Is Cosmos's Modular Blockchain Architecture Actually Becoming the Technical Foundation for Central Bank Digital Currencies?

Written by: Sanqing

Introduction

On May 22, 2025, Maghnus Mareneck, co-CEO of Interchain Labs, revealed that the Colombian government is collaborating with a banking alliance to test a CBDC aimed at cross-border payment scenarios on the Cosmos network, having chosen a private, permissioned node model and the IBC Eureka technology stack. [Source: news.bitcoin.com]

No DAO, no on-chain governance, only permissioned nodes and distributed ledgers. Who would have thought that Cosmos, known as "decentralized Lego," would become the ideal partner for central bank digital currencies?

Cosmos: Building Blocks for Chains, Just the Right Power Suit

Cosmos is not a public chain but a complete toolbox for "chain building + chain communication," specifically designed for multi-chain architecture. Compared to the standardized and open Ethereum, Cosmos's flexibility and controllability provide central banks with an ideal template for a "custom sovereign ledger."

Cosmos SDK: Assembling Sovereign Chains Like Lego

The Cosmos SDK is a modular development framework that allows central banks to assemble as needed:

Add account permissions and KYC modules

Disable smart contract virtual machines to prevent "uncontrollable" contract deployment

Add regulatory plugins for auditing and directed payments

Tendermint BFT: Taking Turns as the "Central Bank"

Cosmos uses the Tendermint consensus, which does not rely on computational mining but instead has authorized validators take turns producing blocks. Node members are controllable, with very low latency and strong block confirmation, making it naturally suitable for the real-time payment scenarios of CBDCs.

IBC: The "TCP/IP" Between Chains

IBC is Cosmos's cross-chain communication protocol:

Supports state proofs and asset cross-chain

Zone chains are independent, exchanging authentication data packets when necessary

Implements chain-level whitelisting and packet inspection, allowing for "controlled interoperability" rather than chaotic interoperability

With this protocol and the ICS-20 standard, tokens like ATOM and OSMO can circulate freely among multiple Zones in the Cosmos ecosystem without the need for bridging.

Hub-and-Zone: Rejecting Redundant Layer 2s

The architecture of Cosmos is based on "Hub and Zone":

Cosmos Hub is the earliest chain in the ecosystem but is not the "commander-in-chief"

Zones refer to independent chains, such as Osmosis and Juno, each with its own ledger and validators

They communicate through IBC without needing to route through the Hub

Each Zone is a "pluggable, self-operating" sovereign chain, interconnected but not subordinate.

Colombian Path: The Sovereign Calculation Behind Technical Choices

The CBDC chain in Colombia is essentially a Zone that utilizes Cosmos technology.

It does not rely on Cosmos Hub

It does not directly interconnect with other DeFi ecosystems

It is a closed permissioned chain that only borrows the three main components: Cosmos SDK, Tendermint, and IBC

For the Colombian central bank, this is not a decentralized "idealism," but a "pragmatism" choice.

The Divergence Between Cosmos and mBridge: Balancing Cost, Efficiency, and Control

In the selection of infrastructure for central bank digital currencies, Cosmos may not have anticipated that it would become one of the routes.

Currently, the dominant route is still mBridge, led by the Bank for International Settlements (BIS) and involving many cooperating countries—an alliance chain network connecting various countries' CBDC networks (including five member central banks and over 32 observer members). Each member country's central bank establishes an Operator Node here, resembling a united central bank, and allows licensed commercial banks or other clearing and settlement institutions to operate nodes for currency exchange.

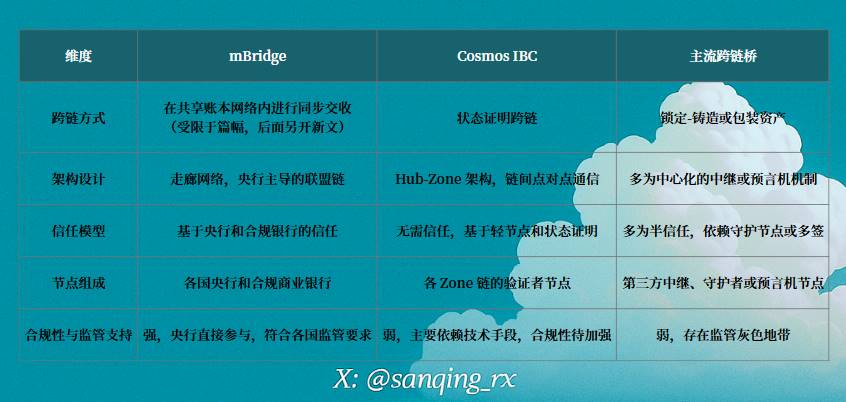

I compare mBridge, Cosmos, and mainstream cross-chain bridges as follows:

Why Did Colombia Choose Cosmos Instead of mBridge?

On one hand, mBridge is a product of great power competition, with a slow pace of technological updates and high entry barriers; on the other hand, Cosmos provides "out-of-the-box" technical components, allowing for the construction of a local permissioned chain without complex negotiations or diplomatic coordination, while reserving the possibility for future interoperability through IBC.

This aligns more closely with the current practical demands of Latin American economies:

Limited budget, need for rapid construction

Reluctance to fully depend on alliances led by specific major powers

Desire to find a balance between compliance control and blockchain innovation

If Colombia's pilot is successful, Cosmos may become a new path for small and medium-sized economies to build sovereign digital currencies. A controllable, cost-acceptable, and technology-independent road may be replicated by more sovereign nations in South America, Africa, and even Southeast Asia. This is a typical victory of "technological pragmatism."

Conclusion

What Cosmos offers is a kind of technical "neutrality" and "customizability": it does not preset governance answers nor does it reject centralized deployment.

Colombia has not joined Web3; it has merely borrowed from Cosmos. Without open nodes, without on-chain governance, and without connections to public chain ecosystems—this CBDC chain based on Cosmos resembles a streamlined and modified "sovereign currency machine."

However, this "cooling adaptation" of Web3 technology in real-world scenarios also acknowledges its engineering value in some way.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。