There is no such thing as a free lunch.

Written by: Thejaswini M A, Nameet Potnis, Prathik Desai

Translated by: Block unicorn

Preface

On May 22, the first 220 holders of the $TRUMP token will dine with the president at Trump’s golf club in Virginia.

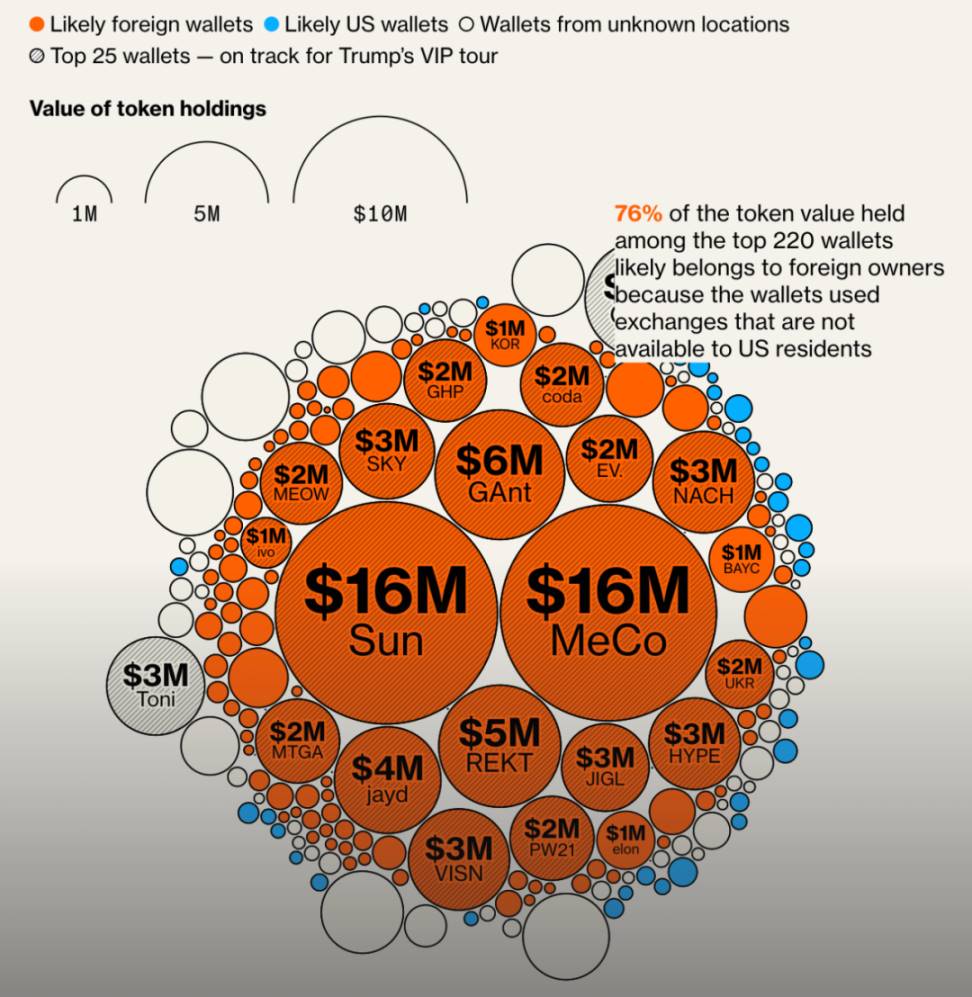

But there’s a question: blockchain analysis shows that most attendees may not be Americans.

By associating wallets with exchanges like Binance that do not serve U.S. customers, and spending a total of $148 million just to get an invitation, this dinner represents the intersection of cryptocurrency, politics, and foreign influence.

Who exactly received the invitation to dine with the president?

Are they speculative traders, strategic influence buyers, or entirely different roles?

What happens when a world leader invites anonymous online strangers to dinner based solely on the number of tokens they purchase?

Guest List

If you spent a significant amount of money buying $TRUMP tokens before May 12, congratulations, you might be dining with the president this Wednesday.

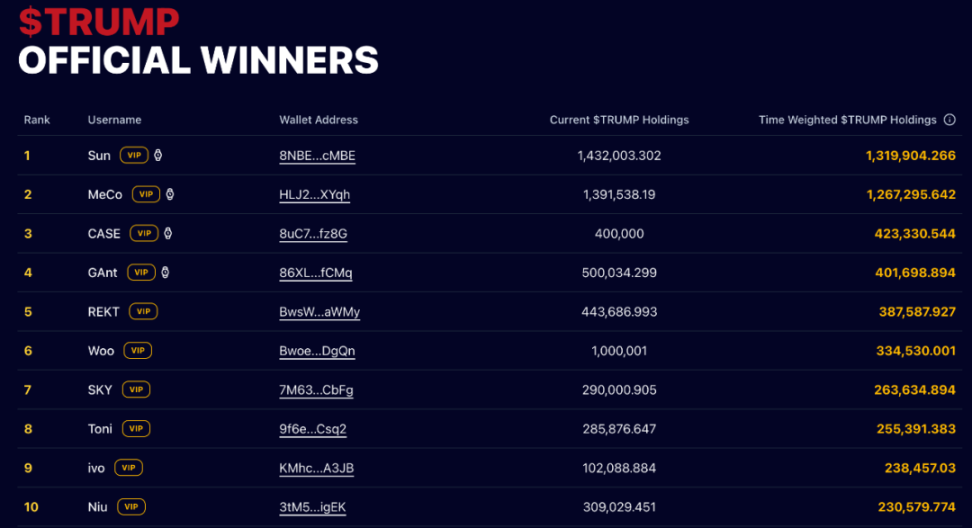

The website states: "Hold as many $TRUMP as possible from April 23 to May 12. Your average holding during this period will determine your ranking. The more $TRUMP you hold and the longer you hold it, the higher your ranking."

So who successfully made the cut?

Let’s take a look at the seating chart.

Table One: The Whales

Sitting at the head of this table is a recognized $TRUMP king: Justin Sun, who officially announced on Monday that he is the top holder on the leaderboard. The founder of Tron holds over 1.4 million TRUMP tokens, worth about $20 million.

Justin Sun not only holds tokens—after the dinner announcement, he doubled down, adding another 359,000 TRUMP tokens (about $4.72 million) during the qualification period.

This founder of Tron is no stranger to controversy—he is currently negotiating with the U.S. Securities and Exchange Commission (SEC) over fraud allegations. The timing is surprisingly coincidental, as the SEC, led by officials appointed by Trump, requested a court stay on the lawsuit against Justin Sun in February.

Joining him at the table is MemeCore, based in Singapore, which invested $18 million. They were very active in vying for dinner tickets, almost live-streaming their token buying frenzy.

Table Two: The International Contingent

According to Bloomberg, 19 of the top 25 wallets belong to individuals outside the U.S.

Kane Warwick, founder of Infinex (Australia), told reporters he would "wear a suit" to the dinner and does not expect to have much face time with the president.

Vincent Liu from Kronos Research in Taiwan.

An anonymous attendee using the pseudonym "Ogle," who holds over 250,000 tokens and refused to disclose their citizenship, stating, "This is the crypto world, bro. If I wanted my information exposed, I wouldn’t be using a pseudonym."

Several anonymous wallets associated with Asian exchanges.

Table Three: The "Barely Qualified" Group

The last holder who qualified for the dinner has 4,196 tokens, worth about $60,000 at the cutoff. If they sell immediately after qualification (considering a 10% price drop), the actual cost to "attend" the dinner would be about $6,000, which is a bargain compared to the $1 million "candlelight dinner" tickets sold by Trump’s super PAC in March.

Notably, Houston logistics company Freight Technologies spent $2 million trying to influence U.S.-Mexico trade policy by purchasing tokens but ultimately ranked 250th, missing out by 30 spots. What a shame…

Price Tag

The numbers behind this dinner are staggering.

For the guests:

$148 million: Total spending by all 220 qualifying wallet holders.

$4.8 million: Average token holding amount for VIP guests (top 25).

$20 million: Confirmed token holding amount by Justin Sun (1.5 million TRUMP tokens).

$60,000: Token holding amount of the last qualifying guest (220th).

In comparison:

$1 million: Ticket cost for the "candlelight dinner" with Trump, sold by the super PAC in March.

$5 million: Price for a one-on-one meeting with the president through traditional channels.

$15 billion: Peak market cap of the $TRUMP token after its launch on January 19.

$2.9 billion: Current market cap.

$320 million: Transaction fees collected by Trump-associated entities.

80%: Proportion of tokens controlled by the Trump Group and its affiliates (specifically CIC Digital and Fight Fight Fight LLC).

The wealth transfer here is shocking. Behind every winner celebrating a dinner invitation, there are thousands of losers funding this party without an invite.

Complexity

Just dining with the president? No. This is a diplomatic, legal, and ethical minefield:

Identity Crisis

Since crypto wallets are anonymous, no one knows exactly who purchased these tokens. Some wallets can be traced back to known individuals, but others are completely anonymous.

The Secret Service must be tearing their hair out while vetting these guests. "Mr. President, we only have a wallet address starting with 0x4f9…"

VIP Experience

The dinner itself is just part of the experience. The top 25 VIPs will also receive exclusive reception with Trump before the dinner and enjoy a "special VIP tour" (though what that entails is currently unclear. This is typically reserved for $5 million super PAC donors).

Foreign Influence

Senator Richard Blumenthal warned that the Trump family's cryptocurrency business could become a "secret backdoor for foreign and corporate interests seeking access to the president."

When most dinner guests are foreign nationals who paid hundreds of thousands (or even millions) of dollars to qualify for entry, it’s hard to refute this claim.

Legislative Impact

Despite initial concerns, the dinner controversy ultimately did not hinder cryptocurrency legislation. The Senate has actually passed a bipartisan vote to advance the GENIUS Act stablecoin regulatory bill, with Democrats and Republicans working together to push the bill forward.

Although some Democrats initially expressed reservations, the bill's progress indicates that cryptocurrency regulation is becoming a genuine bipartisan priority beyond the meme coin dinner controversy.

Investigations in the Works

Democratic lawmakers have requested all suspicious activity reports (SARs) related to World Liberty Financial and the $TRUMP token since 2023.

The request specifically seeks all mentions of WinRed, America PAC, Elon Musk, Trump, WLF, TRUMP, MELANIA, and Justin Sun. This investigative train has just begun to roll.

Follow-Up

What happens after the plates are cleared? Here are some things to watch for:

Market Movements: A typical "sell the news" type of sell-off is expected after the dinner. Those who bought tokens purely for the information have no reason to continue holding after the dinner ends.

Media Coverage: How much access will the media have? Will attendees share details, or will they sign non-disclosure agreements to remain silent? Transparency will largely reveal the true purpose of this event.

Political Consequences: Democrats have already weaponized this dinner to attack the administration. Hearings, investigations, and even potential legislation targeting similar "access for cryptocurrency" schemes are expected.

Copycat Events: If Trump’s move proves effective, other politicians may follow suit. Imagine cabinet members hosting luncheons for token holders or senators holding NFT meet-and-greets.

Whether you view this dinner as innovation or corruption largely depends on your political stance. But one thing is certain: the line between cryptocurrency and political influence has never been so blurred.

Remember—like politics, there is no free lunch in cryptocurrency. Especially when that lunch costs millions of dollars in meme tokens.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。