Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.34 trillion, with BTC accounting for 61.55%, amounting to $2.06 trillion. The market cap of stablecoins is $245.9 billion, with a recent 7-day increase of 1.1%, of which USDT accounts for 62.26%.

This week, BTC's price has shown a volatile upward trend, currently priced at $110,915; ETH has also shown a volatile upward trend, currently priced at $2,670.

Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen, including: DOG with a 7-day increase of 54.14%, MOO DENG with a 7-day increase of 40.66%, HYPE with a 7-day increase of 33.48%, and WLD with a 7-day increase of 32.44%.

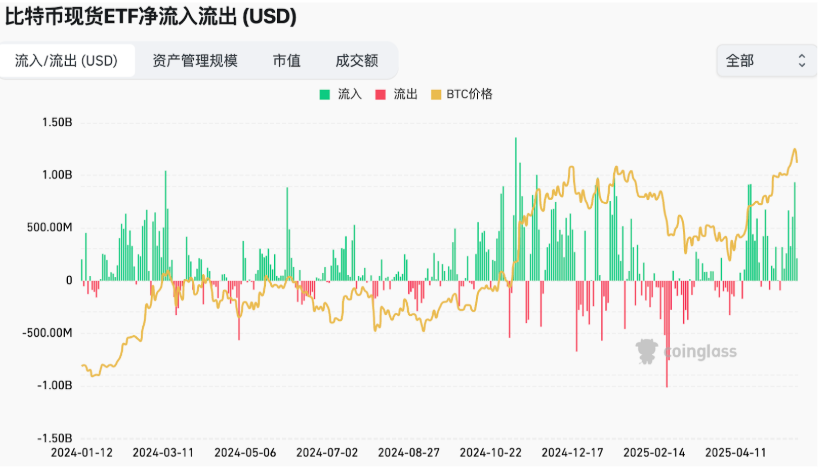

This week, the net inflow for Bitcoin spot ETFs in the U.S. was $2.75 billion; the net inflow for Ethereum spot ETFs in the U.S. was $247.7 million.

On May 23, the "Fear & Greed Index" was at 76 (higher than last week), indicating a sentiment of greed over the past 7 days.

Market Predictions:

This week, stablecoins continued to be issued, and there were significant inflows into Bitcoin and Ethereum spot ETFs in the U.S., marking the largest inflow week since January. BTC surged from $103,520 to a new historical high of $111,313, with a 7-day increase of 4.37%. The RSI index is at 44.88, indicating a neutral position, while the altcoin season index is at 18. This new high was driven by institutional "buying" rather than community-led efforts. The market remains in a state of greed. On Friday, following Trump's remarks suggesting a 50% tariff on EU products starting June 1, the market experienced a brief decline but gradually recovered, with the weekend typically being a period of low trading activity; the current pullback appears normal.

The probability of a 25 basis point rate cut by the Federal Reserve in June is only 5.3%, lower than last week, with expectations of only 1-2 rate cuts this year. However, the steady progress of the U.S. stablecoin "GENIUS Act" this week has provided a boost to the market. Crypto czar David Sacks stated in an interview with CNBC that if the GENIUS stablecoin bill passes, it could bring trillions of dollars in demand for U.S. Treasury bonds. He anticipates that once the bill provides a legal framework, the stablecoin market will rapidly expand from the current $200 billion (unregulated) to trillions, with Tether already holding nearly $120 billion in U.S. debt, surpassing Germany to become the 19th largest holder. The passage of stablecoins will mark another celebration in this bull market.

Understanding Now

Review of Major Events of the Week

On May 19, on-chain data analyst Murphy published an analysis of BTC's concentration of holdings, noting that from May 7 to May 14, BTC's concentration dropped from a high of 15.5% to 8.2% in just 7 days. This indicates that as prices rise, they are gradually moving away from concentrated holding areas; if the concentration curve continues to decline, it is likely that prices will continue to rise.

On May 20, The Block reported that Anza, a development studio spun off from Solana Labs, announced what they call "the largest transformation of the Solana core protocol in history." According to the announcement, this high-throughput Layer 1 blockchain will welcome a newly designed underlying architecture called Alpenglow.

On May 20, FOX Business reporter Eleanor Terrett reported that the U.S. Senate voted to pass a "cloture motion" to formally consider the "GENIUS Act," with at least 15 Democratic senators changing their votes to support it, including Cortez Masto, Adam Schiff, and Mark Warner. The bill will now enter a comprehensive review process, having only passed the "cloture motion" so far; the bill itself has not yet passed. The "GENIUS Act" will next enter the debate and amendment phase in the Senate.

On May 20, Jupiter announced that it has fully aggregated the time tokenization platform time.fun for trading, which supports the buying and selling of time from creators, influencers, and experts, with all tokens available for instant trading on Jupiter.

On May 20, it was announced that Farcaster's verification feature is about to go live. By connecting two social accounts (X, phone number, or GitHub) and holding at least $25 in a wallet, users can complete account verification.

On May 20, Bloomberg senior ETF analyst Eric Balchunas stated on the X platform that BlackRock's Bitcoin holdings are now second only to Satoshi Nakamoto, currently reaching 57% of the total supply. At the current trend, BlackRock is expected to become the world's largest Bitcoin holder by the end of next summer.

On May 20, Robinhood submitted a 42-page proposal to the U.S. Securities and Exchange Commission (SEC) suggesting the establishment of a federal-level "RWA tokenization" framework aimed at modernizing the U.S. securities market.

On May 22, according to 8marketcap data, Bitcoin surpassed Amazon to become the fifth largest asset by market capitalization globally.

On May 22, crypto journalist Eleanor Terrett reported that the stablecoin "GENIUS Act" passed the debate motion with 69 votes in favor and 31 against, entering the amendment process.

On May 22, Lookonchain monitored that Cetus suffered a hacker attack, resulting in losses exceeding $260 million.

On May 23, Bloomberg ETF analyst James Seyffart stated that the U.S. SEC decided today to postpone its decision on the Bitwise and CoinShares XRP spot ETFs, as well as CoinShares' Litecoin spot ETF, while delaying the decision on Fidelity's FBTC physical Bitcoin redemption, but officially accepted the TRX staking ETF application submitted by Canary Capital.

Macroeconomics

On May 19, Bitcoin For Corporations reported that the UK-listed company Vinanz purchased 16.9 Bitcoins at an average price of $103,341, totaling approximately $1.75 million.

On May 20, the Reserve Bank of Australia lowered the benchmark interest rate by 25 basis points to 3.85%, in line with market expectations.

On May 20, the People's Bank of China lowered the one-year and five-year Loan Prime Rates (LPR) from 3.1% and 3.6% to 3% and 3.5%, respectively.

On May 21, according to CME's "FedWatch" data, the probability of a 25 basis point rate cut by the Federal Reserve in June is 5.3%, while the probability of maintaining the current rate is 94.7%.

On May 22, Japan's 40-year government bond yield rose by 6 basis points to 3.675%, reaching the highest level since 2007.

ETF

According to statistics, from May 19 to May 23, the net inflow of U.S. Bitcoin spot ETFs was $2.75 billion; as of May 23, GBTC (Grayscale) had a total outflow of $23.033 billion, currently holding $20.426 billion, while IBIT (BlackRock) currently holds $70.058 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $134.838 billion.

The net inflow of U.S. Ethereum spot ETFs was $247.7 million.

Envisioning the Future

Upcoming Events

Bitcoin 2025 will be held from May 27 to 29 in Las Vegas, USA;

NFT NYC 2026 will be held from June 23 to 25, 2025, in New York, USA;

Permissionless IV will be held from June 24 to 26, 2025, in New York, USA;

EthCC 8 will be held from June 30 to July 3, 2025, in Cannes, France.

Project Progress

Ethereum developers announced that fusaka-devnet-0 is expected to go live on May 26;

Ethena Labs launched eUSDe (in collaboration with Ethereal), with the Pendle pool maturing on May 29, offering 50 times Ethena rewards and Ethereal points;

Pendle's collaboration with LevelUSD on lvlUSD and slvlUSD markets will mature on May 29, 2025. lvlUSD is the native non-yield stablecoin of the protocol, based on USDT and USDC; while slvlUSD is the staked yield stablecoin, with yields coming from the base earnings of Aave V3 deposits and the re-staking earnings of Aave aTokens;

FTX will begin distributing over $5 billion in funds to creditors on May 30;

The Ethereum re-staking protocol ether.fi Season 5 will run from February 1, 2025, to May 31, 2025, with rewards including ETHFI tokens (at least 10 million), partner tokens, and King Protocol rewards;

The final 25% of the Mint community airdrop on the Ethereum L2 network will be unlocked on May 31;

The Treasure Chain under the gaming ecosystem Treasure DAO will close at 3:00 AM Beijing time on May 31. Holders must cross-chain all ETH, MAGIC, SMOL, and NFTs before the end of May.

Important Events

The U.S. Securities and Exchange Commission (SEC) has opened a public comment period for Canary Funds' Litecoin ETF. This inquiry primarily focuses on whether the ETF proposal meets regulatory requirements to prevent fraud and market manipulation. The deadline for public comments is May 26, 2025, and the deadline for rebuttals is June 9, 2025;

Kraken has sent confirmation emails to FTX customers stating that the next round of FTX compensation distribution will take place on May 30, 2025. This round of distribution will include creditors with claims both below and above $50,000;

On May 28, U.S. Vice President Vance will deliver a speech at the "Bitcoin 2025" conference;

On May 29, the Federal Reserve will release the minutes from the May monetary policy meeting.

Token Unlocking

Altlayer (ALT) will unlock 195 million tokens on May 25, valued at approximately $7.21 million, accounting for 1.95% of the circulating supply;

Axelar (ALX) will unlock 13.51 million tokens on May 27, valued at approximately $5.33 million, accounting for 1.12% of the circulating supply;

Open Campus (EDU) will unlock 21.02 million tokens on May 28, valued at approximately $3.66 million, accounting for 2.1% of the circulating supply;

Renzo (REZ) will unlock 423 million tokens on May 29, valued at approximately $6.93 million, accounting for 4.24% of the circulating supply;

About Us

Hotcoin Research, as the core research and investment hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We have built a "trend analysis + value discovery + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and round-the-clock market volatility monitoring. Combined with our weekly dual updates of the "Hotcoin Selected" strategy live broadcast and the "Blockchain Today Headlines" daily news brief, we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。