility" characteristics, capture "asymmetric" opportunities in this turbulent game?

In the investment world, asymmetry refers to situations where potential gains far exceed potential losses, or vice versa. At first glance, this does not seem to be a characteristic of Bitcoin. After all, most people's impression of Bitcoin is: either you get rich overnight or you lose everything.

However, behind this polarized perception lies a neglected possibility: during Bitcoin's periodic deep declines, value investing methods may create an extremely attractive risk-return structure.

Looking back at Bitcoin's history, it has experienced multiple crashes of 80% or even 90% from its highs. During these moments, the market is shrouded in panic and despair, with capitulation selling driving prices back to square one. But for investors who deeply understand Bitcoin's long-term logic, this is precisely the classic "asymmetric" opportunity—taking on limited loss risk in exchange for potentially massive returns.

Such opportunities are rare. They test investors' cognitive levels, emotional control, and belief in long-term holding. This raises a more fundamental question: Do we have reason to believe that Bitcoin truly possesses "intrinsic value"? If so, how do we quantify and understand it, and based on that, formulate investment strategies?

In the following content, we will embark on this exploratory journey: revealing the deep logic behind Bitcoin's price fluctuations, clarifying the shining points of asymmetry during "blood in the streets," and contemplating how the principles of value investing can be revitalized in the decentralized era.

However, you first need to understand one thing: in Bitcoin investing, asymmetric opportunities have never been scarce; in fact, they are everywhere.

Why are there so many asymmetric opportunities in Bitcoin?

If you browse Twitter today, you will see overwhelming celebrations of the Bitcoin bull market. With prices breaking through $110,000, many are proclaiming on social media that the market forever belongs to the prophets and the lucky.

But if you look back at the past, you will find that the invitation to this feast was actually sent out at the most desperate moments in the market; it’s just that many lacked the courage to open it.

Historical Asymmetric Opportunities

Bitcoin's growth trajectory has never been a straight line upward; its historical script is interwoven with extreme panic and irrational exuberance. Behind every deep decline lies an extremely attractive "asymmetric opportunity"—the maximum loss you bear is limited, while the potential return could be exponential.

Let’s traverse time and let the data speak.

2011: -94%, from $33 to $2

This was Bitcoin's first moment of "widespread recognition," with prices soaring from a few dollars to $33 in just six months. But soon, the crash followed. Bitcoin's price plummeted to $2, a drop of 94%.

Imagine the despair at that time: major geek forums were desolate, developers fled, and even core Bitcoin contributors expressed doubts about the project's prospects on the forums.

But if you had "taken a gamble" and invested $1,000, when Bitcoin's price broke $10,000 years later, your holdings would be worth $5 million.

2013-2015: -86%, Mt.Gox Collapse

At the end of 2013, Bitcoin's price first broke $1,000, attracting global attention. But the good times were short-lived. In early 2014, the world's largest Bitcoin exchange, Mt.Gox, declared bankruptcy, and 850,000 Bitcoins disappeared from the blockchain.

Overnight, the media consensus was: "Bitcoin is finished." CNBC, BBC, and The New York Times all reported the Mt.Gox scandal on their front pages. Bitcoin's price fell from $1,160 to $150, a drop of over 86%.

But what happened next? By the end of 2017, the same Bitcoin price reached $20,000.

2017-2018: -83%, ICO Bubble Burst

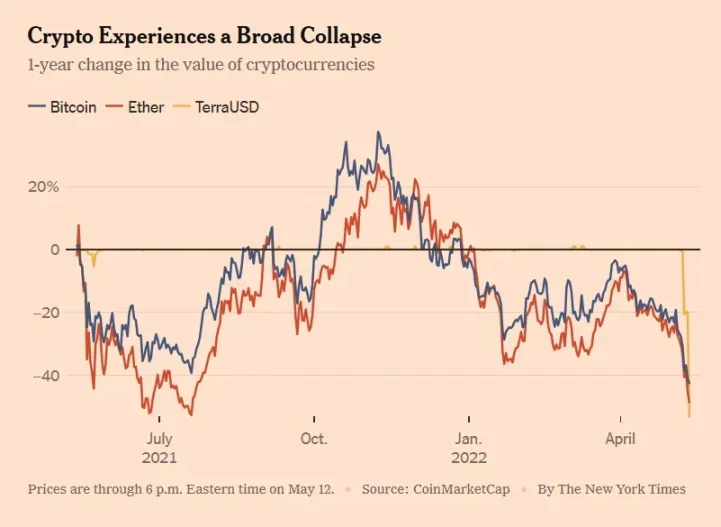

The above image is from The New York Times' report on this stock market crash. The red box highlights a statement from an investor who said their portfolio had lost 70% of its value.

2017 was the "year of mass speculation," and Bitcoin entered the public eye. Countless ICO projects emerged, with white papers filled with terms like "disrupt," "reconstruct," and "decentralized future," leading the entire market into a frenzy.

But when the tide receded, Bitcoin fell from its historical high of nearly $20,000 to $3,200, a drop of over 83%. That year, Wall Street analysts mocked: "Blockchain is a joke"; the SEC filed multiple lawsuits; retail investors were liquidated, and the forums fell silent.

2021-2022: -77%, Industry "Black Swan" Chain Explosions

In 2021, Bitcoin wrote a new myth: each coin broke $69,000, with institutions, funds, countries, and retail investors flocking in.

But just a year later, Bitcoin fell to $15,500. The collapse of Luna, the liquidation of Three Arrows Capital, the explosion of FTX… a series of "black swan" events destroyed the confidence of the entire crypto market like a domino effect. The fear and greed index once dropped to 6 (extreme fear zone), and on-chain activity nearly froze.

The above image is from a May 12, 2022 article in The New York Times, showing the simultaneous plummet of Bitcoin, Ethereum, and UST. We now realize that behind UST's crash was the "stock price manipulation" orchestrated by Galaxy Digital and Luna, which greatly contributed to UST's collapse.

However, by the end of 2023, Bitcoin quietly rebounded to $40,000; after the approval of ETFs in 2024, it soared to today's $90,000.

Sources of Bitcoin's Asymmetric Opportunities

We see that Bitcoin has repeatedly achieved astonishing rebounds during seemingly disastrous moments in history. So the question arises—why? Why can this high-risk asset, often ridiculed as a "game of hot potato," repeatedly rise after crashes? More importantly, why does it provide such strong asymmetric investment opportunities for patient and knowledgeable investors?

The answer lies in three core mechanisms:

Mechanism 1: Deep Cycles + Extreme Emotions Lead to Price Deviations

Bitcoin is the only truly free market that operates 24/7 globally. There are no circuit breakers, no market maker protections, and no Federal Reserve safety nets. This means it is more susceptible to amplifying human emotional fluctuations than any other asset.

In bull markets, FOMO (fear of missing out) dominates the market, retail investors chase prices madly, narratives soar, and valuations are severely overextended; in bear markets, FUD (fear, uncertainty, doubt) fills the internet, calls for "cutting losses" echo, and prices are trampled into the dust.

This emotional amplification cycle causes Bitcoin to frequently enter a state of "severe price deviation from true value." And this is precisely the fertile ground where value investors seek asymmetric opportunities.

In summary: In the short term, the market is a voting machine; in the long term, it is a weighing machine. Bitcoin's asymmetric opportunities appear in the moments before the weighing machine starts.

Mechanism 2: Extreme Price Volatility, but Very Low Probability of Death

If Bitcoin were truly the "asset that could go to zero at any moment" as the media often sensationalizes, then it would indeed have no investment value. But in fact, it has survived every crisis—and emerged stronger.

- In 2011, after falling to $2, the Bitcoin network continued to operate as usual.

- In 2014, after the Mt.Gox collapse, new exchanges quickly filled the void, and the number of users continued to grow.

- In 2022, after the FTX bankruptcy, the Bitcoin blockchain continued to generate a new block every 10 minutes without interruption.

Bitcoin's underlying infrastructure has almost no history of downtime. Its system resilience far exceeds most people's understanding.

In other words, even if the price is halved again and again, as long as Bitcoin's technological foundation and network effects remain, there is no real risk of going to zero. We have an extremely attractive structure: limited short-term downside risk and open long-term upside potential.

This is asymmetry.

Mechanism 3: Intrinsic Value Exists but is Overlooked, Leading to "Oversold" Conditions

Many people believe that Bitcoin has no intrinsic value, and therefore its price can fall indefinitely. This view overlooks several key facts:

- Bitcoin has algorithmic scarcity (a hard cap of 21 million coins enforced by the halving mechanism);

- It is protected by the world's most powerful proof-of-work (PoW) network, with quantifiable production costs;

- It benefits from strong network effects: over 50 million addresses have non-zero balances, and transaction volume and hash rate are hitting new highs;

- It has gained recognition from mainstream institutions and even sovereign nations as a "reserve asset" (ETFs, legal tender status, corporate balance sheets).

This raises the most controversial yet crucial question: Does Bitcoin have intrinsic value? If so, how do we define, model, and measure it?

Will Bitcoin Go to Zero?

It is possible—but the probability is extremely low. A certain website has recorded 430 instances of Bitcoin being declared "dead" by the media.

However, below this death declaration count, there is a small note: if you had bought $100 worth of Bitcoin every time it was declared dead, today your holdings would be worth over $96.8 million.

You need to understand: Bitcoin's underlying system has been operating stably for over a decade, with almost no downtime. Whether it was the Mt. Gox collapse, the failure of Luna, or the FTX scandal, its blockchain has consistently generated a new block every 10 minutes. This technological resilience provides a strong survival baseline.

Now, you should see that Bitcoin is not "baseless speculation." On the contrary, its asymmetric potential stands out precisely because its long-term value logic exists—yet is often severely underestimated by market emotions.

This leads us to the next fundamental question: Can Bitcoin, which has no cash flow, no board of directors, no factories, and no dividends, really become an object of value investment?

Can Bitcoin Be a Value Investment?

Bitcoin is notorious for its extreme price volatility. People swing between extreme greed and fear. So how does an asset like this fit into "value investing"?

On one side are the classic value investing principles of Benjamin Graham and Warren Buffett—"margin of safety" and "discounted cash flow." On the other side is Bitcoin—a digital commodity with no board of directors, no dividends, no earnings, and not even a legal entity. Under traditional value investing frameworks, Bitcoin seems to have no footing.

The real question is: How do you define value?

If we move beyond traditional financial statements and dividends, returning to the core essence of value investing—buying at a price below intrinsic value and holding until that value is realized—then Bitcoin may not only be suitable for value investing but could even embody the concept of "value" more purely than many stocks.

Benjamin Graham, the father of value investing, once said: "The essence of investing is not what you buy, but whether you buy it at a price below its value."

In other words, value investing is not limited to stocks, companies, or traditional assets. As long as something has intrinsic value and its market price is temporarily below that value, it can be a valid target for value investment.

But this raises a more critical question: If we cannot use traditional metrics like price-to-earnings or price-to-book ratios to estimate Bitcoin's value, where does its intrinsic value come from?

Although Bitcoin does not have financial statements like a company, it is far from being valueless. It possesses a fully analyzable, modelable, and quantifiable value system. While these "value signals" are not organized into quarterly reports like stocks, they are equally real—perhaps even more consistent.

We will explore Bitcoin's intrinsic value from two key dimensions: supply and demand.

Supply Side: Scarcity and Programmatic Deflation Model (Stock-to-Flow Ratio)

The core of Bitcoin's value proposition lies in its verifiable scarcity.

- Fixed total supply: 21 million coins, hard-coded and immutable.

- Halving every four years: Each halving reduces the annual issuance rate by 50%. The last Bitcoin is expected to be mined around 2140.

- After the 2024 halving, Bitcoin's annual inflation rate will drop below 1%, making it scarcer than gold.

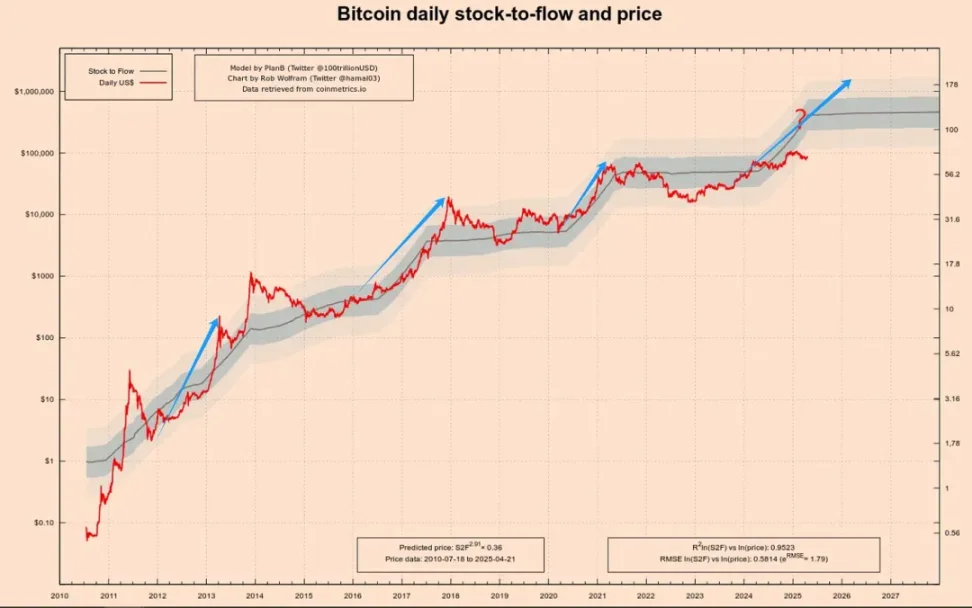

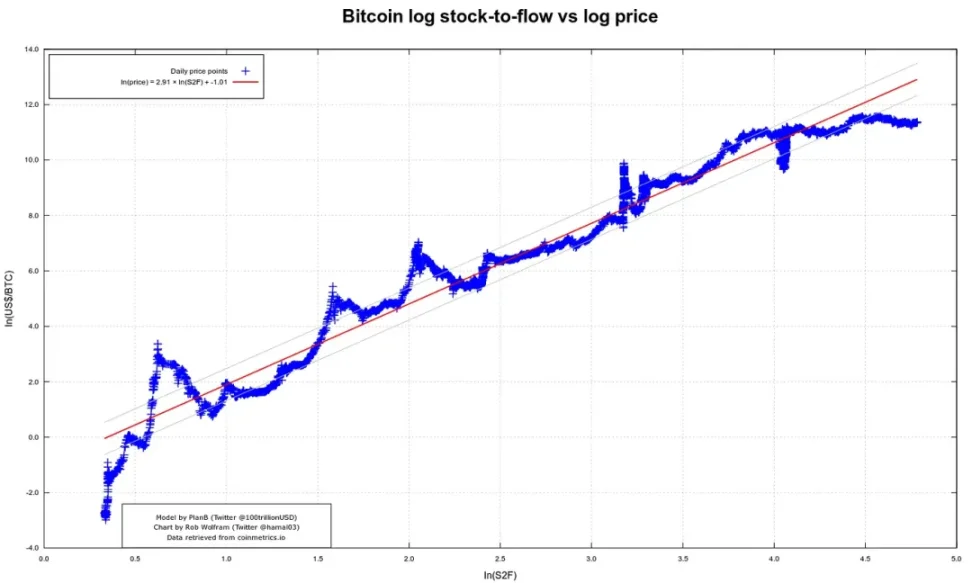

The Stock-to-Flow (S2F) model, proposed by analyst PlanB, has gained attention for its ability to predict Bitcoin price trends during halving cycles. This model is based on the ratio of the existing stock of an asset to its annual production.

- Stock: The total amount of the asset that exists.

- Flow: The amount produced each year.

- S2F = Stock / Flow

A higher S2F ratio indicates relative scarcity of the asset, theoretically leading to a higher value. For example, gold has a high S2F ratio (around 60), which supports its role as a store of value. Bitcoin's S2F ratio steadily increases with each halving:

- 2012 Halving: Price soared from about $12 to over $1,000 within a year.

- 2016 Halving: Price climbed from about $600 to nearly $20,000 within 18 months.

- 2020 Halving: Price rose from about $8,000 to $69,000 18 months later.

Will the fourth halving in 2024 continue this trend? My view is: yes, but the increase may be weaker.

Note: The left vertical axis of the chart uses a logarithmic scale, which helps visualize early trends. The jumps from 1 to 10 occupy the same space as the jumps from 10 to 100, making exponential growth easier to interpret.

The model is inspired by the valuation logic of precious metals like gold and silver. The logic is:

The higher the S2F ratio, the lower the asset's inflationary nature, theoretically allowing for greater value retention.

In May 2020, after the third halving, Bitcoin's S2F ratio rose to about 56, nearly on par with gold. The keywords of the S2F model are scarcity and deflation, ensuring that Bitcoin's supply decreases year by year through algorithms, thereby boosting its long-term value.

But of course, no model is perfect. The S2F model has a key weakness: it only considers supply and completely ignores demand. Before 2020, when Bitcoin's adoption was limited, this may have been effective. However, since 2020—after institutional capital, global narratives, and regulatory dynamics entered the market—demand has become the dominant driving force.

Therefore, to form a complete valuation framework, we must turn to the demand side.

Demand Side: Network Effects and Metcalfe's Law

If S2F locks in the "supply valve," then network effects determine how high the "water level" can rise. The most intuitive indicators here are the expansion of on-chain activity and user base.

- By the end of 2024, Bitcoin had over 50 million addresses with non-zero balances.

- In February 2025, daily active addresses rebounded to about 910,000, reaching a three-month high.

According to Metcalfe's Law—the value of a network is roughly proportional to the square of the number of users (V ≈ k × N²)—we can understand:

When the number of users doubles, the theoretical network value may increase fourfold.

This explains why Bitcoin often exhibits "jump-like" value growth after significant adoption events.

Once again, it should be emphasized that the image of Metcalfe enthusiastically appreciating Bitcoin is an AI-generated fictional depiction.

Three core demand indicators:

- Active addresses: Reflects short-term usage intensity.

- Non-zero addresses: Marks long-term penetration. Despite bear markets, the annual compound growth rate over the past seven years has been about 12%.

- Value-carrying layer: The capacity of the Lightning Network and off-chain payment volume continues to rise, indicating real-world adoption beyond "holding."

This "N²-driven + sticky user base" model implies two forces:

- Positive feedback loop: More users → deeper transactions → richer ecosystem → more value. This explains why events like ETF launches, cross-border payments, or emerging market integrations often lead to nonlinear price surges.

- Negative feedback risk: If global regulations tighten, new technologies emerge (e.g., CBDCs, Layer-2 alternatives), or liquidity dries up, user activity and adoption may shrink—leading to value contraction alongside N².

Therefore, only by combining S2F (supply) and network effects (demand) can we build a robust valuation framework:

When S2F signals long-term scarcity, and active users/non-zero addresses maintain an upward trend, the mismatch between demand and supply amplifies asymmetry.

Conversely, if user activity declines—even if scarcity remains fixed—prices and values may fall in tandem.

In other words: Scarcity ensures Bitcoin does not depreciate, but network effects are key to its appreciation.

It is particularly noteworthy that Bitcoin was once ridiculed as a "geek's toy" or "symbol of speculative bubbles." But now, its value narrative has quietly undergone a fundamental transformation.

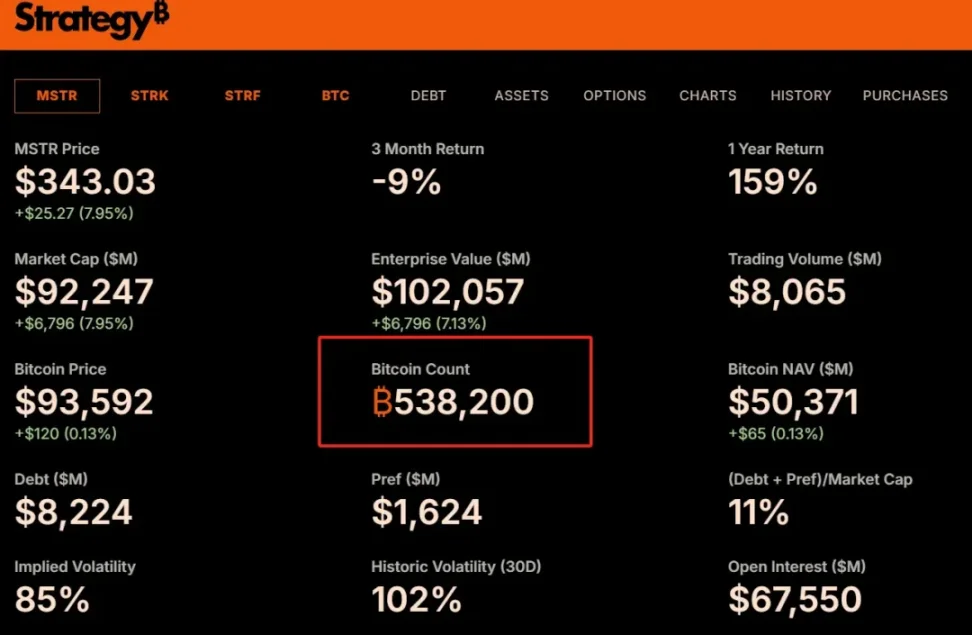

Since 2020, MicroStrategy has incorporated Bitcoin into its balance sheet, currently holding 538,000 BTC. Global asset management giants like BlackRock and Fidelity have launched spot Bitcoin ETFs, bringing in billions of dollars in incremental capital. Morgan Stanley and Goldman Sachs have begun offering Bitcoin investment services to high-net-worth clients. Even countries like El Salvador have adopted Bitcoin as legal tender. These changes are not just capital inflows—they represent endorsements of legitimacy and institutional consensus.

Conclusion

In Bitcoin's valuation framework, supply and demand are never isolated variables—they intertwine to form a double helix of asymmetric opportunities.

- On one hand, the algorithmic deflation-based S2F model mathematically outlines how scarcity enhances long-term value.

- On the other hand, the network effects measured through on-chain data and user growth reveal the real-world demand foundation for Bitcoin as a digital network.

In this structure, the disconnection between price and value becomes more apparent—this is precisely where value investors find golden windows. When the market is shrouded in fear and prices fall below levels suggested by comprehensive valuation models, asymmetry quietly opens the door.

Is the essence of value investing merely to seek asymmetry?

The core of value investing is not just "buying cheap." It is based on a more fundamental logic: finding a structure with limited risk but significant potential returns in the gap between price and value.

This is precisely what distinguishes value investing from trend following, momentum trading, or speculative gambling.

- Trend investing relies on market inertia;

- Momentum trading bets on short-term fluctuations;

- Value investing requires patience and rationality, intervening when emotions and fundamentals are severely misaligned, assessing long-term value, and buying when prices are far below value—then waiting for reality to catch up.

Its effectiveness lies in its construction of a natural asymmetric structure: the worst outcome is a controllable loss, while the best case may exceed expectations several times over.

If we delve deeper into value investing, we find that it is not a set of techniques but a way of thinking—a structural logic based on probabilities and imbalances.

- Investors analyze "margin of safety" to assess downside risk.

- They study "intrinsic value" to determine the likelihood and extent of mean reversion.

- They choose "patient holding" because asymmetric returns often require time to materialize.

None of this is about making perfect predictions. It’s about constructing a bet: when you are right, what you win far exceeds what you lose when you are wrong. This is the definition of asymmetric investing.

Many people mistakenly believe that value investing is conservative, slow, and low-volatility. In reality, the true essence of value investing is not about earning little with low risk—but rather pursuing disproportionately large returns with controllable risk.

Whether it’s early shareholders of Amazon or Bitcoin enthusiasts quietly accumulating during the crypto winter, at their core, they are doing the same thing:

When most people underestimate the future of an asset, and its price is driven to the bottom by emotions, regulations, or misinformation—they take action.

From this perspective:

Value investing is not an outdated strategy of "buying low and collecting dividends." It is a universal language for all investors seeking asymmetric return structures.

It emphasizes not only cognitive ability but also emotional discipline, risk awareness, and most importantly—faith in time.

It doesn’t require you to be the smartest person in the room. It only asks that you remain calm when others panic and place your bets when others exit.

Therefore, once you truly understand the deep connection between value investing and asymmetry, you will realize why Bitcoin—despite its unfamiliar form—can be embraced by serious value investors.

Its volatility is not your enemy—but your gift.

Its panic is not your risk—but the market mispricing.

Its asymmetry is not gambling—but a rare opportunity to reprice undervalued assets.

True value investors do not shout in bull markets. They quietly position themselves in the calm beneath the storm.

Summary

Bitcoin is not a gambling table to escape reality—it is a footnote that helps you reinterpret reality.

In this uncertain world, we often mistake safety for stability, risk aversion, and avoiding volatility. But true safety has never been about avoiding risk—it’s about understanding it, mastering it, and seeing the buried value foundation when everyone else is fleeing.

This is the true essence of value investing: finding asymmetric structures based on insight and mispricing; quietly accumulating the market's forgotten chips at the bottom of the cycle.

And Bitcoin—an asset born from code-enforced scarcity, evolving value through networks, and repeatedly reborn in fear—may be the purest expression of asymmetry in our time.

Its price may never be calm. But its logic remains steadfast:

- Scarcity is the baseline

- The network is the ceiling

- Volatility is opportunity

- Time is leverage

You may never perfectly time the bottom. But you can traverse cycles again and again—buying misunderstood value at reasonable prices.

Not because you are smarter than others—but because you have learned to think in different dimensions: you believe the best bet is not placed on price charts—but standing on the side of time.

So, remember:

Those who bet in the depths of irrationality are often the most rational. And time—is the most loyal executor of asymmetry.

This game always belongs to those who can read the order behind chaos and the truth behind collapses. Because the world does not reward emotions—the world rewards understanding. And understanding, ultimately—always proves to be correct over time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。