An optimistic interpretation of Animoca's performance is that the company has found a way to operate profitably before the next GameFi wave arrives.

Author: Steven Ehrlich

Translation: Deep Tide TechFlow

Cryptocurrency games have failed to meet their enormous market expectations, but now, one of the early pioneers in this field is finding its financial footing in this challenging industry.

Animoca's cryptocurrency gaming business is becoming increasingly profitable.

Image source: Shutterstock

The cryptocurrency industry is once again experiencing a highlight moment. Bitcoin has reached a new high, with a price of $111,814; Coinbase has become the first cryptocurrency company to enter the S&P 500 index; and more industry companies are planning to go public in this suddenly warming cryptocurrency market.

Against this backdrop, Hong Kong's Web3 company Animoca Brands has also joined the ranks. This privately traded company is involved in NFTs, cryptocurrency games, and an investment platform that includes investments from over 500 companies, including cryptocurrency exchange Kraken and Ethereum development studio ConsenSys.

Animoca was delisted from the Australian Securities Exchange in 2020 due to its ties to the cryptocurrency industry, but during the pandemic, its valuation grew from $100 million to $5.9 billion, marking a glorious moment. However, amid the crypto winter, the collapse of the NFT market, and the subsequent meme coin craze, the company gradually faded from public view. At the same time, the GameFi craze failed to attract widespread attention from the global gaming market, estimated by Oppenheimer to be worth $180 billion, further complicating the situation.

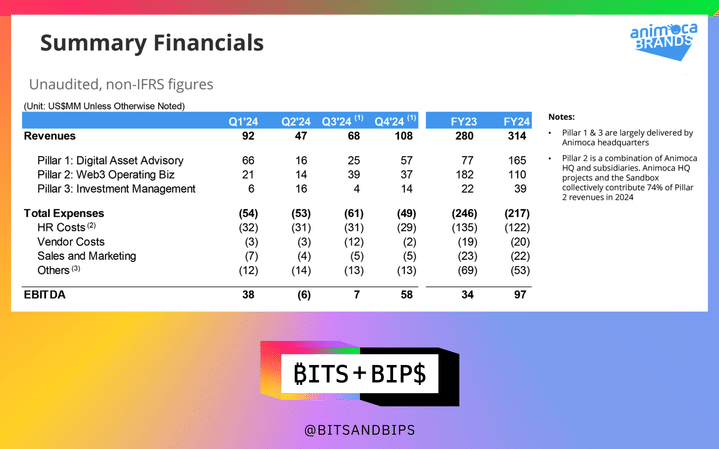

Nevertheless, under the leadership of CEO Yat Siu, Animoca continues to move steadily forward, carving out profitable business strategies for the company. According to unaudited financial data published on the company's website, Animoca achieved a profit of $97 million last year, a 185% increase from 2023.

Today, the company is exploring more business connections with the U.S. market alongside numerous global enterprises, thanks to the Trump administration's friendly stance towards the cryptocurrency industry, including plans to potentially list on well-known exchanges like Nasdaq or the New York Stock Exchange. "We believe the U.S. will become the largest cryptocurrency market in the world, so it would be very foolish not to try to enter this market," Siu said in an interview with Unchained. However, he also pointed out that a U.S. listing is just one of many opportunities the company is currently exploring.

What kind of market reaction will Animoca receive? This will depend on whether GameFi and NFTs can re-attract users and whether investors recognize Animoca as a "tool provider" in the GameFi space.

Game Pause

Although the global gaming industry is largely unaffected by specific tariffs from the Trump administration, it remains highly dependent on the ever-changing macroeconomic environment. "Overall, the industry is performing reasonably well, but it's far from as good as during the pandemic," said Martin Yang, a senior analyst at Oppenheimer. "We experienced very strong growth over the past two years, but now the overall annual growth rate may only be 3-6%."

The situation in the mobile gaming market is even more concerning, as this is where GameFi primarily exists. For external observers, this may seem somewhat counterintuitive, as the "freemium" model and relatively low costs of mobile games appear more resilient. However, this phenomenon reveals an important detail about the gaming industry and explains why cryptocurrency games struggle to gain a foothold.

"People used to think, 'Oh, players either pay nothing or just a little to play games,' so they felt that the [mobile gaming model] could withstand a challenging macro environment," said Mike Hickey, a senior analyst at The Benchmark Company, in an interview. "But in fact, we found that the mobile gaming market has been the most vulnerable since a few years ago." He further pointed out that even many major independent mobile game studios, such as Zynga, have been acquired or face layoffs.

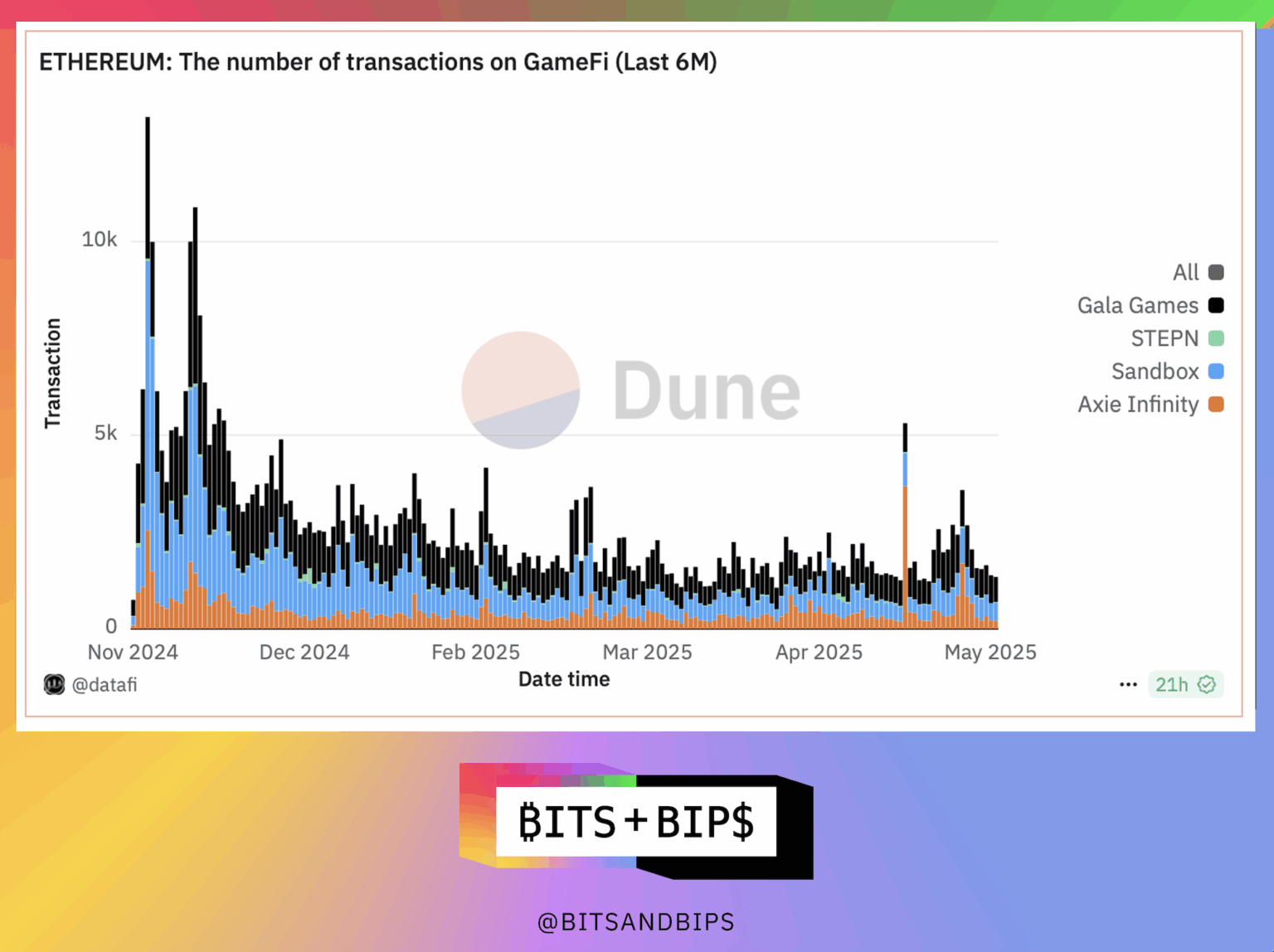

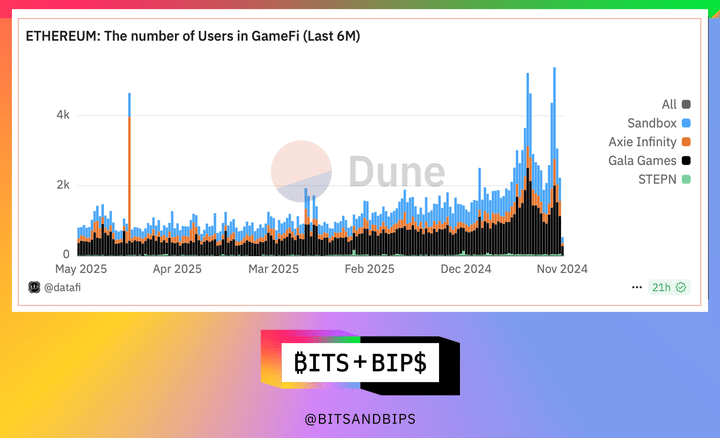

How do these trends relate to the cryptocurrency industry? Data shows that GameFi is in trouble, partly because its user base is far smaller than the overall gaming market. Take Ethereum as an example (the dominant blockchain in this field); key metrics such as transaction volume and user numbers have significantly declined, as can be clearly seen in the chart below (the second chart needs to be read from right to left).

Animoca's B2B Strategy: Becoming the Market Engine for GameFi

In the current market environment, it seems surprising that Animoca has been able to nearly triple its profitability within a year, but that is precisely what it has achieved. How did it do this? By becoming the primary liquidity engine or market maker for GameFi. Yat Siu realized that providing financial backend support to these companies is more robust, safer, and potentially more profitable than launching more games in an already competitive market. "This is the evolution of the business," Siu said. "We know that many small companies lack such financial infrastructure or relevant experience when launching games. We buy their tokens and provide capital market support, such as over-the-counter trading. It sounds very financialized, but it's actually just an extension of what we call our publishing business."

What impact does this have on its business? In 2023, most of the company's revenue came from its Web3 operations, including wholly-owned projects like virtual worlds, chess games, and online education platforms. However, from 2023 to 2024, a year of extreme activity in the cryptocurrency industry, that revenue decreased by 39.5%. Yet the company's profits grew by 185% year-on-year. How was this achieved? Its digital asset consulting business grew by 114%, which is where all capital market activities are located.

Can This Growth Be Sustained?

Delta-neutral strategies like market making can be profitable both within and outside the cryptocurrency industry, and data shows that Animoca has found its unique product-market fit in this area. However, investors need to be convinced that the company can continue to expand this revenue line, especially as key GameFi metrics remain sluggish.

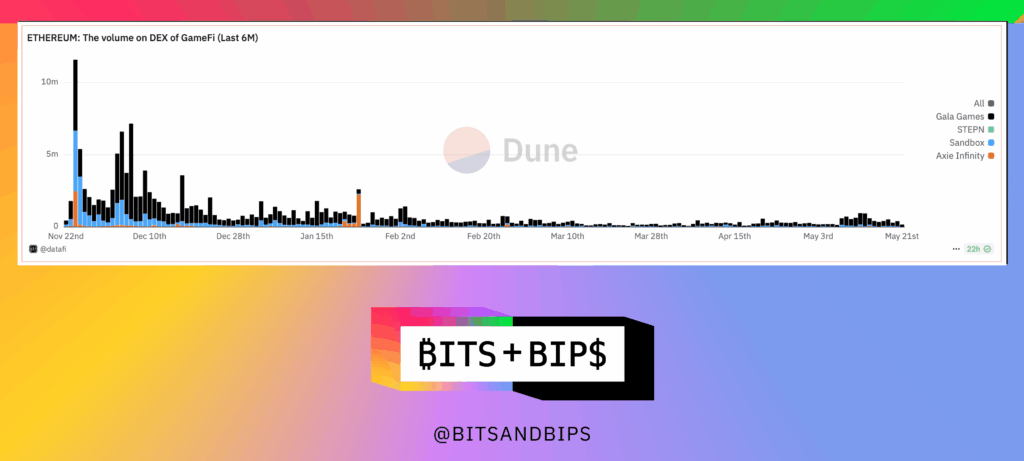

This question is difficult to answer. One data point that can provide clues is the trading volume of GameFi tokens on decentralized exchanges (DEX). As shown in the chart below, when observing Ethereum-based tokens, the trend is similarly negative, although daily trading volumes still reach hundreds of thousands of dollars. Other blockchains like Polygon and BNB show similar trends.

This is important because DEX trading volumes more accurately reflect actual user demand for specific tokens, while CEX trading volumes tend to be more speculative. It is currently unclear how much of this trading volume is conducted on behalf of clients by Animoca, which is a significant blind spot for investors.

Conclusion

An optimistic interpretation of Animoca's performance is that the company has found a way to operate profitably before the next GameFi wave arrives, assuming such a wave will occur. In this regard, Yat Siu stated that President Trump's support for the cryptocurrency market is particularly important, as the unfavorable regulatory environment in the U.S. has hindered major American gaming companies from entering the field.

"We work with large institutions to essentially bring them into the cryptocurrency space," he said. "Doing this [globally] is somewhat comfortable, but in the U.S., communicating with [large gaming companies] can be more challenging. They do regularly communicate with us, saying, 'Hey, tokens are interesting, we should pay attention to them.' But… when the legality of something [the legality of tokens] is not 100% clear, you can only rely on lawyers' estimates." Siu hinted that such attempts may be rejected.

If, and this is a big if, Siu and Animoca can get a major company like EA Sports on board, it could address another major issue in cryptocurrency gaming: the lack of entertainment value, as players react poorly to the industry's excessive financialization. "When you try to attach something that is just a monetization mechanism to a normal gaming experience without enhancing the gaming experience, players will push back against these company-led monetization strategies," Hickey said.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。